Colonoscopes Market Size

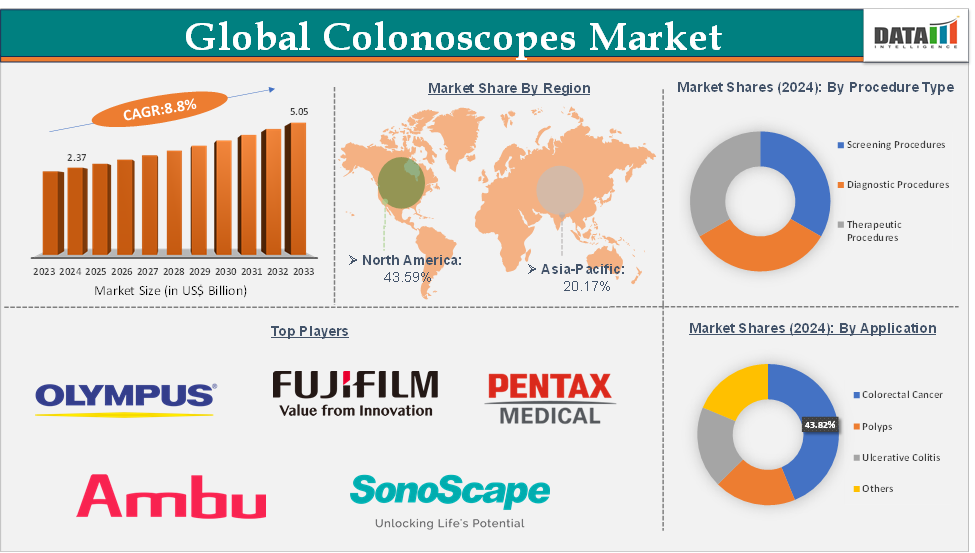

The global colonoscopes market size reached US$ 2.37 Billion in 2024 from US$ 2.20 Billion in 2023 and is expected to reach US$ 5.05 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

Market Overview

The global colonoscopes market is experiencing steady growth, driven primarily by the rising prevalence of colorectal cancer, increasing awareness of early screening, and technological advancements in imaging and AI-assisted diagnostics. Key players such as Olympus, Fujifilm, and PENTAX Medical maintain competitive dominance through product innovation and global distribution networks. The competitive landscape is also seeing new entrants in single-use scopes and AI-powered platforms, intensifying technological differentiation. Overall, the market outlook remains optimistic, with growth opportunities lying in emerging markets, AI-driven clinical decision support, and value-based care models that emphasize preventive diagnostics.

Executive Summary

Market Dynamics

Drivers:

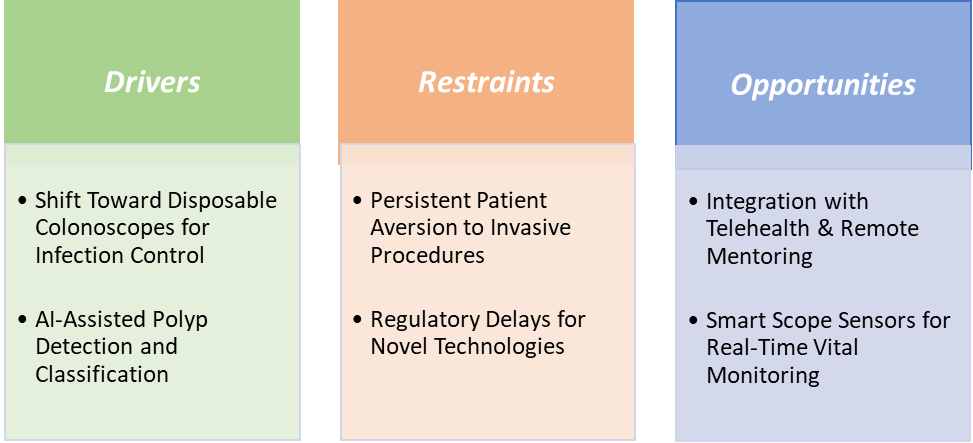

Shift toward disposable colonoscopes for infection control is significantly driving the colonoscopes market growth

The shift toward disposable colonoscopes is emerging as a significant growth driver in the colonoscopes market, primarily fueled by heightened infection control demands following high-profile outbreaks linked to inadequately reprocessed reusable scopes. Reusable colonoscopes require complex manual cleaning and high-level disinfection after each use, a process prone to human error, equipment damage, and time delays.

For instance, the U.S. FDA has issued multiple safety communications urging stricter reprocessing protocols after contamination incidents in hospitals, creating pressure on facilities to seek safer alternatives. Disposable colonoscopes, such as Ambu’s FDA-cleared aScope Colonoscope, eliminate cross-contamination risks by providing a sterile, single-use device for each patient. This approach is particularly attractive for ambulatory surgical centers and resource-limited hospitals lacking advanced reprocessing infrastructure.

Restraints:

Persistent patient aversion to invasive procedures is hampering the growth of the colonoscopes market

Persistent patient aversion to invasive procedures is a notable restraint hampering colonoscopes market growth, as psychological and physical barriers often outweigh medical recommendations for many individuals. Colonoscopy involves bowel preparation, sedation, and insertion of a flexible tube into the colon, steps that many patients perceive as uncomfortable, embarrassing, or even painful. In some cultures, conservative attitudes toward body exposure further suppress screening participation.

The impact is tangible in markets like Japan and Germany, where national screening programs exist, and participation rates for colonoscopy remain significantly below targets due to these personal barriers. Additionally, negative word-of-mouth from patients who had unpleasant preparation experiences can discourage others from undergoing the procedure. While sedation improvements and AI-assisted, faster procedures aim to reduce discomfort, patient reluctance continues to delay early diagnosis, thereby slowing the growth potential of the colonoscopes market.

For more details on this report – Request for Sample

Segmentation Analysis

The global colonoscopes market is segmented based on product type, procedure type, application, end-user, and region.

The colorectal cancer segment from the application is dominating the colonoscopes market with a 43.82% share in 2024

The colorectal cancer segment holds a dominant position in the colonoscopes market due to the critical role colonoscopy plays in both screening and early detection of this high-burden disease. Colorectal cancer is the third most common cancer globally, according to the WHO. Colonoscopy remains the gold standard for colorectal cancer screening because it allows direct visualization of the colon, polyp detection, and immediate polyp removal in a single procedure, capabilities that virtual or less invasive methods cannot fully match.

The increasing adoption of disposable colonoscopes (Ambu aScope Colon) ensures infection control, making them appealing in high-volume colorectal cancer screening centers. In emerging markets, rising awareness campaigns and government-led subsidized screening initiatives are boosting uptake. As lifestyle factors such as poor diet, sedentary habits, and obesity contribute to rising colorectal cancer incidence, healthcare systems are prioritizing colonoscopy access. The combination of epidemiological urgency, preventive potential, reimbursement support, and technological innovation solidifies colorectal cancer as the most revenue-generating and strategically critical application segment in the global colonoscopes market.

Geographical Share Analysis

North America is expected to dominate the global colonoscopes market with a 43.59% in 2024

North America remains the dominant region in the colonoscopes market, driven by its advanced healthcare infrastructure, high awareness of colorectal cancer screening, and strong adoption of cutting-edge endoscopic technologies. The U.S. and Canada have well-established screening programs, supported by organizations like the American Cancer Society, which recommends colonoscopy or CT colonography starting at age 45, ensuring steady procedural demand.

Major industry players such as Olympus Corporation, Fujifilm Holdings, and PENTAX Medical have a strong presence in the region, offering flagship products like the Olympus EVIS X1 Video Colonoscope, Fujifilm ELUXEO 700 Series, and PENTAX i10 Series with high-definition imaging, narrow-band imaging, and AI-assisted lesion detection. North America also leads in the adoption of disposable colonoscopes, with FDA-cleared devices like Ambu’s aScope Colonoscope gaining traction due to strict infection control regulations.

Competitive Landscape

Top companies in the colonoscopes market include Olympus, FUJIFILM Holdings, PENTAX Medical, Medtronic, EndoMed Systems GmbH, Sonoscape Pvt. Ltd., Ambu A/S and Smart Medical Systems Ltd., among others.

Report Scope

Metrics | Details | |

CAGR | 8.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

| Procedure Type | Screening Procedures, Diagnostic Procedures and Therapeutic Procedures |

Application | Colorectal Cancer, Polyps, Ulcerative Colitis and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global colonoscopes market report delivers a detailed analysis with 64 key tables, more than 61 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here