Global Circulating Tumor Cells (CTC) Market – Industry Trends & Outlook

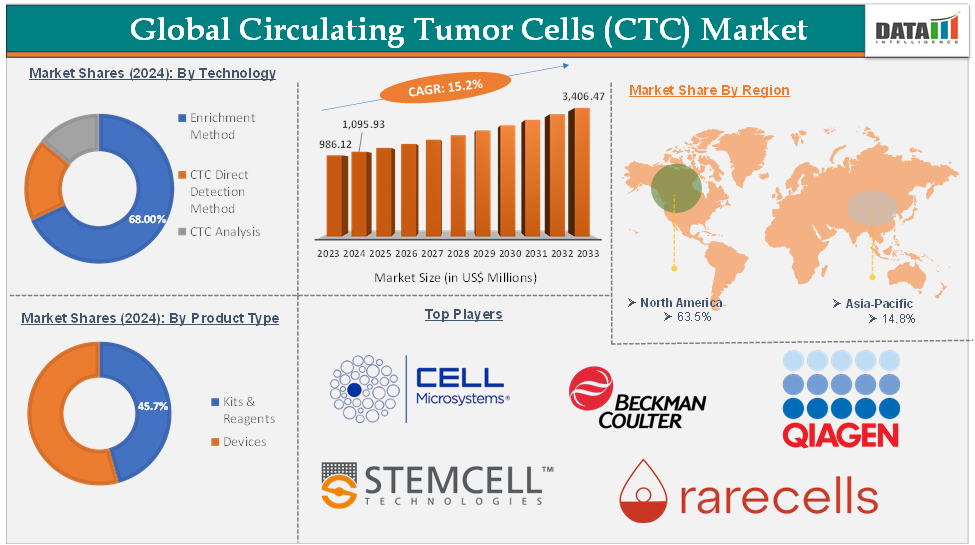

The global circulating tumor cells (CTC) market was valued at US$ 986.12 Million in 2023. The market size reached US$ 1,095.93 Million in 2024 and is expected to reach US$ 3,406.47 Million by 2033, growing at a CAGR of 15.2% during the forecast period 2025-2033.

Circulating tumor cells (CTCs) have significant potential for the early detection of cancer, monitoring the response to treatment, and predicting the course of the disease. Furthermore, technological progress and the creation of novel methods for detecting and isolating CTCs have significantly improved the precision and dependability of diagnostics based on CTCs.

Moreover, the increasing emphasis on individualized medicine and therapeutic interventions has generated a demand for accurate and up-to-date data regarding tumor properties, which can be acquired via CTC analysis. Thus, the market expansion is also being driven by the incorporation of CTC-based assays in clinical trials and the growing use of liquid biopsy techniques in regular cancer treatment.

According to the American Cancer Society, there were an estimated 127,070 deaths caused by lung cancer reported across the US in 2023, along with around 238,340 new cases of lung cancer diagnosed. Furthermore, the region's expansion is supported by the presence of a population with high vulnerability to cancer, an increase in market penetration rates, and a technologically advanced cancer care infrastructure.

Global Circulating Tumor Cells (CTC) Market – Executive Summary

Global Circulating Tumor Cells (CTC) Market Dynamics: Drivers

Advancements in cluster chip technology

Cells affected by cancer can spread throughout the body by traveling through the bloodstream, either individually or in groups. Current technologies for CTC enrichment focus on isolating individual CTCs. While some cases have shown the presence of CTC clusters, more research is needed to fully understand their prevalence and importance.

A new microchip technology called the Cluster-Chip has been developed to capture CTC clusters from unprocessed blood, regardless of tumor-specific markers. CTC clusters are carefully separated using unique bifurcating traps in low-shear stress conditions to maintain their structure, and even clusters with only two cells are captured effectively. Through the use of the Cluster-Chip, CTC clusters have been detected in a significant percentage of individuals diagnosed with metastatic breast or prostate cancer, as well as melanoma.

The tumor origin of CTC clusters was confirmed through RNA sequencing, which also revealed the presence of tissue-derived macrophages within the clusters. Effective capture of CTC clusters will allow for a thorough understanding of their biological properties and their involvement in metastasis. Cloud computing technology is crucial in detecting the very uncommon category of cells, such as cancer stem cells (CTCs). Achieving isolation of CTCs is a laborious procedure that demands exceptional precision. Chip technology not only enables accurate thermal conductivity (CTC) isolation but also addresses the limitations of isolation devices created by major firms.

