Global Clean Ni-Co Alloy Extraction Market is Segmented By Extraction Process (Hydrometallurgical Process, Pyrometallurgical Process, Bioleaching), By Application (Batteries, Aircraft Engines, Catalytic Converters, Heat Exchangers, Semiconductors, Others), By End-User (Aerospace & Defence, Electrical & Electronics, Automotive & Transportation, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Clean Ni-Co Alloy Extraction Market Size

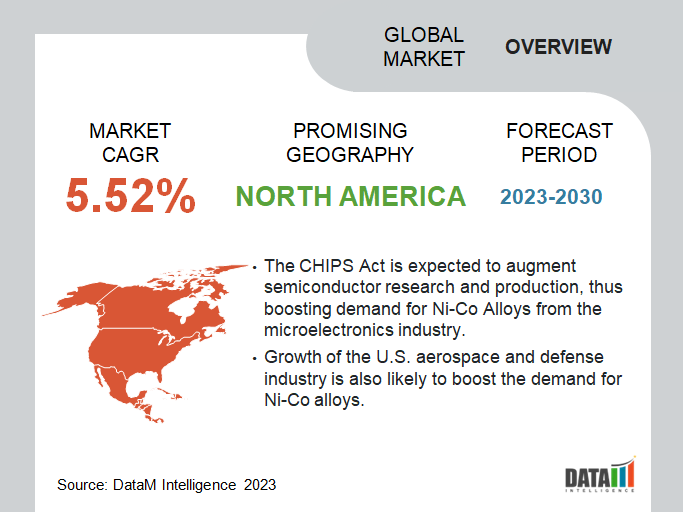

Global Clean Ni-Co Alloy Extraction Market reached USD 1.2 billion in 2022 and is expected to reach USD 1.8 million by 2030, growing with a CAGR of 5.2% during the forecast period 2023-2030. Increasing focus on sustainability in mining operations will augment global clean Ni-Co alloy extraction market growth during the forecast period.

Mining operations significantly to carbon emissions and also lead to contamination of the environment. The expansion of clean Ni-Co alloy extraction will help to curb emissions and prevent contamination.

The development of new Ni-Co alloys with unique properties is also likely to propel market growth during the forecast period. For instance, in December 2022, scientists at the Oak Ridge National Laboratory in Tennessee, U.S. announced the development of a new Ni-Co alloy with highest fracture resistance of any material known on Earth. The fracture resistance increases with decrease in temperature, signaling its potential application in cryogenic environments.

Clean Ni-Co Alloy Extraction Market Scope

|

Metrics |

Details |

|

CAGR |

5.2% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Extraction Process, Application, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Clean Ni-Co Alloy Extraction Market Dynamics

Increasing Global Demand for Electric Vehicles (EVs)

Growing demand for sustainable, zero emission transportation solutions has led to an increase in global production of electric vehicles (EVs). In 2022, global annual EV production exceeded 10 million units for the first time ever. However, the supply of Ni-Co alloys has not kept up with the rapid growth in global demand. Although mining companies are engaged in increasing output, demand has increased exponentially.

Therefore, mining companies are undertaking clean extraction of Ni-Co alloys from waste metal scrap to augment global supplies. Ni-Co alloys are used to manufacture key components of lithium-ion batteries, the main power source of electric vehicles. Since new mines can take years to come online, companies are expected to ramp up clean extraction to keep up with rising global production of electric vehicles.

Advancements in Aerospace Industry

The global aerospace industry operates at the cutting edge of technology and therefore, generates constant demand for new materials. The ongoing development of new commercial aircrafts, combat drones, fifth generation stealth fighter jets and new space exploration probes is likely to lead to search for advanced materials that offer superior performance and reduced weight.

One of the major advances in the aerospace industry, is the 3D printing of metal components. Ni-Co alloys have high creep and stress resistance, making them ideal for the manufacturing of turbine rotors and exhaust valves. The demand for high-performance Ni-Co alloys from the aerospace industry is likely to increase over the medium term.

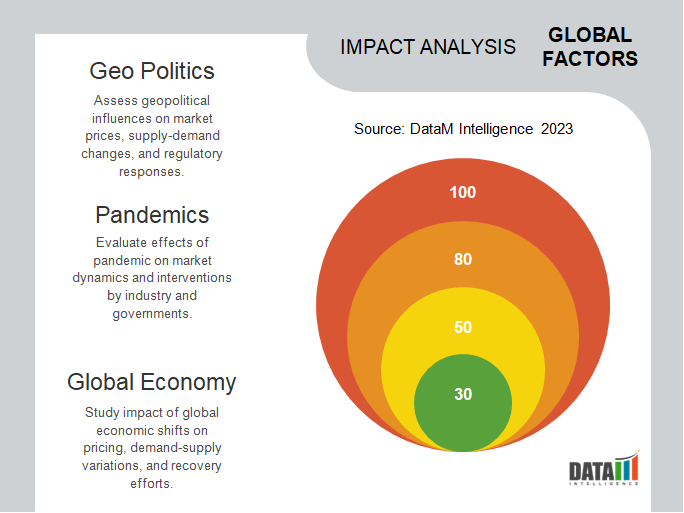

Volatility in Metal Prices

Metals, being tradable commodities have prices that fluctuate depending on various factors. Supply and demand, production, geopolitics and natural disasters are some of the major factors that can affect the price of metals. Volatility of metal prices is a key determinant in the success of commercial Ni-Co alloy extraction projects.

Prices need to remain at certain levels in order to make a project commercially viable. An average Ni-Co alloy clean extraction project requires atleast a couple of years to begin commercial operations. Prolonged price volatility during this period can undermine the economics of the project, potentially leading to its cancellation. Volatility in metal prices remains a major impediment for global market growth.

Clean Ni-Co Alloy Extraction Market Segment Analysis

The global clean Ni-Co alloy extraction market is segmented based on extraction process, application, end-user and region.

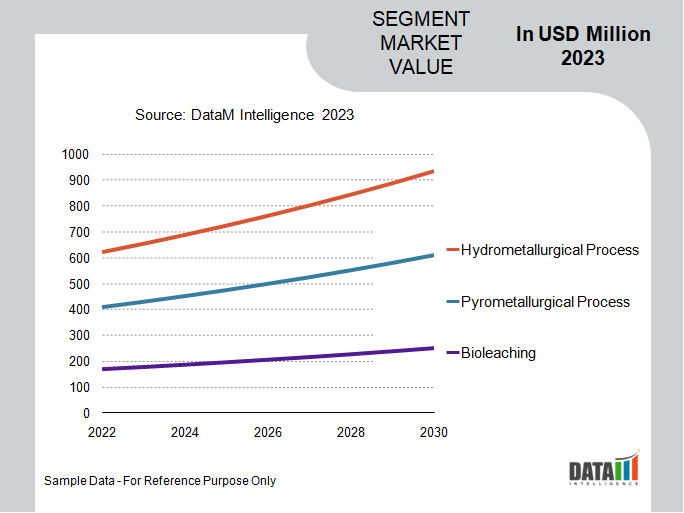

Hydrometallurgical Process is Mostly Preferred for Alloy Extraction

Hydrometallurgical extraction processes offer high efficiency in recovering nickel and cobalt alloys from metal scraps. Hydrometallurgical processes involve the use of chemical solutions to dissolve the metals selectively, allowing for efficient separation and recovery. Advancements in hydrometallurgical extraction processes, has led to high extraction yields and minimum losses.

Hydrometallurgical processes offer high selectivity for nickel and cobalt alloys, allowing for the targeted extraction of these metals while leaving impurities behind. The high selectivity of hydrometallurgical extraction process is crucial for achieving the highest possible purity levels in the extracted Ni-Co alloys. Furthermore, hydrometallurgical extraction processes are generally more environmentally friendly compared to pyrometallurgical extraction processes, which can lead to large-scale air pollution.

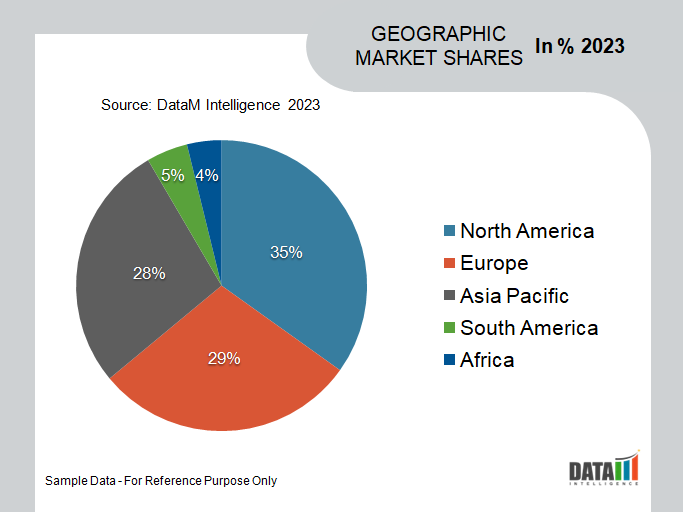

Global Clean Ni-Co Alloy Extraction Market Geographical Share

New Semiconductor Manufacturing Will Propel Market Growth in North America

North America is expected to account for more than a third of the global market. Countries in the region, such as U.S. and Canada have major concentration of high-technology industries such as electronics and aerospace and defense. North America thus accounts for a significant chunk of the global demand for Ni-Co alloys. The ongoing process to onshore semiconductor manufacturing in U.S. will generate major demand for Ni-Co alloys in the medium and long term.

In August 2022, the CHIPS Act was adopted into law by U.S. The act allocates more than USD 280 billion in funding to boost research, development and manufacturing of semiconductors in U.S. Attracted by subsidies, tax credits and other incentives, companies are setting up new semiconductor factories in U.S. In October 2022, Micron Technology, a microelectronics manufacturers, announced an investment of USD 20 billion to build a new semiconductor factory in New York State, U.S.

Clean Ni-Co Alloy Extraction Market Companies

The major global players include Vale, Norilsk Nickel, Sumitomo Metal Mining Co., Ltd., Glencore, GEM Co., Ltd, Eramet, Umicore, Anglo American Plc, Sherritt International Corporation and Jinchuan Group International Resources Co. Ltd.

COVID-19 Impact on Clean Ni-Co Alloy Extraction Market

The COVID-19 pandemic caused major challenges for the global market. It created disruptions across the global supply chains, affecting mining operations and processing facilities. Pandemic restrictions such as lockdown measures along with labor shortages led to a significant reduction in clean Ni-Co alloy extraction operations.

Due to the economic uncertainty brought on by the pandemic, mining companies were forced to reassess their capital expenditure and investment plans, leading to delays and scaling back of new projects. Th disruptions of existing projects led to cash flow problems and financial constraints for most of the major mining companies.

Russia- Ukraine War Impact Analysis

The Ukraine-Russia war has had significant implications for the global market. Russia is a major commodity exporter. Many western countries have imposed tough economic sanctions on Russia for its participation in the war. It has caused significant volatility in global commodity prices, thus jeopardizing the development of new Ni-Co alloy projects.

Norilsk Nickel, is a Russian company that is among the major global producers of Nickel, Cobalt and its alloys. Due to sanctions imposed on Norilsk Nickel, a lot of its joint ventures and collaborations with western companies have been terminated, creating uncertainty for various Ni-Co alloy extraction projects.

By Extraction Process

- Hydrometallurgical Process

- Pyrometallurgical Process

- Bioleaching

By Application

- Batteries

- Aircraft Engines

- Catalytic Converters

- Heat Exchangers

- Semiconductors

- Others

By End-User

- Aerospace & Defence

- Electrical & Electronics

- Automotive & Transportation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In August 2022, a team of scientists from the Northeastern University in Qingdao, China published a research paper detailing the development of a clean process for the extraction of Ni-Co alloys from spent lithium-ion batteries.

- In January 2023, researchers from the Wuhan University in China published a research paper describing the repurposing of Ni-Co alloys from metal scraps derived from disused battery cathode materials.

- In March 2023, scientists from the Jiangsu University of Science and Technology in China published a research paper detailing a new novel method for the extraction of Ni-Co alloys at low-temperatures from polymetallic nodules.

Why Purchase the Report?

- To visualize the global clean Ni-Co alloy extraction market segmentation based on extraction process, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of clean Ni-Co alloy extraction market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global clean Ni-Co alloy extraction market report would provide approximately 57 tables, 61 figures and 185 Pages.

Target Audience 2023

- Mining & Recycling Companies

- Commodity Traders

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies