Electrosurgical Devices Market: Industry Outlook

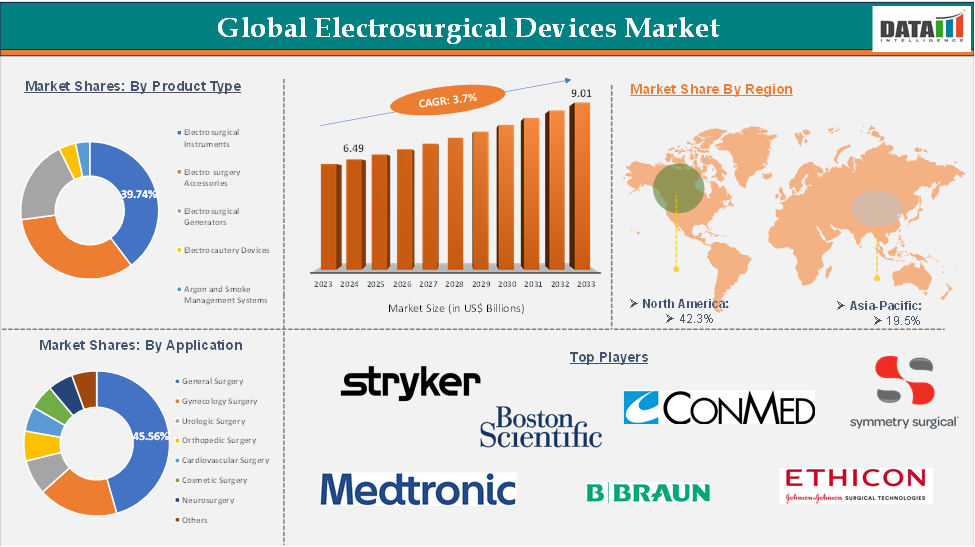

Electrosurgical Devices Market reached US$ 6.49 Billion in 2024 and is expected to reach US$ 9.01 Billion by 2033, growing at a CAGR of 3.7% during the forecast period 2025-2033.

The electrosurgical unit, also known as the Bovie, is a surgical tool used to incise, destroy tissue through desiccation, and control bleeding by coagulating blood. It uses a high-powered generator to produce a radiofrequency spark between a probe and the surgical site, causing localized heating and tissue damage.

The global electrosurgical devices market is expanding due to demographic, technological, and clinical factors. The demand for minimally invasive surgical procedures is driving this growth, offering benefits like reduced recovery time, less postoperative pain, and lower infection risk. These devices are widely used in various medical specialties, including general surgery, gynecology, urology, cardiology, and orthopedic procedures.

Executive Summary

For more details on this report, Request for Sample

Electrosurgical Devices Market Dynamics: Drivers & Restraints

Driver: Rise in technological advancements

Technological advancements have significantly shaped the global electrosurgical devices market, enhancing precision and safety in procedures. This includes minimally invasive techniques, robotic-assisted systems, and advanced energy-based modalities. These advancements help healthcare providers achieve better patient outcomes with reduced recovery times and complications. The integration of intelligent systems and data analytics has improved device functionality. As technology evolves, electrosurgical devices are adopted across various medical disciplines, contributing to the market's growth.

For instance, in August 2024, Olympus introduced two new jaw designs in its PowerSeal sealer/divider portfolio: the PowerSeal Curved Jaw, double-action (SJDA) and PowerSeal Curved Jaw, single-action (CJSA). These devices support dissection, grasping, and sealing techniques during surgery, promoting procedural efficiency and comfort. Olympus claims that the PowerSeal design requires less squeeze force than competitor instruments to close the jaws, without compromising jaw force or sealing capability. These single-use devices can be used in laparoscopic and open surgery.

Restraint: High cost of the devices

The global electrosurgical devices market faces challenges due to the high cost of advanced technologies, a significant barrier for healthcare facilities in low- and middle-income regions. These costs, coupled with the need for specialized training and technical expertise, can limit access to state-of-the-art equipment. Despite the potential to improve surgical outcomes and efficiency, the high cost of these devices may hinder their widespread adoption.

