Global Digital Identity Solutions Market: Industry Outlook

The digital identity solutions market is experiencing rapid growth as organizations and governments increasingly prioritize secure digital authentication systems to safeguard sensitive data. The surge in cybersecurity threats, with an average of 2,200 cyber attacks occurring daily—or one attack every 39 seconds—has underscored the urgent need for advanced identity verification platforms. The financial stakes are high, as a data breach in the US costs an average of US$9.44 million, while global cybercrime is projected to reach US$8 trillion by 2023, highlighting the critical role digital identity solutions play in mitigating financial and operational risks.

Adoption is being fueled by growing digitalization across sectors, including e-commerce, finance, healthcare, and government services. Solutions now integrate multifactor authentication, biometrics, AI-driven analytics, and blockchain-based verification to ensure robust security. For instance, in May 2025, Hawaiʻi launched myHawaii, a user-friendly digital identity platform that allows residents to access 96 online state and county services through a single login, incorporating advanced security features like fraud detection and multifactor authentication. Initiatives like myHawaii demonstrate how digital identity solutions are enhancing accessibility, reducing redundancy, and improving operational efficiency, providing a model for government digital transformation globally.

Looking ahead, the Digital Identity Solutions market is projected to grow at a strong double-digit CAGR, driven by increasing investments in cybersecurity infrastructure, regulatory compliance requirements, and the adoption of cloud and mobile-first technologies. Regions like Asia-Pacific are emerging as fast-growing markets, propelled by national digital ID programs, while North America and Europe maintain mature, early-adopter markets. Continuous innovation in self-sovereign identity, privacy-preserving verification, and AI-based threat detection is positioning digital identity as a cornerstone of secure, connected ecosystems worldwide, with both public and private sectors recognizing it as a critical pillar of digital trust.

Key Market Trends & Insights

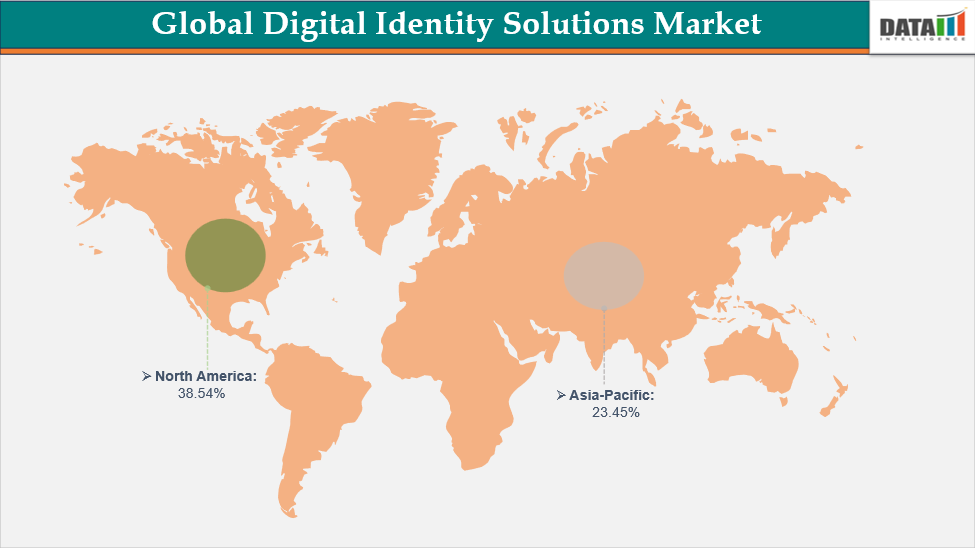

- North America leads the Digital Identity Solutions market with a 38.54% share, driven by early adoption of advanced identity verification technologies, stringent cybersecurity regulations, and widespread digital transformation across government and enterprise sectors.

- Asia-Pacific is the fastest-growing region in the Digital Identity Solutions market, with a CAGR of 25.40%, fueled by rapid digitalization, government-led national ID initiatives, and increasing adoption of mobile and cloud-based identity verification solutions.

- By offering, the Solutions segment leads the Digital Identity Solutions market with a 64.45% share, driven by the high demand for comprehensive identity verification, authentication, and management platforms across enterprises and government sectors.

Market Size & Forecast

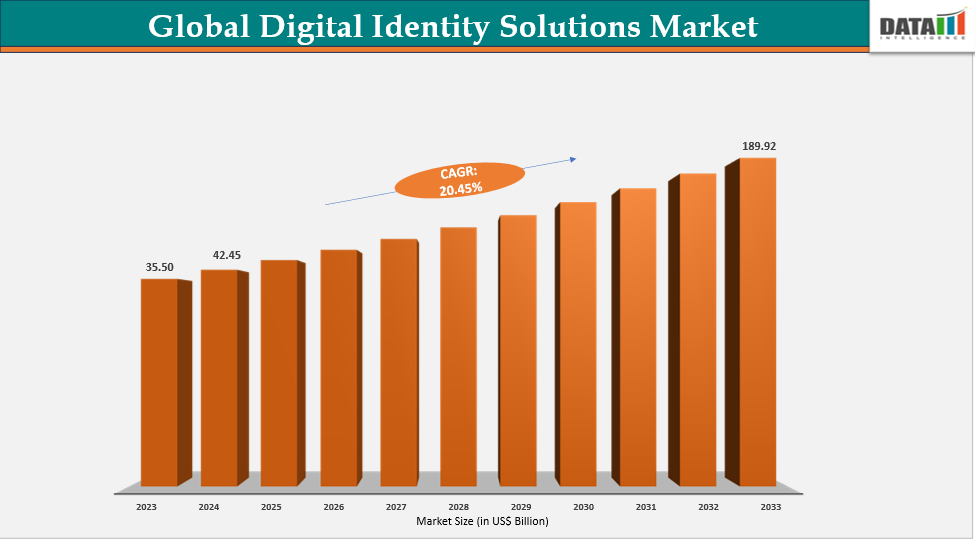

- 2024 Market Size: US$42.45 Billion

- 2033 Projected Market Size: US$189.92 Billion

- CAGR (2025–2033): 20.45%

- North America Largest market in 2024

- Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Growth of Digital Transactions and Online Services

The rapid expansion of digital transactions and online services is a major driver of the Digital Identity Solutions market. In 2024, global digital payment transactions surged to approximately US$8.5 trillion, reflecting a substantial rise from previous years and highlighting the shift toward online and cashless payment methods. As more consumers and businesses adopt digital financial services, the need for secure and efficient identity verification systems has grown significantly. Organizations are increasingly implementing multi-factor authentication, biometrics, and AI-driven verification to protect sensitive financial data and prevent fraud. The rise of e-commerce, mobile banking, and fintech platforms has further emphasized the importance of seamless, reliable digital identity solutions that ensure safe access and transactions.

This growing demand is exemplified by recent initiatives, such as Saudi Arabia’s launch of digital identity services for the financial sector in September 2024. Integrated with the Absher electronic platform, this service enables individuals to verify identities electronically and conduct secure financial transactions, improving user experience while strengthening fraud prevention. Unveiled at the 24 Fintech conference in Riyadh under the patronage of Minister of Interior Prince Abdulaziz bin Saud bin Naif, this initiative reflects the kingdom’s commitment to digital transformation. Such developments illustrate how the growth of online services and digital payments worldwide is driving enterprises and governments to adopt advanced identity solutions, creating significant opportunities for market expansion.

Restraint: High Implementation and Operational Costs

High implementation and operational costs are a major restraint for the digital identity solutions market. Deploying advanced technologies such as biometric authentication, blockchain-based identity management, and AI-driven verification requires significant upfront investment. Small and medium enterprises (SMEs) often struggle to allocate the necessary budget for these solutions, limiting their adoption. Additionally, the integration of these systems with existing legacy infrastructure can be expensive and time-consuming. The requirement for specialized hardware, such as scanners or secure servers, further increases capital expenditure.

Beyond initial setup, ongoing operational costs also pose challenges. Regular system maintenance, software updates, and cybersecurity measures demand continuous financial resources. Training employees to effectively manage and operate digital identity solutions adds another layer of expense. High costs can discourage organizations from scaling their digital identity initiatives across multiple branches or regions. Consequently, the market growth is restrained, particularly in cost-sensitive industries and emerging economies.

For more details on this report, Request for Sample

Segmentation Analysis

The global digital identity solutions market is segmented based on offering, identity type, deployment mode, organization size, end-user, and region.

Offering: Solutions Lead Market With 64.45% Share – Fueled by Software-Driven Identity Verification and Platform Adoption

The Digital Identity Solutions market demonstrates significant adoption across both hardware and software segments, driven by the increasing demand for secure, efficient, and scalable identity verification systems. Hardware solutions, including biometric scanners, smart cards, and mobile authentication devices, continue to play a vital role in ensuring reliable user verification, particularly in high-security environments such as government services, financial institutions, and healthcare.

Meanwhile, software solutions leverage AI, machine learning, and cloud-based platforms to manage identity data, authentication processes, and fraud prevention, offering flexibility, real-time updates, and integration with multiple service providers. The combined strength of hardware and software enables organizations to create end-to-end identity ecosystems that are robust, interoperable, and privacy-focused.

Recent initiatives highlight the growing impact of these solutions globally. In September 2025, Civitas ID launched a human-centered, localized platform at the 80th UN General Assembly, enabling over 123 million displaced people to access financial and economic opportunities through biometrics, AI, and mobile technology while prioritizing privacy and security.

Similarly, in April 2025, India’s mobile Aadhaar app integrated facial biometrics with enhanced privacy controls, improving access to banking, travel, and public benefits while reinforcing the country’s Digital Public Infrastructure. These developments underscore how the synergy of hardware and software solutions not only drives market growth but also addresses critical social and economic challenges, highlighting the transformative potential of digital identity solutions worldwide.