Researchers at the National Institutes of Health (NIH) conducted a small trial test of the Cluster-Chip on 60 individuals diagnosed with metastatic cancer. In 11 out of 27 (41%) breast cancer patients, 6 out of 20 (30%) melanoma patients, and 4 out of 13 (31%) prostate cancer patients, the chip successfully detected CTC clusters. The researchers conducted a comprehensive investigation of several facets of these CTC clusters. The results demonstrate that this method enables the acquisition and examination of clusters of cancer-associated tissues (CTCs) from various forms of cancer.

Global Circulating Tumor Cells (CTC) Market Dynamics: Restraints

Scarcity, sensitivity, and clinical utility in early cancer diagnosis

Optimal early detection of tumors, particularly for rapidly advancing tumors, is the most effective approach to overcome them. Although studies have established a correlation between CTCs and tumor stage, the clinical usefulness of CTCs in cancer detection or early cancer diagnosis remains a subject of controversy. CTCs are regarded as an indicator of metastatic activity; however, there is ongoing debate on whether the spread of CTCs to other parts of the body happens early in the development of the tumor.

Nevertheless, experimental studies in mouse models have shown that early dissemination seeding metastasis occurs in breast and pancreatic carcinogenesis. This suggests that the circulation of cancer-specific T-cells (CTCs) is probably a very early occurrence in the development of cancer. Colony-forming carcinomas (CTCs) are identified in 41% of patients with T1 stage and 47% of patients with axillary lymph node-negative breast cancer, both of whom have early-stage breast cancer.

Among lymph node-negative and positive breast cancer, the CTC positivity rates were 21% and 24% respectively. The idea suggests that cancer stem cells (CTCs) can be identified at an earlier stage before the main tumor becomes visible on imaging investigations. However, the main obstacle in using CTCs for early cancer diagnosis is their limited availability and isolation. The suboptimal sensitivity of CTC detection techniques impedes their utility as a reliable biomarker in early cancer diagnoses.

Global Circulating Tumor Cells (CTC) Market Dynamics: Opportunities

Harnessing circulating tumor cells (CTCs) for advancing drug development

The integration of circulating tumor cells (CTCs) into drug development is revolutionizing cancer research by providing new techniques to assess therapeutic efficacy and improve treatment strategies. In drug testing, oncogenic tumor cells (CTCs) refer to cancer cells that have been liberated into the bloodstream from either a primary tumor or a metastatic site. Researchers can isolate and grow cancer stem cells (CTCs) from blood samples of patients to evaluate the biological reaction of these cells to various drugs.

This technology enables personalized drug screening, allowing pharmaceutical companies to tailor therapies based on the specific characteristics of a patient's cancer, thereby increasing the probability of finding effective drugs.

The utilization of CTCs accelerates the clinical trial process by improving patient categorization and enabling adaptable trial designs. The analysis of CTC allows for the detection of biomarkers associated with drug response or resistance, therefore enhancing the precision of patient selection and the achievement of better trial outcomes. Real-time monitoring of CTC levels during clinical trials can offer early indications of drug efficacy, enabling researchers to quickly refine trial protocols. The flexibility inherent in this approach can lead to more efficient and successful research, thereby accelerating the integration of novel treatments into the market.

For more details on this report, Request for Sample

Global Circulating Tumor Cells (CTC) Market - Segment Analysis

The global circulating tumor cells (CTC) market is segmented based on technology, product type, specimen, application, end-user, and region.

Technology:

The enrichment method technology segment in the circulating tumor cells (CTC) market was valued at US$ 734.03 Million in 2024

The CTC enrichment based on their physical properties is generally label-free, which is independent of the expression biomarkers represented by CTCs. In other words, CTCs are enriched by using density, size, deformability, and electric charge as selection criteria. Such enrichment methods are usually low-cost and quick.

The enrichment method is a crucial tool in the global circulating tumor cells (CTC) market, aiding in the isolation and concentration of rare CTCs from blood samples. This method, based on physical properties or molecular markers, enhances the detection of rare CTCs, enabling early cancer detection, prognosis assessment, and therapeutic efficacy monitoring, thus driving advancements in personalized oncology treatments.

For instance, Akadeum's Red Blood Cell Depletion Microbubbles can remove up to 99% of contaminating red blood cells (RBCs) in under 10 minutes, while maintaining the health and physiology of cells of interest. This technology allows for enrichment of rare target populations in 10 minutes, enabling higher efficiency of downstream applications like single-cell analysis.

The removal of RBCs and other unwanted cells is fast and easy by binding to surface markers identified by specific antigens in the bubbles. Akadeum's microbubbles can be used to enrich for rare circulating cells like CTCs, as presented at the 12th Scientific Workshop of the Early Detection Research Network.

For instance, in June 2024, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostics products, announced the launch of Celselect Slides 2.0 to enhance rare cell and circulating tumor cell (CTC) capture. Compatible with Bio-Rad’s Genesis Cell Isolation System, the latest version of Celselect Slides enables the processing of greater volumes of liquid biopsy samples and offers the ability to capture and recover a greater number of CTCs for enumeration or use in downstream applications. Hence, the above-mentioned factors help the enrichment method segment to grow during the forecast period.

Product Type:

The device product type segment in the circulating tumor cells (CTC) market was valued at US$ 596.29 Million in 2024

The devices segment is anticipated to grow at a substantial rate over the analysis period. A significant surge in the adoption of devices or systems used in the isolation of circulating tumor cells (CTCs) can be attributed to the growing usage of CTCs for cancer diagnosis, prognosis, and treatment monitoring. These devices and systems offer higher sensitivity, specificity, and efficiency in capturing CTCs from peripheral blood samples. The ease of use, scalability, and compatibility of these devices have further fueled their widespread adoption.

Devices play a key role in the circulating tumor cells (CTC) market by enabling the efficient detection, isolation, and analysis of CTCs from patient blood samples. These devices include a variety of technologies, such as microfluidic systems, automated cell sorters, and imaging instruments, which are designed to capture and analyze rare tumor cells present in the bloodstream.

Overall, devices leveraging physical properties, immunoaffinity, or a combination of both are critical for the sensitive and specific detection of rare CTCs in patient blood samples. These devices enable downstream analysis of CTCs to provide insights into cancer metastasis and guide treatment decisions. These factors have solidified the segment's position in the global circulating tumor cells (CTC) market.

Global Circulating Tumor Cells (CTC) Market – Geographical Analysis

The North America circulating tumor cells (CTC) market was valued at US$ 695.86 Million in 2024

North America is poised to hold the largest share of the global circulating tumor cells (CTC) market. The North American market has witnessed a significant shift towards liquid biopsy, a minimally invasive diagnostic approach that includes CTC detection as a key component. Market trends show that North America’s focus on early cancer detection and personalized treatment options will continue to expand the demand for CTC technologies.

The US circulating tumor cells (CTC) market was valued at US$ 625.00 Million in 2024

For instance, in March 2024, Datar Cancer Genetics, a global leader in liquid biopsy technology, targeted US Food and Drug Administration (FDA) clearance within the next two years for its brain cancer early detection test. The assay recently demonstrated high accuracy in diagnosing malignant brain tumors during a small real-world study.

Currently, no rapid, simple blood tests exist to diagnose brain cancers. In the US alone, around 25,400 malignant brain or spinal cord tumors were diagnosed last year, according to the American Cancer Society. Malignant brain tumors generally consist of glial cells, whereas nonmalignant tumors may involve other cell types or metastatic cells from primary epithelial cancers.

Collaborations between academia and industry to advance cancer diagnostics further strengthen North America’s market position. For instance, in March 2024, Bio-Rad Laboratories, Inc., released new validated antibodies designed for the enumeration of rare cells and circulating tumor cells (CTCs). These antibodies, tailored for use with Bio-Rad’s Celselect Slides Enumeration Stain Kits, target specific CTC surface markers.

Asia-Pacific circulating tumor cells (CTC) market was valued at US$ 162.39 Million in 2024

The Asia-Pacific region is expected to hold a significant share of the global circulating tumor cells (CTC) market. Growing awareness about the benefits of early cancer detection and the availability of liquid biopsy tests are expected to further boost the CTC market in Asia-Pacific. With increasing public and private sector initiatives aimed at raising awareness about cancer screening and diagnosis, thereby driving the demand for CTC detection technologies. This trend is particularly evident in countries like India, where the government is promoting cancer screening programs across the country.

The Japan circulating tumor cells (CTC) market was valued at US$ 32.01 Million in 2024

According to the Chief Scientific Officer of Actorius Innovations and Research, Indian researchers have developed a novel method for determining cancer stages. This breakthrough was recognized at the Liquid Biopsy Conference in Miami, hosted by the American Association of Cancer Research. Head and neck cancers are highly prevalent in India, with approximately 30 percent of cases linked to widespread smoking, tobacco, and alcohol use.

The International Agency for Cancer Research reports that head and neck cancers account for 270,000 new cases and 170,000 deaths annually in India. These cancers affect various areas, including the mouth, nose, larynx, lips, throat, salivary glands, and other parts of the head and neck. A study conducted at Tata Memorial Hospital in Mumbai, with contributions from leading oncologists, demonstrated that chemotherapy significantly reduced circulating tumor cell (CTC) counts by up to 22 percent in patients undergoing treatment compared to those who did not.

Furthermore, increased investments in healthcare and research are playing a pivotal role in shaping the Asia-Pacific CTC market. Governments in countries like Japan and Singapore are making substantial investments in cancer research and precision medicine, with a focus on developing personalized cancer treatments. These initiatives are expected to drive demand for CTC technologies, as they offer valuable insights into tumor biology and can help guide treatment decisions in real-time.

Global Circulating Tumor Cells (CTC) Market – Competitive Landscape

The major global players in the circulating tumor cells (CTC) market include Cell Microsystems Inc. (Fluxion Biosciences, Inc.), STEMCELL Technologies Inc., Beckman Coulter, Inc., Qiagen NV, Rarecells, Inc., ScreenCell, Menarini Silicon Biosystems, Inc, RareCyte, Inc., ANGLE plc, and Thermo Fisher Scientific Inc. among others.

Global Circulating Tumor Cells (CTC) Market – Key Developments

In March 2025, Creative Bioarray, a leading name in biotechnology services, is excited to unveil its state-of-the-art Circulating Tumor Cell (CTC) FISH (Fluorescence In Situ Hybridization) services. This innovative technology equips researchers with an advanced solution for the detection and analysis of circulating tumor cells, key elements in cancer research, diagnosis, and monitoring treatment effectiveness.

In June 2024, Bio-Rad Laboratories, Inc. announced the release of Celselect Slides 2.0, designed to improve the capture of rare cells and circulating tumor cells (CTCs). Fully compatible with Bio-Rad’s Genesis Cell Isolation System, the upgraded Celselect Slides allow researchers to process larger volumes of liquid biopsy samples and efficiently capture and recover more CTCs for counting or further downstream analysis.

In May 2024, ANGLE announced the launch of a strategic supplier agreement with AstraZeneca to develop an Androgen Receptor (AR) assay for use in prostate cancer studies. This partnership aims to leverage ANGLE’s Parsortix system, which isolates and harvests circulating tumor cells (CTCs) from blood samples for detailed analysis.

Global Circulating Tumor Cells (CTC) Market – Scope

Metrics | Details | |

CAGR | 15.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Technology | Enrichment Method, CTC Direct Detection Method, CTC Analysis |

Product Type | Kits & Reagents, Devices | |

Specimen | Blood, Bone Marrow, Others | |

Application | Clinical, Research | |

End-User | Hospitals and Clinics, Diagnostic Centers, Research Facilities, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

DMI sees the CTC market as a game-changer in precision cancer, with a compound annual growth rate (CAGR) of 15.2% by linking diagnostics, treatments, and drug discovery. Cluster-Chips and microbubble platforms are two examples of enrichment and detection technologies that are changing quickly. These technologies are making CTCs important instruments for real-time cancer surveillance and early-stage diagnosis. However, clinical usefulness in early diagnosis is still restricted by problems with sensitivity and low CTC counts. To get better insights into stratification and treatment effectiveness, companies should put their money into high-throughput, high-specificity systems and use CTC in more clinical trials. The rising alignment in the pharmaceutical industry is shown by partnerships like ANGLE-AstraZeneca and new products like Bio-Rad's Celselect 2.0. North America is in the lead because of its established infrastructure. Asia-Pacific, on the other hand, has unexplored prospects because of expanding screening programs and government-backed research and development. In this fast-changing field, market leaders will be those that focus on device innovation, biomarker discovery, and validation that is backed by the government.

The global circulating tumor cells (CTC) market report delivers a detailed analysis with 78 key tables, more than 71 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here