For instance, electrosurgical devices can range from $5000 to USD 15,000, with well-known brands like Covidien, Ellman, and Erbe in the US. Top-selling brands outside the US include Conmed and Sometech. New and demo machines are more expensive than refurbished or used ones. New machines have a manufacturer's warranty and are never used, while demo machines are exhibition models. Refurbished machines have undergone improvements and can be done at the manufacturer's facilities or private repair shops

Electrosurgical Devices Market Segment Analysis

The global electrosurgical devices market is segmented based on product type, application, end user, and region.

Product Type

The electrosurgical instruments segment from the product type is expected to hold 39.74% of the electrosurgical devices market

The electrosurgical instruments segment holds a major portion of the electrosurgical devices market share and is expected to continue to hold a significant portion of the electrosurgical devices market share during the forecast period.

Electrosurgical instruments, including electrodes, forceps, scissors, and probes, are crucial for precision and minimal tissue damage in various surgical procedures. They are versatile and used in general surgery, gynecology, urology, and orthopedics. Innovations in design, like non-stick coatings and ergonomics, enhance their effectiveness and safety. As demand for minimally invasive procedures increases, the adoption of advanced electrosurgical instruments is expected to drive market expansion, meeting healthcare providers' needs for reliable and efficient surgical tools.

For instance, in August 2024, Olympus introduced two new jaw designs in its PowerSeal sealer/divider portfolio: the PowerSeal Curved Jaw, double-action (SJDA) and PowerSeal Curved Jaw, single-action (CJSA). These devices support dissection, grasping, and sealing techniques during surgery, promoting procedural efficiency and comfort due to their multifunctional feature set and ergonomic design.

Electrosurgical Devices Market - Geographical Analysis

North America dominated the global electrosurgical devices market with the highest share of 42.3% in 2024

North America holds a substantial position in the electrosurgical devices market and is expected to hold most of the market share due to significant investments in medical technologies and the high prevalence of chronic diseases. The region's strong base of leading medical device manufacturers and research institutions drives innovation in electrosurgical technologies.

Government initiatives like favorable reimbursement policies and funding for medical advancements contribute to market growth. The widespread adoption of minimally invasive surgical procedures and skilled healthcare professionals further enhances the use of electrosurgical devices.

For instance, in March 2025, Johnson & Johnson MedTech launched the DUALTO Energy System, a surgical solution that integrates multiple energy modalities for open and minimally invasive surgery. The system can be paired with Service Solutions for uptime support and works with Polyphonic Fleet software for device management. It is also designed for future use with the OTTAVA Robotic Surgical System.

Asia-Pacific is the global electrosurgical devices market with a market share of 19.5% in 2024.

The Asia-Pacific region is gaining momentum in the global electrosurgical devices market due to expanding healthcare infrastructure, increasing access to surgical procedures, and a rise in chronic diseases and age-related conditions. The preference for minimally invasive surgeries, increased medical tourism, government initiatives to improve healthcare delivery, and a large patient pool contribute to the market's growth. Cost-effective manufacturing and expansion strategies of key market players in the region further strengthen its role as a major contributor to global market expansion.

For instance, in April 2025, Erbe Elektromedizin GmbH introduced the VIO 3n, a new generation of electrosurgical generators, specifically designed for various medical specialties and procedural requirements, and the VIO® seal, the first generator fully dedicated to bipolar applications.

Electrosurgical Devices Market - Key Players

The major global players in the electrosurgical devices market include Stryker Corporation, Boston Scientific Corporation, Symmetry Surgical Inc., CONMED Corporation, Medtronic Plc, Ethicon (Johnson and Johnson), B. Braun SE, Smith+Nephew, Olympus Corporation, Abbott Laboratories, OTTek, Dalent Medical, MMI, EGDe Surgical, and among others.

Industry Key Developments

In September 2024, Mindray, a leading global medical equipment manufacturer, showcased its UP700 Electrosurgical Unit at the 27th International Federation for the Surgery of Obesity and Metabolic Disorders World Congress in Melbourne, Australia. The UP700 Electrosurgical Unit was the highlight of the cutting-edge innovations in bariatric and metabolic surgery.

Market Scope

Metrics | Details | |

CAGR | 3.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product | Electrosurgical Instruments, Electrosurgical Generators, Electrocautery Devices, Argon and Smoke Management Systems |

Application | General Surgery, Gynecologic Surgery, Urologic Surgery, Orthopedic Surgery, Cardiovascular Surgery, Cosmetic Surgery, Neurosurgery, Others | |

End User | Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |