Global Cathode Materials Market Overview

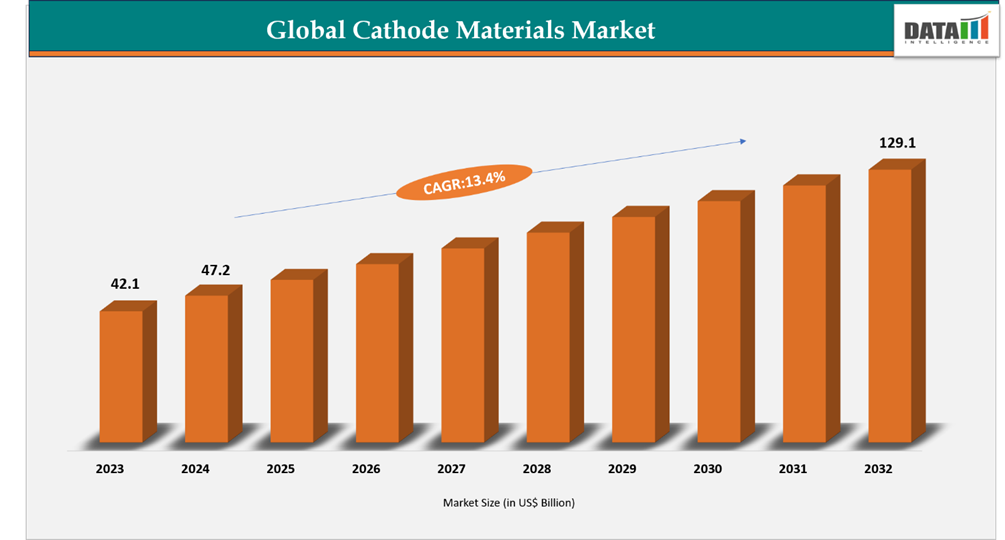

Global cathode materials market reached US$ 47.2 billion in 2024 and is expected to reach US$ 129.1 billion by 2032, growing with a CAGR of 13.4% during the forecast period 2025-2032. The global cathode materials market is witnessing robust growth, driven by rising demand from electric vehicles, energy storage systems, and consumer electronics sectors. Rapid expansion of EV production and battery manufacturing capacities in the Asia-Pacific region are major contributors to market growth. Governments worldwide are promoting local production of battery materials to secure supply chains and reduce dependency on imports, with China’s New Energy Vehicle (NEV) policy and Japan’s battery material incentives being key examples. These policy-driven initiatives are expected to directly enhance cathode materials manufacturing, adoption, and technological development across key markets.

High Cathode Materials Industry Trends and Strategic Insights

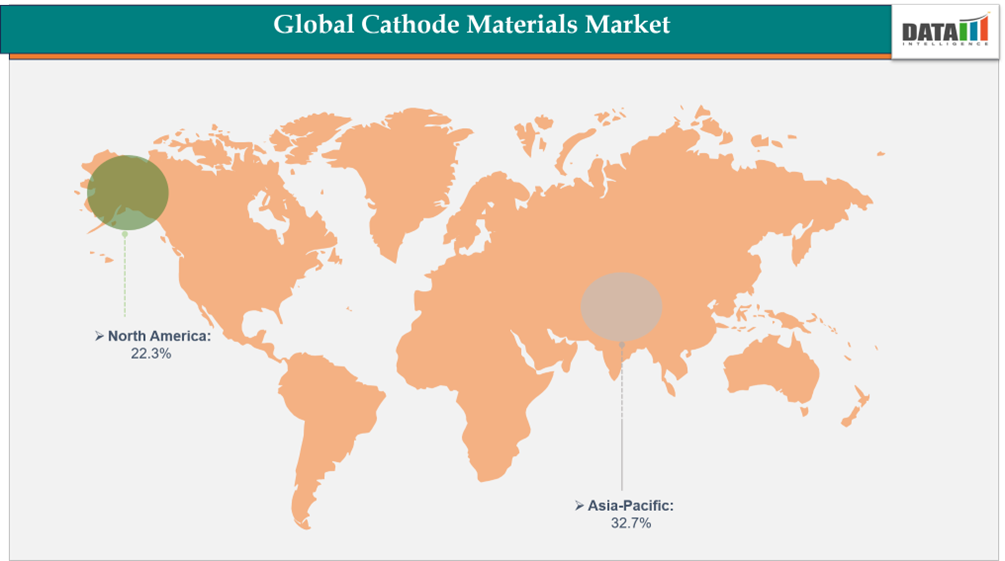

- Asia-Pacific dominates the cathode materials market, capturing the largest revenue share of 32.7% in 2024.

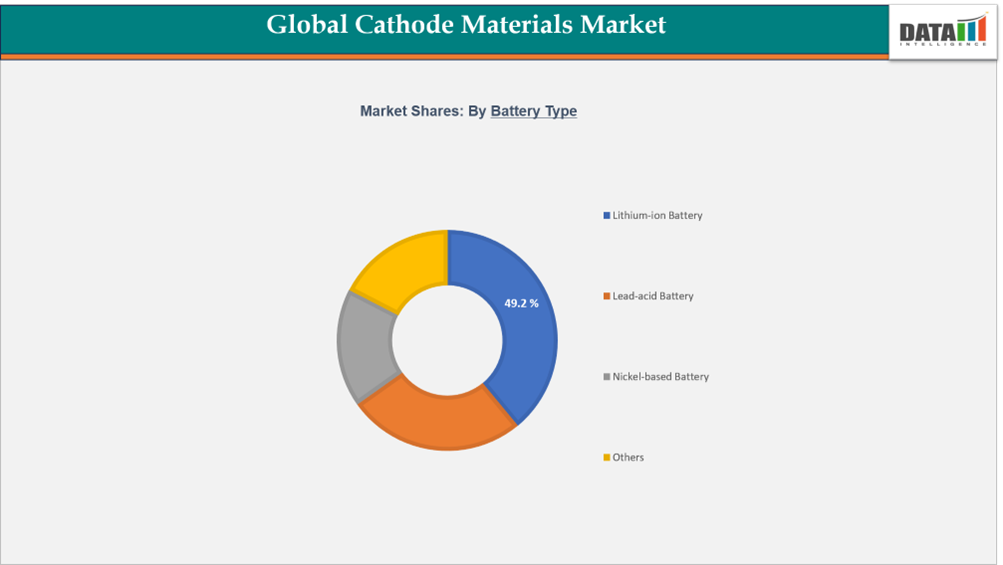

- By battery type, the lithium-ion battery segment is projected to be the largest market, holding a significant share of 49.2% in 2024.

Global Cathode Materials Market Size and Future Outlook

- 2024 Market Size: US$ 47.2 Billion

- 2032 Projected Market Size: US$ 129.1 Billion

- CAGR (2025-2032): 13.4%

- Largest Market: Asia-Pacific

- Fastest Market: North America

Market Scope

| Metrics | Details |

| By Battery Type | Lithium-ion Battery, Lead-acid Battery, Nickel-based Battery, Others |

| By Material Type | Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Others |

| By End-User | Automotive, Consumer Electronics, Industrial, Energy & Utilities, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Growing Demand for Electric Vehicles (EVs)

The global shift toward electric vehicles (EVs) is a major driver of growth in the cathode materials market. As governments enforce stricter emission regulations and encourage clean mobility, automakers are transitioning from conventional internal combustion engine vehicles to battery electric vehicles (BEVs). Cathode materials are a crucial component of lithium-ion and next-generation batteries, directly impacting energy density, battery life, safety, and overall performance factors that influence EV range, charging efficiency, and reliability.

The surge in EV adoption is driving demand for high-performance cathode materials capable of supporting advanced batteries. Materials such as Lithium Nickel Manganese Cobalt Oxide (NMC) and Lithium Nickel Cobalt Aluminum Oxide (NCA) are preferred in BEVs for their superior energy density and long-term performance. The development of solid-state batteries, which offer higher energy density and improved safety, is further increasing the need for innovative cathode solutions.

