Egg and Egg Products Market Overview

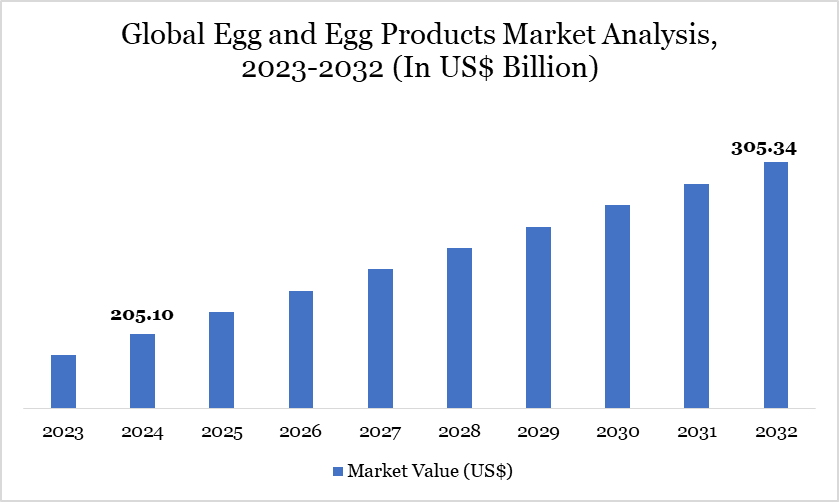

Egg and Egg Products Market size reached US$ 205.10 billion in 2024 and is expected to reach US$ 305.34 billion by 2032, growing with a CAGR of 5.10% during the forecast period 2025-2032.

The global egg and egg products market has experienced significant growth and transformation in recent years. According to the Food and Agriculture Organization (FAO), world egg production reached 97 million tonnes in 2023, with Asia contributing over 64% of this output.

China remains the largest producer, accounting over 30% of global production, followed by the US and India, each contributing 7%. The market has also seen shifts in production methods; for instance, the European Union reported that over 55% of laying hens were kept in cage-free systems as of 2024, reflecting a trend towards more humane and sustainable farming practices.

Egg and Egg Products Market Trend

A notable trend in the egg industry is the increasing demand for egg components over whole eggs. In the US, while whole egg production decreased by 2%, the production of egg whites and yolks increased by 5% and 8%, respectively, indicating a shift towards processed egg products. This change is driven by consumer preferences for convenience and the food industry's demand for specific egg components in various products.

Additionally, the industry is adapting to challenges such as avian influenza outbreaks, which have impacted production and led to fluctuations in egg prices globally. Efforts to stabilize the market include increasing biosecurity measures and exploring alternative production methods to meet the growing demand for eggs and egg products.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

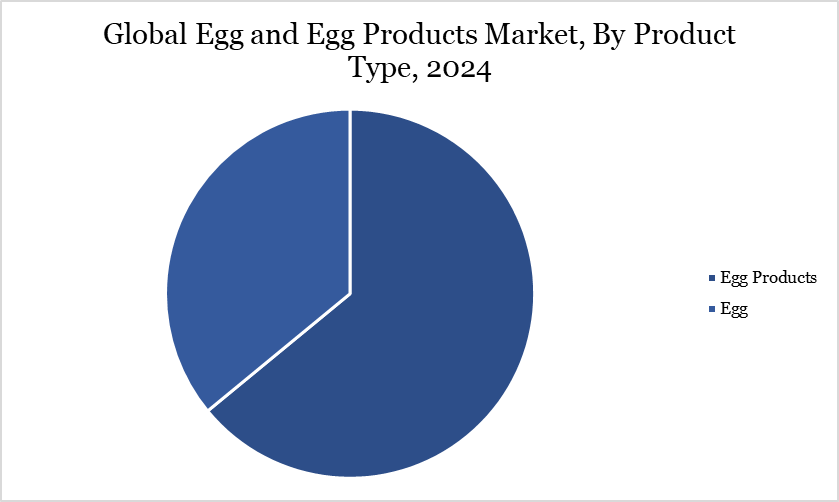

| By Product Type | Egg, Egg Products |

| By Form | Solid, Liquid, Frozen |

| By Application | Food and Beverages, Nutraceuticals and Dietary Supplements, Personal Care and Cosmetics, Animal Feed, Others |

| By Distribution Channel | B2B, B2C |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Egg and Egg Products Market Dynamics

Increasing Health Consciousness

The growing health consciousness among consumers is driving the demand for eggs and egg-based products. As consumers become more aware of the nutritional benefits, such as high-quality protein and essential vitamins, eggs are being increasingly incorporated into health-focused diets. It aligns with the rising popularity of low-carb and high-protein dietary trends, positioning eggs as a key staple in promoting overall wellness.

Additionally, consumers are increasingly seeking sustainably produced eggs, such as organic or free-range options, reflecting their concerns about ethical sourcing and environmental impact. The convenience of ready-to-eat egg products further boosts demand, catering to busy, health-conscious individuals. As a result, the egg market is experiencing growth, driven by both nutritional value and evolving consumer preferences.

For instance, in July 2024, Chulalongkorn University's Faculty of Allied Health Sciences introduced "eggyday," an innovative, ready-to-eat rice alternative made from egg whites. The product offers a nutritious option with low calories, high-quality protein, calcium, dietary fiber and gluten-free. Designed for health-conscious individuals, particularly those managing their weight, the elderly and diabetics, "eggyday" addresses concerns related to excessive rice consumption, such as weight gain and elevated blood sugar levels.

Competition from Plant-based Alternatives

The growing competition from plant-based egg alternatives is emerging as a key restraint for the traditional egg market. Driven by consumer demand for healthier, more sustainable and ethical food choices, plant-based eggs offer benefits such as lower cholesterol, reduced environmental impact and no animal welfare concerns. As these alternatives continue to improve in taste, texture and affordability, they increasingly appeal to flexitarian consumers, who are shifting away from animal-based products.

As plant-based egg products continue to improve in taste, texture and affordability, they pose a direct challenge to conventional egg producers. With innovations in formulation and production methods, plant-based alternatives are becoming more competitive, offering both nutritional benefits and a reduced environmental footprint. Traditional egg producers respond by innovating or diversifying their offerings to maintain relevance in a market that is increasingly dominated by consumer demand for sustainable, ethical alternatives.

Egg and Egg Products Market Segment Analysis

The global egg and egg products market is segmented based on product type, form, application, distribution channel and region.

Egg Products Segment Driving Egg and Egg Products Market

Rising demand for egg products, such as liquid, frozen and dried eggs, is driven by their versatility, food safety and convenience for the foodservice and commercial food industries. These products, commonly used in items including mayonnaise, ice cream and bakery goods, are favored for their ease of handling and extended shelf life. The increasing adoption of pasteurized egg products helps mitigate the risks of foodborne illnesses, aligning with increased consumer awareness around food safety.

Additionally, the foodservice sector, including restaurants, hospitals and fast-food chains, is turning to egg products as a reliable solution for high-volume operations. With processed egg products requiring minimal preparation and storage, they offer an efficient, cost-effective alternative to whole eggs. As food manufacturers continue to prioritize convenience, the demand for egg products is expected to keep rising, further boosting the market.

For instance, in November 2024, Ready Egg Products launched the UK’s first modern egg drying facility, enabling manufacturers to use the British Lion mark on egg powder products. The move expands the range of Lion egg products and addresses the growing consumer demand for British-sourced ingredients in prepared foods. The facility, commissioned in 2022, is the only one of its kind in the UK and Ireland.

Egg and Egg Products Market Geographical Share

Demand for Egg and Egg Products in North America

The demand for eggs and egg products in North America remains robust, driven by consistent consumer consumption and evolving market dynamics. In the US, per capita egg consumption was estimated at 287.4 eggs in 2023, reflecting a steady demand despite fluctuations in production due to factors like avian influenza outbreaks.

The US egg industry produced approximately 93.1 billion eggs in 2024, a slight decrease from the previous year, yet indicative of a resilient market. In Canada, egg production increased by 2.0% in 2023, totaling 883.9 million dozen eggs, with total sales rising by 8.4% to $2.2 billion, primarily driven by higher egg prices. However, per capita availability slightly declined by 1.1% to 21.2 dozens per person, as population growth outpaced production increases. These figures underscore a sustained demand for eggs and egg products across North America, influenced by both consumer preferences and market conditions.

Sustainability Analysis

The global egg and egg products market is undergoing a significant shift toward sustainability, driven by regulatory policies and evolving consumer preferences. According to the Food and Agriculture Organization (FAO), global egg production reached 86.5 million metric tons in 2022, with China accounting for over 34%, making it the world's largest producer.

Sustainability challenges include greenhouse gas emissions and animal welfare: the FAO estimates that poultry contributes approximately 9% of livestock sector emissions, largely from feed production and manure management. In the EU, the European Commission reports that as of 2023, 56% of laying hens are kept in cage-free systems, a result of the Union's directive banning conventional battery cages since 2012.

Similarly, India’s National Egg Coordination Committee (NECC) is promoting the adoption of enriched housing systems as demand grows for humane and antibiotic-free production. Leading producers like France’s Matines and Germany’s Deutsche Frühstücksei GmbH have pledged to fully transition to cage-free production by 2025. These trends, supported by both policy frameworks and corporate sustainability goals, highlight a global move toward more environmentally responsible and ethically aligned egg production systems.

Egg and Egg Products Market Major Players

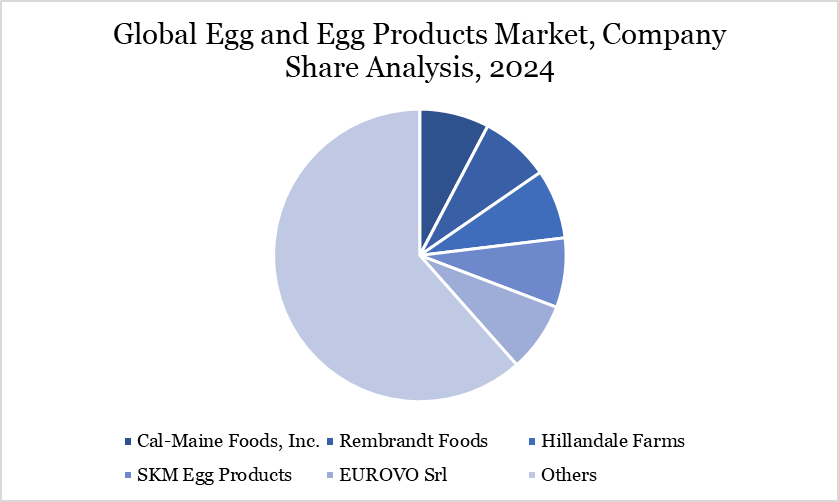

The major global players in the market include Rose Acre Farms, Cal-Maine Foods, Inc., Rembrandt Foods, Hillandale Farms, SKM Egg Products, EUROVO S.r.l, OVOBEL, Interovo Egg Group BV, IGRECA, Venky’s India and Michael Foods, Inc.

Key Developments

In November 2024, READY EGG PRODUCTS launched the UK’s first modern egg drying facility, enabling manufacturers to access British Lion-certified egg powder for the first time. The British Egg Industry Council (BEIC) supports this launch, noting it expands the range of trusted Lion egg products available to manufacturers.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies