Decentralized Clinical Trials Market Size

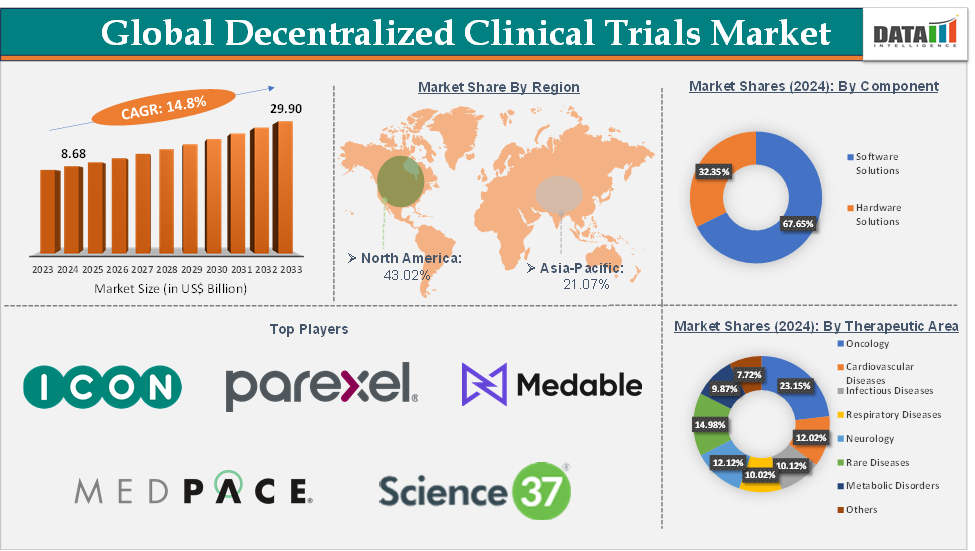

Decentralized Clinical Trials Market Size reached US$ 8.68 Billion in 2024 and is expected to reach US$ 29.90 Billion by 2033, growing at a CAGR of 14.8% during the forecast period 2025-2033.

Decentralized Clinical Trials Market Overview

The decentralized clinical trials market is undergoing rapid transformation, driven by technological innovation, shifting regulatory landscapes, and growing stakeholder investment. Challenges persist, particularly in areas such as regulatory standardization and data security, but opportunities abound. Organizations that invest in robust digital infrastructures, AI-driven analytics, and patient-centric engagement models are well-positioned to capture market share and redefine clinical research paradigms over the next decade.

Executive Summary

For more details on this report – Request for Sample

Decentralized Clinical Trials Market Dynamics: Drivers & Restraints

The rising technological advancements in decentralized clinical trials are significantly driving the market growth

Companies like Medidata, Medable, and other major and emerging players have integrated AI-software solutions, Bluetooth-enabled ECG patches, continuous glucose monitors, and activity trackers into their DCT platforms. Instead of visiting a clinic for vitals or an ECG, patients simply wear a small patch (e.g., BioTelemetry’s Mobile Cardiac Outpatient Telemetry device) that streams heart-rate data in real-time to a centralized dashboard. Real-time physiological monitoring means faster safety signals, fewer on-site visits, and higher patient compliance. Trials for chronic conditions no longer require weekly clinic visits, patients can transmit data from home.

For instance, in November 2024, Medable Inc., a leading provider of clinical development technology, announced Medable AI, generative AI capabilities that help sponsors and clinical research organizations (CROs) build digital and decentralized trials faster with complete visibility and control over technology setup. Medable is the first to incorporate generative AI in the study build process, ultimately driving the industry to a breakthrough, one-day study startup.

Moreover, Science 37 offers a virtual trial operating system that integrates secure video calls, eConsent, and ePRO (electronic patient-reported outcomes) all in one place. During the COVID-19 pandemic, Pfizer used a telemedicine approach for its COVID vaccine booster study participants could be screened, consented, and followed up entirely via video call, with the investigational product shipped directly to their homes. By replacing in-person site visits with video visits (and mobile nursing visits, when necessary), sponsors reduce geographic barriers, speed up recruitment, and improve retention.

Data privacy and security concerns are hampering the growth of the decentralized clinical trials market

In a traditional, site‐centric trial, data is largely generated and stored within a controlled hospital or research center. In decentralized clinical trials, however, data streams in real time from smartphones, wearable sensors (e.g., continuous glucose monitors, ECG patches), home‐visit nurses’ tablets, local laboratories, and cloud‐based EDC (electronic data capture) systems, which can lead to data breaches, further hampering the market growth.

For instance, according to the HIPAA Journal, in 2024, the protected health information of 276,775,457 individuals was exposed or stolen. On average, that is 758,288 records per day. In March 2025, 1,754,097 individuals had their protected health information exposed, stolen, or impermissibly disclosed in a healthcare data breach.

Decentralized Clinical Trials Market Segment Analysis

The global decentralized clinical trials market is segmented based on study type, component, therapeutic area, end-user, and region.

The oncology segment from the therapeutic area is expected to hold 23.15% of the market share in 2024 in the decentralized clinical trials market

According to the World Health Organization (WHO), over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022. Thus, rising cancer cases increase the need for further oncology trials, which often require continuous monitoring and long-term follow-up to assess the efficacy and safety of treatments. There is a rising oncology clinical trials, and many researchers are choosing the decentralized oncology trials, which further accelerates the segment’s growth.

For instance, in May 2025, Researchers at the Ohio State University Comprehensive Cancer Center (OSUCCC) are enrolling patients with advanced pancreatic cancer in a Phase II study of Incyte's Pemazyre (pemigatinib). Patients in this trial will be able to do all the tests and follow-ups to track their outcomes on the drug through community providers and via telemedicine, a fully decentralized approach that hasn't been widely embraced by drugmakers and researchers.

Decentralized clinical trials facilitate remote monitoring through wearable devices and telemedicine, enabling oncologists to observe changes in real time without the patient needing to make frequent clinic visits. For instance, in February 2023, the Nova Scotia Health Innovation Hub selected Medable’s decentralised clinical trial (DCT) platform to improve care accessibility for remote oncology patients in rural Nova Scotia, Canada. Patients can use Total Consent Management and Televisit solutions, plus other services from Medable, to speak with a physician from their home. Additionally, the new strategy is expected to empower primary care providers to be more involved with their patients after trials through a shared care model, which will be supported by decentralized clinical trial technologies.

Decentralized Clinical Trials Market Geographical Analysis

North America is expected to dominate the global decentralized clinical trials market with a 43.02% share in 2024

North America, especially the United States, has been a leader in pioneering new clinical trial models, with early adopters of decentralized clinical trial technologies making significant strides in remote patient monitoring, virtual visits, e-consent, and mobile health tools.

For instance, in November 2024, Medable Inc. released Medable AI, generative AI capabilities that help sponsors and clinical research organizations (CROs) build digital and decentralized trials faster with complete visibility and control over technology setup. Medable is the first to incorporate generative AI in the study-build process, ultimately driving the industry to a breakthrough, one-day study startup. Medable AI, integrated with Medable Studio, automates repetitive, time-intensive manual tasks to decrease time to First Patient In (FPI) for digital and decentralized clinical trials, dramatically accelerating study startup.

North America hosts a disproportionate share of large pharmaceutical and biotechnology headquarters. These companies are already running thousands of site-based trials, can readily convert portions of their portfolios to decentralized formats. For instance, Pfizer and Roche both piloted decentralized clinical trials modules (eConsent, direct‐to‐patient drug shipments, remote safety monitoring) in late 2023, taking advantage of U.S. infrastructure to execute these modules more swiftly than their non-U.S. peers.

Asia-Pacific is growing at the fastest pace in the decentralized clinical trials market, holding 21.07% of the market share

Asia Pacific is home to a vast and diverse population, with over 4.83 billion people across the region. This diverse population, especially in countries like China and India, presents significant opportunities for clinical trials that benefit from both a high volume of potential participants and varied demographics.

Clinical trials in the Asia Pacific are often more cost-effective compared to Western regions. For instance, according to the Clinical Leader, clinical trials in APAC countries cost 30%-40% less than in other regions, making the area very attractive to pharmaceutical and biotech companies. Lower costs of healthcare, patient recruitment, and infrastructure mean that pharmaceutical companies and contract research organizations (CROs) can run decentralized clinical trials at reduced costs. This makes it an attractive option for both global pharmaceutical companies and local biotech firms.

Decentralized Clinical Trials Market Top Companies

Top companies in the decentralized clinical trials market include ICON plc, Parexel International Corporation, Laboratory Corporation of America Holdings, Medpace, Inc., Science 37, THREAD, Inc., Curebase, Castor, IQVIA Inc., and Medable Inc., among others.

Emerging Players

The emerging players in the decentralized clinical trials market include Veeva Systems Inc., PRAXIS, Advarra, The Emmes Company, LLC, and Syneos Health, among others.

Key Developments

In May 2025, ABM Respiratory Care, an innovator in respiratory therapy solutions, announced the initiation of a multi-center home care study in collaboration with Delve Health, a trailblazer in decentralized clinical trial technology, to evaluate the impact of its BiWaze Clear System in patients living with bronchiectasis. The study will assess how the BiWaze Clear System affects respiratory health over six months.

In October 2024, Adaptive Research, a clinical trial site organization dedicated to democratizing clinical trials, announced its participation in a groundbreaking decentralized study for Parkinson’s Disease sponsored by PhotoPharmics Inc. California Movement Disorders Center, part of Adaptive Research’s network, will serve as a site for PhotoPharmics’ LIGHT-PD trial, testing the efficacy of Celeste Specialized Phototherapy in treating Parkinson’s symptoms.

In August 2024, Walgreens and the Biomedical Advanced Research and Development Authority (BARDA) announced a strategic partnership to increase innovation in decentralized clinical trials as part of the Decentralized Clinical Operations for Healthcare and Research (D-COHRe) program. The program is designed to strengthen U.S. decentralized clinical research capabilities to support the development of U.S. Food and Drug Administration (FDA)-regulated products, enhance clinical innovation to execute more efficient and relevant clinical research, and evaluate other medical countermeasures in real-world environments that may be used in a public health emergency.

Market Scope

Metrics | Details | |

CAGR | 14.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Study Type | Interventional Trials, Observational Trials, Expanded Access Trials, Others |

Component | Software Solutions, Hardware Solutions | |

Therapeutic Area | Oncology, Cardiovascular Diseases, Infectious Diseases, Respiratory Diseases, Neurology, Rare Diseases, Metabolic Disorders, Others | |

End-User | Pharmaceutical and Biotechnology Companies, Contract Research Organizations, Academic and Research Institutes, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global decentralized clinical trials market report delivers a detailed analysis with 62 key tables, more than 53 visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.