Endoscopes Market: Industry Outlook

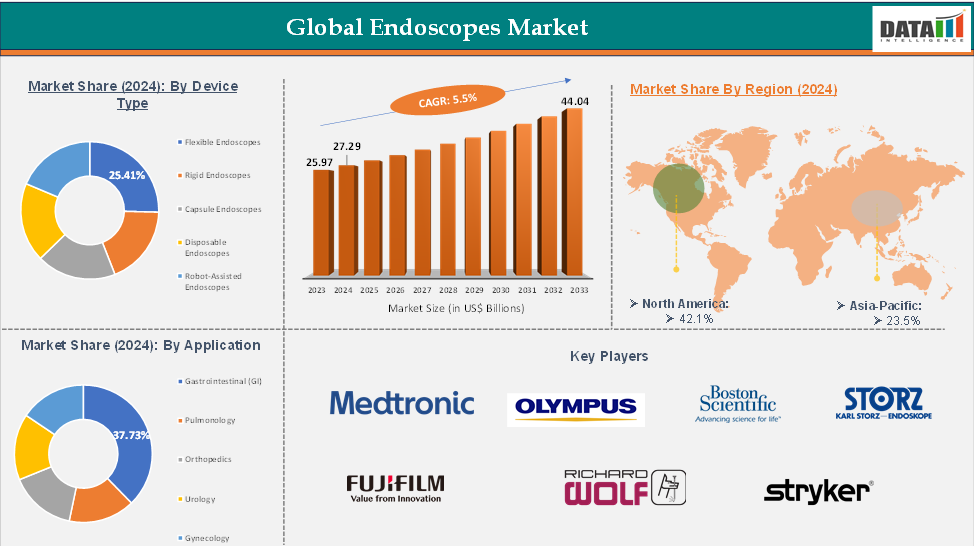

The global endoscopes market reached US$ 25.97 billion in 2023, with a rise of US$ 27.29 billion in 2024, and is expected to reach US$ 44.04 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

Key Trends and Insights

- The market growth is driven by the increasing demand for minimally invasive procedures, rising prevalence of gastrointestinal and respiratory disorders, and advancements in visualization technologies such as HD, 4K, and AI-assisted imaging.

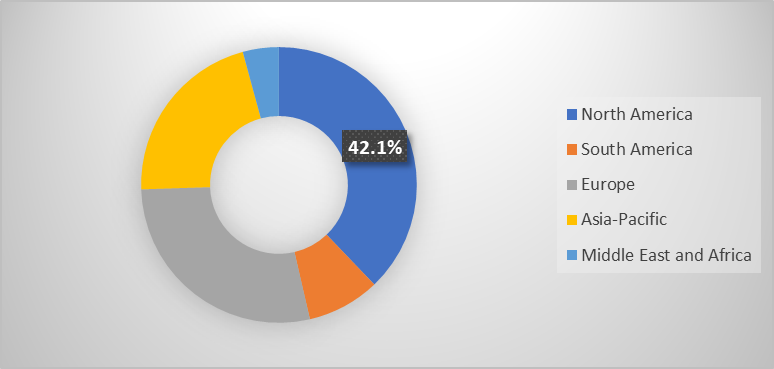

- North America dominates the global endoscopes market with the largest revenue share due to advanced healthcare infrastructure and high adoption of innovative devices.

- The Asia Pacific region is the fastest-growing market, expected to expand at the highest CAGR over the forecast period, driven by rising healthcare investments and a growing patient pool.

- Based on device type, the flexible endoscopes segment leads the market with the largest revenue share, attributed to wide adoption in gastrointestinal and pulmonology procedures.

- Based on application, the gastrointestinal endoscopy segment is expected to lead the market with the highest revenue contribution.

- The major market players are Olympus Corporation, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, HOYA Corporation (Pentax Medical), Stryker Corporation, Boston Scientific Corporation, Medtronic plc, Richard Wolf GmbH, STERIS and ATMOS MedizinTechnik GmbH & Co. KG among others.