For instance, In October 2025, Sumitomo Metal Mining Co., Ltd. (TSE: 5713) and Toyota Motor Corporation (TSE: 7203) have entered into a joint development agreement to mass-produce cathode materials for all-solid-state batteries for BEVs. This collaboration focuses on developing next-generation cathode materials with enhanced energy density, improved safety, and longer lifespan, demonstrating how partnerships between battery material producers and automakers are essential to meet growing EV demand.

Rising EV production is also encouraging investments in cathode material manufacturing capacity. Automakers are partnering with suppliers to secure a reliable and scalable supply of high-quality cathodes, ensuring continuous production of advanced batteries.

Raw Material Price Volatility and Supply Chain Challenges

The cathode materials market is constrained by the high volatility in the prices of key raw materials such as lithium, cobalt, nickel, and manganese. These fluctuations—driven by factors like geopolitical instability, mining limitations, and export controls—significantly increase production costs and put pressure on manufacturers’ profit margins. In addition, the limited availability of high-purity raw materials and the complexity of global supply chains often lead to production delays, bottlenecks, and inconsistent product quality, directly affecting battery and electric vehicle manufacturing.

To counter these challenges, companies are focusing on backward integration, material recycling, and regional sourcing to ensure supply stability and cost efficiency. Governments worldwide are also promoting domestic mining, refining, and material processing initiatives to strengthen local supply chains. These strategic measures are helping to reduce dependency on imports, stabilize material availability, and support the long-term sustainability of the cathode materials market.

Segmentation Analysis

The global cathode materials market is segmented based on battery type, material type, end-user and region.

Rising Electric Vehicle Adoption and Energy Storage Expansion Drive the Lithium-Ion Battery Segment

Lithium-ion batteries dominate the energy storage market, powering applications from electric vehicles (EVs) and grid storage to consumer electronics. Within the cathode materials market, different lithium-ion chemistries such as Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Lithium Iron Phosphate (LFP) play a critical role in determining battery performance, safety, lifespan, and cost. The choice of cathode material directly affects energy density, thermal stability, and suitability for specific applications, making it a key consideration for battery manufacturers.

Lithium Iron Phosphate (LFP), in particular, is gaining prominence due to its safety, long cycle life, cost-effectiveness, and thermal stability. LFP batteries are widely used in electric buses, mid-range EVs, and stationary energy storage systems. Meanwhile, high-energy-density cathodes such as NMC and NCA are favored for premium EVs or applications that require longer driving ranges.

For instance, In October 2025, Nano One® Materials Corp., a process technology company specializing in lithium-ion battery cathode active materials, is advancing its collaboration with Rio Tinto to pre-qualify high-volume, battery-grade raw material inputs for Nano One’s One-Pot™ LFP cathode active material (CAM) production process. This initiative aims to ensure a consistent, scalable supply of high-quality materials for large-scale LFP production. The collaboration underscores how partnerships and innovative manufacturing processes are critical to meeting the growing demand for lithium-ion batteries, particularly in the EV and energy storage sectors.

Steady Demand from Backup Power and Industrial Applications Strengthens

The lead-acid battery segment continues to maintain a significant presence in the global cathode materials market, accounting for a notable share in 2024. Despite the rising adoption of lithium-ion batteries, lead-acid batteries remain a preferred choice in automotive starter systems, backup power supplies, uninterruptible power systems (UPS), and industrial equipment due to their proven reliability, cost-effectiveness, and recyclability. The segment benefits from established manufacturing infrastructure, easy availability of raw materials, and a strong recycling ecosystem, which ensures consistent material supply and supports circular economy initiatives.

Growing demand for backup energy solutions in data centers, telecommunications, and renewable power installations is contributing to the steady expansion of lead-acid battery usage. Moreover, hybrid vehicles, forklifts, and off-grid energy storage systems continue to rely on advanced lead-acid technologies like absorbent glass mat (AGM) and gel batteries for their durability and maintenance-free operation. Although the shift toward lithium-based batteries is evident in high-performance applications, the lead-acid battery segment remains resilient—driven by cost efficiency, widespread applicability, and ongoing technological upgrades aimed at improving energy density and lifecycle performance.

