Cardiovascular Biologics Market Size & Industry Outlook

The market for cardiovascular biologics has grown rapidly due to developments in RNA and biologic technology. Biologics, such as recombinant proteins and monoclonal antibodies, allow for the exact targeting of biological pathways implicated in inflammation, thrombosis, and lipid metabolism. RNA-based treatments, such siRNA and mRNA, provide novel ways to inhibit or change the expression of genes linked to cardiovascular disorders. These technologies offer long-lasting therapeutic benefits, lessen side effects, and increase treatment efficacy. Expanded clinical applications and groundbreaking biologic approvals have resulted from growing research into the PCSK9, IL-6, and TTR pathways.

Key Highlights

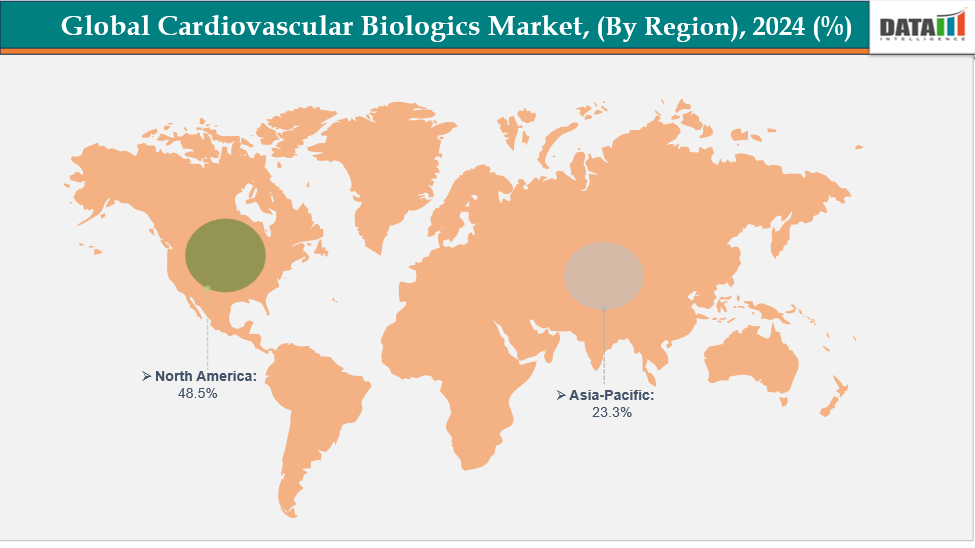

- North America is dominating the global cardiovascular biologics market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global cardiovascular biologics market, with a CAGR of 7.7% in 2024

- The monoclonal antibodies segment is dominating the cardiovascular biologics market with a 45.2% share in 2024

- The coronary artery disease segment is dominating the cardiovascular biologics market with a 35.3% share in 2024

- Top companies in the cardiovascular biologics market include Regeneron Pharmaceuticals, Inc., Amgen Inc., Novartis Pharmaceuticals Corporation, Alnylam Pharmaceuticals, Inc., Genentech USA, Inc., Reliance Life Sciences, Biocon Biologics Limited, and Shanghai Junshi Biosciences Co., among others.

Market Dynamics

Drivers: Strong research and development pipeline and biologics innovation are accelerating the growth of the cardiovascular biologics market

The cardiovascular biologics market expanded more rapidly due to robust R&D pipelines and quick biologics innovation. The approval of new treatments like PCSK9 inhibitors and RNAi therapeutics was facilitated by ongoing developments in gene therapies, RNA-based medications, and monoclonal antibodies. Big investments were made by biotech and pharmaceutical corporations to find new molecular targets for cardiomyopathies, hyperlipidemia, and heart failure.

Owing to the factors like a robust research and development (R&D) pipeline and rapid biologics innovation. For instance, in August 2025, Roche and Alnylam advanced zilebesiran into a global Phase III cardiovascular outcomes trial to assess its potential to reduce major adverse cardiovascular events in patients with uncontrolled hypertension, marking a major milestone in RNAi-based cardiovascular therapy.

Restraints: Limited number of approved cardiovascular biologics are hampering the growth of the cardiovascular biologics market

The market's overall growth has been hindered in recent years by the small number of authorized cardiovascular biologics. Few biologics had obtained commercial approval, which limited the variety of products and available treatments. Due to less competition, this small repertoire kept accessibility low and pricing high. Healthcare professionals had so continued to rely on conventional small-molecule medications.

Additionally, new approvals for gene- and cell-based cardiovascular treatments have been delayed due to regulatory uncertainties. Pharmaceutical businesses' investment and innovation were hindered by the scarcity of late-stage pipeline candidates.

For more details on this report, see Request for Sample

Cardiovascular Biologics Market, Segment Analysis

The global cardiovascular biologics market is segmented based on biologic type, indication, distribution channel and region

By Biologic Type: The monoclonal antibodies segment is dominating the cardiovascular biologics market with a 45.2% share in 2024

The market for cardiovascular biologics was dominated by the monoclonal antibody category due to of its quick uptake in lipid-lowering therapy and demonstrated clinical effectiveness. These biologics, such evolocumab and alirocumab, significantly decreased cardiovascular risk in high-risk patients and successfully lowered low-density lipoprotein cholesterol (LDL-C) levels. When compared to conventional small-molecule medications, their specific mode of action on the PCSK9 protein produced superior results.

Moreover, pharmaceutical companies' continuous research and development for monoclonal antibodies and their ongoing clinical trials make them dominant. For instance, in June 2025, Merck announced positive topline results from the first two Phase 3 CORALreef trials, demonstrating that enlicitide decanoate, an investigational oral PCSK9 inhibitor, significantly reduced LDL cholesterol levels in adults with hyperlipidemia receiving standard lipid-lowering therapies.

