Synthetic Biology Market Size

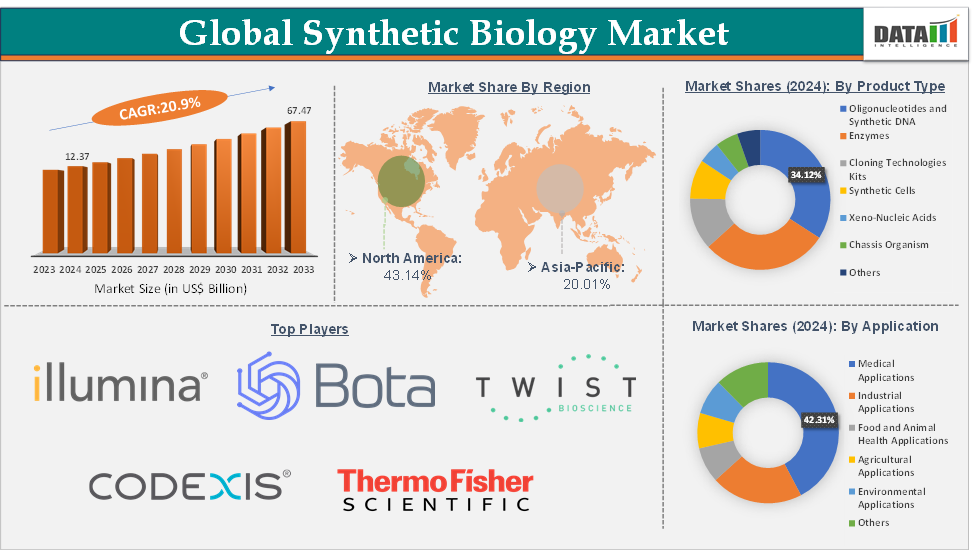

The global synthetic biology market size reached US$ 12.37 Billion in 2024 from US$ 10.38 Billion in 2023 and is expected to reach US$ 67.47 Billion by 2033, growing at a CAGR of 20.9% during the forecast period 2025-2033.

Synthetic Biology Market Overview

The synthetic biology market growth is driven by rising demand for sustainable bio-based solutions (biofuels, bioplastics, circular economy chemicals) and healthcare breakthroughs (vaccines, diagnostics, personalized medicine) are pushing synthetic biology into mainstream industries.

North America dominates the synthetic biology market with the largest revenue share of 43.14% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 21.1% over the forecast period.

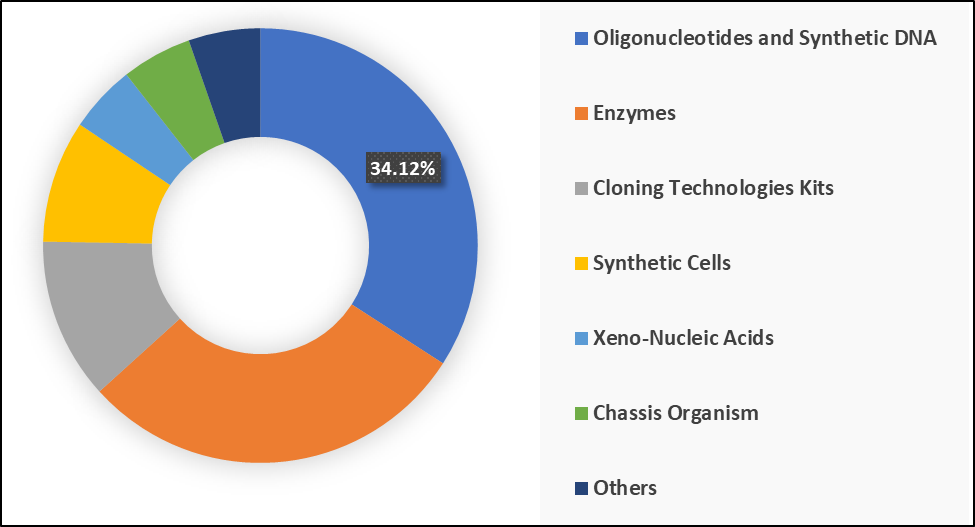

Based on product type, the oligonucleotides and synthetic DNA segment led the market with the largest revenue share of 34.12% in 2024.

Based on application, the medical applications segment is expected to lead the market with the largest revenue share of 42.31% in 2024.

The major market players in the synthetic biology market are Illumina, Inc., Merck KGaA, Thermo Fisher Scientific Inc., Bota Biosciences, Codexis, Inc., Twist Bioscience, Creative Biogene and Eurofins Genomics, among others

Synthetic Biology Market Executive Summary

Synthetic Biology Market Dynamics

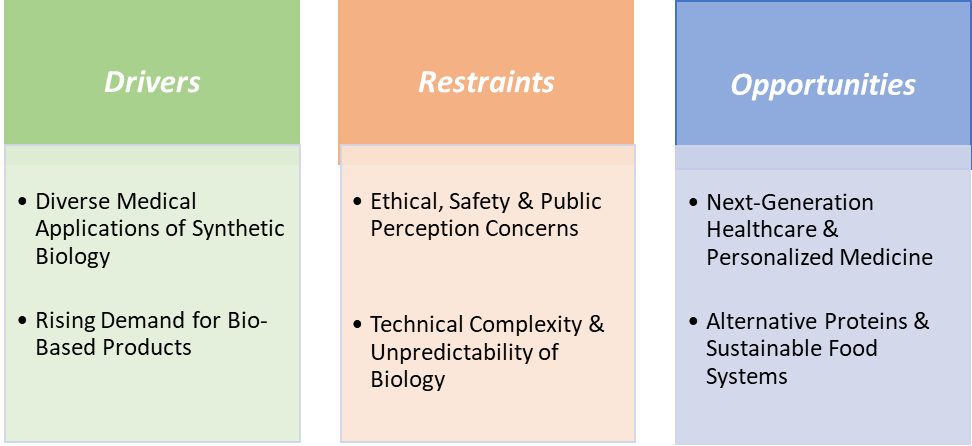

Drivers - Diverse medical applications of synthetic biology are significantly driving the synthetic biology market growth

The diverse medical applications of synthetic biology are significantly driving market growth by transforming how therapies, vaccines, diagnostics, and drug manufacturing are approached. Synthetic biology enables precision medicine through innovations like CRISPR Therapeutics’ exa-cel, approved in 2023 for sickle cell disease and beta-thalassemia, showcasing the real-world impact of engineered gene-editing therapies. Vaccine development has also been revolutionized, with Moderna’s mRNA platform, rooted in synthetic biology, enabling rapid vaccine design, as seen during the COVID-19 pandemic.

Meanwhile, advanced medical technologies like biohybrid microswimmers are being designed for targeted drug delivery to tumor sites, and Organovo’s 3D-printed human tissues are being adopted for disease modeling and preclinical drug testing, with its FXR program recently acquired by Eli Lilly in 2025. Collectively, these applications highlight how synthetic biology is expanding from lab research into real-world medical solutions, fueling investor confidence, accelerating commercialization, and driving sustained growth across the healthcare sector.

Restraints - Ethical, safety & public perception concerns are hampering the growth of the synthetic biology market

Ethical, safety, and public perception concerns are acting as major restraints on the growth of the synthetic biology market, as they directly influence regulatory decisions, investment confidence, and consumer adoption. A primary issue stems from biosafety risks, where the possibility of engineered organisms escaping into the environment raises fears of unintended ecological consequences. Similarly, biosecurity concerns, particularly the fear that synthetic biology tools could be misused to create harmful pathogens, have prompted governments to impose tighter oversight on DNA synthesis providers, increasing compliance burdens for legitimate companies.

Ethical debates also play a significant role, with critics questioning the morality of “creating synthetic life” and raising concerns about potential misuse of technologies like gene editing and minimal genomes. Public perception compounds these issues, such as consumer skepticism toward “lab-grown” or “synthetic” food products has slowed the rollout of innovations such as cultivated meat and animal-free dairy proteins, despite their environmental benefits.

Get a Free Sample PDF Of This Report

Segmentation Analysis

The global synthetic biology market is segmented based on product type, technology, application, end-user, and region.

Product Type: The oligonucleotides and synthetic DNA segment is dominating the synthetic biology market with a 34.12% share in 2024

Oligonucleotides and synthetic DNA remain dominant in the synthetic biology market, primarily as indispensable tools across research, diagnostics, and therapeutics. The reagents and consumables used in oligo workflows also dominate, bolstered by recurring purchase cycles and high demand in R&D and biotech applications. Recent breakthroughs in synthetic DNA products underscore this dominance.

For instance, in May 2025, Ribbon Bio GmbH, the DNA synthesis company, launched MiroSynth DNA, its first commercial product designed to meet the growing demand for complex and highly accurate synthetic DNA molecules. MiroSynth DNA is built on Ribbon’s proprietary algorithm-driven technology and precision enzymatic assembly process, delivering exceptional accuracy and performance for applications initially in biopharma, life sciences, and academic research.

Technological improvements continue the segment’s growth, for instance, Twist Bioscience introduced its “Express Genes” rapid gene synthesis service in late 2023, offering full-length gene constructs in just 5–7 business days, marrying the efficiency of gene synthesis with the precision required in synthetic biology applications. These developments illustrate that oligonucleotides and synthetic DNA are not just foundational, they're the fastest-evolving and highest-volume segments in synthetic biology, supported by continuous innovations in synthesis speed, fidelity, scale, and regulatory-grade production.

Application - The medical applications segment is dominating the synthetic biology market with a 54.21% share in 2024

The medical applications segment is dominating the synthetic biology market as it has become the largest and fastest-growing area of adoption, driven by its central role in drug discovery, precision medicine, vaccines, and advanced therapies. The segment is reflecting strong demand for genome editing, synthetic gene synthesis, and engineered biologics. This dominance is exemplified by breakthroughs such as CRISPR Therapeutics’ exa-cel, approved for sickle cell disease and beta-thalassemia, and Moderna’s mRNA vaccine platform, which relies heavily on synthetic biology to rapidly design and scale vaccines.

Synthetic biology is also enabling entirely new therapeutic categories and novel product launches. For instance, in May 2025, RootPath launched Megabase Spark, a quarterly initiative aimed at providing impactful but underfunded research projects with free synthetic DNA. Each quarter, RootPath will award up to 500,000 base pairs of its rBlocks synthetic DNA to selected researchers. RootPath is committed to giving away a total of 3 million base pairs by the end of 2026, helping to accelerate breakthrough discoveries in biotechnology, medicine, and life sciences. Collectively, these innovations show how medical applications are not only leveraging synthetic biology to address urgent global health challenges but also shaping the commercial landscape, cementing healthcare as the dominant and most influential segment within the synthetic biology market.

Geographical Analysis

North America is expected to dominate the global synthetic biology market with a 42.52% in 2024

The United States is the clear leader in the global synthetic biology market, which is fueled by strong government funding from agencies like the NIH, NSF, DOE, and DARPA, which have spearheaded initiatives such as the Living Foundries program to accelerate bioengineering innovation. Academic hubs like the Innovative Genomics Institute are advancing CRISPR-based therapies, including groundbreaking personalized genetic treatments.

Alongside these giants, biotech innovators like Illumina, Inc., Merck KGaA, Thermo Fisher Scientific Inc., Twist Bioscience, and Bota Biosciences continue to push the frontier in the development of advanced synthetic biology products. With robust infrastructure, deep venture capital funding, and cutting-edge research clusters from Boston to San Francisco, the U.S. serves as the global epicenter of synthetic biology innovation and commercialization, outpacing other regions in both scale and speed of adoption.

Competitive Landscape

Top companies in the synthetic biology market include Illumina, Inc., Merck KGaA, Thermo Fisher Scientific Inc., Bota Biosciences, Codexis, Inc., Twist Bioscience, Creative Biogene, and Eurofins Genomics, among others.

Bota Biosciences: Bota Biosciences is a major market leader in synthetic biology. Camino is a recently launched service powered by Bota Bio’s cutting-edge synthetic biology technology platform. Bota Biosciences has deep scientific expertise and excels in discovering and optimizing enzymes, proteins, and peptides, with a particular emphasis on driving advancements in food and nutrition, alongside industrial and pharmaceutical applications. Bota Biosciences provides milligram quantities of enzymes, proteins, and peptides for early testing and can scale up to full manufacturing within collaborative projects. Recent launches showcase Bota’s ability to bring lab innovations directly to market.

Synthetic Biology Market Scope

Metrics | Details | |

CAGR | 20.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Oligonucleotides and Synthetic DNA, Enzymes, Cloning Technologies Kits, Synthetic Cells, Xeno-Nucleic Acids, Chassis Organism and Others |

Technology | Genome Engineering, Sequencing, Bioinformatics, Cloning, Nanotechnology and Others | |

Application | Medical Applications, Industrial Applications, Food and Animal Health Applications, Agricultural Applications, Environmental Applications and Others | |

End-User | Pharmaceutical & Biotechnology Companies, Industrial & Chemical Companies, Food & Beverage Companies, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global synthetic biology market report delivers a detailed analysis with 64 key tables, more than 72 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here