Global Bullous Keratopathy Market – Industry Trends & Outlook

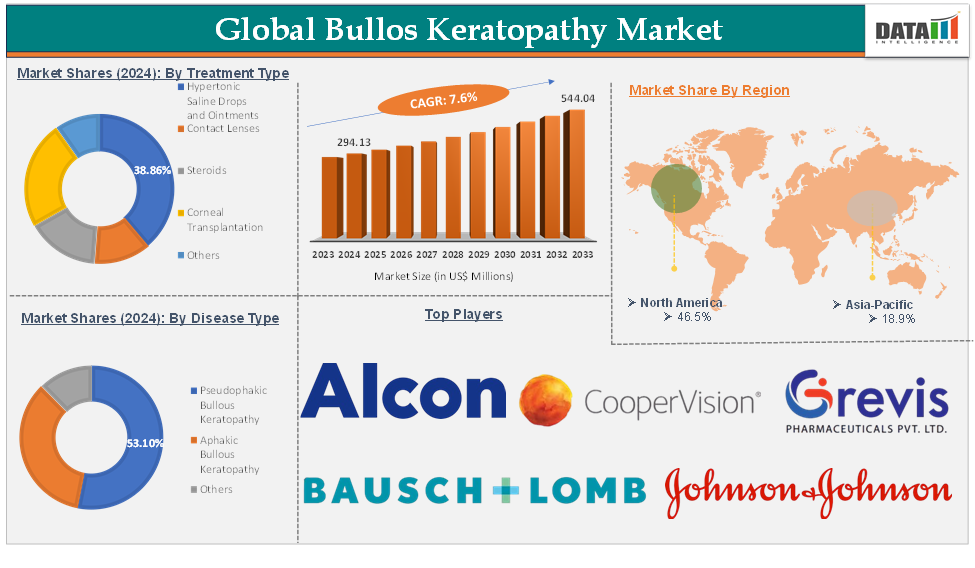

The global bullous keratopathy market was valued at US$ 275.64 Million in 2023. The market size reached US$ 294.13 Million in 2024 and is expected to reach US$ 544.04 Million by 2033, growing at a CAGR of 7.6% during the forecast period 2025-2033.

Bullous keratopathy is a degenerative eye condition marked by the formation of fluid-filled blisters (bullae) on the cornea due to endothelial cell dysfunction. This leads to corneal swelling, pain, and vision impairment. It often arises from surgical complications, trauma, or underlying corneal diseases such as Fuchs’ endothelial dystrophy, keratoconus, and infectious keratitis.

The main drivers include the increasing prevalence of ophthalmic diseases, the aging global population, and a rising number of cataract and other ocular surgeries that can lead to bullous keratopathy. Technological advancements in surgical techniques, such as endothelial keratoplasty and regenerative cell therapies, are significantly improving treatment outcomes and expanding therapeutic options.

There is a growing demand for innovative, less invasive treatments, and the development of novel therapeutics, such as cell-based and regenerative therapies, is accelerating. Favorable reimbursement policies and increased investment in ophthalmic research and development also create a fertile environment for new entrants and established players to expand their offerings.

Companies are actively pursuing partnerships, mergers, and acquisitions to strengthen their portfolios and access new technologies. Key trends shaping the market include a shift toward minimally invasive procedures, the adoption of advanced diagnostic tools, and the integration of personalized medicine approaches.

Global Bullous Keratopathy Market – Executive Summary

Global Bullous Keratopathy Market Dynamics: Drivers

Increasing demand for therapeutic innovations

The increasing demand for therapeutic innovations for treating bullous keratopathy is expected to drive the market. If the existing treatments for bullous keratopathy are limited in their effectiveness or are associated with significant side effects, there is a strong incentive for the development of new and improved therapies. This unmet medical need can stimulate investment and innovation in the market.

For instance, in September 2024, Aurion Biotech announced the commercial launch of Vyznova (neltependocel) in Japan, marking a significant milestone as it is the first approved cell therapy for treating bullous keratopathy. This condition severely affects the cornea's endothelial cells.

Similarly, in March 2023, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) approved Aurion Biotech’s allogeneic cell therapy, Vyznova, to treat patients with bullous keratopathy. This approval is believed to be the first for an allogeneic cell therapy for corneal endothelial disease.

Moreover, many clinical trials are going on for the development of novel therapeutics that show better results in inflammatory myositis. For instance, in June 2023, Trefoil Therapeutics is working to improve outcomes in patients who experience corneal edema. A new investigational therapy developed by Trefoil, called TTHX1114, has been shown to stimulate natural cellular processes that protect the corneal cells from damage and improve the rate at which those tissues heal.

Further, the increasing prevalence of bullous keratopathy, increasing clinical trials, increasing awareness, and advancements in the development of novel drugs and therapies are the factors expected to drive the market.

The growing prevalence of ocular disorders

The growing prevalence of ocular disorders is a major driver for the global bullous keratopathy market. Worldwide, at least 2.2 billion people have some form of vision impairment, with a significant portion stemming from ocular conditions such as cataracts, glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy.

Cataracts alone are responsible for nearly 45% of global blindness and affect tens of millions, with prevalence sharply increasing with age, reaching over 90% in people aged 80 and older. Similarly, the incidence of AMD and glaucoma is projected to double or even triple by 2050, fueled by an aging population and lifestyle changes such as increased sedentary behavior and rising rates of diabetes and myopia. As these primary eye diseases progress, they frequently lead to complications like bullous keratopathy, especially following ocular surgeries or in advanced disease stages.

This surge in ocular disorders not only increases the pool of patients at risk for bullous keratopathy but also amplifies demand for effective treatments and innovative therapies. With population growth and global aging trends, the number of people requiring intervention for corneal endothelial dysfunction is expected to rise substantially in the coming decades. As a result, the bullous keratopathy market is poised for expansion, driven by the urgent need to address the downstream effects of widespread and growing ocular disease burdens.

Global Bullous Keratopathy Market Dynamics: Restraints

High cost of treatment

The high cost of treatment is a significant restraint for the global bullous keratopathy market. Advanced therapies, especially corneal transplantation and emerging cell-based treatments, are expensive. For example, the average cost of a cornea transplant in the United States can exceed US$ 25,000 for those under 65 and nearly US$ 20,000 for older adults, with additional annual expenses of US$ 10,000 or more for necessary post-transplant immunosuppressive medications.

Endothelial keratoplasty, a common surgical intervention for bullous keratopathy, incurs similar or even higher costs, creating a substantial financial burden for patients and healthcare systems, particularly in regions with limited insurance coverage or reimbursement options.

These high costs restrict access to care, especially in low- and middle-income countries, where healthcare infrastructure and funding may be inadequate. Even in developed markets, out-of-pocket expenses and variable insurance coverage can delay or prevent patients from receiving timely treatment. The financial barrier also limits the adoption of innovative therapies, as new cell-based or regenerative treatments often come with premium pricing due to complex manufacturing and regulatory requirements.

As a result, the high cost of treatment remains a major challenge, slowing market growth and leaving many patients with unmet medical needs. Thus, the above factors could be limiting the global Bullous keratopathy market's potential growth.

Global Bullous Keratopathy Market Dynamics: Opportunities

Expansion into emerging markets

Expansion into emerging markets presents a major opportunity for the global bullous keratopathy market, driven by several converging factors. Rapidly developing healthcare infrastructures in regions such as Asia-Pacific, Latin America, the Middle East, and parts of Africa are increasing access to ophthalmic care, which is essential for diagnosing and treating corneal diseases like bullous keratopathy.

These regions are experiencing rising rates of underlying ocular conditions such as cataracts, glaucoma, and Fuchs’ endothelial dystrophy, largely due to aging populations and increased life expectancy, which in turn expands the potential patient pool.

Emerging markets also benefit from growing healthcare investments, government initiatives to combat vision impairment, and heightened awareness about eye health among both patients and healthcare professionals. As advanced treatments, including minimally invasive surgeries and regenerative cell therapies, become more available, these markets are expected to see faster adoption of innovative solutions that were previously limited to developed countries. Companies entering these regions can capitalize on unmet medical needs, less saturated competitive landscapes, and favorable demographic trends.

For more details on this report, Request for Sample

Global Bullous Keratopathy Market - Segment Analysis

The global bullous keratopathy market is segmented based on Disease type, treatment type, end-user, and region.

Treatment Type:

The hypertonic saline drops and ointments treatment type segment is expected to hold 38.9% of the global bullous keratopathy market in 2024

These are considered a first-line treatment for bullous keratopathy. These are often used to reduce corneal edema and alleviate discomfort. Hypertonic saline drops are occasionally used to draw excess fluid from the cornea.

For instance, according to the National Institute of Health, topical ocular hypertonic saline seems to be a safe and effective treatment in the management of less severe forms of corneal edema or bullous keratopathy and other corneal disorders such as filamentary keratitis. Further, hypertonic saline solutions have a higher salt concentration than the natural tears in the eye. When applied topically, they create an osmotic gradient, drawing excess fluid out of the cornea.

This helps to reduce corneal edema and relieve the associated pain and discomfort. The primary goal of using hypertonic saline drops and ointments in bullous keratopathy is to alleviate the symptoms, such as pain, photophobia, and blurred vision, which are caused by the presence of corneal bullae.

Moreover, key players in the industry's product launches help to propel this segment’s growth in the market. For instance, one of the key players in the industry, Bausch & Lomb Inc., introduced the Muro 128 (Sodium Chloride Hypertonicity Ophthalmic Solution, 5%) is a well-established treatment for managing corneal edema, particularly in conditions like bullous keratopathy (BK). This hypertonic solution works by creating an osmotic gradient that draws excess fluid out of the cornea, thereby alleviating symptoms associated with corneal swelling.

Similarly, Rayner Group launched the AEON Sodium Chloride Eye Drops, which are a hypertonic solution commonly used in the management of bullous keratopathy (BK), a condition characterized by corneal edema due to endothelial dysfunction. These drops are formulated to help reduce corneal swelling and improve symptoms associated with BK. These factors have solidified the segment's position in the global bullous keratopathy market.

Global Bullous Keratopathy Market – Geographical Analysis

North America is expected to hold 46.5% of the global bullous keratopathy market in 2024

The increasing geriatric population and the rising prevalence of cataract and glaucoma surgeries are significant drivers of the bullous keratopathy market. These are closely linked to an increase in bullous keratopathy cases due to surgical complications that damage the corneal endothelium.

As people age, they become more susceptible to various ocular conditions, including bullous keratopathy. Studies indicate that age-related eye diseases such as cataracts, glaucoma, and age-related macular degeneration (AMD) are prevalent among the elderly population. For instance, it is stated that by age 65, one in three individuals has some form of vision-reducing eye disease.

Supportive reimbursement frameworks in the U.S. play a crucial role in enhancing patient access to treatments for bullous keratopathy, a condition characterized by corneal edema and vision loss. These financial mechanisms encourage healthcare providers to offer advanced therapies and surgical options, thereby improving patient outcomes.

The landscape of treatment for bullous keratopathy is evolving rapidly due to significant investments in research and development (R&D), which are focused on innovative treatment modalities and technologies. Innovations in corneal transplant surgeries and technologies have significantly improved patient outcomes and reduced complications, leading to increased surgical interventions.

Moreover, key players’ strategies such as partnerships & collaborations, research activities, a majority of key players’ presence, well-advanced healthcare infrastructure, technological advancements, & investments are driving this market growth.

In addition, the rising number of clinical trials and advancements in the development of novel drugs and therapies are the factors expected to drive the market over the forecast period. As per Ophthalmology Times, in October 2024, Emmecell announced the completion of the final patient visit in the Phase 1 EMME-001 trial for EO2002, a novel magnetic cell therapy designed to treat corneal edema associated with conditions such as Fuchs corneal dystrophy and pseudophakic bullous keratopathy. Thus, the above factors are consolidating the region's position as a dominant force in the global bullous keratopathy market.

Asia Pacific is expected to hold 18.9% of the global bullous keratopathy market in 2024

The Asia-Pacific bullous keratopathy market is experiencing notable growth, driven by several key factors. A primary driver is the rising number of cataract surgeries in the region, which increases the risk of developing bullous keratopathy due to surgical complications and postoperative endothelial cell loss. The region’s rapidly aging population further contributes to the prevalence of corneal disorders, as older adults are more susceptible to conditions like bullous keratopathy following ocular procedures or as a result of age-related degeneration.

Advancements in corneal transplant and implant technologies are also propelling market expansion in Asia-Pacific. The adoption of innovative surgical techniques, such as endothelial keratoplasty, has improved treatment outcomes and reduced recovery times, making these interventions more attractive to both patients and healthcare providers. Additionally, the increasing use of advanced medical devices and greater investment in ophthalmic research and development are enhancing the quality and accessibility of care in the region.

Favorable reimbursement policies in some Asia-Pacific countries are making treatments more accessible, while the growing need for research and development of new therapeutic methods presents further opportunities for market growth. The presence of major healthcare companies and specialized eye hospitals, along with expanding healthcare infrastructure in countries like China, India, and Japan, supports the rising demand for effective bullous keratopathy treatments.

For instance, in September 2024, Aurion Biotech announced the commercial launch of Vyznova (neltependocel) in Japan, marking a significant milestone as the first approved cell therapy specifically for treating bullous keratopathy of the cornea. Thus, the above factors are consolidating the region's position as a dominant force in the global bullous keratopathy market.

Global Bullous Keratopathy Market – Competitive Landscape

The major global players in the bullous keratopathy market include Alcon Vision LLC, CooperVision, Inc., Bausch & Lomb Inc., Johnson and Johnson, Grevis Pharmaceuticals Pvt Ltd, Rayner Group, SERVIMED INDUSTRIAL S.P.A., MERCK & CO., Inc., Aurion Biotech, Novartis AG, and Cellusion Inc., among others.

Global Bullous Keratopathy Market – Key Developments

In March 2025, Alcon, a global leader in eye care, acquired a majority interest in Aurion Biotech, a clinical-stage company specializing in advanced cell therapies for eye diseases, particularly corneal endothelial disease. This acquisition allows Alcon to leverage its global scale and resources to support and accelerate Aurion’s development of innovative cell therapy treatments, notably AURN001, which targets corneal edema secondary to corneal endothelial disease.

Global Bullous Keratopathy Market – Scope

Metrics | Details | |

CAGR | 7.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Disease Type | Pseudophakic Bullous Keratopathy, Aphakic Bullous Keratopathy, Others |

Treatment Type | Hypertonic Saline Drops and Ointments, Contact Lenses, Steroids, Corneal Transplantation, Others | |

End-User | Distribution Channel, End-User | |

End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialized Clinics | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global bullous keratopathy market report delivers a detailed analysis with 65 key tables, more than 54 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.