Cell Line Development & Bioproduction Services Market Size and Trends

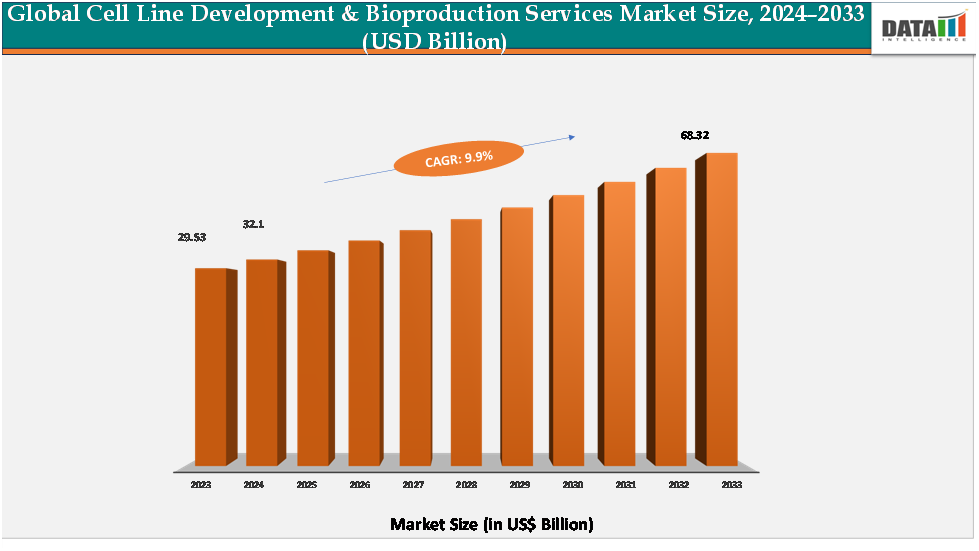

The global cell line development & bioproduction services market reached US$ 29.53billion in 2023, with a rise to US$ 32.1 billion in 2024, and is expected to reach US$ 68.32billion by 2033, growing at a CAGR of 9.9% during the forecast period 2025–2033.

The cell line development & bioproduction services market is experiencing strong momentum as these services become critical enablers of next-generation biologics and advanced therapies. By supporting the creation of high-yield, stable, and regulatory-compliant cell lines, service providers are empowering biopharmaceutical companies to accelerate the development of monoclonal antibodies, recombinant proteins, vaccines, and cell & gene therapies with improved quality and scalability. Furthermore, rapid innovations in single-use bioprocessing, automation, high-throughput screening, and genetic engineering platforms are aligning with global demand for faster, more efficient, and cost-effective drug development. At the same time, the expansion of outsourcing to specialized CDMOs and the growing availability of these services in emerging markets are creating new opportunities for wider adoption, streamlined workflows, and long-term market growth.

Key Market highlights

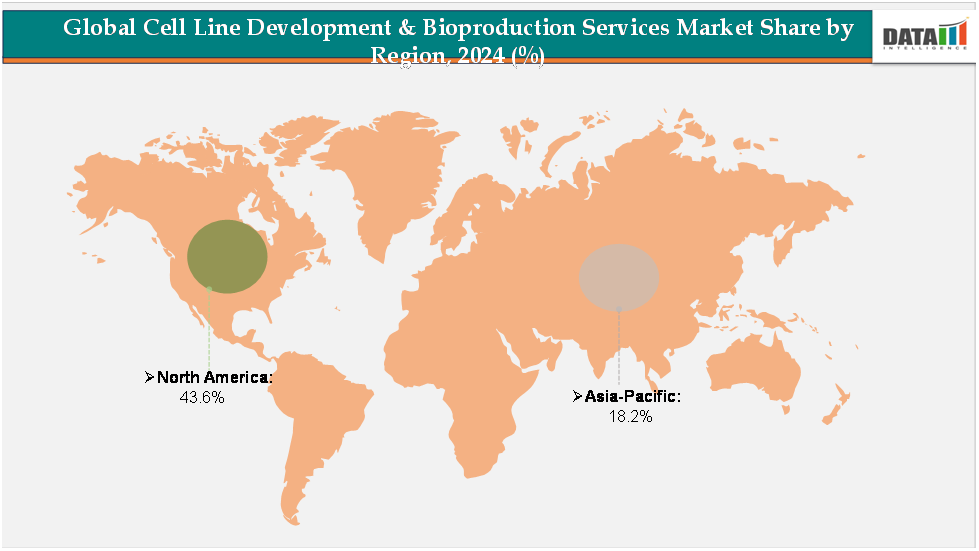

- North America leads the cell line development & bioproduction services market, accounting for approximately 43.6% of global revenue, driven by the strong presence of biopharmaceutical giants, well-established CDMOs, and advanced R&D infrastructure.

- Asia-Pacific represents the fastest-growing regional market, holding about 18.2% of the share, fueled by increasing investments in biomanufacturing facilities across China, India, Japan, and South Korea. Government-backed initiatives to strengthen biotechnology ecosystems, the growing presence of regional CROs and CDMOs, and rising demand for affordable biologics are propelling the region’s growth.

- Cell line engineering & development remains the dominant service segment, contributing around 38% of market revenue. This is attributed to the high demand for stable, high-yield cell lines to support large-scale monoclonal antibody, vaccine, and recombinant protein production.

Market Size & Forecast

- 2024 Market Size: US$32.1Billion

- 2033 Projected Market Size: US$68.32Billion

- CAGR (2025–2033): 9.9%

- North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Source : Datam Intelligence Email : [email protected]

Drivers & Restraints

Driver: Rapid Growth in Biologics, mAb s, Cell & Gene Therapies

The accelerating demand for biologics, mAbs, and cell & gene therapies is substantially propelling the cell line development & bioproduction services market, as these therapeutic modalities require highly optimized, stable, high-yield cell lines capable of correct folding, post-translational modifications (PTMs), and scalable production.

Monoclonal antibodies and therapeutic proteins increasingly dominate treatment regimens for cancer, autoimmune conditions, metabolic disorders and rare diseases, pushing pharmaceutical and biotech companies to invest more heavily in cell line platforms (especially mammalian systems like CHO, HEK-293) to ensure quality, consistency, and efficiencies in biomanufacturing.

Similarly, cell and gene therapies add pressure to CDMOs and development service providers to not only supply cell line creation but also the upstream vector production, characterization, scale-up, and compliance capabilities.

Restraint: High Capital Expenditure and Operational Costs

High capital expenditure and operational costs pose a significant restraint to the growth of the Cell Line Development & Bioproduction Services market, as establishing GMP-compliant facilities requires substantial upfront investment in infrastructure, bioreactors, cleanrooms, and advanced analytical platforms, along with ongoing costs for quality assurance, regulatory compliance, and consumables.

For more details on this report, Request for Sample

Segmentation Analysis

The global cell line development & bioproduction services market is segmented by service type, cell type, application, and end-user, and region.

Service Type:

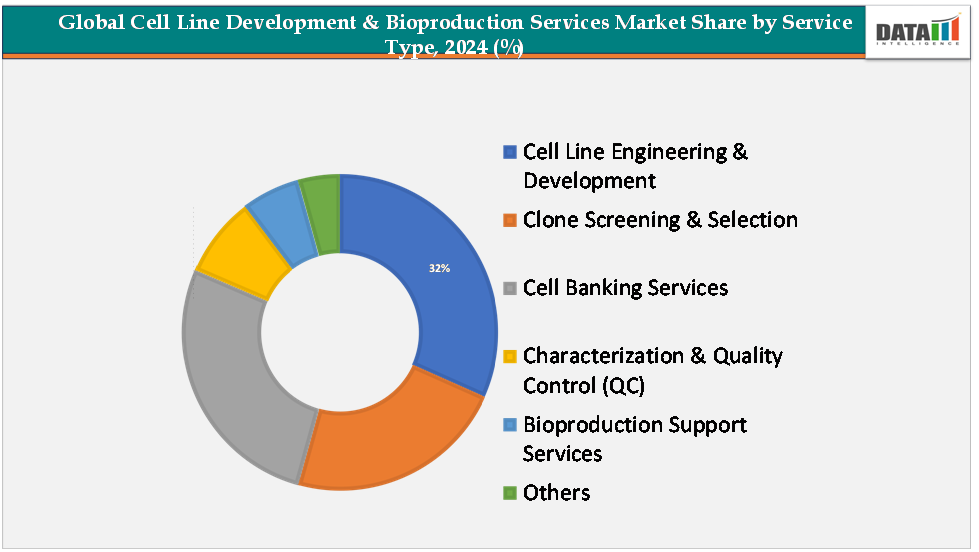

The cell line engineering and development segment is estimated to have 32% of the Cell Line Development & Bioproduction Services Market share.

Cell line engineering and development is expected to remain the dominant segment within the cell line development & bioproduction services market, largely driven by the rising demand for customized, high-yield, and stable expression systems to support the growing pipeline of biologics and biosimilars. Pharmaceutical and biotechnology companies are increasingly outsourcing this stage to specialized service providers due to the complexity of generating robust mammalian and microbial cell lines capable of consistent protein production under GMP conditions.

The dominance of this segment is also reinforced by the adoption of advanced technologies such as CRISPR/Cas9 genome editing, single-cell cloning, and high-throughput screening platforms, which enhance clone selection efficiency and reduce development timelines. Furthermore, as monoclonal antibodies, recombinant proteins, and advanced therapies like cell and gene therapies expand rapidly, the need for tailored cell line engineering solutions that optimize productivity and quality attributes continues to grow, ensuring this segment maintains its leading market share.

The cell banking services segment is estimated to have 29% of the cell line development & bioproduction services market share.

Cell banking services are anticipated to be the fastest-growing segment, fueled by the increasing regulatory emphasis on product consistency, traceability, and long-term storage of production-ready cell lines. Establishing master and working cell banks under strict quality standards ensures a reliable and contamination-free source of cells for large-scale manufacturing, which is critical for biologics and ATMPs (Advanced Therapy Medicinal Products). The rapid expansion of cell and gene therapies, particularly CAR-T and viral vector-based therapies, has heightened the need for robust cell banking infrastructure to support clinical and commercial production pipelines. In addition, the outsourcing trend is strong in this space, as smaller biotechs and even mid-sized firms prefer engaging CDMOs with GMP-certified facilities to manage banking and characterization services, thereby saving costs and accelerating regulatory approvals. Recent technological advances, such as automated cryopreservation systems and digital tracking solutions, further enhance the reliability of cell banking, contributing to its rapid growth trajectory in the global market.

Geographical Analysis

The North America cell line development & bioproduction services market was valued at 43.6%market share in 2024

North America is expected to maintain its dominance in the cell line development & bioproduction services market, supported by its strong biopharmaceutical ecosystem, high R&D expenditure, and robust clinical trial pipeline. The region is home to leading pharmaceutical and biotechnology companies, CDMOs, and academic research institutes that are heavily investing in biologics, biosimilars, and advanced therapies such as monoclonal antibodies, cell therapies, and gene-modified products.

The presence of well-established GMP-certified facilities, coupled with early adoption of innovative technologies such as CRISPR-based genome editing, automated high-throughput cell screening, and AI-driven process optimization, further reinforces North America’s leadership. Additionally, favorable regulatory frameworks provided by the U.S. FDA and Canada’s Health authorities create a supportive environment for biologics development and commercialization. Growing investments in cell and gene therapy CDMO capacity expansions, particularly in the U.S., further strengthen the region’s position as the global hub for cell line development and large-scale bioproduction.

The Europe cell line development & bioproduction services market was valued at 20.4% market share in 2024

Europe is expected to hold a significant share in the cell line development & bioproduction services market, supported by its strong regulatory framework, thriving biopharma sector, and a well-established clinical research environment. The region benefits from a growing biosimilar pipeline, strong demand for cost-effective biologics, and government initiatives promoting advanced therapy medicinal products (ATMPs). Countries like Germany, the U.K., and Switzerland lead the European market with their advanced CDMO networks and innovation-driven biotech hubs.

Europe’s commitment to high regulatory and quality standards ensures the development of reliable, compliant cell lines, positioning the region as a trusted partner for global collaborations. Moreover, increasing investments in cell and gene therapy research, supported by the European Medicines Agency (EMA), are expanding opportunities in cell banking, viral vector production, and cell line characterization services. Europe remains a crucial market due to its innovation-driven focus, strategic collaborations, and strong biosimilars adoption.

The Asia-Pacific cell line development & bioproduction services market was valued at 18.2% market share in 2024

Asia-Pacific is projected to be the fastest-growing regional market, fueled by expanding biologics manufacturing capabilities, increasing government support, and the rapid growth of domestic biotech companies across China, India, South Korea, and Japan. Rising demand for affordable biosimilars, a surge in clinical trials, and active investments in local CDMOs are accelerating the region’s growth trajectory. Many global pharmaceutical companies are also shifting outsourcing activities to the Asia-Pacific due to cost advantages, skilled workforce availability, and expanding infrastructure for GMP-compliant cell line development and bioproduction. Furthermore, regional governments are actively promoting investments in biotechnology through funding programs, tax incentives, and public-private collaborations. With countries like China and South Korea heavily investing in cell and gene therapy manufacturing capabilities, and India emerging as a cost-competitive hub for biosimilar development, the Asia-Pacific market is set to expand at the highest CAGR globally, making it the most dynamic growth region.

Competitive Landscape

The major players in the cell line development & bioproduction services market include Lonza, Thermo Fisher Scientific Inc., Samsung Biologics, Sartorius AG, WuXi Biologics, Cytiva, Eurofins Discovery, Biocomputer, Revit, ProBioGen AG, among others.

Key Developments:

- In March 2024, Sartorius and LFB BIOMANUFACTURING, a CDMO specializing in recombinant protein development and manufacturing, announced a strategic partnership. Under the agreement, LFB BIOMANUFACTURING will outsource its cell line development (CLD) services to Sartorius. The collaboration aims to offer joint customers end-to-end solutions spanning CLD to clinical manufacturing, leveraging both companies’ expertise to accelerate therapy development and enhance customer value.

- In November 2024, Scorpius Holdings, Inc., an integrated CDMO, announced a partnership with Celltheon Corporation to deliver cell line development services leveraging Celltheon’s proprietary GOLDILOCKS™ transposase-based platform.

Market Scope

| Metrics | Details | |

| CAGR | 9.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US $Bn) | |

| Segments Covered | Service Type | Protein Expression Services, Protein Purification Services |

| Protein Type | Natural Proteins, Synthetic Proteins | |

| Application | Research and Development, Diagnostics, Biotechnological Product Manufacturing, Agriculture, Others | |

| End-User | Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organizations (CDMOs), Diagnostic Laboratories & Clinical Research Centers, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cell line development & bioproduction services market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here