Cardiovascular, Renal & Metabolic Diseases Market Size & Industry Outlook

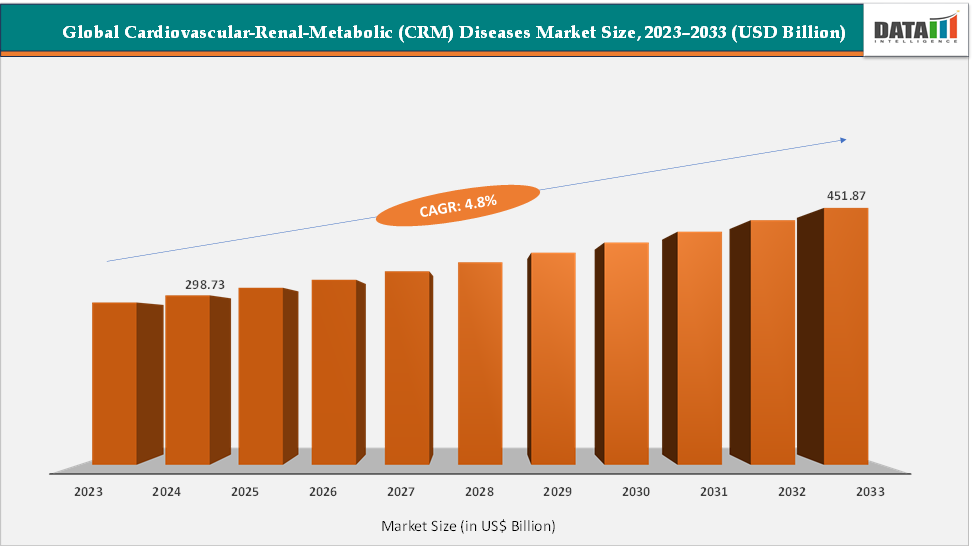

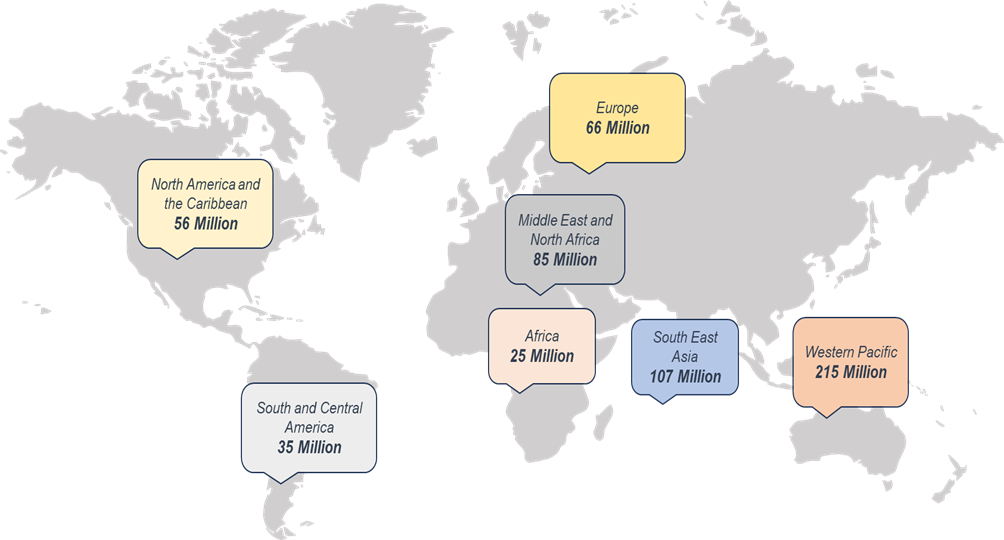

The global CRM diseases market size reached US$ 298.73 Billion in 2024 from US$ 286.12 Billion in 2023 and is expected to reach US$ 451.87 Billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033. The market is undergoing a major transformation driven by therapies that address overlapping pathways across heart, kidney, and metabolic disorders. Rising global prevalence over 589 million people with diabetes, over 64 million with heart failure, and over 850 million people with chronic kidney disease has created a vast, multimorbid patient base requiring integrated care.

Innovative therapeutics such as SGLT2 inhibitors (Farxiga, Jardiance, Invokana) and GLP-1 receptor agonists (Ozempic, Wegovy, Mounjaro) now provide proven cardio-renal benefits beyond glucose control, reshaping treatment guidelines and payer priorities. Recent launches like tirzepatide (Mounjaro/Zepbound) and the expanded cardiovascular label for semaglutide (Wegovy) highlight the rapid expansion of metabolic drugs into cardiovascular prevention. Meanwhile, non-steroidal MRAs (Kerendia), PCSK9 inhibitors (Repatha, Praluent), and digital and device innovations in dialysis, cardiac monitoring, and metabolic tracking complement pharmaceutical advances. Together, these developments position the CRM market as one of the fastest-growing therapeutic frontiers, uniting cardiology, nephrology, and metabolic care under a precision-medicine framework.

Key Market Highlights

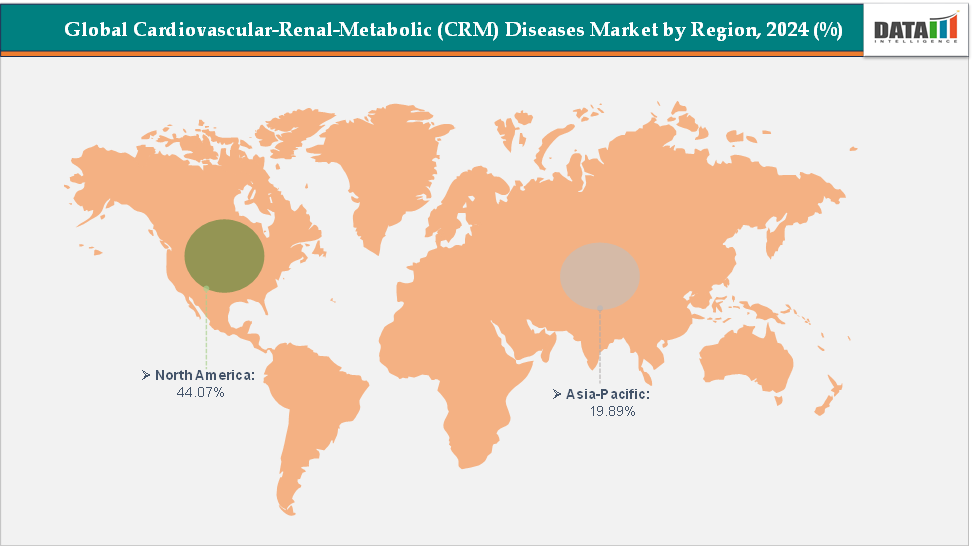

- North America dominates the cardiovascular, renal & metabolic (CRM) diseases market with the largest revenue share of 44.07% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.7% over the forecast period.

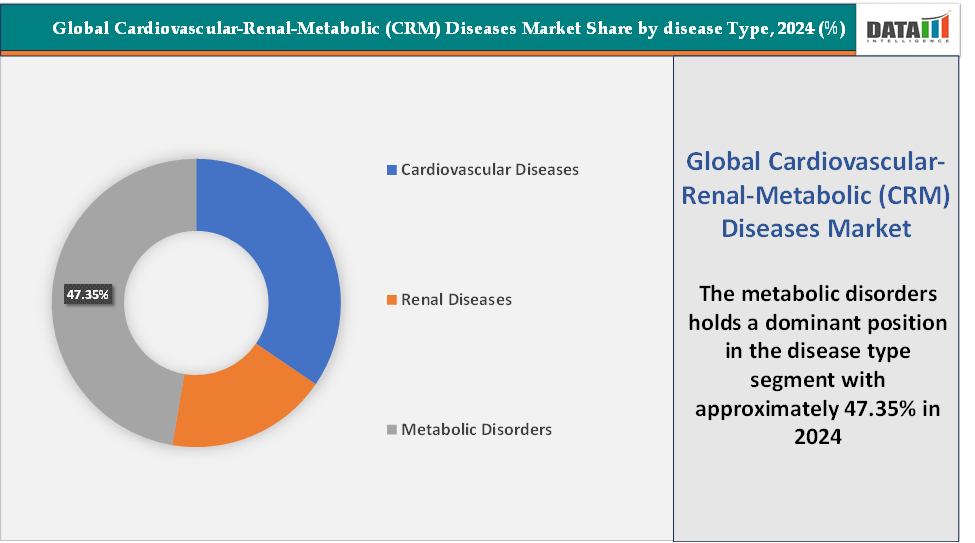

- Based on disease type, the metabolic disorders segment led the market with the largest revenue share of 47.35% in 2024.

- The major market players in the cardiovascular, renal & metabolic (CRM) diseases market are Novo Nordisk, Eli Lilly and Company, AstraZeneca, Boehringer Ingelheim International GmbH, Johnson & Johnson, Bayer AG, Merck & Co., Inc., Novartis AG, Sanofi, and Amgen Inc., among others

Market Dynamics

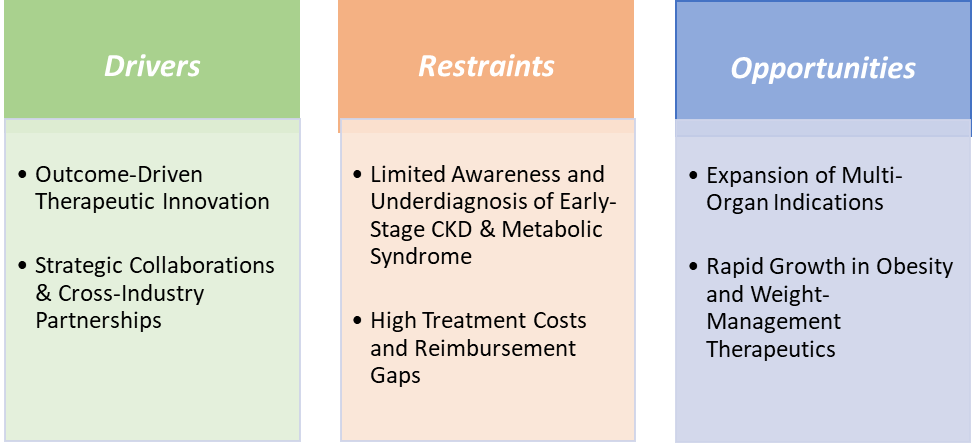

Drivers: Outcome-driven therapeutic innovation is significantly driving the cardiovascular, renal & metabolic (CRM) diseases market growth

Outcome-driven therapeutic innovation has become the principal growth engine for the cardiovascular, renal & metabolic (CRM) market because regulators, payers and clinicians now prioritize drugs that demonstrate hard clinical benefits (reduction in MACE, HF hospitalization, or CKD progression) rather than just surrogate endpoints like glucose or LDL lowering. This paradigm shift accelerated adoption and premium pricing for classes that prove cross-organ benefit notably SGLT2 inhibitors, which moved from glucose-lowering to proven heart-failure and kidney-protection indications, expanding the addressable population dramatically.

Recent high-impact launches and label expansions illustrate the effect. For instance, in August 2025, the U.S. Food and Drug Administration approved Wegovy (semaglutide) injection to treat metabolic-associated steatohepatitis (MASH) in adults with moderate-to-advanced fibrosis (excessive scar tissue in the liver). Wegovy, which was first approved in 2017, is also approved for obesity or overweight and to reduce cardiovascular events, such as heart attacks, in individuals at high risk of these events. Approximately 6% of U.S. adults (14.9 million people) have MASH, and its prevalence is expanding.

These outcome-driven approvals spur guideline updates, create clear value propositions for value-based contracting, and motivate earlier intervention strategies (treating prediabetes, early CKD or obesity to prevent HF/ESRD), which together expand market volume and willingness-to-pay. The CRM market’s growth today is less about incremental symptomatic benefit and more about therapies that demonstrably change long-term cardiovascular and renal outcomes, and recent launches/label expansions have turned that scientific proof into commercial acceleration across cardiology, nephrology and metabolic care.

Restraints: Limited awareness and underdiagnosis of early-stage CKD & metabolic syndrome is hampering the growth of the market

Limited awareness and underdiagnosis of early-stage chronic kidney disease (CKD) and metabolic syndrome remain major restraints to the growth of the cardiovascular, renal & metabolic (CRM) market, as they delay therapeutic intervention and reduce eligible patient identification. Globally, CKD affects an estimated 850 million people, yet up to 90% of those with early-stage CKD are undiagnosed, according to the International Society of Nephrology. Similarly, metabolic syndrome affecting roughly 25% of adults worldwide often goes unrecognized in primary care because early symptoms such as mild hypertension, insulin resistance, or dyslipidemia are overlooked.

This lack of early detection means patients typically enter treatment only after significant renal or cardiovascular damage, when options are limited and costly interventions like dialysis or heart-failure management dominate. Even though drugs like dapagliflozin (Farxiga), empagliflozin (Jardiance), and finerenone (Kerendia) can slow CKD progression and reduce cardio-renal risk if started early, their uptake is restricted by low screening rates for eGFR and albuminuria in diabetic and hypertensive patients. In many emerging markets, absence of standardized metabolic screening and limited specialist access further exacerbate the gap. This underdiagnosis constrains the addressable population for CRM therapies, weakens the business case for early prevention programs, and slows overall market expansion despite strong clinical evidence and product availability.

CRM Diseases Market, Segmentation Analysis

The global cardiovascular-renal-metabolic (CRM) diseases market is segmented based on disease type, treatment type, end-user, and region.

Disease Type: The metabolic disorders segment is dominating and fastest-growing in the cardiovascular-renal-metabolic (CRM) diseases market with a 47.35% share in 2024

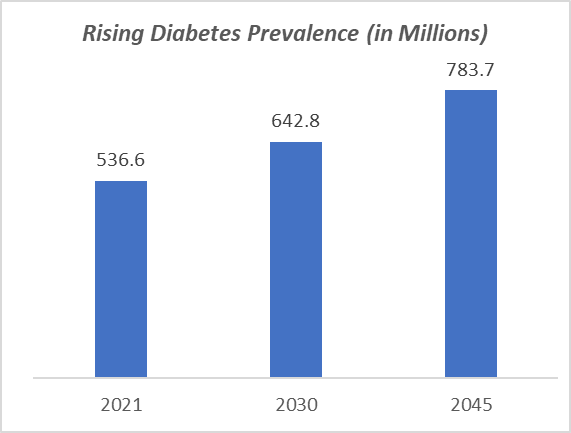

The metabolic disorders especially the diabetes segment is both dominating and fastest-growing in the cardiovascular, renal & metabolic disease market owing to its massive prevalence and the recent surge of therapies addressing it. For instance, the global diabetes burden is rising sharply, according to IDF Diabetes Atlas (2025) 11.1% of adults (1 in 9) worldwide are living with diabetes, and over 40% remain undiagnosed. Projections indicate that by 2050, 1 in 8 adults around 853 million people will have diabetes, representing a 46% increase.

This enormous disease burden has driven explosive demand for next-generation metabolic drugs such as SGLT2 inhibitors (dapagliflozin (Farxiga), empagliflozin (Jardiance)) and GLP-1 receptor agonists (semaglutide – Ozempic/Wegovy, tirzepatide – Mounjaro/Zepbound), which now deliver proven benefits far beyond glucose control, including reductions in heart-failure hospitalization, CKD progression, and cardiovascular mortality. The shift toward outcome-driven innovation has allowed metabolic drugs to dominate CRM therapeutics by addressing multiple organ systems simultaneously. Together, these trends make metabolic disorders not only the largest revenue-contributing segment in the CRM landscape but also its primary growth engine, transforming the paradigm of chronic disease management from organ-specific treatment to holistic metabolic optimization that simultaneously protects the heart, kidneys, and vascular system.

Geographical Analysis

North America is expected to dominate the global cardiovascular, renal & metabolic (CRM) diseases market with a 44.07% in 2024

North America is projected to remain the dominant region in the global Cardiovascular–Renal–Metabolic (CRM) diseases market, driven by a combination of high disease prevalence, strong regulatory support, rapid adoption of outcome-based therapeutics, and robust healthcare infrastructure.

US cardiovascular, renal & metabolic Diseases Market Trends

The United States alone accounts for a largest share of the global CRM disease burden with an estimated 38.4 million adults (14.7% of the population) living with diabetes, 35.5 million with chronic kidney disease (CKD), and over 120 million adults affected by cardiovascular diseases, according to the CDC and American Heart Association. This convergence of comorbidities creates a vast and clinically complex patient base, making the region an epicenter for integrated CRM care. The U.S. FDA has played a catalytic role in advancing innovative therapeutics such as Wegovy (semaglutide), tirzepatide (Zepbound/Mounjaro).

Major companies like Novo Nordisk, Eli Lilly, AstraZeneca, Boehringer Ingelheim, and Bayer continue to channel R&D and commercial investments into the US market due to favorable reimbursement frameworks and a large insured population willing to adopt premium therapies. FDA support, along with increasing payer inclusion of obesity drugs under health plans, further underscore the region’s leadership in CRM innovation. Additionally, the rapid scaling of digital health tools, telemedicine platforms, and remote monitoring technologies supports early diagnosis and long-term disease management enabling higher therapy adherence and better outcomes.

The Asia Pacific region is the fastest-growing region in the global cardiovascular, renal & metabolic diseases market, with a CAGR of 5.7% in 2024

The Asia–Pacific region has emerged as the fastest-growing market in the global Cardiovascular–Renal–Metabolic (CRM) diseases landscape, driven by an enormous and rapidly escalating disease burden, expanding access to innovative therapeutics, and proactive regulatory and commercial developments. The region is home to the majority of the world’s diabetic population with over 250 million people, including 101 million in India and 140 million in China and faces a surge in obesity and metabolic syndrome due to urbanization, sedentary lifestyles, and dietary changes. This has led to a steep rise in comorbid cardiovascular and renal complications, creating an urgent need for integrated CRM therapies.

Meanwhile, rising healthcare expenditure, government initiatives for early CKD and diabetes screening, and rapid adoption of digital health technologies (telemedicine, AI-based risk detection, and remote monitoring) are improving diagnosis and long-term disease management. With obesity and diabetes now recognized as critical public health threats, payers and policymakers are beginning to support reimbursement for metabolic and cardio-renal drugs, further fueling uptake. Combined with a massive patient base and a swiftly expanding middle-class population seeking preventive and premium care, solidifying its position as the fastest-growing regional hub for integrated cardiovascular, renal, and metabolic therapeutics.

Europe cardiovascular, renal & metabolic Diseases Market Trends

Europe is witnessing strong and sustained growth in the Cardiovascular–Renal–Metabolic (CRM) diseases market, driven by a rising multimorbid population, regulatory alignment with outcome-based therapeutics, and a surge in innovative product launches. The region faces a significant chronic disease burden, with over 65 million adults living with diabetes and approximately 10% of adults affected by chronic kidney disease (CKD) alongside an aging population highly prone to cardiovascular complications. These factors have positioned Europe as a key market for integrated CRM therapies. The European Medicines Agency (EMA) has accelerated approvals and label expansions for breakthrough treatments that demonstrate robust cardiovascular and renal outcomes.

Notably, Novo Nordisk’s Wegovy (semaglutide) received EMA approval for reducing major adverse cardiovascular events in overweight and obese adults with established cardiovascular disease, while Eli Lilly’s tirzepatide (Mounjaro) was authorized for both Type 2 Diabetes and chronic weight management, marking a significant advancement in metabolic care. Likewise, SGLT2 inhibitors such as dapagliflozin (Forxiga) and empagliflozin (Jardiance) have gained EU-wide approvals for heart failure (HFrEF and HFpEF) and CKD, expanding their role beyond diabetes into core cardiology and nephrology practice. Supported by strong physician education, digital health integration, and rising payer coverage for metabolic and obesity therapies, Europe is rapidly evolving into a high-value CRM market, translating clinical innovation into broad patient access and steady double-digit growth through the next decade.

Competitive Landscape

Top companies in the cardiovascular, renal & metabolic diseases market include Novo Nordisk, Eli Lilly and Company, AstraZeneca, Boehringer Ingelheim International GmbH, Johnson & Johnson, Bayer AG, Merck & Co., Inc., Novartis AG, Sanofi, and Amgen Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Cardiovascular Diseases, Renal Diseases, and Metabolic Disorders |

| Treatment Type | Therapeutics, Devices, and others | |

| End-User | Hospitals, Specialty Clinics, Homecare Settings, Academic and Research Institutes, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The cardiovascular, renal & metabolic diseases market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here