Colombia Food Supplement Market Overview

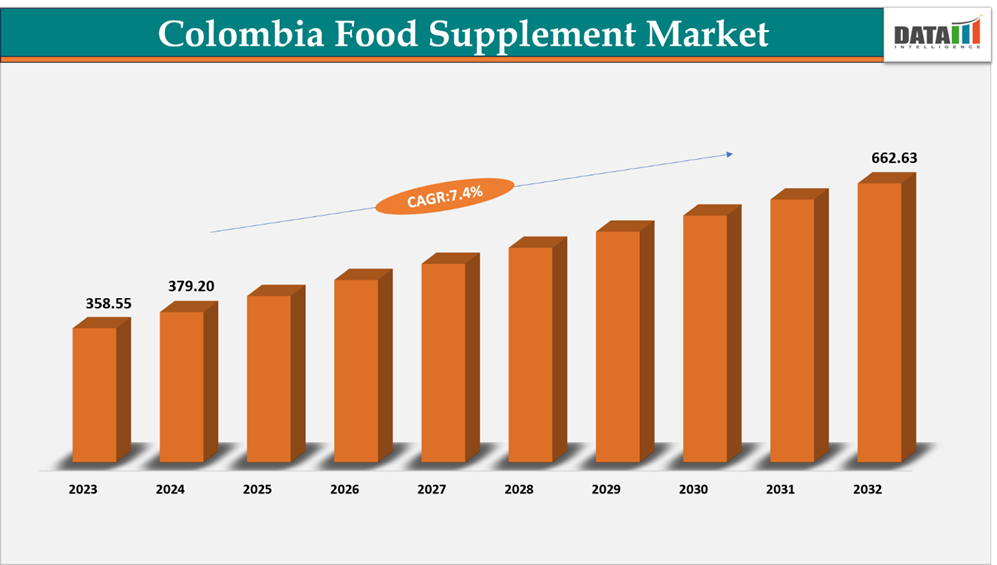

The Colombia food supplement market reached US$358.55 million in 2023, rising to US$379.20 million in 2024 and is expected to reach US$662.30 million by 2032, growing at a CAGR of 7.4% from 2025 to 2032.

The Colombian food supplements market is one of Latin America’s fastest-growing sectors, driven by rising health awareness, demographic changes, and supportive regulations. Despite growth, per capita spending (USD $17) remains well below that of the US (~$150) and Brazil (~$45), signaling vast expansion potential as income and health consciousness increase.

Market demand is shaped by three key factors such as preventive healthcare adoption, rising lifestyle diseases, and digital health literacy. Urban consumers aged 25–45 are leading this shift, favoring supplements for immunity, stress relief, and performance enhancement.

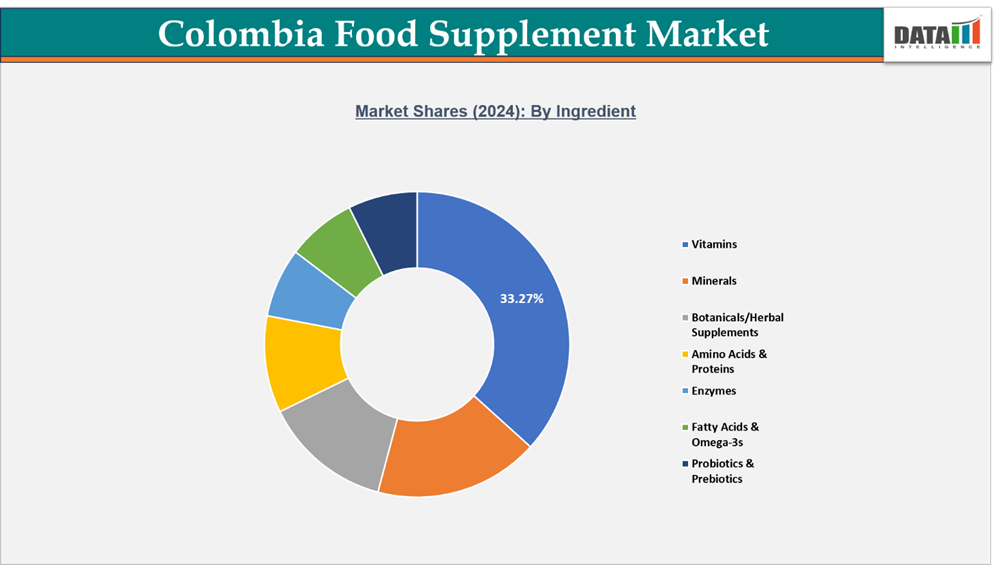

Vitamins and minerals dominate with about 47.6% market share, while botanicals and herbal supplements are growing fastest, fueled by traditional medicine and natural product preferences. Probiotics and digestive health supplements, though underdeveloped, are expanding rapidly with rising consumer awareness.

Food Supplement Market Industry Trends and Strategic Insights

- By ingredient segment, Vitamins lead the Colombian food supplement market, capturing the largest revenue share of 33.27% in 2024.

Colombia Food Supplement Market Size and Future Outlook

- 2024 Market Size: US$379.20 million

- 2032 Projected Market Size: US$662.63 million

- CAGR (2025–2032): 7.4%

Market Scope

| Metrics | Details |

| By Ingredient | Vitamins, Minerals, Botanicals/Herbal Supplements, Amino Acids & Proteins, Enzymes, Fatty Acids & Omega-3s, Probiotics & Prebiotics |

| By Dosage | Solid Form (Tablets, Capsules, Powders, Gummies, Lozenges & Chewables) Liquid Forms (Syrups & Tonics) |

| By Age | Infants & Toddlers (Ages 0-3 years), Children (Ages 4-12 years), Adolescents & Teenagers (Ages 13-19 years), Young Adults (Ages 20-39 years), Middle-Aged Adults (Ages 40-64 years), Seniors / Elderly (Ages 65+ years) |

| By Application | Gastrointestinal Health, Urinary Tract Health, Oral Health, Bone & Joint Health, Brain/Mental Health, Cardiovascular Health, Energy & Fatigue Reduction, Immunity/Respiratory Infections, Beauty & Anti-Aging, Women’s Health, Weight Management, Pediatric Health, Other Applications |

| By Distribution Channel | Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Specialty Health & Wellness Stores, Online Retailers, E-Commerce Websites, Brand Websites |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Health Consciousness Driving Demand For Preventive Wellness Products

Colombia has experienced a profound transformation in consumer attitudes toward health and wellness, marking a decisive shift from reactive healthcare approaches to proactive prevention strategies.

Social media platforms, particularly Instagram and YouTube, have become primary information sources where fitness enthusiasts, nutritionists, and healthcare professionals share evidence-based content, creating organic demand generation.

Despite Colombia's tropical geography, an estimated 40-50% of adults in major cities like Bogotá have insufficient Vitamin D levels, a direct result of indoor lifestyles and sun avoidance, driving demand for Vitamin D3 supplements.

2024 survey on lifestyle trends revealed that nearly 55% of urban Colombians now discuss their supplement routines openly with friends or colleagues, positioning these products as smart lifestyle choices rather than indicators of poor health.

Colombian consumers increasingly recognize that maintaining optimal health requires consistent nutritional supplementation rather than addressing deficiencies only after symptoms emerge. This preventive mindset has become deeply embedded in daily routines, with supplements transitioning from occasional purchases to essential household items.

Segmentation Analysis

The Colombia food supplement market is segmented based on ingredient, dosage, age, application, distribution channel.

Vitamins Segment Leads as the Foundation of Colombia’s Food Supplements Market

The vitamins segment represents the cornerstone of Colombia’s food supplements market, holding the largest share and serving as the primary entry point for new supplement users. Around 42% of the urban population currently uses dietary supplements, with Vitamin C leading due to its strong association with immunity and disease prevention, particularly post-pandemic. B-complex vitamins are gaining popularity among professionals managing stress and fatigue, while Vitamin E attracts beauty-focused consumers seeking antioxidant and skin health benefits.

Over 70% of first-time users begin with a multivitamin or a single vitamin such as C or D, reinforcing this segment’s foundational role. Its growth is supported by affordable pricing, wide distribution across pharmacies and supermarkets, and strong consumer trust in medically endorsed brands. Future growth will center on specialized formulations tailored to life stages such as prenatal, child immunity, and senior vitality—alongside personalized vitamin solutions enabled by digital health assessments and subscription-based delivery models that boost loyalty and convenience.

Minerals Segment Gains Strength with Rising Demand for Stress, Sleep, and Bone Health Solutions

The minerals segment in Colombia is expanding steadily, driven by rising awareness of micronutrient deficiencies and preventive health practices. With over 30% of the population projected to be over 50 years old by 2030, there is sustained demand for bone health products containing calcium and vitamin D. Iron supplements maintain strong sales among women of reproductive age, addressing a national anemia prevalence of about 20%. However, limited awareness that less than 15% of consumers know vitamin C enhances iron absorption presents opportunities for pharmacist-led education initiatives.

Magnesium has emerged as a fast-growing mineral, valued for stress relief, better sleep, and muscle recovery, aligning with the wellness priorities of fitness enthusiasts and urban professionals. Over 40% of urban consumers actively seek stress and sleep supplements, fueling magnesium’s double-digit growth. Multi-mineral formulations combining calcium, magnesium, and vitamin D are also performing well, offering convenient, all-in-one solutions. The segment’s future will likely focus on advanced trace mineral complexes, liquid formulations for improved absorption, and personalized mineral protocols guided by digital dietary assessments and telehealth integration.

Sustainability and ESG Analysis

Sustainability and ESG (Environmental, Social, and Governance) priorities are increasingly shaping the direction of the Colombia food supplement market, influencing production methods, sourcing strategies, and corporate responsibility frameworks. Companies are aligning with Colombia’s sustainability goals and international ESG standards to reduce environmental impact, promote ethical operations, and build stronger consumer trust.

The market is steadily transitioning toward natural, plant-based, and clean-label supplements that promote both personal well-being and environmental stewardship. Manufacturers are adopting renewable ingredient sourcing, biodegradable packaging, and energy-efficient manufacturing processes to lower carbon emissions and support circular economy principles.

Social initiatives are also gaining momentum as companies collaborate with local communities, farmers, and health professionals to improve nutrition awareness, encourage healthier lifestyles, and strengthen local supply chains. These efforts enhance social value while reinforcing brand loyalty and credibility.

Governance efforts are focused on greater transparency, strict regulatory compliance, and responsible marketing practices. Clear labeling, traceable ingredient sourcing, and adherence to international quality standards are becoming vital for consumer confidence and regulatory alignment.

Overall, the integration of sustainability and ESG principles is driving innovation and accountability across the Colombia food supplement industry, positioning it for long-term, responsible growth in an increasingly health- and environment-conscious market.

Consumer Analysis

Colombia’s food supplement market is expanding rapidly, driven by a rising focus on preventive health, wellness, and balanced nutrition. Increasing awareness of lifestyle-related disorders, combined with higher incomes and urban lifestyles, is boosting demand for vitamins, minerals, probiotics, and herbal supplements across diverse consumer groups. The key consumer base consists of health-conscious adults aged 25-45, who actively seek supplements that enhance immunity, reduce stress, and improve overall energy and performance. There is a noticeable shift toward natural, clean-label, and plant-based formulations, reflecting stronger preferences for products perceived as safe, transparent, and science-backed.

Digital health awareness and social media influence are reshaping buying behavior, with many consumers relying on wellness influencers, online platforms, and telehealth advice to make informed supplement choices. E-commerce, pharmacy chains, and direct-selling brands such as Amway and Herbalife are expanding product reach and accessibility nationwide.

Colombia’s aging population, projected to surpass 30% over 50 years old by 2030 is driving consistent demand for supplements supporting bone, joint, and heart health. Meanwhile, younger consumers increasingly prefer products for energy, stress relief, and skin wellness, highlighting a diverse and evolving health focus across age segments. Overall, growing health awareness, self-care trends, and consumer trust in clinically validated supplements are creating a vibrant, fast-maturing market landscape in Colombia.

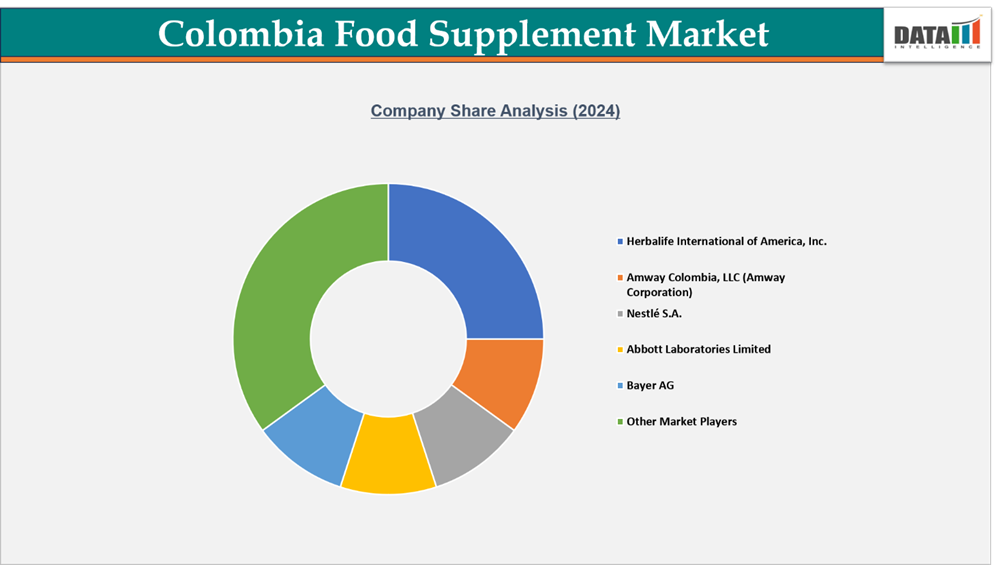

Competitive Landscape

- The Colombia food supplement market is highly competitive, with a blend of leading multinational corporations and strong domestic brands. Colombia players such as Herbalife International of America, Inc., Amway Colombia LLC, Nestlé S.A., Abbott Laboratories Limited, and Bayer AG hold significant market share due to their broad product ranges, strong brand reputation, and extensive retail and online distribution networks.

- Local companies, including Funat Laboratories S.A.S., NUTRABIOTICS S.A.S., and Naturmega, are steadily increasing their presence by offering affordable, natural, and locally adapted formulations that resonate with Colombian consumer preferences.

- Market leaders are leveraging strategic collaborations, influencer partnerships, and digital wellness platforms to expand their customer base and strengthen brand loyalty. The rise of e-commerce and direct selling models has particularly benefited companies like Herbalife, Amway, and USANA Health Sciences, driving deeper penetration in both urban and semi-urban regions.

- Competitive advantage in the Colombian food supplement industry increasingly depends on innovation, scientific validation, and personalized nutrition offerings. Brands focusing on targeted solutions for immunity, digestive health, and stress management are poised to capture greater market share in this rapidly evolving, health-conscious environment.

Key Developments

- In September 2025, USANA expanded its Nutritionals line with powerful new products and enhanced formulas. The upgraded line includes CellSentials with pyrroloquinoline quinone (PQQ) for mitochondrial support, Core Aminos with HMB for muscle health, and circulate+ for heart health. Additionally, USANA has enhanced its Proflavanol antioxidant supplement with a diverse range of flavonoids and introduced Marine Collagen Peptides with 4.8 grams of high-quality marine collagen. These innovative offerings are designed to help people live more vibrant lives

- In June 2023, Herbalife, through its Nutrition for Zero Hunger initiative and the Herbalife Nutrition Foundation (HNF), is supporting 2,000 children in Colombia by partnering with Fundación Comparte. The collaboration provides daily nutritional support, education, and wellness resources to vulnerable children across multiple regions. This effort aligns with Herbalife’s global mission to combat food insecurity and promote healthy development. Fundación Comparte operates community centers offering balanced meals, academic support, and physical activity programs. The initiative reflects Herbalife’s commitment to social impact and sustainable nutrition, helping children in Colombia thrive through improved access to essential nutrients and holistic care.

What Sets This Colombia Food Supplement Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes Colombia value by product type, stage, form, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect food supplement commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.