Cosmetic CDMO Market Size and Trends

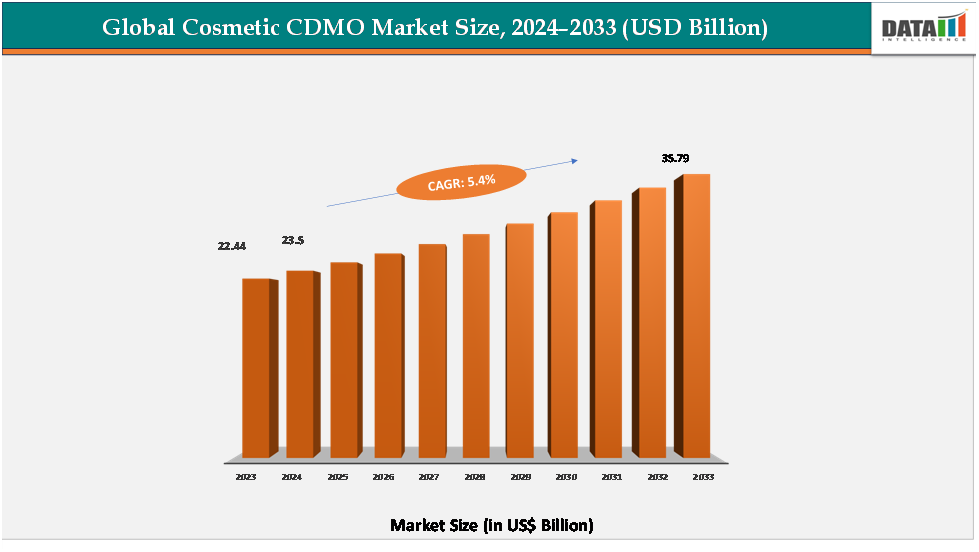

The global cosmetic CDMO Market reached US$ 22.44billion in 2023, with a rise to US$ 23.50 billion in 2024, and is expected to reach US$ 35.79billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025–2033.

The growing demand for innovation, sustainability, and customization in the beauty industry is reshaping the cosmetic CDMO market, as contract partners are becoming essential enablers of modern cosmetic solutions. By offering advanced formulation expertise, scalable manufacturing, and eco-conscious packaging, CDMOs are empowering brands to deliver safer, more effective, and consumer-driven products. The surge in clean-label beauty, natural ingredients, and dermatology-backed formulations aligns with consumer expectations for both performance and sustainability, while the rise of indie and private-label brands is creating new opportunities for agile, full-service CDMO partnerships.

Key Market highlights

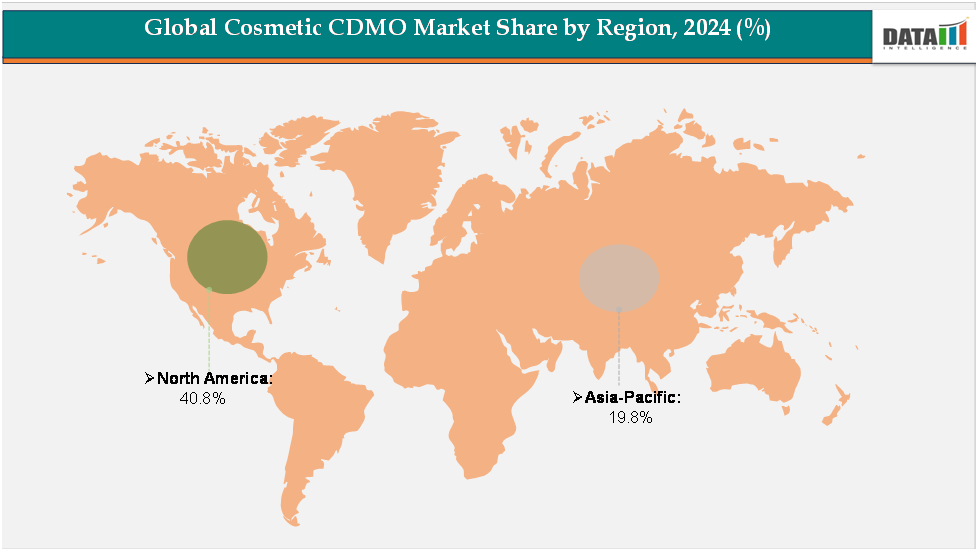

- North America leads the Cosmetic CDMO market with over 40.8% revenue share, supported by the strong presence of established cosmetic brands, high demand for premium skincare and clean-label products, and the widespread adoption of outsourcing strategies to accelerate innovation and reduce costs.

- Asia-Pacific is the fastest-growing region, holding around 19.8% of the market, driven by the booming beauty and personal care industry in countries such as South Korea, China, and Japan, alongside increasing consumer spending power and the rapid rise of indie and K-beauty brands.

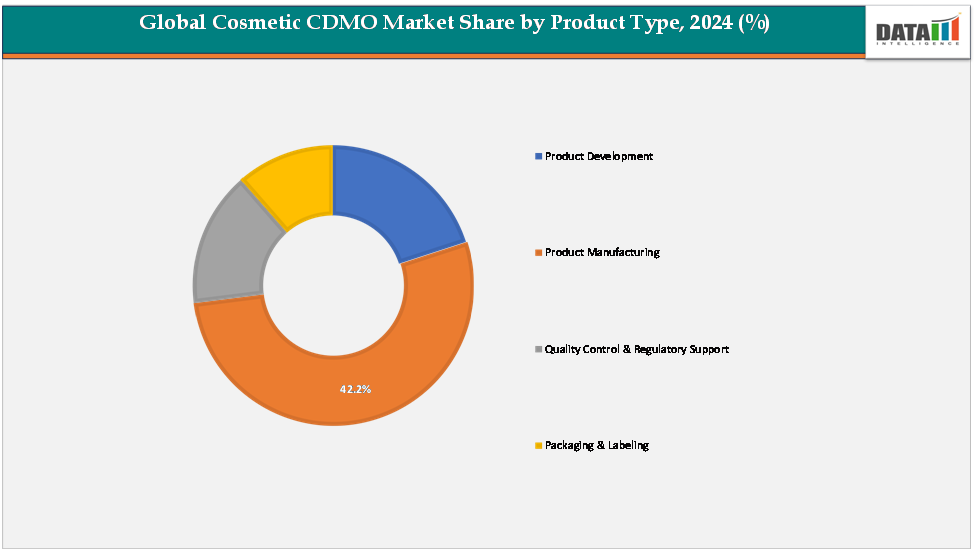

- The product manufacturing segment dominates the Cosmetic CDMO market, accounting for approximately42.4% of global revenue, as brands increasingly rely on outsourcing large-scale production to ensure cost efficiency, scalability, and faster time-to-market.

Market Size & Forecast

- 2024 Market Size: US$23.50 Billion

- 2033 Projected Market Size: US$35.79Billion

- CAGR (2025–2033): 5.4%

- North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Source : Datam Intelligence Email : [email protected]

Drivers & Restraints

Driver: Rising Demand for Personalized and Premium Skincare

The rising demand for personalized and premium skincare is a major growth driver for the cosmetic CDMO market, as consumers increasingly seek products tailored to their unique skin types, concerns, and lifestyles. This shift toward high-end, customized solutions is pushing cosmetic brands to rely on CDMOs with advanced R&D and formulation capabilities. Premium skincare often requires specialized ingredients, cutting-edge technologies, and strict safety testing, which many brands find more efficient to outsource rather than develop in-house. CDMOs not only provide expertise in innovative formulations but also enable scalability and faster product launches, helping brands meet evolving consumer expectations without compromising quality.

Companies are forming strategic collaborations, acquisitions, and partnerships to cater to the growing demand for cosmetic products. For instance, in August 2025, Germany-based Contract Development and Manufacturing Organization (CDMO) 1Q Health Group, backed by European private equity firm Nord Holding, acquired Beauty Production GmbH, a specialist in liquid dietary supplements and cosmetics. With existing expertise in producing hard capsules, liquids, powders, and tablets across its facilities in Germany and Austria, the acquisition strengthens 1Q Health’s position as a full-service CDMO, expanding its end-to-end development and manufacturing capabilities.

By serving as innovation partners, CDMOs are playing a pivotal role in transforming personalized skincare into a mainstream market force, thereby accelerating the overall growth of the cosmetic CDMO market.

Restraint: High Regulatory and Compliance Requirements

High regulatory and compliance requirements present a significant challenge for the Cosmetic CDMO market, as cosmetics are subject to stringent safety, labeling, and ingredient standards across regions such as the FDA in the U.S., the EU Cosmetics Regulation in Europe, and similar authorities in the Asia-Pacific. Meeting these diverse and evolving regulations requires CDMOs to invest heavily in advanced testing facilities, documentation processes, and compliance expertise, which increases operational costs and slows down product development cycles.

For more details on this report, Request for Sample

Segmentation Analysis

The global cosmetic CDMO Market is segmented byservice type, product type, end-user, and region.

Product Type:

The product manufacturing segment is estimated to have 42.2% of the cosmetic CDMO market share.

Product manufacturing represents the dominant segment of the cosmetic CDMO market, holding the largest revenue share, as cosmetic and personal care brands increasingly depend on outsourcing for large-scale and small-batch production. With growing consumer demand for premium skincare, dermatology-based solutions, and clean-label beauty, manufacturing partnerships enable brands to maintain consistency, ensure product safety, and accelerate time-to-market without the heavy capital investment required for in-house facilities.

CDMOs specializing in manufacturing offer flexibility in production volumes, advanced technology for handling complex formulations, and expertise in compliance with global quality standards, making them indispensable partners for both established multinationals and emerging beauty startups. Furthermore, as supply chains become more complex and sustainability requirements more stringent, CDMOs that provide scalable, cost-efficient, and turnkey manufacturing solutions are positioned as the backbone of the cosmetics industry. This entrenched reliance on outsourced production firmly establishes product manufacturing as the leading service segment in the global cosmetic CDMO market.

The product development segment is estimated to have 22.6% of the cosmetic CDMO Market share.

Product development is emerging as the fastest-growing segment in the cosmetic CDMO market, driven by the rising demand for innovation, personalization, and clean beauty solutions. Indie and niche brands, which are rapidly gaining popularity worldwide, rely heavily on CDMOs for formulation expertise, prototyping, and pilot-scale production to bring unique products to market quickly. With consumers seeking natural, vegan, cruelty-free, and dermatology-tested cosmetics, CDMOs are expanding their R&D capabilities to create differentiated formulations that address evolving beauty trends.

The segment’s growth is further fueled by increasing collaboration between global brands and CDMOs to co-develop advanced skincare, anti-aging, and multifunctional products that combine efficacy with sustainability. Speed-to-market is another critical factor, as brands aim to respond rapidly to shifting consumer preferences, and CDMOs with agile product development pipelines are becoming preferred partners. As a result, product development is not only the fastest-growing service area but also the strategic core of future innovation in the cosmetic industry.

Geographical Analysis

The North America cosmetic CDMO Market was valued at 40.8%market share in 2024

North America is expected to dominate the Cosmetic CDMO market, holding the largest share of global revenues, primarily driven by the strong presence of established multinational cosmetic brands and a highly developed R&D and regulatory ecosystem. The region benefits from high consumer demand for premium skincare, anti-aging solutions, and dermatology-driven cosmetics, pushing brands to partner with CDMOs for innovation and speed-to-market advantages. The trend of outsourcing is particularly pronounced in the U.S., where large companies increasingly rely on CDMOs to streamline operations, reduce manufacturing costs, and maintain compliance with stringent FDA regulations.

Furthermore, the growing popularity of clean-label, organic, and eco-friendly beauty products has reinforced the need for CDMOs with expertise in sustainable formulations and packaging. The robust distribution network across retail and e-commerce platforms further supports strong growth, making North America the most lucrative market for CDMO services in cosmetics.

The Europe cosmetic CDMO Market was valued at 21.2% market share in 2024

Europe holds a significant position in the Cosmetic CDMO market, backed by its rich legacy in luxury cosmetics, strong regulatory frameworks, and widespread consumer preference for sustainable and clean-label products. Countries such as France, Italy, and Germany serve as major hubs for cosmetic innovation and production, housing some of the world’s leading CDMOs and premium beauty brands. European CDMOs are recognized for their expertise in high-quality formulation development, regulatory compliance under the EU Cosmetics Regulation, and leadership in sustainable packaging solutions. The region is also witnessing strong demand for eco-conscious and cruelty-free cosmetics, aligning with consumer trends and pushing CDMOs to invest in greener technologies and ingredients.

Additionally, Europe’s thriving private-label and contract manufacturing ecosystem is providing opportunities for indie brands and retailers to enter the market with differentiated offerings. With its combination of established luxury markets and rising focus on sustainability, Europe continues to play a pivotal role in shaping the global Cosmetic CDMO industry.

The Asia-Pacific Cosmetic CDMO Market was valued at 19.8% market share in 2024

Asia-Pacific is emerging as the fastest-growing region in the Cosmetic CDMO market, fueled by rapid urbanization, rising disposable incomes, and a booming beauty and personal care industry across countries such as South Korea, China, Japan, and India. The rise of K-beauty and J-beauty trends has positioned Asia-Pacific as a global innovation hub, with regional CDMOs playing a critical role in developing cutting-edge formulations and supporting both domestic and international cosmetic brands. Increasing demand for natural and herbal ingredients, coupled with government support for local manufacturing and export-oriented production, has further boosted the CDMO landscape in the region.

The strong expansion of e-commerce platforms, particularly in China and India, is improving product accessibility and enabling small and indie brands to scale up quickly through CDMO partnerships. With consumer preferences shifting toward affordable yet high-quality and innovative beauty solutions, the Asia-Pacific is set to outpace other regions in growth, becoming a strategic focus area for both global and regional CDMOs.

Competitive Landscape

The major players in the cosmetic CDMO Market include Fareva Group, INTERCOS S.p.A., TOYO BEAUTY CO., LTD., Catalent, Inc., Swiss American, NOX BELLCOW Cosmetics Co., Ltd, COSMOBEAUTY Co., Ltd., BiofarmaSrl, TOA Inc., Ancorotti Cosmetics S.p.A., among others.

Fareva Group:

Fareva Group, headquartered in France, is one of the largest global players in the cosmetic CDMO market, offering end-to-end contract development and manufacturing services for leading beauty and personal care brands. With operations in more than 10 countries and a network of advanced production facilities, Fareva specializes in the formulation, development, and large-scale manufacturing of a wide range of cosmetic products, including skincare, haircare, makeup, toiletries, and fragrances. The company is known for its strong R&D capabilities, enabling it to co-develop innovative formulations in collaboration with brand owners, particularly in premium skincare and luxury cosmetics.

Key Developments:

- In May 2023, EUROAPI entered a four-year manufacturing agreement with Novéal, part of the L’Oréal Group, to advance eco-responsible cosmetic ingredients. Through its CDMO services, EUROAPI will develop and industrialize innovative ingredient manufacturing, with the first project launching at its Frankfurt site on a dedicated complex chemistry production line.

Market: Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US $Bn) | |

| Segments Covered | Service Type | Product Development, Product Manufacturing, Quality Control & Regulatory Support, Packaging & Labeling |

| Product Type | Skincare Products, Haircare Products, Fragrances & Deodorants, Other Personal Care Products | |

| End-User | Multinational Cosmetic Companies, Independent & Emerging Beauty Brands, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cosmetic CDMO Market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare-related reports, please click here