Lithium Ion Battery Market Size

Global Lithium-ion Battery Market reached US$ 43.5 billion in 2023 and is expected to reach US$ 124.4 billion by 2031 growing with a CAGR of 13.5% during the forecast period 2024-2031.

The lithium-ion battery market is showing significant growth with new advancements and trends, also chain encompassing activities from mining to recycling is projected to experience robust growth. The growth of the lithium-ion battery market can be attributed to the increased use of these batteries in electric vehicles.

For instance, according to the report given by the International Energy Association, the demand for automotive lithium-ion batteries surged by approximately 65% to reach 550 GWh compared to 330 GWh in the previous year 2021. The growth can be attributed primarily to the rising sales of electric passenger cars, with new registrations experiencing a notable 55% increase in 2022 compared to 2021.

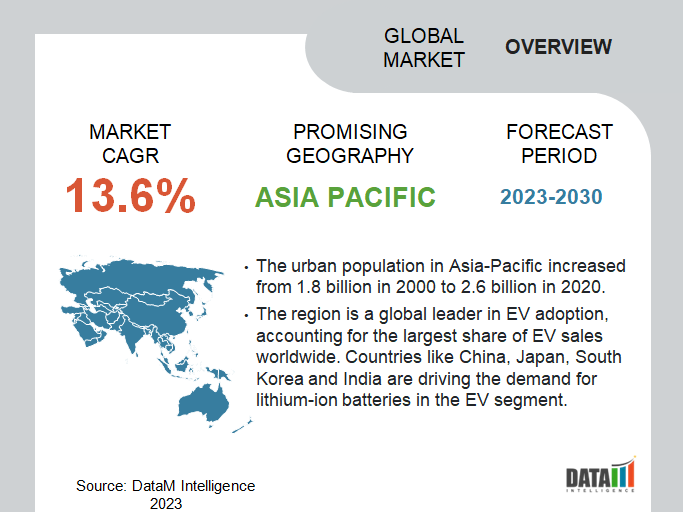

In 2022, Asia-Pacific is expected to be the fastest-growing region holding more than 1/3rd of the global lithium-ion battery market. Countries such as China, Japan, India are taking significant strides to dominate the race for developing alternatives to lithium-ion batteries. Chinese government has been actively promoting the development and adoption of electric vehicles, which has further fueled the growth of the battery industry in the country.

Market Summary

| Metrics | Details |

| CAGR | 13.5% |

| Size Available for Years | 2023-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Material, Capacity, Voltage, End-User and Region |

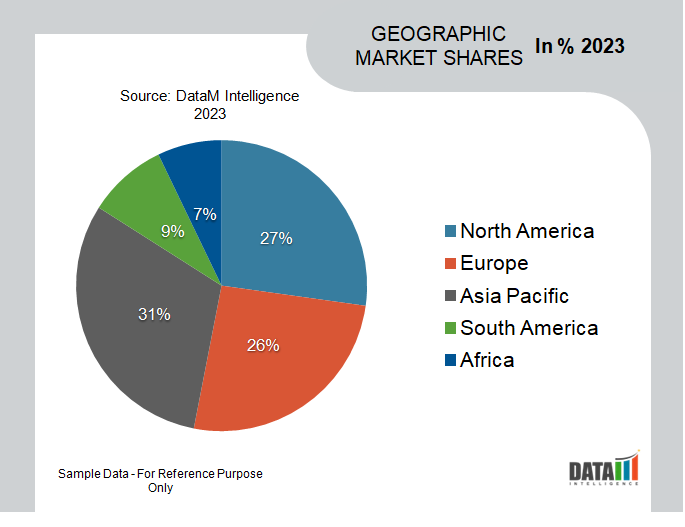

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Market Dynamics

Growing Demand for Li-ion Batteries in Electric Vehicle

The growing demand for electric vehicles has been accompanied by a significant rise in the adoption of Lithium-ion batteries. As per the International Energy Agency, the anticipated globally demand for Li-ion batteries for electric vehicles is projected to reach approximately 2-4 TWh per year by 2031, corresponding to a demand of around 1-2 million tons of lithium and 300-500 kilotons of cobalt.

