Global Buy Now Pay Later Market: Industry Outlook

The global buy now pay later market reached US$ 35.47 billion in 2023, with a rise to US$ 42.78 billion in 2024, and is expected to reach US$ 238.56 billion by 2033, growing at a CAGR of 21.04% during the forecast period 2025–2033. The global buy now pay later market is witnessing robust growth, driven by rising consumer demand for flexible payment options, rapid digitalization of commerce, and increasing adoption among younger demographics. The shift toward e-commerce, coupled with growing smartphone penetration and strong fintech innovation, is fueling the widespread use of BNPL solutions across retail, travel, healthcare, and other sectors.

Additionally, merchants are embracing BNPL to boost conversion rates and average order values, further accelerating adoption. Expanding financial inclusion, particularly in emerging economies, along with continuous partnerships between retailers and fintech providers, is creating significant opportunities. Technological advancements in payment security and AI-driven credit assessment are also enhancing trust, customer experience, and regulatory compliance, supporting the market’s long-term growth trajectory.

Key Market Trends & Insights

North America represented around 30.1% of the global buy now pay later market in 2023 and is anticipated to retain its leading position throughout the forecast period. The region’s dominance is supported by a well-established digital payment infrastructure, high e-commerce penetration, advanced fintech adoption, and the presence of leading BNPL providers.

Asia Pacific is expected to record the fastest growth, driven by rapid digitalization, rising smartphone usage, increasing preference for alternative credit solutions among younger demographics, and growing collaborations between retailers and fintech players.

The Online Segment continues to hold the largest market share, fueled by the growth of e-commerce transactions, convenience of digital shopping, and the widespread integration of buy now pay later solutions at checkout by major online platforms and marketplaces.

Market Size & Forecast

2024 Market Size: US$ 42.78 Billion

2033 Projected Market Size: US$ 238.56 Billion

CAGR (2025–2033): 21.04%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Driver: Strategic Partnerships Accelerating Buy Now Pay Later Market Expansion

The global buy now pay later market is witnessing robust growth, fueled by the increasing demand for flexible payment solutions across e-commerce, retail, and financial services. By allowing consumers to purchase products and services instantly while spreading payments into smaller, affordable installments, BNPL has become an attractive option in today’s cost-conscious environment.

A major factor driving this momentum is the rise in strategic partnerships between buy now pay later providers, fintech players, and established financial institutions. For instance, PAYONE partnered with PayPal and Volksbanken Raiffeisenbanken (VVRB) to enhance buy now pay later accessibility for both merchants and customers in Germany. These collaborations integrate buy now pay later solutions offerings directly into existing payment ecosystems, enabling seamless checkout experiences without disrupting retailers’ operations.

Beyond convenience, such alliances expand market reach, enhance consumer trust through association with regulated banks, and deliver clear benefits like improved affordability, higher merchant sales, and greater customer retention. As global e-commerce and digital transactions accelerate, strategic partnerships are expected to be a cornerstone in scaling BNPL adoption and solidifying its position as a mainstream payment solution.

Restraint: Rising Consumer Debt & Default Risk

The rising consumer debt and default risk is expected to act as a significant restraint on the growth of the global buy now pay later market. Although buy now pay later solutions provide convenient and flexible payment options, their increasing adoption is also linked to unsustainable spending behaviors. Consumers may accumulate multiple buy now pay later obligations across platforms, often without a clear understanding of repayment timelines, which increases the chances of defaults.

High default rates not only strain buy now pay later providers but also impact their partnerships with merchants and financial institutions. This risk is further magnified in regions where credit assessment mechanisms are weak, making it difficult to evaluate consumer repayment capacity. Additionally, regulators are raising concerns about the financial vulnerability created by buy now pay later, which may result in tighter compliance requirements for providers. As consumer awareness of debt traps grows and stricter regulations emerge, the BNPL market could face slower adoption, particularly among risk-averse users and merchants who prioritize financial stability.

For more details on this report, Request for Sample

Segmentation Analysis

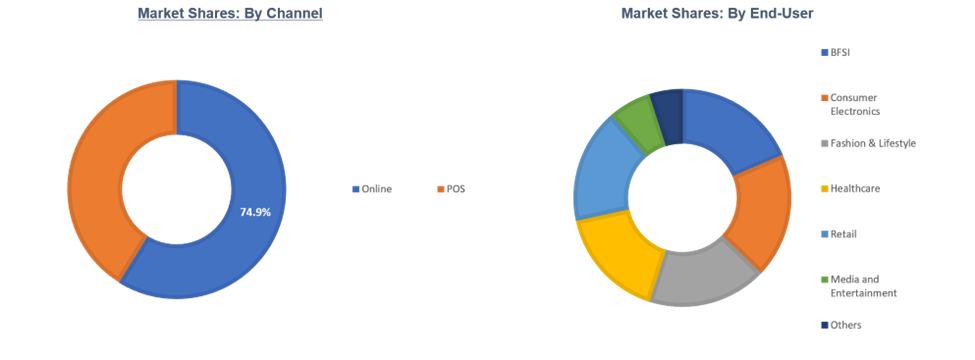

The global buy now pay later market is segmented based on channel, enterprises size, end-user, and region.

Channel:The Online Segment for buy now pay later market was valued at 40% market share in 2024

The online segment is projected to account for the largest share of the global Buy Now Pay Later market. This dominance is fueled by the rapid growth of e-commerce platforms, rising smartphone penetration, and consumers’ increasing preference for flexible and convenient digital payment options. Online buy now pay later solutions resonate strongly with younger generations, particularly Millennials and Gen Z, who value seamless checkout experiences and short-term, interest-free financing while shopping online.

The popularity of online buy now pay later offerings is further strengthened by their extensive integration with major e-commerce platforms, fashion retailers, and electronics brands. Merchants are increasingly partnering with BNPL providers to enhance customer conversion rates, reduce cart abandonment, and increase average order value. For digital-first consumers, the promise of instant credit approvals without the complications of traditional banking makes buy now pay later a vital enabler of online retail growth.

This segment also benefits from fintech-driven advancements, including AI-powered credit risk assessments, personalized repayment plans, and promotional offers such as zero-interest installments and loyalty rewards, all of which broaden accessibility and consumer adoption.

The surge in global online shopping accelerated during the COVID-19 pandemic and sustained by changing digital lifestyles has firmly positioned the online channel as a central driver of BNPL market expansion. With applications across diverse e-commerce categories such as fashion, electronics, travel, and lifestyle, the online segment is expected to maintain its lead over offline alternatives in the years ahead.

Geographical Analysis

The North America Buy Now Pay Later market accounted for 40.1% of the global share in 2023

North America holds a leading position in the buy now pay later market, supported by its advanced digital payment infrastructure, strong e-commerce penetration, and early embrace of fintech-driven solutions. The U.S. has witnessed substantial growth in buy now pay later adoption, with leading retailers and online platforms integrating flexible deferred payment options to cater to rising consumer demand for affordability and convenience. Industry insights highlight a steady increase in buy now pay later usage among U.S. shoppers over the past five years, particularly during peak sales seasons and for higher-value purchases such as fashion, travel, and electronics.

This leadership is further strengthened by the strong presence of established buy now pay later providers, fintech innovators, and financial institutions actively pursuing strategic partnerships to extend market reach. The region also benefits from a digitally savvy population, high credit card penetration, and robust consumer protection frameworks that enhance transparency and trust in buy now pay later services. Businesses across sectors are leveraging buy now pay later to drive higher customer conversion, reduce cart abandonment, and raise average order values. Coupled with ongoing advancements in AI-based credit scoring and loyalty-driven payment offerings, North America is expected to maintain its dominant role in the global buy now pay later landscape over the coming years.

The Asia-Pacific Buy Now Pay Later market captured 18.6% of the global share in 2023

Asia-Pacific represents the fastest-growing buy now pay later market, fueled by rapid digitalization, widespread smartphone adoption, and surging e-commerce activity across economies such as China, India, Japan, and Southeast Asia. Younger consumers, especially Millennials and Gen Z, are increasingly favoring buy now pay later over traditional credit options due to its frictionless checkout experience and short-term, interest-free installment features. For example, buy now pay later usage in India and Southeast Asia has surged in categories like electronics, fashion, and travel, propelled by the expansion of digital wallets and online marketplaces.

The region’s growth is further supported by robust economic development and a sizable underbanked population, creating strong demand for alternative credit solutions. Fintech firms and global buy now pay later providers are rapidly expanding through collaborations with e-commerce platforms, local retailers, and financial institutions to tap into this vast consumer base. Additionally, government-backed initiatives promoting digital payments and increasing merchant adoption of flexible financing tools are accelerating uptake. With e-commerce volumes continuing to grow and digital payment ecosystems maturing, Asia-Pacific is poised to become the primary engine of global buy now pay later market expansion, establishing itself as the fastest-advancing region during the forecast horizon.

Competitive Landscape

The major players in the buy now pay later include Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc., Zip Co, Ltd, Afterpay, Openpay, PayPal Holdings, Inc., LatitudePay Financial Services.

Affirm, Inc.: Affirm, Inc. is a leading provider in the buy now pay later market, specializing in transparent and flexible consumer financing solutions. The company’s flagship offering allows customers to split purchases into simple, interest-free or low-interest installments, enhancing affordability and convenience across online and offline retail. Affirm partners with major e-commerce platforms, travel providers, and lifestyle brands to deliver seamless checkout experiences while empowering consumers with clear repayment terms and no hidden fees, thereby reducing financial stress and driving higher merchant conversion rates.

Market Scope

Metrics | Details | |

CAGR | 21.04% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Channel | Online, POS |

Enterprises Size | Large Enterprises, SME’s | |

| End-User | BFSI, Consumer Electronics, Fashion & Lifestyle, Healthcare, Retail, Media and Entertainment, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The Global Buy Now Pay Later market report delivers a detailed analysis with 64 key tables, more than 54 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more buy now pay later-related reports, please click here