Digital Pathology Market Size & Industry Outlook

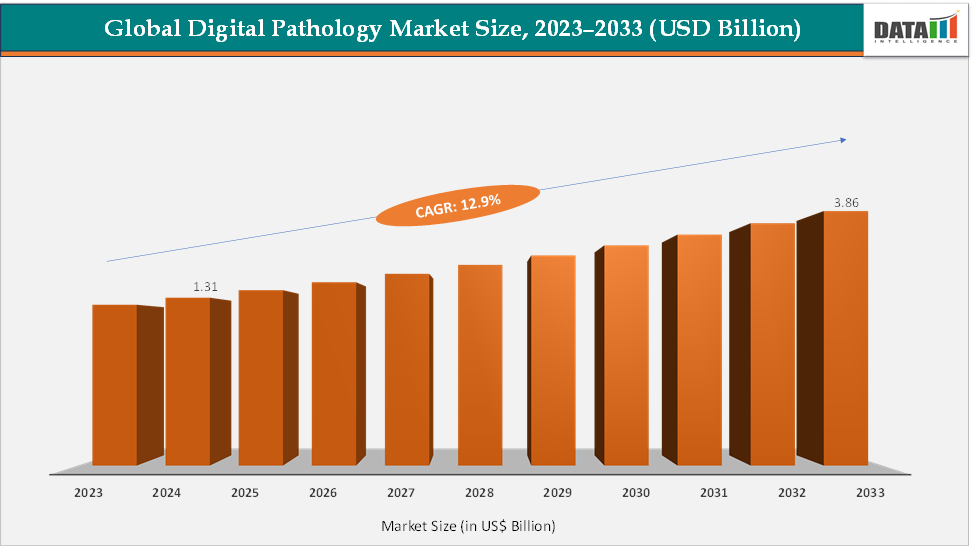

The global digital pathology market size reached US$ 1.31 Billion in 2024 from US$ 1.17 Billion in 2023 and is expected to reach US$ 3.86 Billion by 2033, growing at a CAGR of 12.9% during the forecast period 2025-2033. The market is growing rapidly due to the rising demand for faster, more accurate diagnostics and the integration of AI-driven image analysis that enhances cancer detection and biomarker quantification. Regulatory approvals, such as the FDA clearance of Philips IntelliSite Pathology Solution (2017, first WSI system approved for primary diagnosis) and Leica’s Aperio AT2 DX scanner, have legitimized digital workflows in clinical settings, accelerating hospital adoption.

Pharma and biotech companies increasingly rely on digital pathology for drug discovery and clinical trials, where tools like Visiopharm’s AI platform or PathAI’s algorithms streamline biomarker studies. The shift toward telepathology and remote consultation, which surged during COVID-19, has further fueled adoption by enabling case sharing and collaboration across geographies. Coupled with cloud-based platforms from players like Proscia and Sectra, the market is being propelled by both clinical efficiency gains and research innovation.

Key Market Highlights

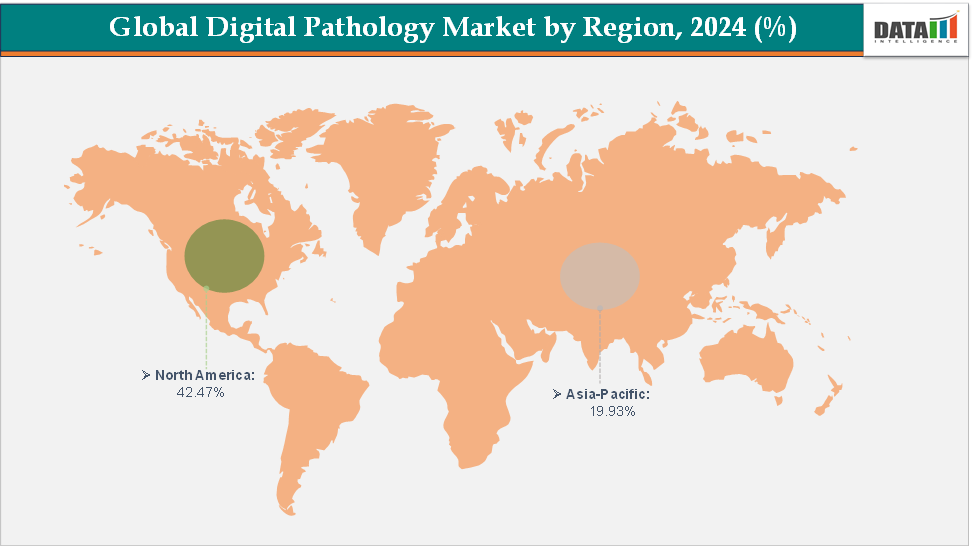

- North America dominates the digital pathology market with the largest revenue share of 42.37% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 12.7% over the forecast period.

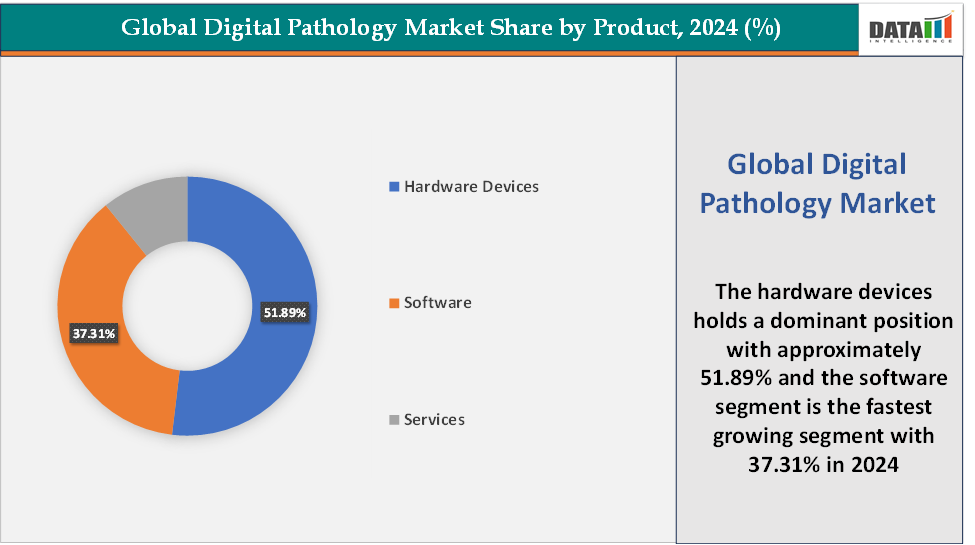

- Based on product, the hardware devices segment led the market with the largest revenue share of 51.89% in 2024.

- The major market players in the digital pathology market are Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Hamamatsu Photonics K.K., Olympus Corporation, Nikon Corporation, Visiopharm A/S, Proscia Inc., PathAI, Inc., 3DHISTECH Ltd., and Sectra AB, among others

Market Dynamics

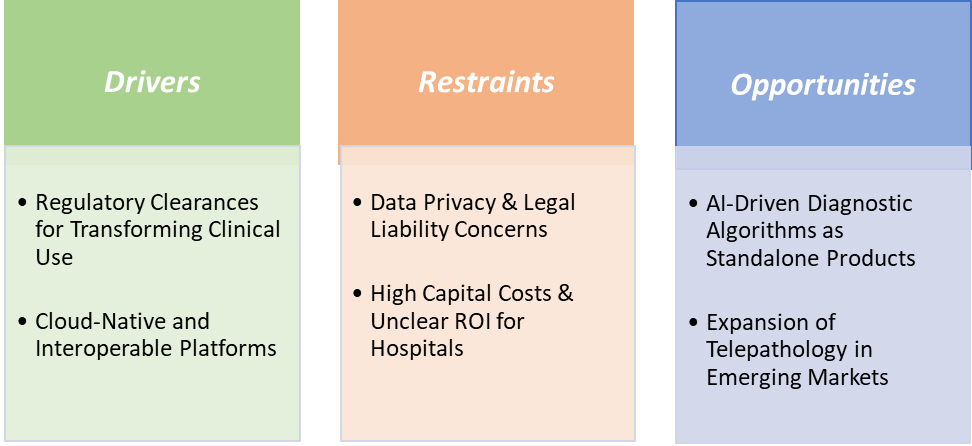

Drivers: Regulatory clearances for transforming clinical use are significantly driving the digital pathology market growth

Regulatory clearances have been a critical growth driver for the digital pathology market because they transformed digital pathology from a research-only tool into a clinically validated diagnostic solution. Before regulatory approvals, whole slide imaging (WSI) systems were largely restricted to academic research and secondary review, limiting market adoption. The landmark FDA clearance of the Philips IntelliSite Pathology Solution in 2017 was a turning point, as it became the first WSI system approved for primary diagnosis in clinical settings, enabling hospitals and laboratories to replace conventional microscopy with digital workflows.

Similarly, in June 2025, PathAI, a global leader in artificial intelligence (AI) and digital pathology solutions, announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for AISight Dx, its digital pathology image management system, for use in primary diagnosis in clinical settings. Building on the initial 510(k) clearance for AISight Dx(Novo) in 2022, this latest milestone underscores the platform’s continuous innovation and PathAI’s commitment to delivering enhanced capabilities as the product evolves.

Restraints: Data privacy & legal liability concerns are hampering the growth of the market

Data privacy and legal liability concerns are significant restraints on the growth of the digital pathology market because digital workflows inherently involve the collection, storage, and transmission of sensitive patient data. As pathology slides are digitised and shared across networks, protecting patient information under regulations like HIPAA (USA), GDPR (Europe), and similar regional laws becomes a critical challenge. Any breach or misuse of digital pathology data can result in severe legal penalties, reputational damage, and loss of trust for hospitals and diagnostic labs.

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records are reported. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records and the median breach size is 4,109 records.

These privacy and liability concerns lead hospitals and research institutions to adopt conservative, incremental implementation strategies, slowing large-scale deployment of digital pathology systems. Consequently, while digital pathology offers efficiency and analytical advantages, regulatory, legal, and compliance risks remain a key barrier, particularly in cloud-based and AI-integrated workflows.

For more details on this report – Request for Sample

Digital Pathology Market, Segment Analysis

The global digital pathology market is segmented based on product, type, application, end-user, and region.

Product:The hardware devices segment is dominating the digital pathology market with a 51.89% share in 2024

The hardware devices segment dominates the digital pathology market because digitisation begins with whole slide scanners and imaging systems, which are essential for converting glass slides into high-resolution digital images. These devices carry the highest upfront capital costs, making them the largest revenue contributor compared to software or services. The need for high-throughput devices in large pathology labs, capable of processing hundreds of slides daily, further fuels dominance, as they support clinical diagnostics, research, and pharma collaborations.

Additionally, novel product launches are also accelerating the growth of the market. For instance, in August 2025, Leica Biosystems unveiled its Aperio GT 180 scanner at the Asia Pacific Imaging Summit 2025. Building on more than 25 years of innovation, the Aperio GT 180 scanner represents the next step in Leica Biosystems' slide scanning portfolio. While offering a more compact 180-slide capacity compared to its predecessor, the Aperio GT 450, the GT 180 retains the trusted speed and reliability that defines the Aperio platform. It hosts a suite of scalable, workflow-enhancing features designed to streamline operations and accelerate scientific discovery.

Similarly, in September 2025, Philips announced a digital pathology scanner with native, configurable DICOM JPEG and JPEG XL output in the world. Philips Pathology Scanner SGi offers a powerful extension of native DICOM support designed for high-resolution whole slide images. It is the first in the world to offer native DICOM JPEG XL output. DICOM JPEG XL output files are up to 50% smaller while still providing the same high image quality, enabling pathology labs to store, manage, and analyse growing volumes of digital pathology data and enable more productive workflows in the cloud and on-premises.

The software segment is the fastest-growing in the digital pathology market, with a 37.31% share in 2024

The software segment is the fastest-growing part of the digital pathology market because it transforms static digital slides into actionable insights through AI-powered analytics, image management, and workflow integration. With its ability to enable automation, cloud collaboration, and personalised medicine, the software segment is expanding as the fastest-growing segment, outpacing hardware and services in growth trajectory.

The novel product launches by major and emerging market players are further boosting the growth of the market by offering various software solutions. For instance, in June 2025, Barco, global leader in medical visualisation and connectivity solutions, launched SlideRightQA, an in-house developed, AI-powered and vendor-neutral software solution for quality assurance in digital pathology labs. By automating quality review of whole slide images, SlideRightQA supports continuous process improvement as well as time and cost savings for labs working digitally.

Geographical Analysis

North America is expected to dominate the global digital pathology market with a 42.47% in 2024

North America dominates the global digital pathology market due to a combination of early FDA approvals, the presence of major market players, and high adoption of advanced technologies. North America also benefits from a dense network of academic medical centres (Mayo Clinic, Johns Hopkins), which have integrated digital pathology into both clinical and research workflows, often in collaboration with industry players for AI algorithm development.

US Digital Pathology Market Trends

The United States is the largest contributor, supported by the FDA’s early clearance of key digital pathology systems such as the Philips IntelliSite Pathology Solution in 2017, which was the first WSI system approved for primary diagnosis, and Leica Biosystems’ Aperio AT2 DX scanner, which further validated digital workflows in clinical pathology. These approvals reassured hospitals, academic centers, and reference labs about the clinical reliability of digital systems, catalysing large-scale adoption.

For instance, in August 2025, Artera announced that the U.S. Food and Drug Administration (FDA) granted De Novo authorisation for ArteraAI Prostate, establishing it as the first and only AI-powered software authorised to prognosticate long-term outcomes for patients with non-metastatic prostate cancer. ArteraAI Prostate is recognised as an FDA-regulated Software as a Medical Device (SaMD). The technology’s De Novo authorisation establishes a new product code category for future AI-powered digital pathology risk-stratification tools and enables its implementation at the point of diagnosis at qualified pathology labs in the U.S.

The US is home to many leading vendors, including Proscia, PathAI, Philips and others, giving it an innovation edge and easier access to cutting-edge software and AI tools. Telepathology gained particular traction in the U.S. during COVID-19, as labs adopted digital slide sharing and remote workflows to maintain continuity of care. Its dominance is reinforced by robust regulatory support, advanced infrastructure, and strong vendor presence, positioning the region as the epicentre of innovation and clinical adoption in digital pathology.

The Asia Pacific region is the fastest-growing region in the global digital pathology market, with a CAGR of 12.7% in 2024

The Asia Pacific (APAC) region is the fastest-growing market for digital pathology, driven by rising cancer incidence, improving healthcare infrastructure, and rapid adoption of AI and telemedicine. Countries such as China, Japan, South Korea, and India are investing heavily in the digital transformation of healthcare to meet growing diagnostic demand. In Japan, the Hamamatsu NanoZoomer series of scanners, which are CE-marked and widely adopted in academic and clinical settings, have been pivotal in pushing local uptake.

India is seeing growth through partnerships between hospitals and global vendors, leveraging digital pathology for telepathology services. For instance, in January 2025, IIIT Hyderabad, in collaboration with Nizam's Institute of Medical Sciences (NIMS), released digitised datasets of histopathological images focused on brain cancer and kidney disease (lupus nephritis). The effort, dubbed the India Pathology Dataset (IPD) project, a collaborative initiative involving academia, hospitals, industry, and govt, aims to digitise tissue biopsy slides. It also seeks to prevent damage to physical slides, improve clinical decision-making, accelerate diagnosis and enable AI-driven research.

Europe Digital Pathology Market Trends

The digital pathology market in Europe is expanding steadily, supported by strong regulatory frameworks, new product launches, and increasing clinical adoption across major healthcare systems. This growth is fueled by the rising cancer burden, the need for faster diagnostic turnaround times, and EU-backed initiatives like the Europe’s Beating Cancer Plan and Horizon Europe programs, which are accelerating the modernisation of diagnostic infrastructure. Several recent product approvals and launches highlight this momentum, along with partnerships between the market players.

For instance, in June 2025, FUJIFILM Healthcare Europe, the global leader in Digital Pathology software and Ibex Medical Analytics (Ibex), a leader in AI-powered cancer diagnostics in Pathology, are delighted to announce a formal partnership to support efficient and accurate cancer diagnosis. Integrating Ibex’s AI platform with Fujifilm’s SYNAPSE Pathology solution is expected to allow users across the world to optimise laboratory workflows and reduce turnaround times. Ibex’s AI solutions have been shown to improve reporting efficiency and drive productivity by up to 37%. The SYNAPSE Pathology solution has been proven to deliver digital images for diagnosis 1.7 hours faster than glass slides, while increasing collaboration and communication.

Competitive Landscape

Top companies in the digital pathology market include Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Hamamatsu Photonics K.K., Olympus Corporation, Nikon Corporation, Visiopharm A/S, Proscia Inc., PathAI, Inc., 3DHISTECH Ltd., and Sectra AB, among others.

Market Scope

| Metrics | Details | |

| CAGR | 12.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Hardware Devices, Software, and Services |

| Type | Human Pathology and Veterinary Pathology | |

| Application | Clinical Diagnostics, Telepathology, Drug Discovery, Training & Education, and Others | |

| End-User | Hospitals, Diagnostic Laboratories, Academic & Research Institutes, Veterinary Clinics, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global digital pathology market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here