Global Digital Therapeutics Market Size & Industry Outlook

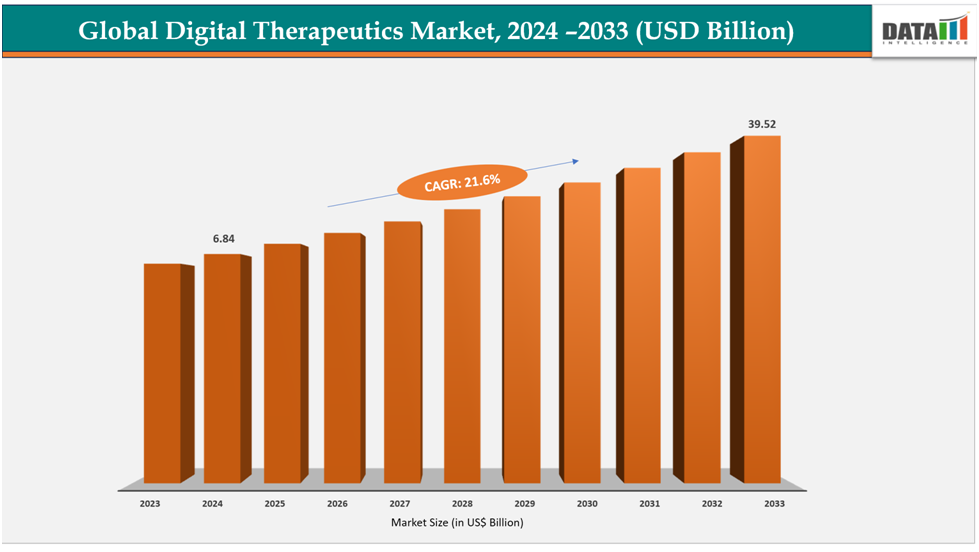

The global digital therapeutics market size reached US$ 6.84Billion in 2024 and is expected to reach US$ 39.52 Billion by 2033, growing at a CAGR of 21.6%during the forecast period 2025-2033.

Digital therapeutics (DTx) is a rapidly expanding area of digital health that uses devices and software to give evidence-based interventions for illness prevention, management, and treatment. The market's wide range of service models, from fully integrated ecosystems that combine hardware, software, and clinical services to modular Software-as-a-Service (SaaS) platforms, demonstrate its adaptability. This flexibility guarantees broad adoption among payers, patient populations, and healthcare systems, establishing DTx as a major force behind innovation in chronic illness management and healthcare delivery.

The sector's growth trajectory is highlighted by recent product launches. For instance, in April 2025, Teladoc Health launched its Next Generation Cardiometabolic Health Program with the goal of enhancing population health and halting the advancement of obesity, diabetes, and hypertension. This launch is a prime example of how top businesses are using digital medicines to treat both individual ailments and broader, population-level interventions that address chronic diseases that are interconnected.

Key Highlights

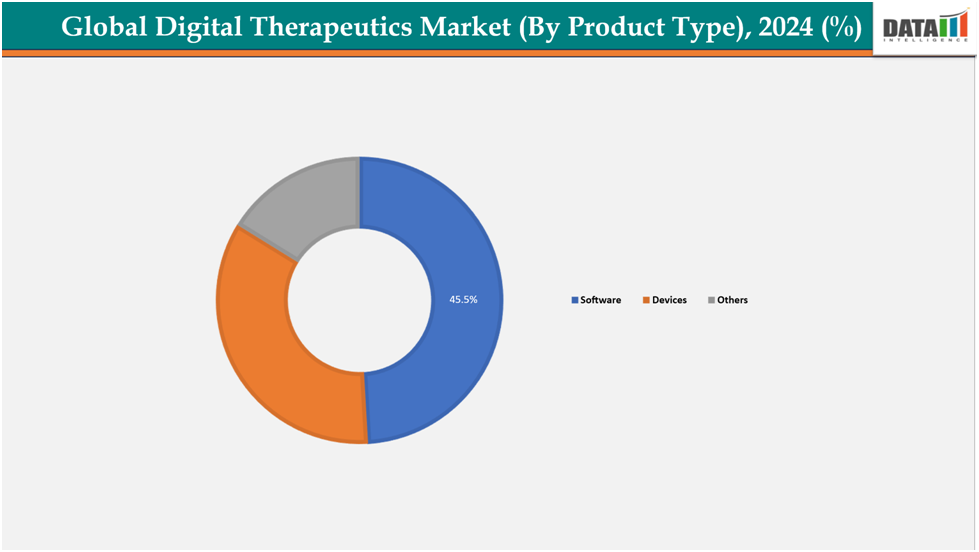

Based on product type software to lead the market with strong growth potential with 45.5% share in 2024

Based on application, the diabetes management segment led the market with the largest revenue share of 35.3% in 2024.

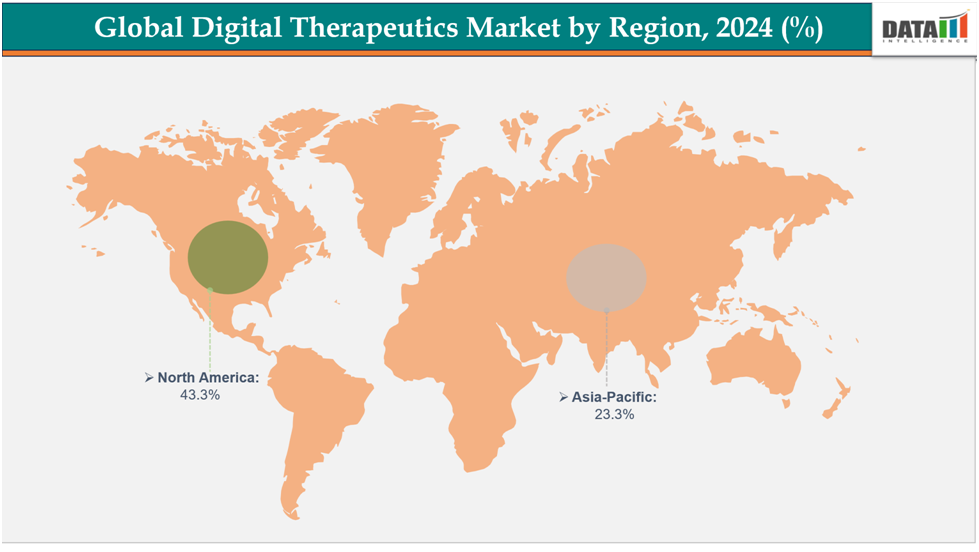

North America is dominating the digital therapeutics market with the largest revenue share of 43.3% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.9% over the forecast period.

- The major market players in the digital therapeutics market are Digital Therapeutics Alliance, Noom, Inc., Omada Health, Inc., Q4, Inc., Teladoc Health, Inc., Akili, Inc., Kaia Health, Welldoc, Inc., Hinge Health, Inc., and Click Therapeutics, Inc., among others.

Market Dynamics

Drivers: The rising burden of chronic diseases is significantly driving the global digital therapeutics market growth

One of the main factors propelling the growth of the digital therapeutics (DTx) market is the increasing prevalence of chronic diseases worldwide, including diabetes, cardiovascular ailments, obesity, COPD, and mental health issues. Traditional healthcare systems frequently find it difficult to provide the ongoing monitoring, lifestyle changes, and adherence assistance needed to manage these chronic conditions. Through wearable technology, mobile apps, and AI-powered platforms, DTx offers scalable, evidence-based therapies that facilitate patient self-management and individualized therapy. DTx provide high clinical and economic value by minimizing complications, lowering overall healthcare costs, and reducing hospital readmissions.

For instance, according to National Center for Chronic Disease Prevention and Health Promotion, The US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases.

Restraints: Data privacy, security, and compliance concernsare hampering the growth of the digital therapeutics market

The market for digital therapeutics (DTx) is severely constrained by issues of data privacy, security, and compliance. It is crucial to make sure that DTx systems are protected against breaches and hacks because they gather sensitive health data, including medical history, biometrics, and behavioral data. Strict laws like the GDPR in Europe and HIPAA in the US need intricate compliance procedures, which drive up prices and delay the release of new products. Restrictions on cross-border data transfers make global scalability even more difficult. Adoption is also constrained by patients' reluctance to divulge private health information because of a lack of confidence.

Owing to this breachdata published by IBM,in 2023, over the last three years, the average cost of a data breach has increased by 15% to a record US$4.45 million. The healthcare business was still the most affected, with average breach expenses rising to US$10.93 million, almost twice as much as the finance sector's US$5.9 million. Adoption of digital health and therapies is still hampered by significant financial and security issues, as evidenced by the United States reporting the highest national average breach costs of US$9.48 million.

For more details on this report: Request for Sample

Segmentation Analysis

The global digital therapeutics market is segmented based onproduct type, application, end user and region

By Product Type:

By Product Type—Software is leading the market with strong growth potential with a 45.5% share in 2024:

The market for digital therapies is dominated by software due to its scalability, affordability, and broad accessibility via web platforms and smartphones. Instead of using hardware, the majority of top DTx solutions for mental health, diabetes, obesity, and sleeplessness rely on lifestyle coaching, AI-driven customization, and software-based cognitive behavioral therapy (CBT). Adoption is accelerated by the fact that regulatory approvals for Software as a Medical hardware (SaMD) are typically easier and faster than hardware clearances. Software is preferred by patients and healthcare systems because it is less expensive, easier to update, and has a wider range of applications.

For instance, in September 2024,The FDA has approved DeepWellDTx, a product that uses interactive media, including video games, to treat mental health. The FDA has given its biofeedback (ABS) software development kit (SDK) 510(k) clearance for use in over-the-counter stress-reduction and high blood pressure-adjunctive treatments in conjunction with other pharmaceutical and/or nonpharmacological interventions.

The diabetes management segment from the application segment is dominating in the digital therapeutic market with a 35.3% share in 2024

The market for digital therapeutics (DTx) is dominated by diabetes management because of its high incidence worldwide, growing financial burden, and suitability for digital solutions. Owing to this, according to the IDF in 2024, diabetes, which affected over 589 million people globally, necessitates constant monitoring, lifestyle changes, and rigorous medication adherence, making it a prime candidate for wearable technology, mobile apps, and AI-driven platforms. Livongo, Omada Health, and Dario Health are examples of digital therapies that have shown promising clinical results, such as lower complications and higher HbA1c levels. For instance, in April 2025, Q4 Inc. received FDA approval for the 4 Continuous Glucose Monitoring System for US adults with diabetes who are at least 18 years old.

Geographical Analysis

North America is dominating the global digital therapeutic market share with 43.3% in 2024.

North America is dominating the global digital therapeutics market mainly because of its robust digital infrastructure, high prevalence of chronic diseases, and sophisticated healthcare ecosystem. Due to the high prevalence of diabetes, obesity, cardiovascular disease, and mental health issues in the US in particular, there is a big need for digital health solutions. Adoption is accelerated and trust is fostered by regulatory bodies like the FDA taking proactive measures to approve digital therapies. Additionally, employer-based health coverage and broad insurance reimbursement lower financial barriers to DTx by increasing patient accessibility. Moreover, the area is home to well-known businesses with significant corporate and venture capital backing, including Livongo (Teladoc), Omada Health, Akili Interactive, and Click Therapeutics.

For instance, in April 2025, the FDA granted Click Therapeutics marketing permission for CT-132, the first prescription digital therapy authorized in the US for the prevention of episodic migraine. In addition to highlighting the increasing clinical validation of digital medicines, this milestone increases patient access to cutting-edge, non-pharmacological migraine therapy choices.

Europe is the second dominating region after North America in the global digital therapeutic market share with 33.4% in 2025.

The market for digital therapeutics is expected to be led by Europe in 2025 because of its robust regulatory frameworks, high level of healthcare digitization, and government backing for the adoption of digital health. The area gains from programs like Germany's Digital Health Applications (DiGA) program, which enables doctors to prescribe authorized digital medicines and get paid by statutory health insurance. Digital health is also being quickly incorporated into national healthcare systems in countries like the UK, France, and the Nordic countries, guaranteeing widespread patient access. Furthermore, the aging population and increasing prevalence of chronic diseases in Europe are driving up the need for scalable, affordable treatment solutions.

Owing to the initiatives such as Germany’s Digital Health Applications (DiGA) program in March 2023, the German Federal Institute for Drugs and Medical Devices has permanently placed Kaia Back Pain, a digital therapy for treating non-specific back pain, in the Directory of Digital Health Applications (DiGA). When prescribed, the digital therapy is free for Germans with statutory health insurance.

Owing to the prevalence of chronic diseases, the Kaia therapy is extremely beneficial because 69 million adults in Germany, or 52 million on average, experience back pain each year, with up to 90% of those cases being non-specific.

The Asia Pacific region is the fastest-growing region in the global digital therapeutic market, with a CAGR of 9.9% in 2024.

The Asia Pacific area's vast population, increased prevalence of chronic diseases, and robust government support make it the fastest-growing region in the worldwide digital health market. Nations such as China, India, and Japan are making significant investments in telemedicine, AI-powered healthcare, and digital health infrastructure. Widespread access to digital solutions is made possible by high smartphone and internet usage rates, and rising healthcare expenses are driving the need for scalable, reasonably priced technologies. The introduction of telehealth was boosted by COVID-19 and has continued since the epidemic.

Owing to this digital health in India, the government introduced Eka Care, a digital health platform that already has over 50 million users and has digitized over 110 million medical records. The COVID-19 pandemic and the Ayushman Bharat Digital Mission (ABDM) platform drove the company's expansion. Eka Care tackles the problem of longitudinal non-transactional data in healthcare by concentrating on electronic medical records. With a tight connection with the ABDM platform, the organization has established 17 million ABHA accounts.

Competitive Landscape

Top companies in the digital therapeutics market are Digital Therapeutics Alliance, Noom, Inc., Omada Health, Inc., Q4, Inc., Teladoc Health, Inc., Akili, Inc., Kaia Health,Welldoc, Inc., Hinge Health, Inc., and Click Therapeutics, Inc., among others.

Teladoc Health, Inc.:Teladoc Health is a global leader in digital therapeutics and telehealth, strengthened by its acquisition of Livongo Health for chronic disease management.Its portfolio spans diabetes, hypertension, weight management, and mental health (BetterHelp, myStrength), integrating software with connected devices.With strong payer, employer, and provider partnerships, Teladoc delivers large-scale, outcomes-driven digital care solutions.

Market Scope

Metrics | Details | |

CAGR | 21.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | By Product Type | Software, Devices |

By Application | Diabetes management, Obesity & weight management, Cardiovascular diseases, Respiratory diseases, Central Nervous System, Substance use disorders, Musculoskeletal & chronic pain management and others | |

By Sales Channel | Business-to-Business (B2B), Business-to-Consumer (B2C) | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global digital therapeutics market report delivers a detailed analysis with 56 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.