Hypoallergenic infant formula Market Size & Overview

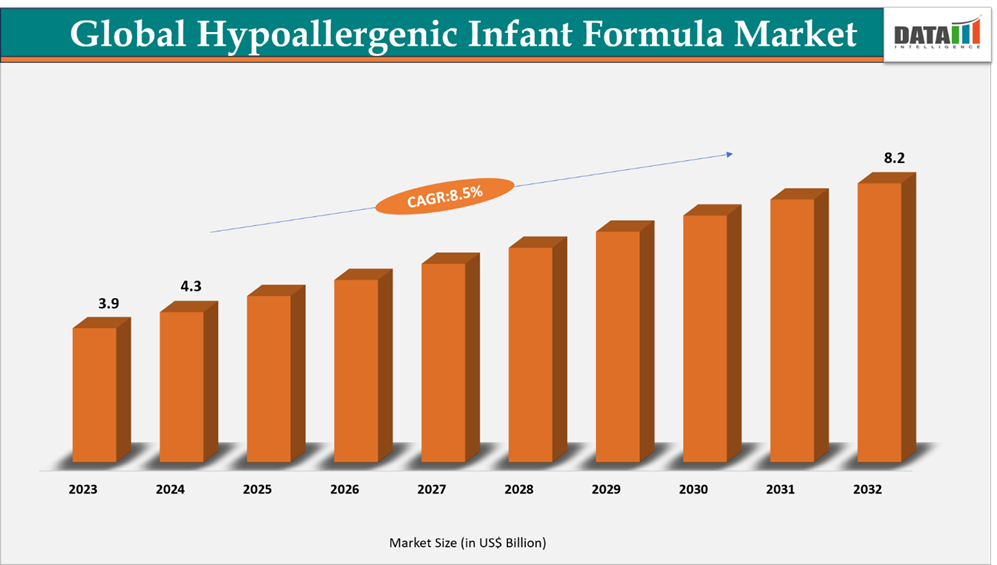

The global hypoallergenic infant formula market reached US$ 3.9 billion in 2023, rising to US$ 4.3 billion in 2024 and is expected to reach US$ 8.2 billion by 2032, growing at a CAGR of 8.5% from 2025 to 2032.

The hypoallergenic infant formula market refers to the sector dedicated to developing and supplying specialized milk formulas designed for infants who experience allergies or sensitivities to cow’s milk protein or lactose. These formulas are typically made with extensively hydrolyzed proteins or amino acids, making them easier to digest and less likely to cause allergic reactions. The market includes a variety of formats such as powdered, liquid, and ready-to-feed options, aimed at supporting infants with conditions like cow’s milk protein allergy (CMPA), lactose intolerance, and other digestive sensitivities. Increasing awareness among parents, progress in infant nutrition science, and growing recommendations from pediatricians are key factors fueling the global market’s expansion.

Hypoallergenic infant formula Market Industry Trends and Strategic Insights

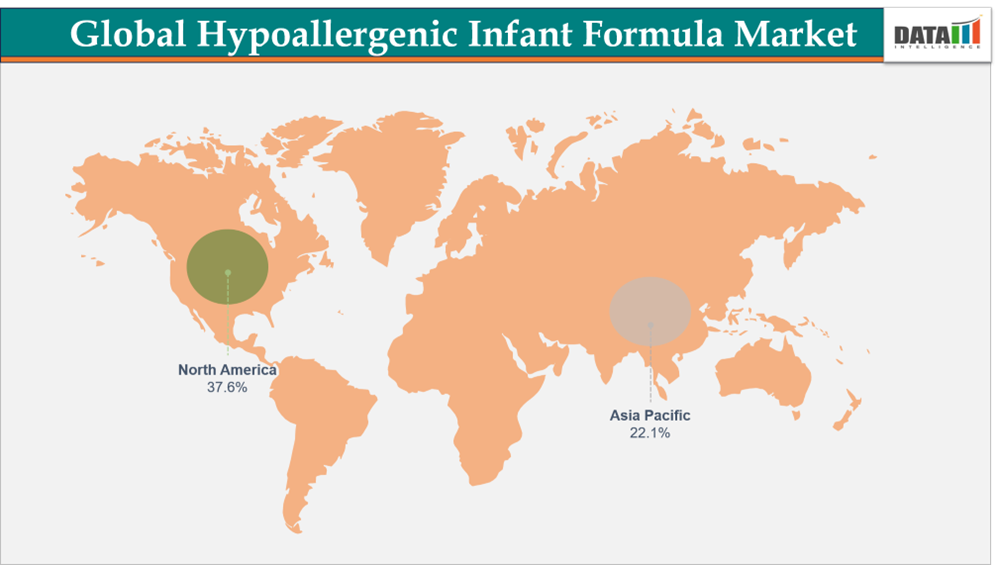

- North America leads the global hypoallergenic infant formula market, capturing the largest revenue share of 37.6% in 2024.

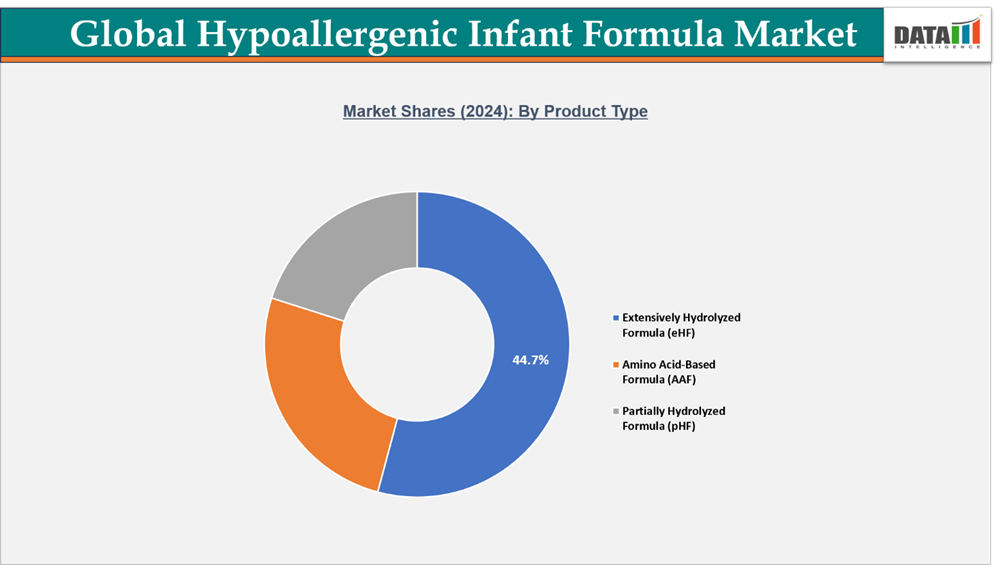

- By product type segment, extensively hydrolyzed formula (eHF) leads the global hypoallergenic infant formula market, capturing the largest revenue share of 44.7% in 2024.

Market Size and Future Outlook

- 2024 Market Size: US$ 4.3 billion

- 2032 Projected Market Size: US$ 8.2 billion

- CAGR (2025–2032): 8.5%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Extensively Hydrolyzed Formula (eHF), Amino Acid-Based Formula (AAF), Partially Hydrolyzed Formula (pHF) |

| By Form | Powder, Liquid (Ready-to-Feed) |

| By Distribution Channel | Online, Offline |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information , Request for Sample

Market Dynamics

Rising Adoption of Premium Infant Nutrition Products

The hypoallergenic infant formula market is experiencing robust growth as parents increasingly shift toward premium and specialized nutrition solutions designed to address allergies and digestive sensitivities in infants. Growing awareness of conditions such as Cow’s Milk Allergy (CMA) and lactose intolerance, along with a heightened focus on early-life health, is propelling demand for high-quality, clinically tested hypoallergenic formulas.

In 2025, several leading manufacturers introduced innovative hypoallergenic products formulated from non-dairy and plant-based protein sources, catering to infants with protein sensitivities and offering alternatives to conventional milk-based formulas. Likewise, domestic producers in emerging economies are entering the market with locally manufactured, affordable premium hypoallergenic products, reducing dependency on imports and expanding accessibility.

Producers are also enhancing nutritional value by incorporating advanced hydrolyzed proteins, probiotics, and immune-boosting nutrients, ensuring products deliver both tolerance and comprehensive nourishment. The increasing willingness of parents to invest in safe, science-backed, and nutritionally advanced products is reinforcing the premiumization trend in infant nutrition.

As a result, the rising adoption of premium infant nutrition products continues to be a key driver of market expansion, fostering innovation and accelerating the global growth of the hypoallergenic infant formula segment.

Segmentation Analysis

The global hypoallergenic infant formula market is segmented based on product type, form, distribution channel and region.

Extensively Hydrolyzed Formula (eHF) Dominates Due to Clinical Reliability and Parental Trust

The Extensively Hydrolyzed Formula (eHF) segment maintains a leading share in the global hypoallergenic infant formula market, driven by its clinical effectiveness, medical recommendations, and suitability for infants with moderate to severe cow’s milk protein allergy (CMPA). By breaking down milk proteins into smaller peptides, eHF minimizes allergenic potential while preserving essential nutrients for growth and immune support, making it the preferred choice among pediatricians and healthcare professionals.

The segment’s dominance is further reinforced through strategic brand collaborations and innovations. For instance, in September 2024, Perrigo Company plc partnered Good Start infant formula with Dr. Brown’s baby bottles, enhancing the feeding experience and building trust among parents seeking specialized hypoallergenic solutions. This exemplifies how combining clinically proven nutrition with advanced delivery systems strengthens market positioning and consumer confidence.

Manufacturers are also focusing on improving taste, digestibility, and nutrient fortification to boost infant acceptance and adherence. Expanding distribution channels, including e-commerce platforms and hospital networks, have increased accessibility for parents. Supported by regulatory approvals, pediatric endorsements, and ongoing innovation, the eHF segment continues to lead the hypoallergenic infant formula market, commanding significant market share and setting benchmarks for infant nutritional care.

Amino Acid-Based Formula (AAF) Witnesses Rapid Adoption Driven by Medical Necessity

The Amino Acid-Based Formula (AAF) segment holds a key position in the global hypoallergenic infant formula market, largely due to its critical role in managing severe cow’s milk protein allergy (CMPA) and multiple food protein intolerances. AAF delivers complete nutrition through free amino acids, minimizing allergenic risks while supporting healthy growth and development in infants with complex dietary needs. This makes it an essential choice for healthcare providers managing high-risk cases.

The segment’s significance is highlighted by recent regulatory developments. For instance, in 2022, Abbott secured approval from the US District Court for the Western District of Michigan, in coordination with the FDA, to release limited batches of its EleCare amino acid-based formulas. These products, previously held following a recall, were made available to children in urgent need, demonstrating the critical nature of AAF in specialized pediatric nutrition. Manufacturers are also focusing on improving nutritional content, taste, and accessibility to encourage consistent use and adherence. Distribution through hospitals, specialty pharmacies, and online channels further enhances availability. With strong clinical support, regulatory backing, and growing awareness among caregivers and healthcare professionals, the AAF segment continues to expand, fulfilling the needs of infants requiring highly specialized hypoallergenic nutrition.

Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Hypoallergenic Infant Formula Market Driven by Focus on Infant Wellness

The North American hypoallergenic infant formula market holds the largest share globally, fueled by growing health-consciousness among parents and the increasing emphasis on infant nutrition and wellness. In 2023, Danone introduced its new hypoallergenic baby formula brand, Pepticate, in the US, highlighting the region’s demand for innovative formulas tailored to infants with specific nutritional needs. Factors such as busy lifestyles, heightened awareness of infant health, and the need for safe, convenient, and nutrient-rich formulas are driving market growth.

US Hypoallergenic Infant Formula Market Insights

The US dominates the region, supported by increasing awareness of infant nutrition and a preference for specialized formulas that cater to infants with allergies or sensitivities. Urban lifestyles, parental focus on preventive health, and the desire for easy-to-use yet effective nutrition solutions are key factors sustaining demand.

Canada Hypoallergenic Infant Formula Market Growth

In Canada, hypoallergenic infant formulas are regulated as Natural Health Products, ensuring strict compliance with quality, dosage, and labeling standards. This regulatory framework enhances consumer confidence and encourages the adoption of clinically backed, safe, and standardized products. Canadian parents increasingly prefer formulas that combine functionality, convenience, and nutritional value to support overall infant well-being.

FASTEST GROWING MARKET:

Asia-Pacific Registers Rapid Growth Driven by Rising Infant Nutrition Awareness

The Asia-Pacific hypoallergenic infant formula market is expanding swiftly, fueled by growing awareness of infant nutritional requirements, urbanization, and changing lifestyles. Parents are increasingly focused on early-life wellness, while the rising prevalence of infant allergies and sensitivities is boosting demand for specialized hypoallergenic formulas. Expansion of retail and e-commerce channels is also improving product accessibility, supporting market penetration across urban and semi-urban regions.

India Hypoallergenic Infant Formula Market Outlook

India is one of the fastest-growing markets in the Asia-Pacific region, driven by rising parental awareness of infant allergies and nutritional needs. Factors such as increasing disposable incomes, urban lifestyles, and a growing number of working parents are accelerating the adoption of convenient, nutritionally tailored hypoallergenic formulas. Manufacturers are also offering fortified and functional variants to cater to the demand for comprehensive infant nutrition.

China Hypoallergenic Infant Formula Market Trends

China holds the largest share in the Asia-Pacific hypoallergenic infant formula market, supported by demand for clinically formulated and high-quality products. Strict regulatory standards ensure safety and build consumer confidence. Urbanization, busy parental routines, and heightened focus on early childhood health are key growth drivers, particularly for premium and prescription-based formulas.

Sustainability and ESG Analysis

Sustainability is increasingly shaping the global hypoallergenic infant formula market, influencing consumer preferences, brand image, and operational strategies. While hypoallergenic infant formula serves a critical nutritional purpose, its production often involves energy-intensive processes, chemical synthesis, and semi-synthetic methods that use solvents and reagents. To address this, manufacturers are adopting green chemistry practices, optimizing production processes, and implementing solvent recovery systems to reduce environmental impact.

Additionally, companies are incorporating renewable energy, water recycling, and waste reduction measures in their facilities to comply with Environmental, Social, and Governance (ESG) standards. Sustainable packaging, ethically sourced ingredients, and transparent supply chains are becoming important differentiators to meet consumer expectations and regulatory requirements.

With growing awareness of sustainability among consumers, investors, and regulatory bodies, firms that prioritize ESG initiatives are likely to gain stronger brand loyalty, enhance market credibility, and ensure long-term resilience. Integrating environmental responsibility, resource efficiency, and ethical practices is becoming a key factor for competitive advantage in the hypoallergenic infant formula market.

Competitive Landscape

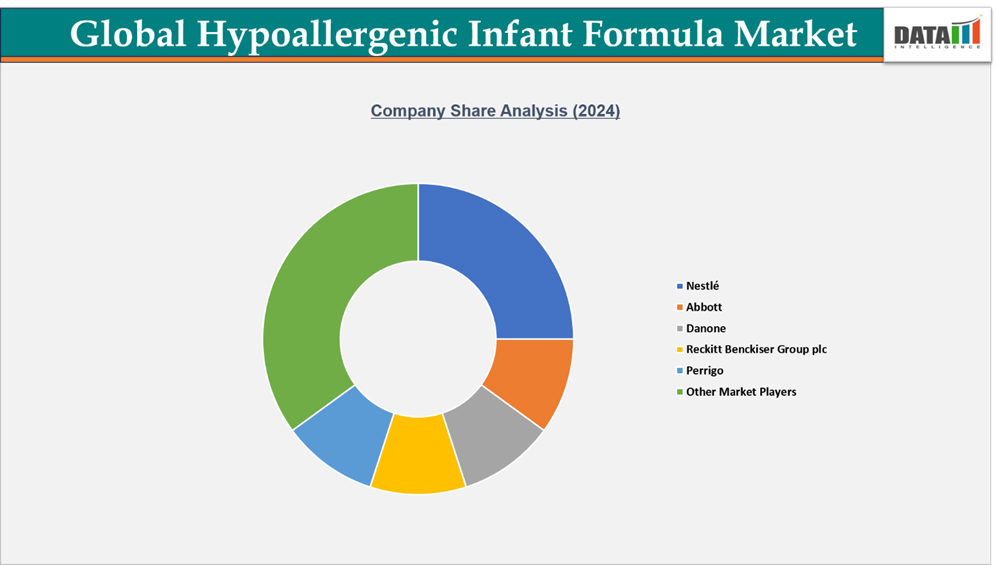

- The global hypoallergenic infant formula market is highly competitive, featuring a mix of multinational corporations and regional players. Leading companies such as Nestlé, Abbott, Danone, Perrigo, and HiPP capitalize on their extensive production networks, diverse product portfolios, and robust R&D capabilities to cater to both mass-market and premium segments.

- International brands maintain a strong presence across retail and e-commerce channels. For instance, products from Abbott and Perrigo are widely available on online platforms, enabling convenient access to hypoallergenic infant formula in capsules, softgels, and liquid forms.

- Market dynamics are shaped by regulatory compliance, brand reputation, product innovation, and distribution strategies. Companies that invest in functional ingredients, sustainable packaging, and multi-channel distribution gain a competitive edge and can tap into the growing demand for high-quality, safe, and convenient infant nutrition solutions.

Key Developments

- In January 2024, The US Food and Drug Administration (FDA) has issued an alert for parents, caregivers, and healthcare providers regarding a voluntary recall by Reckitt/Mead Johnson Nutrition of specific Nutramigen Hypoallergenic Infant Formula Powder products due to potential contamination with Cronobacter sakazakii. To date, no related illnesses have been reported, and it is likely that most of the affected products distributed in the US have already been used.

Investment & Funding Landscape

The global hypoallergenic infant formula market is experiencing a notable increase in investments and strategic initiatives, driven by rising consumer awareness and demand for allergy-free and specialized infant nutrition solutions. In 2025, Porto-based PFx Biotech, a startup focused on developing allergy-free human milk proteins using precision fermentation, successfully closed a US$ 2.73 million Seed funding round. The round was led by Buenavista Equity Partners, with participation from EIT Food and Beta Capital.

This investment, together with a recent US$2.73 million grant from the EIC Accelerator, will allow PFx Biotech to scale up Lactoferrin production, establish advanced laboratories, and expand its research and development team. These developments underscore the growing investor confidence in innovative and sustainable hypoallergenic infant formula technologies.

The funding inflow highlights the market’s shift toward advanced biotech solutions and precision fermentation, which enable high-quality, allergen-free products for infants with special nutritional needs. Increased investment in startups and specialized formulations is expected to accelerate product innovation, enhance production capabilities, and strengthen market growth, while also addressing the rising demand for safe, effective, and scientifically backed hypoallergenic infant nutrition.

| Company | Investment/Funding | Year | Details | |

| PFx Biotech | PFx Biotech Funding | 2025 | Porto-based PFx Biotech, a startup specializing in allergy-free human milk proteins through precision fermentation, has secured a US$2.73 million Seed funding round led by Buenavista Equity Partners, with support from EIT Food and Beta Capital. Alongside a recent US$2.73 million grant from the EIC Accelerator, this funding will allow PFx Biotech to scale up Lactoferrin production, establish advanced laboratories, and expand its workforce. These developments position the company to strengthen the hypoallergenic infant formula market by providing innovative, allergy-free protein solutions that enhance product safety, nutritional quality, and market competitiveness. | |

What Sets This Global Hypoallergenic infant formula Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by dosage form, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect hypoallergenic infant formula commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.