Global Dairy alternatives for infant Market Size & Overview

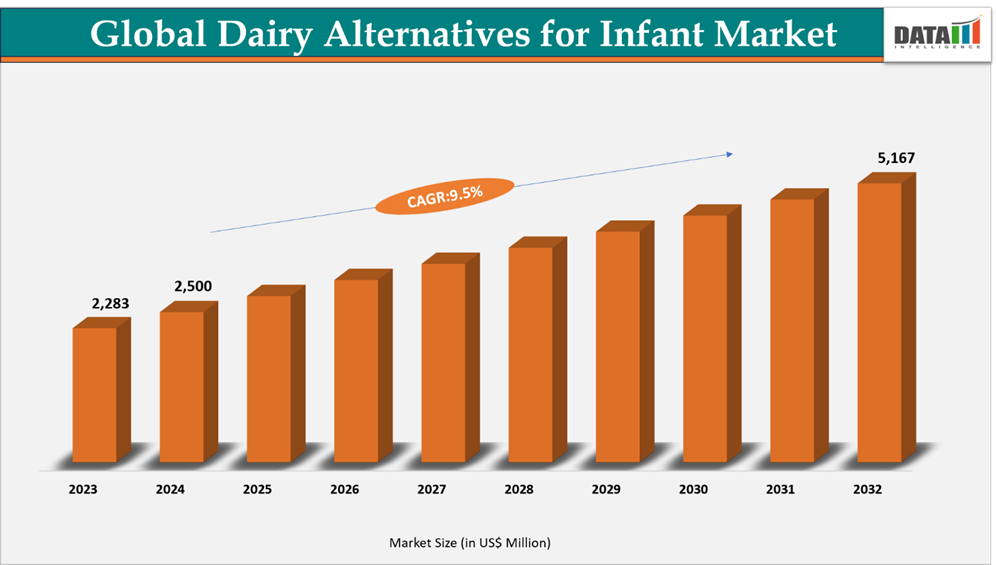

The global dairy alternatives for infant market reached US$ 2,283 million in 2023, rising to US$2,500 million in 2024 and is expected to reach US$ 5,167 million by 2032, growing at a CAGR of 9.5% from 2025 to 2032.

The dairy alternatives for infant market have been gradually expanding, driven by increased knowledge of sleep health, the prevalence of sleep disorders and lifestyle-related stress among urban populations. Dairy alternatives for infant are generally used as a dietary supplement in gummies and softgels, with extended-release formulations approved by the regulations of various countries. Market growth is also being fueled by a growing interest in holistic wellbeing, with manufacturers introducing functional ingredients like herbal extracts, vitamins and stress-relief components to improve product distinctiveness and value.

Dairy alternatives for infant Market Industry Trends and Strategic Insights

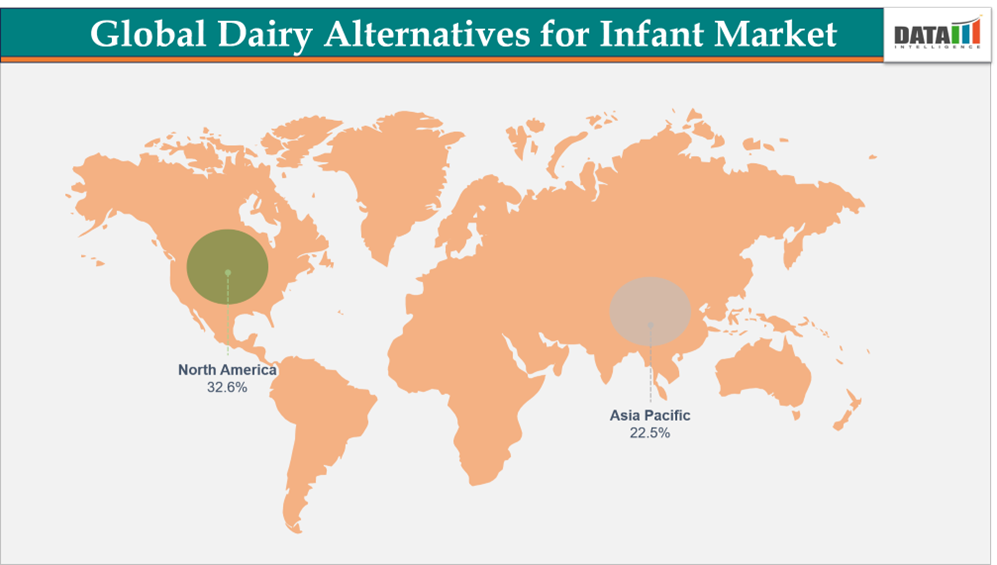

- North America leads the global dairy alternatives for infant market, capturing the largest revenue share of 32.6% in 2024.

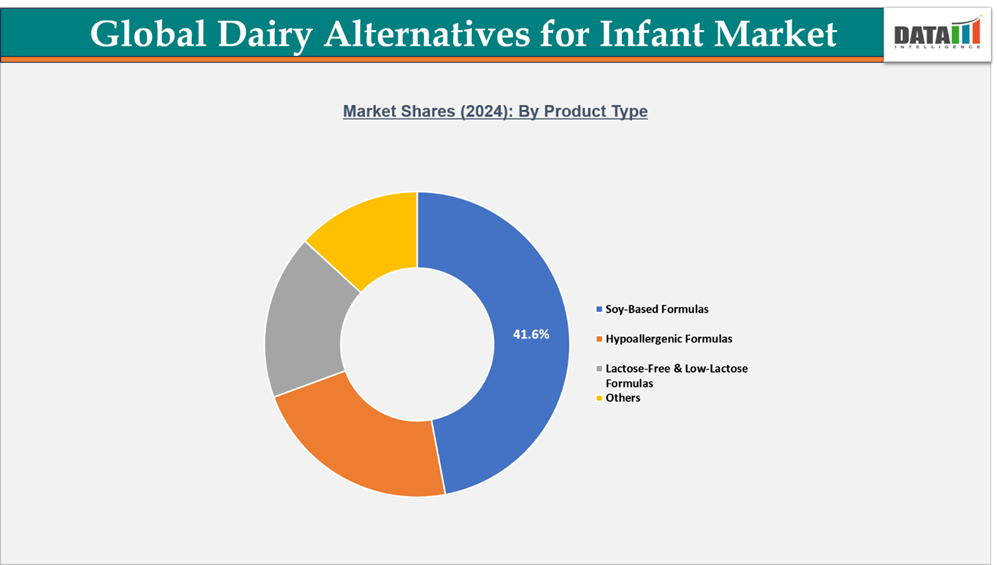

- By product type form segment, soy-based formulas lead the global dairy alternatives for infant market, capturing the largest revenue share of 41.4% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 2,500 million

- 2032 Projected Market Size: US$ 5,167 million

- CAGR (2025–2032): 9.5%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Soy-Based Formulas, Hypoallergenic Formulas, Lactose-Free & Low-Lactose Formulas, Others |

| By Stage | Stage 1 – Infant Formula (0–6 months), Stage 2 – Follow-on Formula (6–12 months) |

| By Distribution Channel | Online, Offline |

| By Category | Organic, Conventional |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report, Request for Sample

Market Dynamics

Preference for Organic and Clean-Label Products

Rising parental awareness about infant health and nutrition is significantly boosting demand for organic and clean-label dairy alternatives. Today’s parents are increasingly selective about the ingredients in infant formulas, favoring products that are free from synthetic additives, preservatives, GMOs, and antibiotics. This reflects a growing desire to provide infants with safe, natural, and nutritionally complete feeding options, aligning with broader trends toward health-conscious consumption and transparent labeling.

In response, manufacturers are expanding and innovating their product portfolios to include organic and plant-based alternatives fortified with essential nutrients such as DHA, ARA, prebiotics, probiotics, vitamins, and minerals that support infant growth, immune development, and digestive health. The shift toward organic and clean-label offerings also encourages companies to enhance domestic production, adopt sustainable sourcing, and implement eco-friendly manufacturing practices, further strengthening consumer trust.

For instance, in July 2023, Bobbie, the only mom-founded and led infant formula company in the US, which acquired Nature’s One, an Ohio-based pediatric nutrition company recognized for decades of excellence in organic formulas. This strategic move allows Bobbie, one of the fastest-growing American infant formula brands in the past fifty years, to scale domestic manufacturing and expand its market presence, illustrating how the growing consumer preference for organic, clean-label, and high-quality infant nutrition is shaping industry strategies and driving growth.

Overall, the demand for organic and clean-label products continues to be a key growth driver, pushing companies to focus on premium formulations, sustainable practices, and transparent ingredient sourcing to meet evolving consumer expectations.

Segmentation Analysis

The global dairy alternatives for infant market are segmented based on product type, stage, distribution channel, category and region.

Soy-Based Formulas Segment Leads Due to Nutritional Adequacy and Digestive Ease

The soy-based formulas segment holds a significant share in the global dairy alternatives for infant market owing to its nutritional adequacy, digestibility, and wide acceptance among infants with lactose intolerance or cow milk protein sensitivity. Soy-based formulas provide essential proteins, carbohydrates, fats, vitamins, and minerals necessary for healthy growth and development while serving as a reliable alternative for infants who cannot tolerate conventional cow milk formulas.

Soy protein formulas are formulated to closely mimic the nutrient profile of breast milk, making them a trusted choice for health-conscious parents and pediatricians. The segment benefits from long-standing regulatory recognition, with formulas complying with FDA and EFSA nutritional standards, ensuring both safety and efficacy for infant consumption.

To meet growing demand for plant-based nutrition options, global players are expanding their portfolios. For instance, in May 2025, French dairy giant Danone is strengthening its presence in the US market by acquiring a majority stake in Kate Farms, a US based plant-based infant formula company. This strategic move underscores the industry’s focus on diversifying product offerings, catering to parents seeking soy-based and plant-based alternatives for infants, and reflects the market trend toward premium, functional, and plant-derived nutrition solutions.

Furthermore, soy-based formulas are increasingly enriched with DHA, ARA, prebiotics, and probiotics to support brain development, immune health, and digestive comfort, enhancing their appeal to parents seeking safe, nutritionally complete alternatives. This combination of nutritional reliability, regulatory compliance, and strategic market expansion continues to solidify soy-based formulas as a leading choice in the global dairy alternatives for infant market, particularly in North America, Europe, and Asia-Pacific.

Hypoallergenic Formulas Segment Gains Traction Due to Allergy Management and Safety

The hypoallergenic formulas segment is growing due to the rising prevalence of cow milk protein allergy (CMPA) and other infant sensitivities. These formulas, including partially hydrolyzed (pHF) and extensively hydrolyzed (eHF) options, provide complete nutrition while minimizing allergenic risks, making them preferred by parents and pediatricians.

Many products are fortified with prebiotics, probiotics, and essential fatty acids to support growth, immune health, and digestion. Regulatory approvals from FDA, EFSA, and Codex standards further enhance trust in these products.

In March 2023, Danone launched its new hypoallergenic baby formula brand, Pepticate, in the U.S., reinforcing the company’s commitment to allergy-friendly infant nutrition and highlighting the market’s focus on specialized, safe, and clinically supported formulas.

The combination of health benefits, regulatory compliance, and product innovation continues to drive growth, particularly in North America and Europe, where awareness of infant allergies is higher.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Market Due to the Increasing Integration of Sleep Optimization

North America dominates the global dairy alternatives for infant market, driven by health-conscious consumer behavior and the rising preference for organic, clean-label nutrition. Parents increasingly seek formulas that promote healthy growth, immunity, and overall wellness, reflecting a broader trend toward natural, safe, and high-quality infant nutrition.

US Dairy alternatives for infant Market Insights

In the US, demand is fueled by high parental awareness, strong retail penetration, and widespread e-commerce access. Health-conscious parents are actively choosing products that are free from artificial additives, GMOs, and allergens, favoring organic and nutrient-rich options. For instance, in 2025, Nara Organics launched the first FDA-registered and USDA-certified organic whole milk infant formula developed to meet both US and European safety standards. Formulated by moms, scientists, pediatricians, and nutritionists, Nara provides a clean, nutritious alternative free from palm oil, soy, corn syrup, maltodextrin, and GMOs, enabling parents to make confident feeding choices.

Canada Dairy alternatives for infant Market Industry Growth

In Canada, dairy alternatives for infants are regulated as Natural Health Products (NHPs) under Health Canada, ensuring ingredient quality, dosage accuracy, and proper labeling, which fosters consumer trust. Market growth is also supported by expanded retail partnerships and online availability. For instance, in July 2024, Else Nutrition Holdings Inc., a leader in complete plant-based infant and toddler nutrition, launched its entire product line on a major Canadian superstore’s online platform in August 2024, significantly enhancing accessibility for Canadian parents seeking plant-based alternatives.

FASTEST GROWING MARKET:

Asia-Pacific is the Fastest-Growing Region Driven by Rising Health and Nutrition Awareness

The Asia-Pacific dairy alternatives for infant market is experiencing rapid growth due to increasing parental focus on infant gut health, immunity, and overall wellness, coupled with rising adoption of organic, plant-based, and allergen-free formulas. Factors such as urbanization, higher disposable income, lifestyle changes, and growing awareness about clean-label and sustainable nutrition are driving demand for premium alternatives to conventional cow’s milk-based formulas.

India Dairy alternatives for infant Market Outlook

India is emerging as the fastest-growing country in Asia-Pacific for dairy alternatives for infants. Urban parents are increasingly adopting soy-based, plant-based, and hypoallergenic formulas for their children due to rising awareness of digestive sensitivities, allergies, and the benefits of organic nutrition. E-commerce growth, retail expansion, and educational initiatives on infant nutrition further support market adoption. Premium, safe, and nutrient-rich formulas are highly sought after, particularly among middle- and upper-income families in metropolitan regions.

China Dairy alternatives for infant Market Trends

China continues to be the largest market in Asia-Pacific for dairy alternatives for infants, although regulatory compliance is stringent. Products must meet strict safety and certification requirements, limiting over-the-counter adoption and positioning premium, clinically validated formulas as high-value offerings. Parents are increasingly opting for organic, non-GMO, plant-based, and allergen-free formulas that provide balanced nutrition and immune support. The market is growing fastest in urban areas, where awareness of infant nutrition, immunity, and clean-label standards is highest. Brands are leveraging cross-border e-commerce, specialty stores, and partnerships to reach health-conscious parents.

Sustainability and ESG Analysis

Sustainability is increasingly shaping the global dairy alternatives for infant market, influencing consumer preferences, brand positioning, and operational strategies. Although many dairy alternatives—such as plant-based, soy-based, or hypoallergenic formulas use natural ingredients, their commercial production often involves energy-intensive processes, specialized sourcing, and stringent regulatory compliance, which can result in higher carbon footprints and resource use.

To meet ESG standards, companies are adopting renewable energy, water recycling, sustainable ingredient sourcing, and process optimization to minimize emissions, waste, and energy consumption. Brands are also embracing eco-friendly packaging, ethical sourcing, and third-party certifications to strengthen credibility with environmentally conscious consumers.

With growing awareness among consumers, regulators, and investors, companies that integrate environmental stewardship, ethical practices, and ESG-aligned operations are better positioned to enhance brand loyalty, regulatory compliance, and long-term resilience in the dairy alternatives for infant industry.

Competitive Landscape

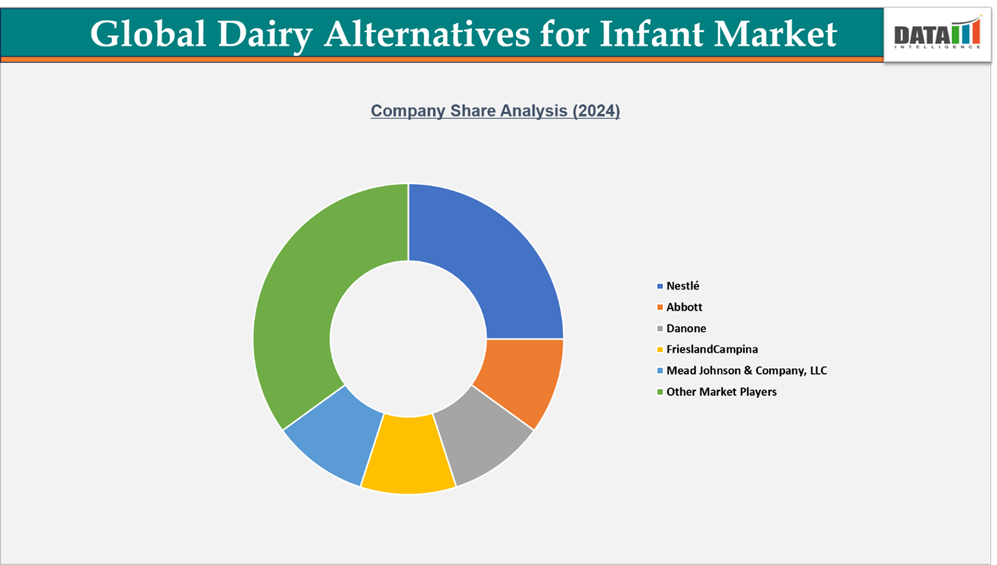

- The global dairy alternatives for infant market is highly competitive, with a mix of multinational corporations and regional players vying for market share. Leading companies such as Nestlé, Abbott, Danone, Friesland Campina, Mead Johnson & Company, dominate the market, leveraging extensive production networks, diverse product portfolios, and strong R&D capabilities.

- International brands have also strengthened their presence through imports and e-commerce channels, expanding accessibility to consumers.

- The market is dynamic, with regulatory compliance, brand reputation, product innovation, and distribution strategies serving as key drivers of competitive advantage. Companies that focus on organic, clean-label, and nutrient-enriched formulas while maintaining high safety and quality standards are best positioned to capture growth in this evolving market.

Key Developments

- On September 2025, Panacea Biotec, a prominent biotechnology firm, has made a notable entry into the Indian baby care market through its fully-owned subsidiary, Panacea Biotec Pharma Limited (PBPL). The company launched ‘NikoMom’, promoted as India’s first 100% toxin-free baby care range, alongside ‘Staart Prime’, an infant milk substitute, highlighting its commitment to safe and high-quality infant nutrition and care products.

- On June 2022, trive Nutrition Corp. announced a partnership with precision fermentation leader Perfect Day, Inc. In July 2022, Strive launched a new line of milk alternatives enriched with Perfect Day’s animal-free whey protein, which promised the authentic taste and nutritional benefits of cow’s milk while being free from many of the health and environmental drawbacks of conventional dairy.

Investment & Funding Landscape

The global dairy alternatives for infant market is witnessing a surge in investments and strategic initiatives, driven by growing consumer demand for natural, plant-based infant nutrition solutions. In 2022, Hawaii-based vegan milk maker PlantBaby was closing a US$4 million seed funding round led by Big Idea Ventures, with participation from The Fund LA, Two Culture Cap, Springbank Collective, Western Technology Investment, and notable private investors including actor Daniella Monet and Athletic Greens president and COO Kat Cole. The investment was being used to support ongoing R&D for existing and future product lines, reflecting the market’s focus on innovation and plant-based nutrition.

| Company | Investment/Funding | Year | Details | |

| PlantBaby | PlantBaby Funding Round | 2022 | Hawaii-based vegan milk maker PlantBaby was closing a US$4 million seed funding round led by Big Idea Ventures, with participation from The Fund LA, Two Culture Cap, Springbank Collective, Western Technology Investment, and notable private investors including actor Daniella Monet and Athletic Greens president and COO Kat Cole. The investment was being used to support ongoing R&D for existing and future product lines, reflecting the market’s focus on innovation and plant-based nutrition. | |

What Sets This Global Dairy alternatives for infant Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by product type, stage, distribution channel and category segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect dairy alternatives for infant commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.