Market Size and Forecast Analysis

- Historical Year:2023: 25.97

- Base Year:2024: 27.29

- Forecast Year:2033: 44.04

- CAGR: 5.5%

- Largest Region: North America

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Gastrointestinal Disorders

The endoscopes market is growing due to the increasing prevalence of gastrointestinal disorders like colorectal cancer, GRD, IBD, ulcers, and bleeding. Endoscopy is crucial for early detection, diagnosis, and treatment, making it indispensable in modern healthcare. Lifestyle-related risk factors like unhealthy diets, alcohol consumption, obesity, and aging populations also accelerate demand for endoscopic interventions. Healthcare systems worldwide are investing in advanced, flexible, and capsule endoscopes, boosting adoption and market growth.

For instance, according to the World Gastroenterology Organisation reports that over 4.5 million people worldwide are affected by inflammatory bowel disease (IBD), with colorectal cancer accounting for 1.9 million new cases annually. GED affects 20% of the global population. These high prevalence rates increase demand for early detection and minimally invasive treatments, with endoscopy being the gold standard. The growing patient burden and awareness of preventive healthcare are driving the adoption of flexible endoscopes, capsule endoscopes, and image-enhanced technologies.

Restraint: High Cost of Endoscopic Procedures and Equipment

The global endoscope market faces significant challenges due to the high cost of advanced endoscopy devices, including high-definition and robotic-assisted systems. Additional expenses like maintenance, sterilization, and operational costs strain healthcare budgets, particularly in low- and middle-income countries. This financial burden limits accessibility, hindering widespread adoption of endoscopic procedures worldwide, especially in low- and middle-income countries where healthcare facilities may struggle to afford or maintain these technologies.

For more details on this report, Request for Sample

Endoscopes Market Segmentation Analysis

The market is segmented by product type, application, end user, and region.

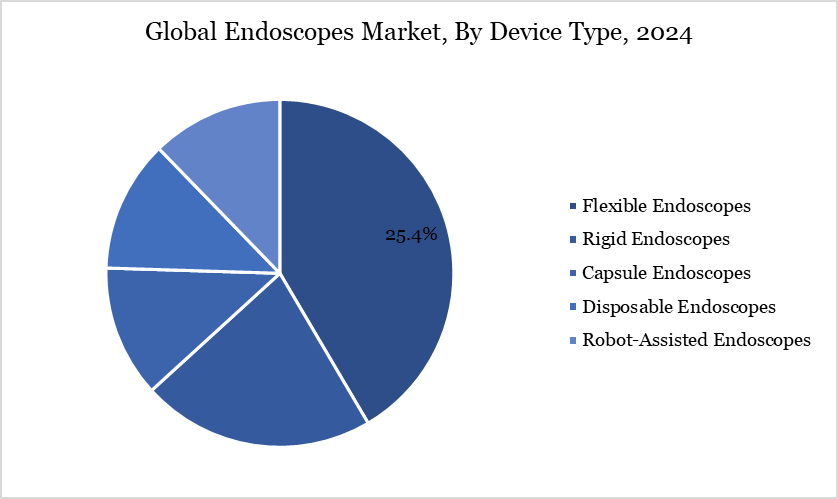

Product Type - The flexible endoscopes from the product type segment the expected to have 25.41% of the endoscope market share.

The flexible endoscopes segment is a significant contributor to the global market due to technological advancements, increasing demand for early diagnosis, monitoring, and treatment of chronic diseases, preference for minimally invasive procedures, and expansion of healthcare infrastructure, particularly in emerging markets like India and China. These factors contribute to the segment's strong growth and the need for more efficient and accurate procedures in the healthcare sector.

For instance, in May 2025, FUJIFILM Healthcare Europe has launched the ELUXEO EG-840T and EG-840TP therapeutic gastroscopes for advanced treatment, marking the second in a series of innovations under the 'WELCOME, FUTURE' initiative, following the groundbreaking ELUXEO 8000 system.

Moreover, in September 2024, Olympus Australia has opened its first flexible endoscope sterilisation facility, Sapphire, in Melbourne. The facility is part of the Olympus On-Demand solution, designed to reduce risks, costs, and complexities associated with managing endoscopy services, and is part of the company's commitment to improving people's lives.

Application - The gastrointestinal (GI) from the application segment the expected to have 37.73% of the endoscope market share.

The endoscopes market is driven by the gastrointestinal (GI) application segment, which is a major contributor to the treatment of disorders like colorectal cancer, inflammatory bowel disease, and peptic ulcers. Endoscopic procedures are crucial for early diagnosis, monitoring, and treatment, enhancing patient outcomes and reducing the need for more invasive surgeries. Increased awareness about GI health, routine screening programs, and advanced imaging technologies further boost demand for endoscopes in GI applications.

For instance, in April 2024, Medtronic, a leading healthcare technology company, has introduced ColonPRO, the latest AI software for the GI Genius intelligent endoscopy system, in a strategic collaboration aimed at improving patient care.

Geographical Analysis

The North America endoscopes market was valued at 42.1% market share in 2024

The North American market is growing due to advanced healthcare infrastructure and the increasing adoption of advanced devices. The high prevalence of gastrointestinal disorders, such as colorectal cancer and inflammatory bowel disease, drives demand for diagnostic and therapeutic endoscopic procedures. Also, FDA approvals, awareness of preventive healthcare and routine screening programs encourages early detection and intervention, further boosting endoscope utilization.

For instance, in May 2025, Olympus received FDA 510(k) clearance for its EZ1500 series endoscopes, which feature Extended Depth of Field (EDOF) technology, aiming to improve health and safety.

Moreover, favorable reimbursement policies from public and private insurers make advanced endoscopic procedures more accessible, reducing financial burden on patients. Technological innovation and a focus on minimally invasive procedures reinforce North America's position as a leading market in the global endoscopes landscape.

The Asia Pacific endoscopes market was valued at 42.1% market share in 2024

The Asia Pacific is experiencing significant growth due to improvements in healthcare infrastructure, rising healthcare expenditure, and expanding hospital networks. Countries like India and China are experiencing a rise in chronic diseases, necessitating the adoption of endoscopic technologies for early diagnosis and treatment. Government initiatives and increased awareness about health and preventive care support the demand for endoscopic procedures.

For instance, in August 2025, Univlabs Technologies, a Gurugram-based startup, has launched GynoStart, India's first portable gynae endoscopy system, aiming to increase accessibility of endoscopy in smaller clinics and hospitals, marking a significant milestone.

Major Players

The major players in the endoscopes market include Olympus Corporation, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, HOYA Corporation (PENTAX Medical), Stryker Corporation, Boston Scientific Corporation, Medtronic, Richard Wolf GmbH, STERIS, and ATMOS MedizinTechnik GmbH & Co. KG among others.

Key Developments

In March 2025, FUJIFILM Healthcare Europe is introduced the EG-740UT interventional Ultrasonic Endoscope, a therapeutic tool with improved visibility, manoeuvrability, and single crystal image quality.

In January 2024, EndoSound Inc. has received FDA clearance for its EndoSound Vision SystemTM (EVSTM), marking a significant milestone in the company's medical technology development. This follows its FDA Breakthrough Device designation in July 2021, emphasizing the technology's safety features and potential for improved patient care.

Endoscopes Market: Scope

Metrics | Details | |

CAGR | 5.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | Flexible Endoscopes, Rigid Endoscopes, Capsule Endoscopes, Disposable Endoscopes, Robot-Assisted Endoscopes |

Application | Gastrointestinal (GI), Pulmonology, Orthopedics, Urology , Gynecology | |

End User | Hospitals, Ambulatory surgery centers (ASCs), Specialty Clinics | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The endoscopes market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here