Moreover, according to IEA, in China, the demand for batteries in vehicles grew by around 65%, while electric car sales increased by around 78% compared to 2021. Also, in U.S. The battery demand in vehicles grew by around 80% outpacing the growth in electric car sales which was around 55% in 2022, which is a major factor for increased consumption of lithium-ion batteries all around the globe.

Government Incentives and Regulations

Government regulations and acts are playing a pivotal role in boosting the electric vehicle and battery manufacturing industries. One such significant regulation is the Inflation Reduction Act passed in late 2022, which promises substantial funding for climate and cleans energy initiatives, with a particular focus on EV and battery manufacturing. The legislation is expected to have a profound impact on the industry by increasing production capacity and encouraging automakers to procure battery materials and produce batteries within U.S. and its free-trade partners.

Furthermore, the IRA has announced to invest approximately US$ 80 billion in new investments into the battery supply chain with a total of at least around US$ 370 billion allocated to the country's clean energy economy. It represents the largest effort to date to strengthen the battery supply chain in U.S.

Risks in the Transport of Lithium-Ion Batteries

The Lithium-ion batteries export and import growth is hindered due to its transportation related problems. The transport of lithium-ion batteries presents potential risks including battery failure and thermal runaway. When a lithium-ion battery fails it can rapidly generate intense heat, produce toxic and flammable gases and create explosive situations.

Also, the speed and severity of these failures are often underestimated, leading to a lack of awareness and preparedness within the maritime community and logistics supply chain. With billions of lithium-ion batteries in circulation globally, the impact of such fires can be significant, particularly in transportation and ports, which furthermore impacting the lithium-ion batteries market growth

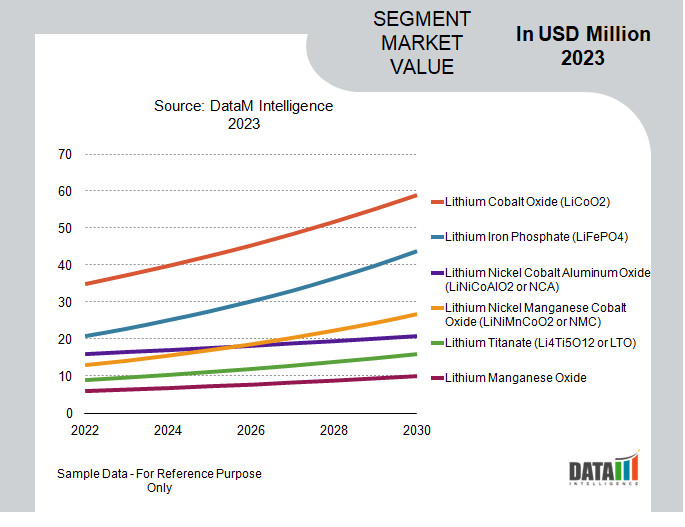

Market Segmentation Analysis

The global lithium-ion battery market is segmented based on type, material, capacity, voltage, end-user and region.

Rising EVs Adoption Drives Automotive Segment

Automotive is expected to be the dominant segment with more than 30% of the market during the forecast period 2024-2031. The electric vehicle manufacturers have become the biggest consumers of lithium-ion batteries, owing to the growing sales of EVs. EVs do not emit CO2, NOX and have a lower environmental impact compared to conventional internal combustion engine vehicles.

Owing to this, many countries are encouraging the use of EVs by introducing subsidies and government programs. Major countries have announced plans to ban the sales of ICE vehicles in the future. Norway announced plans to ban the sales of ICE vehicles by 2025, France by 2040 and UK by 2050. India also planned to phase out ICE engines by 2031, while China's similar plan is currently under the relevant research phase.

Market Geographical Share

Asia-Pacific Increasing Adoption of Electric Vehicles (EVs)

Asia-Pacific is the dominant region in the global lithium-ion battery market covering over 1/3rd of the market. As per IEA, in 2022, there was a significant increase of over 70% in the demand for batteries used in vehicles in China. During the same period, electric car sales experienced remarkable growth, rising by 80% compared to the previous year. Also, As per Invest India, the Indian government has established an ambitious goal of electrifying 30% of the nation's vehicle fleet by 2031.

To facilitate the growth of the electric vehicle industry, the government has implemented various incentives and policies. India has also made advancements in lithium resources, with the announcement of establishing lithium inferred resources of around 6 million Tons in the Reasi district of Jammu and Kashmir in 2023. In line with this growth there is a need for indigenous lithium-ion battery manufacturing in India

Market Companies

The major global players in the market include LG Chem Ltd, Panasonic Corporation, Samsung SDI Co Ltd, BYD Co Ltd, BAK Group, A123 Systems, GS Yuasa Corporation, Hitachi Ltd, Johnsons Controls Inc. and Saft Groupe S.A.

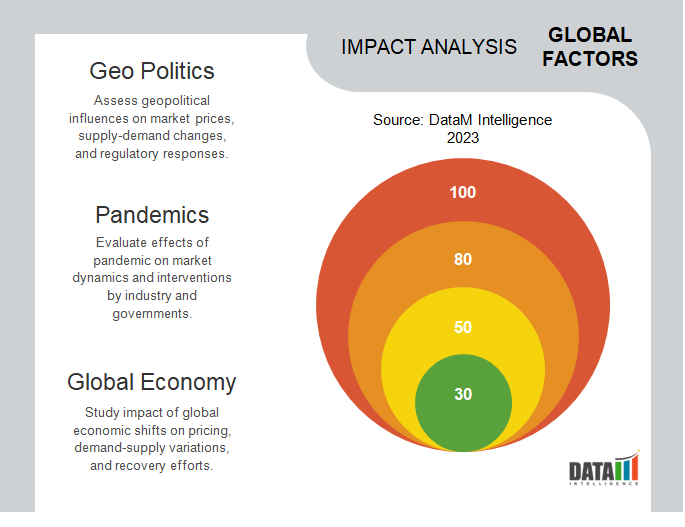

COVID-19 Impact On Market

The COVID-19 pandemic had affected the energy storage sector. Although there was a temporary slowdown in energy storage investments, it is expected to regain momentum in the future. The energy storage sector is projected to grow by around 30% in 2031, reaching 740 GWh. LIBs are expected to play a significant role in energy storage, particularly in the context of electric vehicles and related technologies.

COVID-19 pandemic has brought about changes in energy demand, transportation habits and energy storage. The adoption of electric micro-mobility devices, powered by lithium-ion batteries has increased due to their safety and affordability. The shift towards renewable energy sources and the growing importance of sustainability is driving the demand for energy storage technologies, including lithium-ion batteries in both stationary and non-stationary applications.

Russia-Ukraine War Impact

Preliminary estimates suggest that Ukraine holds a significant lithium reserve of around 500,000 tons, a crucial mineral for renewable energy and electric vehicle batteries. With skyrocketing global demand for lithium, which is estimated to grow by around 450% to 4,000%, there are concerns that supply won't meet the demand.

Russia and Ukraine ongoing war have a major impact on the global lithium-ion battery market. One of the main factors is the dependence on Russia and Ukraine as major suppliers of metals used in battery production like lithium, cobalt, nickel and copper. With geopolitical tensions and potential disruptions in the supply chain there are concerns about the availability and prices of these critical metals.

The war in Ukraine has highlighted the need for global energy security and the urgency of clean energy development. Europe's heavy reliance on Russian energy which includes oil and natural gas has prompted countries like Germany to seek alternative suppliers and invest in renewable energy to reduce dependence.

Key Developments

- In June 2023, Toyota Motor revealed plans to produce a new EV vehicle with a lithium-ion battery capable of providing an outstanding range of 1,000 kilometers.

- In January 2022, Nexeon Limited, a supplier of innovative silicon anode materials for next-generation lithium-ion batteries, has licensed its NSP-1 technology to SKC Co. Ltd., a leading advanced materials company. The transfer assures that clients globally have quick and dependable access to these key resources.

- In February 2022, Panasonic Corporation has announced that its Energy Company will create a manufacturing plant at its Wakayama Factory in western Japan to manufacture new, huge 4680 (46 millimeters wide and 80 millimeters tall) cylindrical lithium-ion batteries for electric vehicles.

Why Purchase the Report?

- To visualize the global lithium-ion battery market segmentation based on type, material, capacity, voltage, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of lithium-ion battery market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global lithium-ion battery market report would provide approximately 78 tables, 83 figures and 207 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies