Bottled Water Market Size

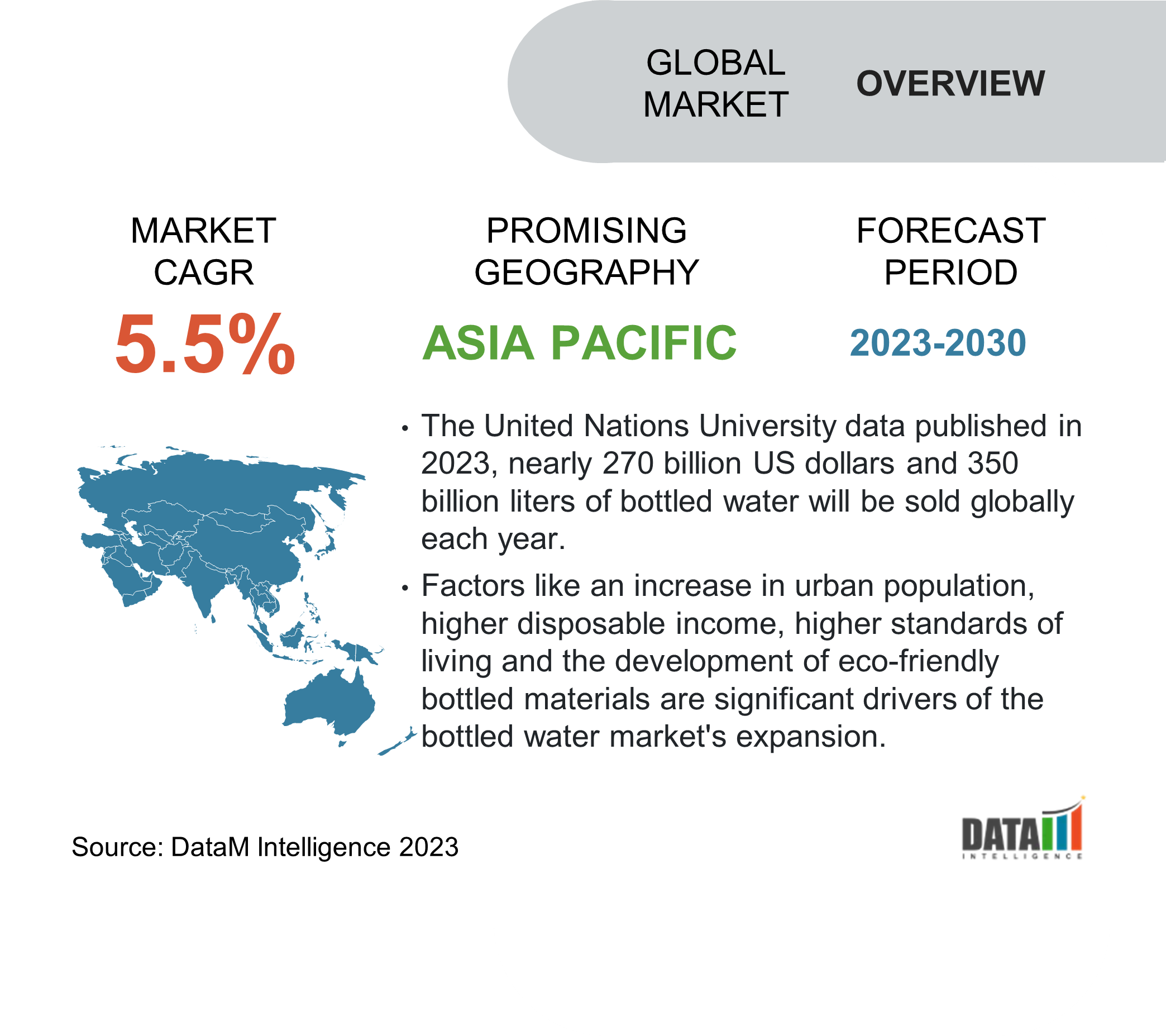

The Global Bottled Water Market was valued at US$ 252.6 billion in 2022 and is expected to reach US$ 388.3 billion by 2031, exhibiting a CAGR of 5.5% during the forecast period(2024-2031). The competitive rivalry intensifies with Bisleri International Pvt. Ltd, Nestle SA., The Coca Cola Company Inc., and others operating in the market. Drinking water shortages in several areas further increase the need for safe drinking water, which drives product sales and boosts market expansion.

Market Summary

| Metrics | Details |

| CAGR | 5.5% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Product, Distribution Channel, Packaging and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights: Download Sample

Market Dynamics

The Market is Expanding Due to Increasing Consumer Health Concerns

As more people become aware of various health problems, including neurological illnesses, reproductive problems and gastrointestinal diseases, the demand for safe and hygienic bottled water is increasing.

The market for bottled water has benefited from consumer worries about rising obesity rates and a rise in public awareness of health issues in nations like China, India and Indonesia. Healthy substitutes have been replacing sugary carbonated drinks among consumers. This change had a sizable impact on the forecasted growth of bottled water.

The Rising Consumption of Packaged Bottled Water is Expected to Drive the Market Growth

Consuming bottled water is believed a simple way to remain hydrated as well as helps in keeping a healthy diet. Increasing consumer awareness of the health benefits of drinking bottled water is expected to enlarge the market growth within the forecast years.

The rising preference for bottled water over ordinary water, especially among younger customers is propelling sales. Due to this trend, various restaurants and hotels are offering bottled water to fulfill customer demand.

Moreover, the rapid growth of restaurants in developed and developing countries is likely to propel the demand for bottled water over the forecast period. Various bottled water companies are introducing new products with attractive packaging, flavoring substances, and bold is also expected to fuel the market growth in the upcoming years.

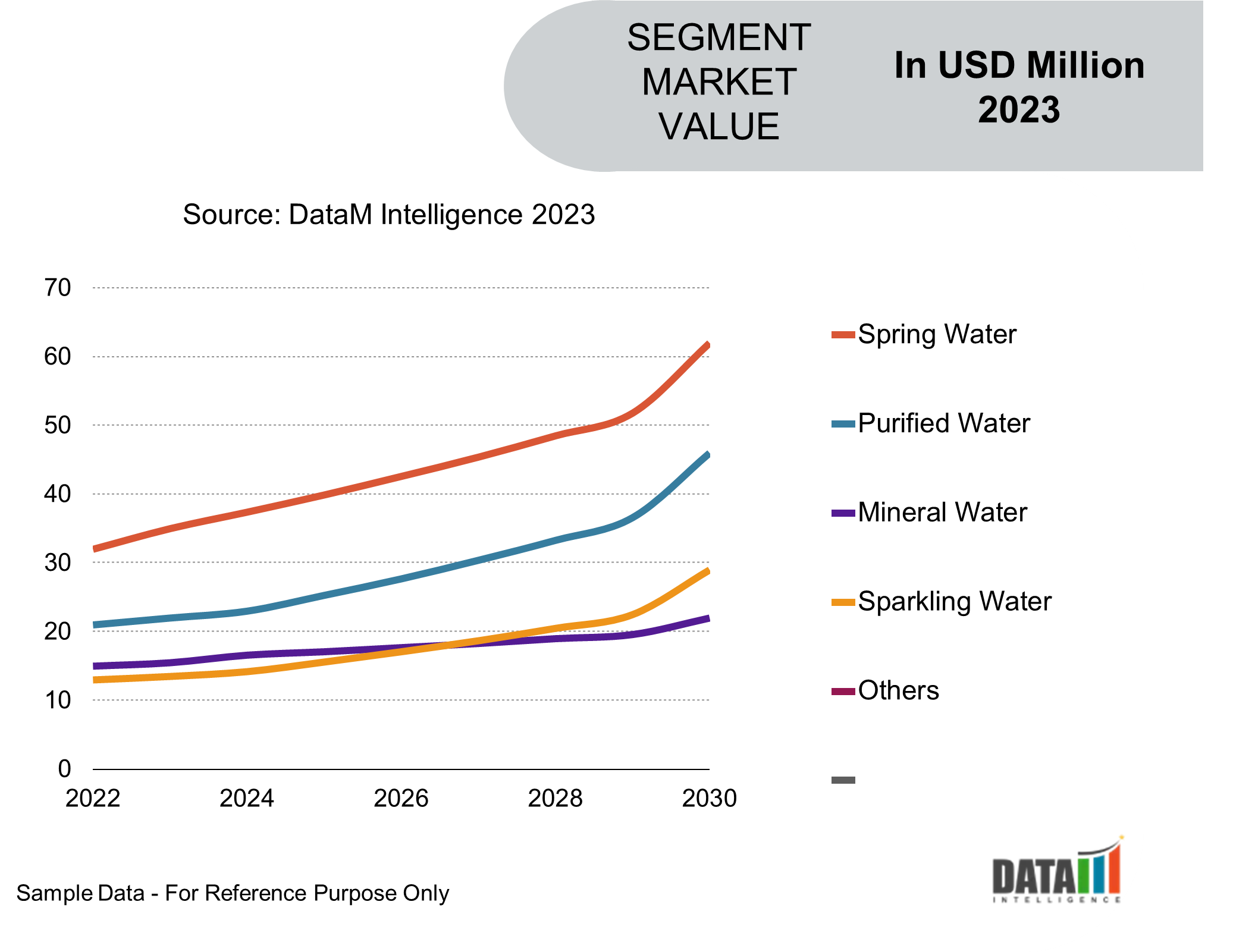

Market Segmentation Analysis

The global bottled water market is segmented based on product, distribution channel, packaging and region.

An Increase in the Adoption of Off-trade Segment by Consumers is Expected to Drive the Segment Growth

Bottled water has been segmented by distribution channel as off-trade and on-trade.

According to the International Bottled Water Association (IBWA), in 2021, the off-trade segment's revenue share was greater than 85%. All retail establishments, including traditional stores, mini markets, convenience stores, supermarkets and hypermarkets, are included in this segment.

The convenience of choosing the required brand of bottled water with a specific combination of minerals quickly will drive market expansion during the forecast period. Aquafina, Dasani, Nestlé and Danone are some of the brands sold by the mentioned stores in the market

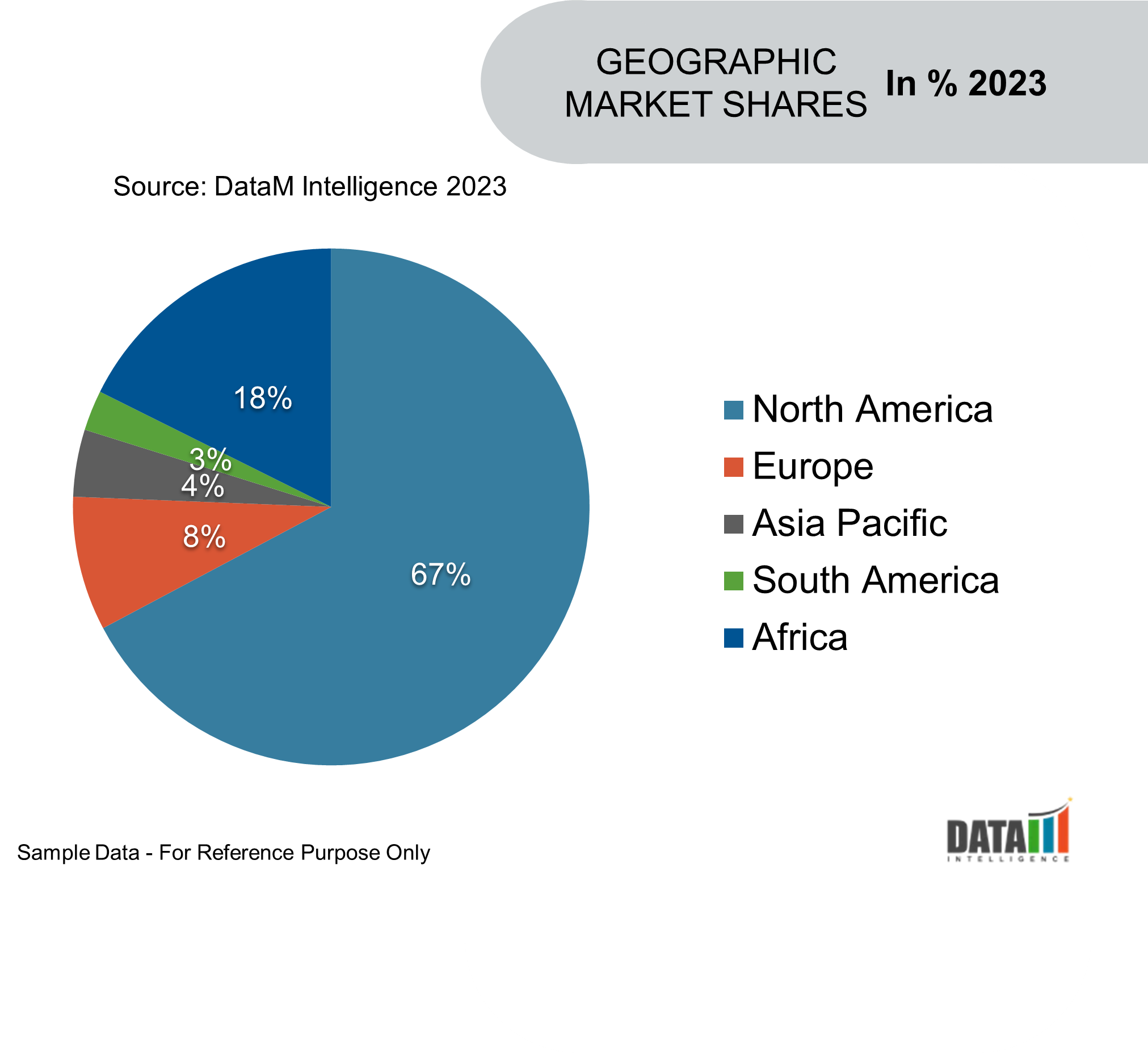

Market Geographical Share

The Market in North America is Expected to Grow Owing to an Increase in the Usage of Bottled Water in the Region

By region, the global bottled water market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east and Africa.

In North America, an increase in the consumers’ shift from sugary drinks to bottled water helps to boost market growth. Retail sales of bottled water are increasing due to the increase in the consumers’ focus on alternatives to sugary and carbonated drinks. In 2021, the U.S. used 4.7% more bottled water.

Each American consumed 47 gallons of bottled water on average in 2021, a 3.9% increase from 2010. Additionally, according to BMC data, retail dollar sales of bottled water increased 11.2% to reach D 40.2 billion. According to the survey conducted by the International Bottled Water Association (IBWA), 9 out of 10 Americans(91%) want bottled water.

Market Companies

The major global players include Bisleri International Pvt. Ltd., Nestle SA, Mountain Valley Water Co., Societe des Eaux Minerales d'Evian SA, The Coca-Cola Company Inc., Primo Water Corporation, GEROLSTEINER BRUNNEN GmbH & Co. KG, Nongfu Spring, TATA Consumer Products Limited and Glaceau.

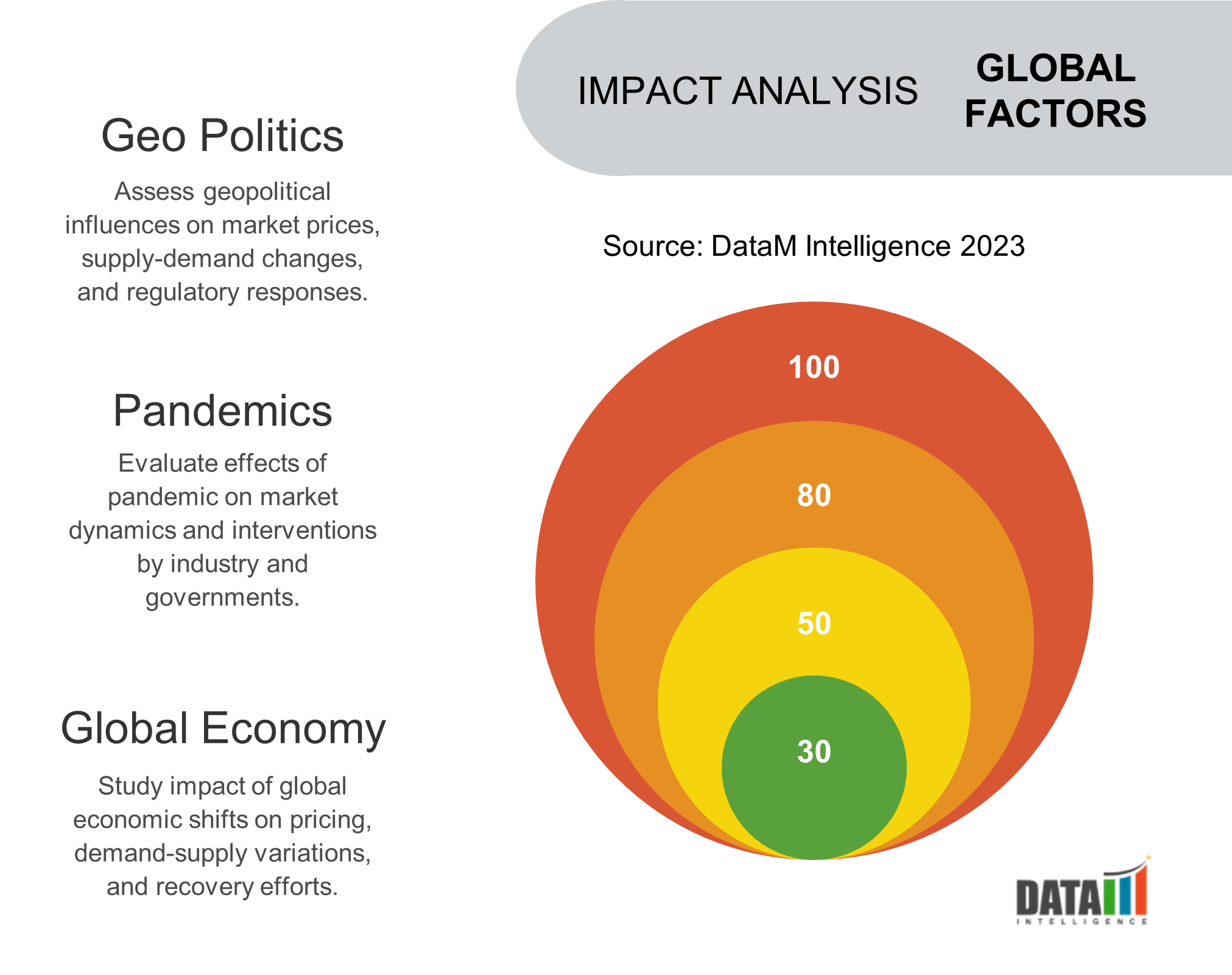

COVID-19 Impact on Market

The bottled water industry faced logistical difficulties due to the extensive restrictions that governments worldwide imposed to combat COVID-19. To meet the increased demand for bottled water in 2020, the International Bottled Water Association (IBWA) reported that bottled water companies increased their production capacities.

This entails boosting bottling capacity, acquiring more production and packaging supplies and speaking with retailers to gauge demand. The demand for purified and ultra-purified bottled options is rising as consumers prioritize their health and wellness. Consumers chose these bottles because they are a healthier alternative to high-calorie, sugary, carbonated drinks like sports drinks and juices.

Sales of bottled water increased by 4.7% in 2020, according to a Beverage Industry article from September 2021. A greater preference for premium or ultra-purified bottled options is being driven by growing awareness of healthy beverages due to informational accessibility and dissatisfaction with quality drinking beverages.

Key Developments

- On December 02, 2021, HidrateSpark Smart Water Bottles, a bottle manufacturer launched smart water bottle, HidrateSpark TAP in the market. It comes in the stainless steel or Tritan plastic and availablein the sizes of 20, 24, and 32oz.

- On April 29, 2022, Apple launched HidrateSpark Smart Water Bottle Accessories in the market. It is available on the Apples website for the sell and in retail stores.

- On October 17, 2022, Gatorade, completed partnership with the impacX to launch smart digital water bottle in the market. impacX has created smart packaging technology for the water bottles.

The Global Bottled Water Market Report Would Provide Approximately 61 Tables, 53 Figures and 195 Pages.