By Indication: The coronary artery disease segment is dominating the cardiovascular biologics market with a 35.3% share in 2024

The global market for cardiovascular biologics has been dominated in recent years by the coronary artery disease (CAD) segment. Due to the significant prevalence of atherosclerotic cardiovascular disease worldwide and the increasing use of sophisticated biologic treatments for plaque stabilization and cholesterol management, this dominance was mainly explained. Treatment results for patients with high LDL-C levels and established heart disease were greatly improved by the growing use of these biologics.

Moreover, strong clinical evidence supporting biologics in reducing major cardiovascular events and their regulatory approvals further boosted demand. For instance, in March 2024, Regeneron Pharmaceuticals, Inc. announced that the FDA had expanded the approval of Praluent (alirocumab) to include pediatric patients aged 8 years and older with heterozygous familial hypercholesterolemia, broadening its therapeutic reach in lipid management.

Geographical Analysis

North America is dominating the global cardiovascular biologics market with a 48.5% in 2024

The market for cardiovascular biologics was dominated by North America due to its high prevalence of cardiovascular disorders, sophisticated healthcare system, and presence of top biopharmaceutical companies. Further solidifying the region's leadership in this field were significant R&D expenditures, advantageous reimbursement practices, the quick uptake of cutting-edge biologics, and rising awareness of precision medicine.

In the USA, cardiovascular biologics market growth was driven by rising FDA approvals, strong R&D investments, innovative biologic therapies, and increasing prevalence of cardiovascular diseases. For instance, in March 2025, Alnylam Pharmaceuticals, Inc. announced that the U.S. FDA had approved AMVUTTRA (vutrisiran) for treating cardiomyopathy caused by wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults, reducing cardiovascular mortality, hospitalizations, and urgent heart failure visits, marking a breakthrough for RNAi-based cardiovascular therapeutics.

Europe is the second region after North America which is expected to dominate the global cardiovascular biologics market with a 34.5% in 2024

In Europe, the market for cardiovascular biologics expanded rapidly due toauic of the growing prevalence of cardiovascular illnesses, a robust innovation environment, and significant research funding. Prolonged biologic innovation, enabling regulatory frameworks, and strategic partnerships between biotech and pharmaceutical firms sped up product development, clinical breakthroughs, and regional market expansion.

Moreover, owing to factors like strategic partnerships and collaborations, pharmaceutical companies, for instance, in April 2024, Bayer and the German-based life science company Evotec announced that they had renewed their strategic collaboration to develop innovative precision therapies for cardiovascular diseases, reinforcing their shared commitment to advancing precision cardiology.

The Asia Pacific region is the fastest-growing region in the global cardiovascular biologics market, with a CAGR of 7.7% in 2024

The Asia-Pacific market for cardiovascular biologics expanded rapidly as a result of growing investments in biotechnology, rising rates of cardiovascular illness, and supportive government healthcare initiatives. Further propelling regional expansion were developments in biologic research, the increasing need for focused treatments, and strategic partnerships between top pharmaceutical firms in China, Japan, India, and South Korea.

China’s cardiovascular biologics market grew rapidly, driven by increasing NMPA approvals, strong R&D investments, and the rising burden of cardiovascular diseases. Supportive government healthcare policies, expanding biotechnology capabilities, and strategic collaborations between domestic and global pharmaceutical companies further accelerated innovation, clinical development, and commercialization across the cardiovascular biologics sector. Owing to factors like NMPA approvals, for instance, in April 2025, Shanghai Junshi Biosciences Co., Ltd. announced that China’s NMPA had approved two supplemental new drug applications for Ongericimab, the nation’s first domestic PCSK9-targeted biologic, expanding its use to statin-intolerant adults with heterozygous familial and non-familial hypercholesterolemia, as well as mixed dyslipidemia.

Cardiovascular Biologics Market Competitive Landscape

Top companies in the cardiovascular biologics market include Regeneron Pharmaceuticals, Inc., Amgen Inc., Novartis Pharmaceuticals Corporation, Alnylam Pharmaceuticals, Inc., Genentech USA, Inc., Reliance Life Sciences, Biocon Biologics Limited, and Shanghai Junshi Biosciences Co., among others.

Regeneron Pharmaceuticals, Inc.: Regeneron Pharmaceuticals, Inc. is a leading U.S.-based biotechnology company specializing in the discovery and development of innovative biologic therapies. In cardiovascular biologics, Regeneron has achieved significant success with Praluent (alirocumab), a PCSK9 inhibitor that lowers LDL cholesterol and reduces cardiovascular risk. The company continues advancing precision biologics targeting lipid metabolism and atherosclerotic cardiovascular diseases through strong R&D and partnerships.

Key Developments:

- In September 2025, Novartis announced its acquisition of Tourmaline Bio, a New York-based clinical-stage biopharmaceutical company, to strengthen its cardiovascular pipeline with pacibekitug, an anti-IL-6 monoclonal antibody targeting atherosclerotic cardiovascular disease, addressing systemic inflammation, and complementing Novartis’ strategy with a Phase 3-ready biologic asset for cardiovascular disease treatment.

- In July 2025, Novartis announced that the U.S. FDA had approved a label update for Leqvio (inclisiran), allowing its use as a monotherapy alongside diet and exercise to reduce LDL cholesterol in adults with hypercholesterolemia, marking its expansion as a first-line PCSK9-targeting cardiovascular biologic therapy.

Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Biologic Type | Monoclonal Antibodies, siRNA-Based Therapeutics, Recombinant Proteins and Others |

| By Indication | Coronary Artery Disease, Heart Failure, Arrhythmias, Valvular Heart Diseases, Hypertension, and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global cardiovascular biologics market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here