Geographical Penetration

Rising Demand from EV, Battery, and Automotive Sectors in Asia-Pacific

The Asia-Pacific region dominates the global cathode materials market, accounting for approximately 32.7% of global share in 2024. China leads regional production, supported by its vast electric vehicle (EV), automotive, and battery manufacturing industries. Rapid industrial expansion, coupled with increasing investments in energy storage systems (ESS) and renewable energy integration, continues to drive market growth. Strong government incentives, advanced manufacturing capabilities, and a well-established supply chain for key raw materials such as lithium, nickel, and cobalt position the region as the central hub for large-scale cathode material production and technological advancement.

India Cathode Materials Market Outlook

India’s cathode materials market is growing rapidly, supported by the country’s expanding automotive, battery manufacturing, and renewable energy sectors. Increasing investments in battery cell production, EV assembly, and energy storage technologies are driving demand for high-performance cathode chemistries. The rising adoption of industrial automation, coupled with growth in infrastructure and manufacturing, is further boosting the market. Global and domestic manufacturers are establishing production facilities and R&D centers across India to cater to the rising demand for lithium-ion batteries and to strengthen regional supply chains.

China Cathode Materials Market Trends

China remains the largest producer of cathode materials in the Asia-Pacific region, accounting for over 40% of regional output. Its dominance stems from a well-developed battery manufacturing ecosystem, robust raw material processing capacity, and the presence of major industry players such as CATL, BYD, Easpring, and BASF Shanshan. Chinese manufacturers are expanding production of NMC, LFP, and high-nickel cathode materials to meet surging demand from EVs and energy storage systems. Meanwhile, South Korean and Japanese companies, including LG Chem, Samsung SDI, and Sumitomo Metal Mining, continue to lead in high-performance, next-generation cathode technologies. Global firms such as BASF and Umicore are also strengthening their regional presence through strategic joint ventures and local production partnerships in China and India.

Presence of Advanced Industrial Infrastructure in North America

North America is projected to hold a significant position in the global cathode materials market, accounting for around 22.3% of total market share in 2024. The region’s growth is supported by strong demand from electric vehicle (EV), aerospace, energy storage, and electronics industries. North America benefits from its advanced industrial base, well-developed infrastructure, and robust research and innovation ecosystem, which collectively drive the development and adoption of high-performance cathode technologies.

The presence of established automotive OEMs, battery manufacturers, and clean energy initiatives has encouraged heavy investment in local supply chain development and pilot-scale production facilities. These initiatives are helping to establish a more resilient and sustainable domestic ecosystem for battery materials manufacturing, reducing dependence on external suppliers and enhancing regional competitiveness in next-generation energy solutions.

US Cathode Materials Market Insights

The US represents the largest share of the North American cathode materials market, supported by rapid advancements in EV manufacturing, battery production, and energy storage projects. The growing transition toward electrification across transportation and industry is fueling demand for cathode chemistries such as NMC (Nickel Manganese Cobalt), LFP (Lithium Iron Phosphate), and NCA (Nickel Cobalt Aluminum).

A notable development strengthening the in 2022, US market is NOVONIX Limited’s establishment of a new 35,000-square-foot pilot production facility, positioning the company as a leader in cathode technology. This facility utilizes NOVONIX’s all-dry cathode synthesis process to pilot its patent-pending production technology, targeting the rapidly expanding EV and energy storage sectors. With an initial capacity of up to 10 tonnes per annum, the facility demonstrates the company’s commitment to scaling up sustainable and cost-efficient cathode material production domestically.

Further momentum is being provided by government incentives under the Inflation Reduction Act (IRA) and increased collaboration among automakers, technology developers, and material suppliers, which are accelerating the creation of a fully integrated U.S. battery materials ecosystem.

Canada Cathode Materials Industry Growth

In Canada, the cathode materials market continues to expand, supported by the country’s rich reserves of lithium, nickel, and cobalt and a strong focus on clean energy development. The mining and materials processing sectors form a vital part of Canada’s strategy to build a sustainable and localized battery supply chain.

Ongoing investments in EV production, battery R&D, and energy infrastructure have positioned provinces such as Quebec and Ontario as emerging hubs for cathode material research, processing, and manufacturing. The country’s collaboration with global battery producers and technology firms is further enhancing its role in the regional value chain. With continued advancements in battery-grade material production and energy transition initiatives, Canada is expected to experience steady growth in cathode materials demand over the coming years.

Sustainability Analysis

The cathode materials market is increasingly prioritizing sustainability and innovation, with manufacturers adopting low-carbon production, recycling, and next-generation battery chemistries to balance performance with environmental responsibility.

In June 2024, BASF Battery Materials, through its joint venture BASF Shanshan Battery Materials Co., Ltd. (BSBM), achieved a key milestone by delivering the first mass-produced Cathode Active Materials (CAM) for semi-solid-state batteries in collaboration with Beijing WELION New Energy Technology Co., Ltd. This breakthrough marks a crucial step toward the industrialization of solid-state batteries, reinforcing BASF’s commitment to sustainable innovation and circular energy solutions.

Competitive Landscape

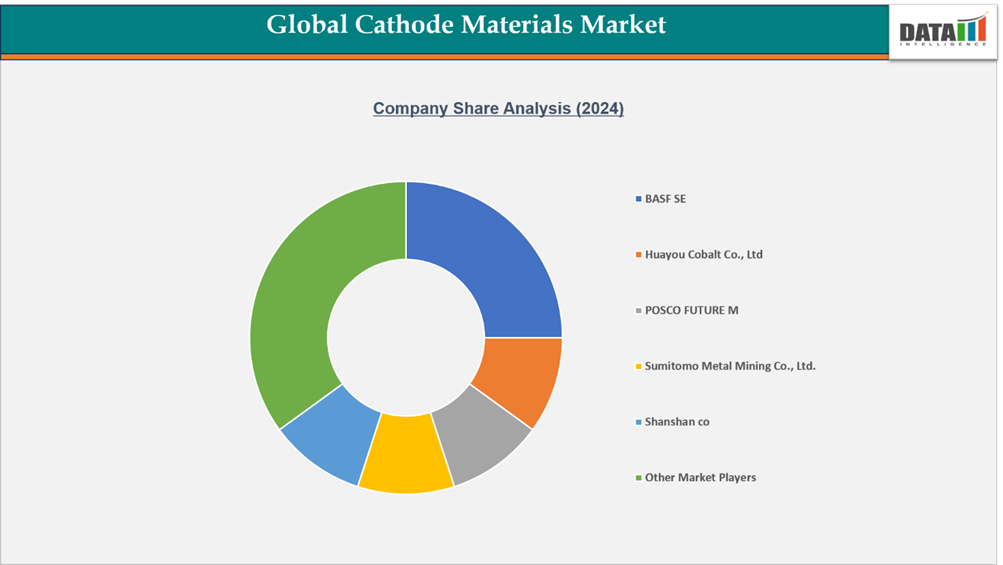

- The global cathode materials market features an increasingly competitive landscape comprising established chemical manufacturers, battery material specialists, and emerging technology innovators.

- Key players include BASF SE, Umicore, LG Chem Ltd., Sumitomo Metal Mining Co., Ltd., POSCO Future M, CATL, Easpring Material Technology Co., Ltd., Nippon Chemical Industrial Co., Ltd., Mitsubishi Chemical Group, and NEI Corporation.

- These companies differentiate their offerings through high-performance cathode chemistries such as NMC, LFP, and NCA, focusing on greater energy density, thermal stability, and cycle life for electric vehicle and energy storage applications.

- Strategic investments in R&D, sustainable material sourcing, and advanced manufacturing processes remain crucial, as the market faces growing competition from emerging solid-state battery technologies and the push toward eco-friendly, recyclable materials.

Key Developments

- In August 2025, South Korean chemical company Posco Future M has signed a memorandum of understanding (MoU) with Chinese battery materials manufacturer CNGR and its South Korean subsidiary FINO to collaborate on the development of cathode materials for lithium iron phosphate (LFP) batteries, with an initial focus on the energy storage systems (ESS) market.

- In July 2025, South Korean battery manufacturer SK On has signed a memorandum of understanding (MoU) with materials producer L&F to collaborate on the supply of lithium iron phosphate (LFP) cathode materials for the North American market. Through this partnership, SK On aims to build a reliable supply chain for energy storage systems (ESS) and enhance its market presence in the United States.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies