Dental Imaging Market Size & Industry Outlook

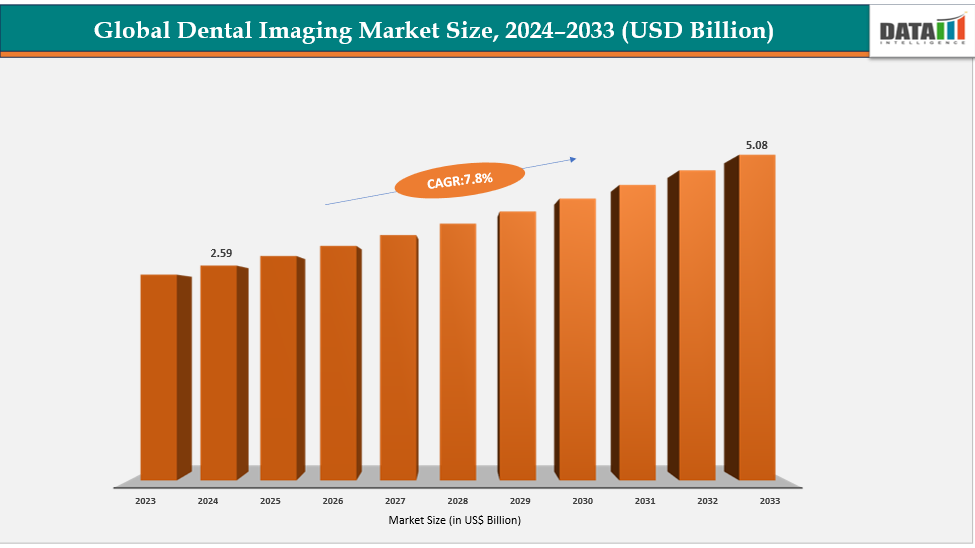

The global dental imaging market size reached US$ 2.59 billion in 2024 is expected to reach US$ 5.08 billion by 2033, growing at a CAGR of 7.8% during the forecast period 2025-2033. One of the most significant drivers propelling the global dental imaging market is the increasing demand for cosmetic and aesthetic dental procedures. As individuals worldwide become more conscious of their appearance and oral health, there is a growing emphasis on achieving a perfect smile through procedures such as teeth whitening, veneers, orthodontic alignments, and dental implants. Advanced imaging technologies like intraoral scanners, cone-beam computed tomography (CBCT), and 3D imaging systems play a critical role in these treatments by providing high-precision visuals that help dentists plan and simulate outcomes with accuracy.

For instance, Align Technology’s iTero scanners are widely used in orthodontic and restorative workflows to capture 3D digital impressions, improving treatment efficiency and patient experience. Similarly, Planmeca’s Romexis software allows clinicians to integrate imaging data for comprehensive aesthetic planning. The rising disposable income in developing countries, social media influence, and the growing trend of dental tourism have further accelerated this demand.

Key Highlights

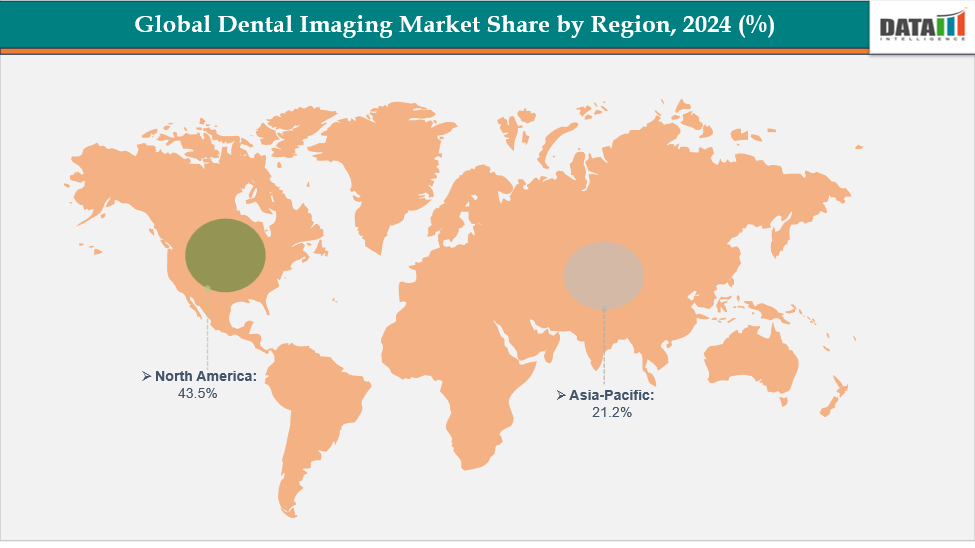

- North America dominates the dental imaging market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

