Bone Grafts and Substitutes Market Size & Industry Outlook

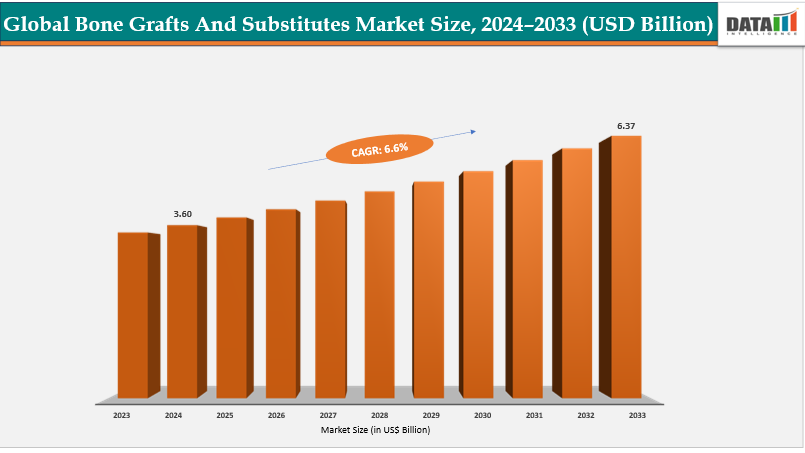

The global bone grafts and substitutes market size reached US$ 3.39 Billion with rise of US$ 3.60 Billion in 2024 is expected to reach US$ 6.37 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. The major driving factor for the global bone grafts and substitutes market is the growing adoption of minimally invasive surgical procedures. modern patients and surgeons increasingly prefer approaches that reduce hospital stay, lower infection risk, and accelerate recovery.

For instance, in spinal fusion surgeries, instead of large open incisions, surgeons can now insert bone graft substitutes through smaller access points with the help of specialized delivery systems. This not only lessens trauma to surrounding tissues but also enhances graft placement accuracy. The result is quicker rehabilitation, fewer complications, and higher patient satisfaction.

As hospitals and surgical centers embrace such advanced techniques, the demand for ready-to-use, easy-to-handle bone substitutes like putties, injectables, and pre-shaped scaffolds keeps rising. This shift highlights how innovation in surgical practice fuels product adoption, making minimally invasive compatibility one of the most powerful growth engines for the market.

Key Highlights

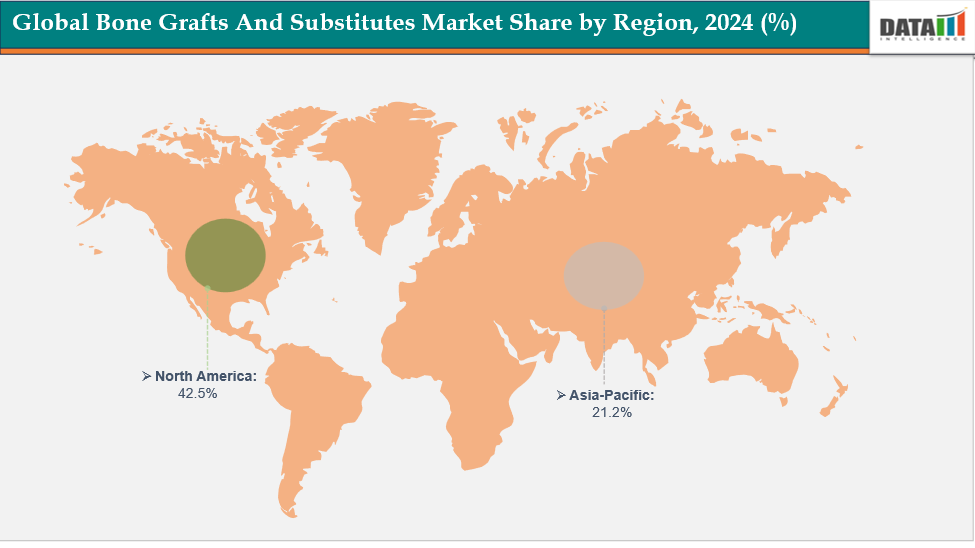

North America is expected to dominate the bone grafts and substitutes market with the largest revenue share of 42.5% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

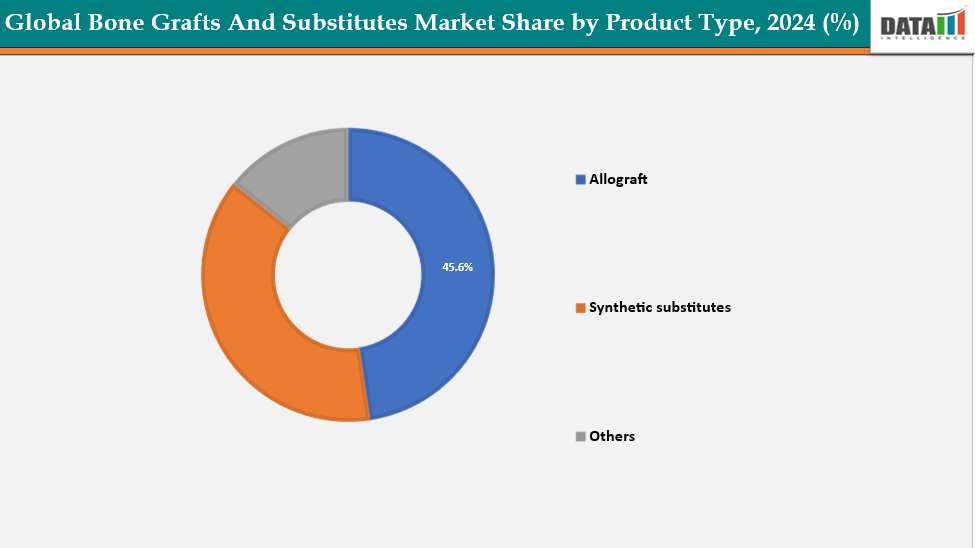

Based on Product Type, the allografts segment led the market with the largest revenue share of 45.6% in 2024.

The major market players in the bone grafts and substitutes market are Orthofix Medical Inc, DePuy Synthes, Zimmer Biomet, Medtronic, Stryker, Bioventus, Arthrex, Inc and among others.

Market Size & Forecast

2024 Market Size: US$ 3.60 Billion

2033 Projected Market Size: US$ 6.37 Billion

CAGR (2025–2033): 6.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Bone Grafts and Substitutes Market Executive Summary

Market Dynamics

Drivers : The increasing prevalence of orthopedic conditions is significantly driving the bone grafts and substitutes market growth

The increasing prevalence of orthopedic conditions such as osteoporosis, osteoarthritis, and fracture-related injuries is a major driver of the global bone grafts and substitutes market.

For instance, in 2024, orthopedic and musculoskeletal disorders affected nearly 1.7 billion people worldwide, with osteoarthritis alone impacting over 600 million and osteoporosis burdening almost 20% of the global population. This growing patient pool, driven by aging demographics and lifestyle factors, is sharply increasing the need for surgical interventions directly fueling demand for bone grafts and substitutes in the global market.

This surge in orthopedic cases directly boosts the demand for bone grafts and substitutes, positioning them as essential solutions for restoring mobility and improving patient outcomes, thereby fueling consistent market growth.

Restraints: Stringent regulatory challenges are hampering the growth of the bone grafts and substitutes market

The global bone grafts and substitutes market faces notable regulatory challenges, as these products fall under stringent approval pathways due to their biologic, synthetic, or combination nature. Regulatory agencies such as the U.S. FDA and EMA require extensive preclinical and clinical data to establish safety, efficacy, and long-term outcomes, often resulting in prolonged approval timelines and high development costs. Variability in regulatory frameworks across regions further complicates global commercialization, creating barriers for smaller players and delaying patient access to innovative grafting solutions.

For more details on this report – Request for Sample

Segmentation Analysis

The global bone grafts and substitutes market is segmented based on product type, material, application, end user, and region.

Product Type-The allograft segment is dominating the bone grafts and substitutes market with a 45.6% share in 2024

The allograft segment is a key growth driver in the global bone grafts and substitutes market due to its unique properties, including strong osteoconductive properties, which support effective bone healing and regeneration. Unlike autografts, allografts don't require harvesting from the patient's body, reducing discomfort and recovery time. They're particularly popular in complex trauma cases, spinal fusion procedures, and large-scale reconstructive surgeries. The availability of processed and sterilized allografts from tissue banks ensures reliability and safety.

For instance, in April 2025, Xtant Medical Holdings, a global medical technology company, has launched Trivium, a premium demineralized bone matrix allograft designed to improve bone grafting procedures. Engineered with PureLoc Fiber Technology, Trivium delivers exceptional performance in structure, handling, and biological activity.

The synthetic substitutes segment is estimated to have a 46.1% of the bone grafts and substitutes market share in 2024

Synthetic substitutes are gaining momentum in the global bone grafts and substitutes market due to their unlimited availability, standardized quality, and lower risk of disease transmission or immune rejection compared to donor-derived grafts. Materials like calcium phosphates, bioactive glass, and polymers are being engineered to mimic natural bone structure, offering reliable options for surgical applications. Advanced product formats like injectable pastes, moldable putties, and porous scaffolds are gaining popularity.

For instance, in June 2023, Nobel Biocare is launched creos syntogain, a biomimetic bone graft substitute, to expand its portfolio of regenerative solutions under the creos brand. Creos syntogain, known as MimetikOss in Spain since 2016, is designed for efficient regeneration.

Geographical Analysis

North America is expected to dominate the global bone grafts and substitutes market with a 42.5% in 2024

North America is expected to maintain its dominant position in the Global Bone Grafts and Substitutes Market, supported by a combination of advanced healthcare infrastructure, strong adoption of innovative medical technologies, and the presence of leading market players headquartered in the region. High prevalence of orthopedic disorders such as osteoporosis, osteoarthritis, and spinal deformities, coupled with an aging population, continues to generate significant demand for bone grafts and substitutes.

For instance, in June 2025, Nobel Biocare is launched creos syntogain, a biomimetic bone graft substitute for efficient regeneration. Creos syntogain, also known as MimetikOss, is part of Nobel Biocare's regenerative solutions portfolio. Cerapedics has announced the FDA premarket approval of PearlMatrix P-15 Peptide Enhanced Bone Graft, a Class III drug-device combination product for single-level transforaminal lumbar interbody fusion surgery in adult patients with degenerative disc disease.

The U.S. remains the single largest contributor within North America, driven by high surgical volumes in spinal fusion, joint reconstruction, and trauma cases. In addition, strong investment in R&D, availability of tissue banks, and early adoption of synthetic and bioactive substitutes reinforce the region’s leadership. Canada also contributes steadily due to rising awareness of minimally invasive procedures and improved healthcare access, but the U.S. clearly dominates the regional market.

Europe is expected to dominate the global bone grafts and substitutes market with a 34.5% in 2024

Europe represents a significant market for bone grafts and substitutes, supported by its well-established healthcare systems, high awareness of advanced orthopedic procedures, and a large aging population that is increasingly vulnerable to bone disorders such as osteoporosis and degenerative joint diseases. The region benefits from widespread access to specialized orthopedic care and a strong network of academic and research institutions that are actively engaged in biomaterials and regenerative medicine innovation.

Countries such as Germany, the United Kingdom, and France are at the forefront, driven by high surgical volumes in spinal fusion, hip and knee replacements, and trauma management. Germany, in particular, holds a dominant position in Europe due to its advanced hospital infrastructure, strong presence of leading medical device companies, and supportive reimbursement frameworks that encourage adoption of innovative grafting solutions.

The Asia Pacific region is the fastest-growing region in the global bone grafts and substitutes market, with a CAGR of 8.1% in 2024

Asia-Pacific is projected to be the fastest growing region in the bone grafts and substitutes market, propelled by rapid improvements in healthcare infrastructure, a large patient pool suffering from trauma injuries, osteoporosis, and spinal conditions, and growing awareness of advanced surgical treatments. The region is witnessing a sharp rise in surgical procedures due to aging demographics, rising road accident rates, and lifestyle-related skeletal disorders. Furthermore, increasing healthcare spending, expanding private hospital networks, and the entry of international players are improving patient access to bone graft substitutes.

India and China are emerging as major growth engines, but China currently holds the dominant share in the region due to its large population base, government investment in healthcare modernization, and rapid adoption of biomaterials and regenerative medicine. India, however, is catching up quickly, supported by rising orthopedic surgery volumes, medical tourism, and cost-effective surgical procedures that attract regional demand.

For instance, in September 2025, Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST) has introduced two innovative drug-eluting bone graft products, launched under the brand names CASPRO and BONYX. The products were unveiled by SCTIMST President S. Kris Gopalakrishnan and were developed by the institute’s Biomedical Technology Wing. For commercialization, the technology has been transferred to Onyx Medicals Pvt. Ltd., Meerut, Uttar Pradesh.

Competitive Landscape

Top companies in the bone grafts and substitutes market include Orthofix Medical Inc, DePuy Synthes, Zimmer Biomet, Medtronic, Stryker, Bioventus, Arthrex, Inc and among others.

Depuy Synthes: In the global bone grafts and substitutes market, DePuy Synthes (a Johnson & Johnson company) holds a strong competitive position owing to its broad portfolio, global reach, and continuous innovation in orthopedic solutions. The company offers a comprehensive range of bone graft substitutes, demineralized bone matrix (DBM) products, and synthetic options that cater to trauma, spine, and reconstructive procedures. Its competitive edge lies in leveraging Johnson & Johnson’s vast distribution network, strong surgeon relationships, and integrated orthopedic ecosystem, which includes implants, surgical tools, and biologics.

Key Developments:

In February 2025, Evergen, a leading CDMO in regenerative medicine, has launched AI-powered image processing software to enhance CT bone graft scan analysis, demonstrating its commitment to innovation and tissue engineering.

In September 2024, Korean med-tech firm Innosys Co. Ltd. recently launched two new injectable spine bone graft substitute products – Velofuse Gel and Velofuse Putty – and announced a name change to CG Medtech Co. Ltd.

Market Scope

Metrics | Details | |

CAGR | 6.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Allograft, Synthetic substitutes, Others |

Material | Ceramic-based, Polymer-based, Others | |

Application | Spinal Fusion, Dental Bone Grafting, Joint Reconstruction, Craniomaxillofacial, Foot and Ankle, Long Bone, Others | |

End User | Hospitals, Orthopedic Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global bone grafts and substitutes market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here