Geographical Analysis

North America Leads Market With 38.54% Share, Driven by Advanced Infrastructure and Early Technology Adoption.

North America leads the Digital Identity Solutions market with a dominating share, supported by a strong technological infrastructure and early adoption of digital identity systems. Governments and enterprises across the US and Canada are investing heavily in secure identity verification platforms to enhance authentication, reduce fraud, and comply with regulatory requirements. The region benefits from widespread integration of software and hardware solutions, including biometric scanners, AI-driven verification, and cloud-based identity management platforms. Rising digital adoption among consumers and businesses is further fueling the demand for robust identity solutions across finance, healthcare, and public services.

Cybersecurity remains a critical driver of the market, as 59% of US businesses reported experiencing successful cyberattacks in the past 12 months, with 33.5% attributing these attacks to AI-enabled threats. This alarming trend underscores the need for advanced, AI-powered digital identity solutions to prevent fraud, secure sensitive data, and ensure trust in digital transactions. Companies are increasingly adopting multi-factor authentication, blockchain-based identity verification, and AI-enhanced monitoring to counter sophisticated cyber threats. At the same time, growing online commerce in Canada—with over 27 million eCommerce users in 2022, expected to rise to 77.6% by 2025—drives demand for scalable digital identity systems to enable secure, seamless transactions.

Strategic collaborations between governments, private enterprises, and technology providers are further strengthening North America’s market leadership. Continuous R&D in AI, biometrics, and identity management platforms is driving innovation, offering secure, interoperable, and privacy-centric solutions. As organizations recognize the importance of digital identity in supporting economic growth, enhancing consumer trust, and mitigating cyber risks, North America is poised to maintain its dominance. The combined effect of technological maturity, cybersecurity awareness, and rapid digital adoption ensures the region remains a key hub for global digital identity advancements.

Asia-Pacific Digital Identity Solutions Market Growing Fast at 24.50% CAGR Due to Rapid Adoption of Contactless and Mobile Payments

Asia-Pacific is emerging as the fastest-growing region in the Digital Identity Solutions market, driven by rapid digital transformation, increasing cyber threats, and a surge in online transactions across countries like India, China, and Southeast Asia. Governments in the region are implementing large-scale identity initiatives and digital payment systems, which are accelerating demand for secure, scalable, and interoperable identity solutions. The mobile-first population and rising e-commerce adoption further fuel the need for robust verification platforms that can support millions of users seamlessly.

In India, the rapid expansion of digital payments highlights this trend, with IMPS transactions increasing from 407.92 million in November 2024 to 441 million in December 2024. UPI processed over 16.73 billion transactions recently and totaled around 172 billion in 2024, marking a 46% increase from 2023. This surge reflects a cultural shift toward financial inclusivity, positioning digital identity solutions as a central enabler of secure and convenient access to banking, public services, and online commerce. These developments drive investments in biometric authentication, multi-factor verification, and AI-powered identity platforms to support the growing volume of digital transactions.

China is also strengthening the regional market with its July 2025 launch of the voluntary Cyberspace ID system, a national digital identity framework enhancing online verification, privacy, and cybersecurity. By providing users with unique internet IDs and digital certificates, the system enables secure access across multiple websites and apps without repeatedly submitting personal information. Combined with India’s massive digital payment growth, these initiatives illustrate how government-backed digital identity programs are transforming the Asia-Pacific region. The integration of technology, policy, and consumer adoption positions Asia-Pacific as the fastest-growing market globally for digital identity solutions.

Competitive Landscape

The major players in the digital identity solutions market include Thales Group, NEC Corporation, IDEMIA, Samsung SDS, Telus, GB Group plc (GBG), Tessi, Daon, Inc., ForgeRock, Inc., and IBM.

Thales Group: Thales Group is a global technology leader headquartered in France, specializing in aerospace, defense, security, and digital identity solutions. The company provides end-to-end digital identity and security products, including biometric authentication systems, smart cards, and identity management platforms. Thales’ digital identity solutions serve governments, financial institutions, and enterprises, enabling secure access, authentication, and credentialing. Its offerings integrate hardware and software components to ensure robust, scalable, and privacy-compliant identity verification. By combining advanced encryption, biometrics, and cloud-based platforms, Thales continues to drive innovation in secure digital identity solutions worldwide.

Market Scope

| Metrics | Details | |

| CAGR | 20.78% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Offering | Solutions, Services |

| Identity Type | Biometrics, Non-Biometrics | |

| Deployment Mode | On-Premises, Cloud | |

| Organization Size | Large Enterprises, Small & Medium Enterprises (SMEs) | |

| End-User | BFSI, IT & Telecom, Retail & E-commerce, Government & Defense, Healthcare, Energy & Utilities, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Digital Identity Solutions market report delivers a detailed analysis with 78 key tables, more than 72 visually impactful figures, and 267 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here