- Based on product type, intraoral X-ray segment led the market with the largest revenue share of 45.1% in 2024.

- The major market players in the dental imaging market includes Dentsply Sirona, DEXIS, Carestream Dental LLC, VATECH Co., Ltd, ACTEON Group, Dürr Dental (DÜRR DENTAL SE), J. Morita Corporation., Midmark Corporation, Cefla / NewTom, Genoray Co., Ltd. and among others.

Market Dynamics

Drivers: Growing prevalence of dental disorders driving the dental imaging market growth

The rising global burden of dental disorders such as tooth decay, dental caries, periodontitis, and oral cancers is a key driver fueling the dental imaging market. Poor oral hygiene, unhealthy diets, and aging populations have led to a significant increase in dental complications, creating a higher demand for accurate and early diagnostic tools. Dental imaging systems especially digital X-rays and cone-beam CT (CBCT) scanners enable dentists to detect hidden caries, bone loss, and structural abnormalities with precision.

For instance, according to NCBI studies 2025, the global prevalence of dental caries among older adults is estimated at 60.7% (95% CI: 54.6%–66.4%), with the Americas reporting the highest rate at 79.6% (95% CI: 34.8%–96.6%). Meta-regression findings indicate that caries prevalence tends to decline with larger sample sizes, higher-quality studies, and increasing age, but has shown a rising trend over time (P < 0.05).

Restraints: High cost of advanced imaging systems are hampering the growth of the dental imaging market

One of the major restraints in the global dental imaging market is the high cost of advanced imaging equipment, which limits adoption among small and mid-sized dental clinics. Cutting-edge technologies such as cone-beam computed tomography (CBCT), digital panoramic systems, and intraoral scanners require substantial investment, making them unaffordable for many practitioners, especially in developing regions.

For instance, a CBCT system typically costs between USD 60,000 and USD 250,000, while high-end intraoral scanners are priced around USD 20,000–50,000, excluding software licenses, maintenance, and training expenses. These high capital and operational costs increase the financial burden on dental practices, slowing the transition from conventional 2D imaging to modern digital and 3D systems.

For more details on this report – Request for Sample

Segmentation Analysis

The global dental imaging market is segmented based on product type, technology, application, end user, and region.

Product Type: The intraoral x-ray from product type segment to dominate the dental imaging market with a 45.1% share in 2024

The intraoral X-ray segment is expanding due to the demand for precise and early diagnosis of dental conditions like cavities, root infections, and bone loss. Technological advancements, such as digital sensors and phosphor storage plates, have improved image clarity, reduced radiation exposure, and enhanced workflow efficiency. Dentsply Sirona's Schick AE sensors and Vatech's EzSensor Soft offer high-resolution imaging with patient comfort and faster processing. The growing awareness of preventive dentistry and integration of imaging with digital record systems further supports the segment's growth.

For instance, in March 2025, Planmeca introduced its first handheld intraoral X-ray device, Planmeca ProX GO, which offers space and time-saving efficiency in traditional clinics, radiology rooms, mobile dental clinics, nursing homes, and emergency situations.

Application: The endodontics segment is estimated to have a 41.1% of the dental imaging market share in 2024

The endodontics segment is a key driver of the global dental imaging market, fueled by the growing need for precise diagnosis and treatment of root canal and pulp-related conditions. Accurate imaging is critical in endodontics to detect complex root structures, canal morphology, infections, and periapical lesions, which directly impacts treatment success. Advanced technologies such as digital intraoral X-rays, CBCT scanners, and 3D imaging systems allow clinicians to visualize fine anatomical details, plan procedures, and reduce the risk of complications.

For instance, Dentsply Sirona’s EndoSequence imaging solutions and Vatech’s Green CT systems are widely used for preoperative assessment and treatment monitoring in root canal therapy. Increasing awareness of oral health, coupled with the adoption of minimally invasive procedures, is further driving the uptake of dental imaging solutions in the endodontics segment.

Geographical Analysis

North America dominates the global dental imaging market with a 43.5% in 2024

North America remains a key market due to the high prevalence of dental disorders and well-established dental infrastructure. Widespread adoption of digital and 3D imaging technologies in dental practices, combined with strong insurance coverage for diagnostic procedures, drives market growth. In the USA, the market is propelled by the rapid integration of advanced imaging systems in routine dental care, such as CBCT and intraoral scanners. Factors like high patient awareness, rising demand for cosmetic dentistry, and technologically advanced dental clinics support widespread utilization.

For instance, in August 2025, Vatech has launched its new dental imaging platform, Vatech Clever One, in the US, following FDA clearance for its AI-driven lesion detection feature. The platform integrates diagnostic tools to support dental professionals in the entire clinical workflow, from imaging to patient communication.

Europe is the second region after north America which is expected to dominate the global dental imaging market with a 34.5% in 2024

Europe’s dental imaging market is driven by technological innovation and adoption of minimally invasive procedures. The increasing number of dental clinics equipped with digital X-rays, CBCT systems, and intraoral scanners, along with rising geriatric populations requiring restorative and implant procedures, boosts demand. Stringent quality standards and safety regulations also promote high-quality imaging solutions. Germany, as a major European hub, sees growth from advanced dental infrastructure and high healthcare expenditure per capita. The demand is supported by cutting-edge imaging technologies, growing dental tourism, and government initiatives promoting preventive oral healthcare.

The Asia Pacific region is the fastest-growing region in the global dental imaging market, with a CAGR of 8.1% in 2024

The Asia-Pacific market is expanding due to rapid urbanization, rising disposable incomes, and growing dental awareness. Increasing numbers of dental clinics, expanding cosmetic dentistry, and the trend toward digitalization of dental procedures are key drivers. Emerging economies like India and China are witnessing strong growth in imaging adoption due to cost-effective solutions.

Japan drives the market with its highly developed healthcare infrastructure and aging population, which increases demand for diagnostic and restorative dental procedures. Early adoption of CBCT and intraoral scanners, along with government support for preventive oral care and technological innovation in dental imaging, strengthens market growth.

For instance, in June 2025, Japanese researchers have initiated human trials for a novel drug designed to regenerate human teeth, representing a major breakthrough in dental innovation. Human trials are crucial in developing dental therapies, as they assess the safety and efficacy of new treatments before broader use. This pioneering tooth-regrowth drug, developed in Japan, holds significant potential to transform dental care and treatment outcomes.

Competitive Landscape

Top companies in the dental imaging market include Dentsply Sirona, DEXIS, Carestream Dental LLC., VATECH Co., Ltd, ACTEON Group, Dürr Dental (DÜRR DENTAL SE), J. Morita Corporation., Midmark Corporation, Cefla / NewTom., Genoray Co., Ltd. and among others.

Dentsply Sirona:- Dentsply Sirona is a key player in the Asia-Pacific dental imaging market, driving growth through its advanced technologies like Primescan 2, SureSmile, and AI-enhanced imaging solutions. With a strong regional leadership presence and a focus on independent clinics and growing dental service organizations, the company leverages digital innovations to meet the rising demand for accurate diagnostics and efficient workflows.

Market Scope

| Metrics | Details | |

| CAGR | 7.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Intraoral X-ray, Extraoral X-ray, Imaging Software, Others |

| Technology | 2D Digital Radiography, 3D CBCT, Optical/impression scanners, Digital sensors, Hybrid Systems | |

| Application | Endodontics, Implantology, Orthodontics, Oral & Maxillofacial Surgery, Others | |

| End User | Dental Clinics & Practices, Hospitals, Dental & Diagnostic Imaging Centers, Academic & Research Institutes, Specialty Clinics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global dental imaging market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here