Global Bluetooth Controller Market: Industry Outlook

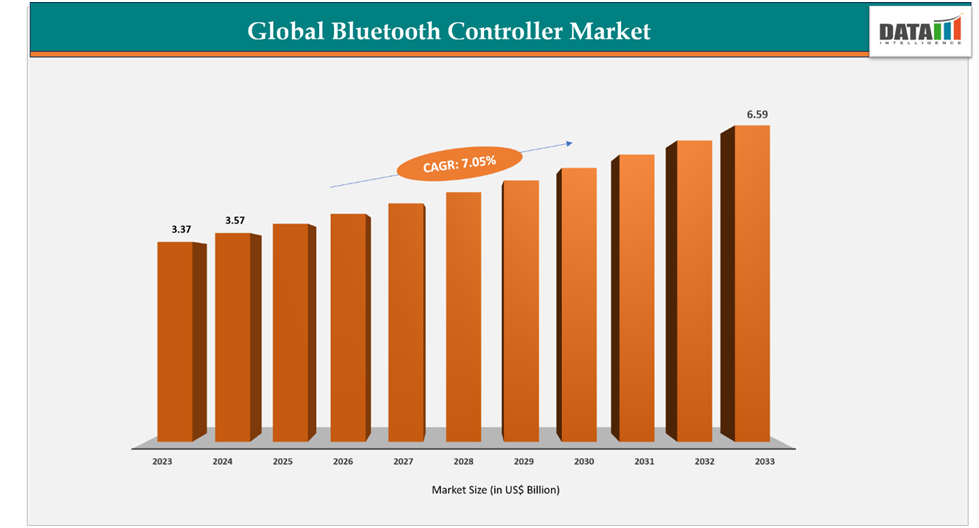

The global Bluetooth controller market reached US$ 3.37 billion in 2023, with a rise to US$ 3.57 billion in 2024, and is expected to reach US$ 6.59 billion by 2033, growing at a CAGR of 7.05% during the forecast period 2025–2033.

The global Bluetooth controller market is growing steadily, driven by widespread adoption in consumer electronics, automotive systems, healthcare devices, and industrial IoT applications. These controllers are essential for enabling seamless short-range wireless communication, powering connectivity in smartphones, wearables, audio devices, smart home solutions, and in-vehicle infotainment systems. Market growth is further supported by advancements in Bluetooth Low Energy (LE), AI-powered power optimization, and the rising need for high-performance, low-latency wireless communication.

Ecosystem partnerships, semiconductor innovations, and ongoing standardization efforts are also strengthening interoperability, energy efficiency, and audio-visual quality. As Bluetooth technology expands into emerging areas such as LE Audio, mesh networking, and automotive V2X communications, Bluetooth controllers are rapidly evolving to meet the demands of next-generation connectivity.

The US leads the Bluetooth controller market, driven by strong consumer electronics adoption, robust R&D, and the presence of major semiconductor players. A notable shift is Apple’s plan to develop its own in-house Bluetooth/Wi-Fi chip, Proxima, from 2025, manufactured by TSMC to enhance performance, integration, and supply chain resilience. Meanwhile, Japan is emerging as a key player, emphasizing innovation and standardization. Toshiba has encouraged greater participation in Bluetooth SIG initiatives to advance features such as LE Audio, mesh networking, and enhanced audio-visual synchronization, positioning Japan at the forefront of Bluetooth controller development.

Key Market Trends & Insights

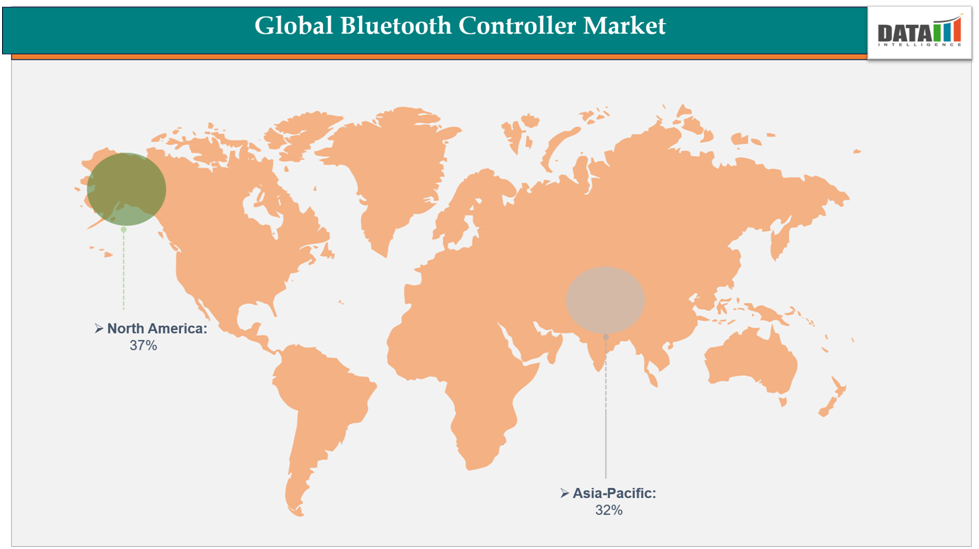

North America accounted for approximately 37% of the global Bluetooth controller market in 2024 and is expected to maintain its dominance throughout the forecast period. This leadership is supported by the region’s strong semiconductor base, high consumer electronics penetration, and growing adoption of Bluetooth technology in automotive, healthcare, and IoT applications. Steady investment in wireless communication technologies and R&D further reinforces the region’s role as a global leader.

Asia-Pacific is projected to be the fastest-growing region, driven by rising demand from consumer electronics, rapid smartphone adoption, and the increasing integration of Bluetooth solutions in industrial and automotive systems. The region’s strong manufacturing ecosystem, large consumer base, and government-backed digitalization programs continue to accelerate growth and establish Asia-Pacific as a key hub for Bluetooth innovation.

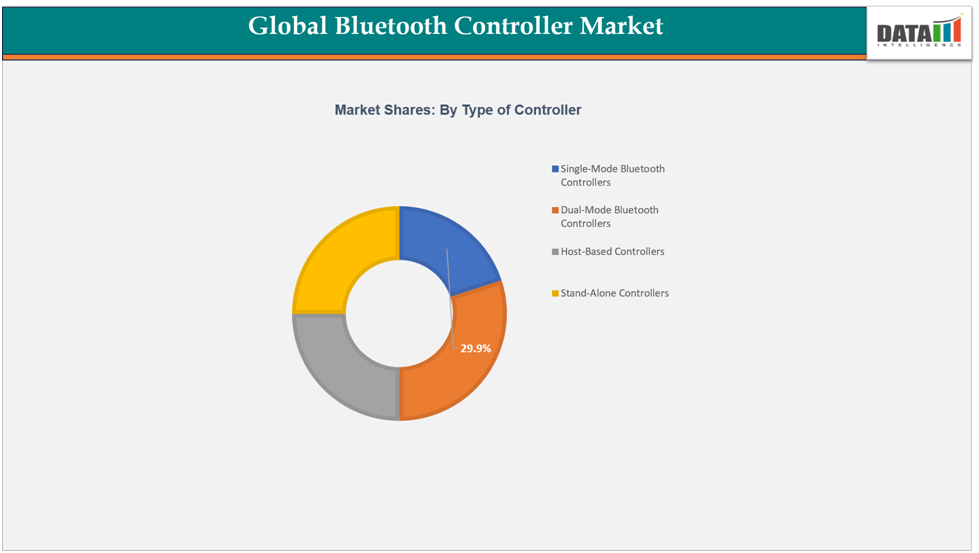

By controller type, dual-mode Bluetooth controllers hold the largest market share, owing to their ability to support both Classic Bluetooth and Bluetooth Low Energy (BLE). Their wide adoption across smartphones, wearables, audio devices, and automotive infotainment systems highlights their importance in ensuring seamless connectivity and efficient performance across multiple use cases.

Market Size & Forecast

2024 Market Size: US$ 3.57 billion

2033 Projected Market Size: US$ 6.59 billion

CAGR (2025–2033): 7.05%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising Adoption in Consumer Electronics and Automotive

The Bluetooth controller market is being driven by growing demand in consumer electronics, automotive systems, and wearables. High-performance, energy-efficient controllers are enabling seamless connectivity across devices like smartphones, smart speakers, automotive infotainment, and IoT gadgets. Innovations such as low-latency communication, AI-based power optimization, and improved audio-visual capabilities are further boosting growth.

For instance, Infineon Technologies expanded its Bluetooth portfolio with eight new products in the AIROC™ CYW20829 Bluetooth Low Energy 5.4 microcontroller family. These Systems-on-Chip (SoCs) and modules are optimized for industrial, consumer, and automotive applications. Their high integration reduces device footprint and bill-of-material costs, while features like secure boot, cryptography acceleration, and robust development support help designers create secure, efficient, and versatile Bluetooth-enabled devices.

Restraint: High Manufacturing Costs

High production and R&D expenses remain a key challenge for the Bluetooth controller market. Developing advanced controllers that support the latest standards, such as Bluetooth 5.4, LE Audio, and mesh networking, requires substantial investment in chip design, testing, and global standard compliance. Automotive and industrial applications, which demand strict safety and reliability certifications, further increase costs.

For instance, Broadcom has significantly increased R&D spending to develop dual-mode controllers with high-data-throughput capabilities, making them costly for smaller manufacturers and slowing adoption of next-generation solutions. Despite these costs, investments in highly integrated solutions and modular designs like Infineon’s CYW20829 MCU family help reduce the bill of materials and device footprint, enabling broader adoption and offsetting some of the financial burden for manufacturers.

For more details on this report - Request for Sample

Segmentation Analysis

The global Bluetooth controller market is segmented based on type of controllers, technology, connectivity range, end user and region.

Type of Controllers: The dual-mode Bluetooth controllers segment accounts for an estimated 29.2% of the global Bluetooth controller market.

The dual-mode Bluetooth controllers segment commands a substantial share of the global Bluetooth controller market, estimated at 29.2% in 2024. These controllers support both classic Bluetooth and Bluetooth Low Energy (BLE), allowing seamless connectivity across a broad spectrum of applications, including smartphones, laptops, wearables, audio devices, and automotive infotainment systems.

Their adaptability makes them ideal for devices requiring both high data throughput and low-power operation, such as smart home gadgets, wireless headphones, and health monitoring wearables. Growth in this segment is fueled by the rising adoption of IoT devices, integration of AI-driven power optimization, and demand for advanced features like Bluetooth LE Audio and mesh networking.

For instance, dual-mode controller use is in gaming peripherals. Many PS5 accessories, including the DualSense wireless controller, are compatible with multiple platforms such as PC, Mac, and mobile devices. The latest PS5 system update introduces functionality that allows DualSense and DualSense Edge controllers to connect to multiple devices simultaneously, enabling users to switch between them effortlessly without re-pairing. This demonstrates how dual-mode controllers enhance flexibility and improve user experience across diverse platforms.

Manufacturers continue to prioritize energy efficiency, miniaturization, and enhanced security to meet consumer and industrial needs. The widespread adoption of dual-mode controllers across various sectors underscores their vital role in advancing wireless communication technologies and driving the continued growth of the Bluetooth controller market.

Geographical Analysis

The North America Bluetooth controller market was valued at 37% market share in 2024

The North America Bluetooth controller market was valued at 37% of the global market share in 2024 and continues to be the largest regional contributor. Growth in the region is driven by the widespread adoption of consumer electronics, automotive systems, and industrial IoT applications. Companies are introducing innovative products to cater to diverse user needs

For instance, AirTurn recently launched the AirTurn MAV, a waterproof, wearable Bluetooth controller designed for adventurers and athletes requiring seamless media control on the move. Strong R&D capabilities, the presence of leading semiconductor firms, and initiatives like Apple’s development of its in-house Proxima Bluetooth/Wi-Fi chip further reinforce North America’s leadership in the global Bluetooth controller market. These advancements enhance device performance, integration, and supply chain resilience, making the region a hub for wireless connectivity innovation.

The Asia-Pacific Bluetooth controller market was valued at 32% market share in 2024

The Asia-Pacific Bluetooth controller market was valued at 32% of the global market share in 2024 and is projected to be the fastest-growing region. Growth is fueled by rising adoption of consumer electronics, gaming peripherals, automotive devices, and industrial applications across countries like Japan, China, and South Korea.

For instance, GuliKit, which recently launched its ES and ES PRO controllers next-generation gaming controllers designed for competitive play with low-latency wireless performance, advanced input precision, and broad cross-platform support. Priced at US$ 24.99 billion and US$ 29.99 billion respectively, these controllers exemplify the region’s emphasis on high-performance, affordable, and innovative wireless solutions. Government support, increasing commercial adoption, and technological innovation continue to drive Asia-Pacific’s expanding share in the global Bluetooth controller market.

Competitive Landscape

The major players in the Bluetooth controller market include Broadcom, Dell Inc., SAMSUNG, 8BitDo, Cosmic Byte, MediaTek, Nordic Semiconductor ASA, Infineon Technologies, STMicroelectronics, Realtek Semiconductor Corp.

Broadcom: Broadcom Inc. is a leading global semiconductor company specializing in high-performance wireless communication solutions, including Bluetooth controllers. The company provides a wide portfolio of single-mode and dual-mode Bluetooth chips, serving consumer electronics, automotive, industrial, and IoT applications. Broadcom’s Bluetooth controllers are known for their low power consumption, high data throughput, and robust connectivity, enabling seamless short-range wireless communication in smartphones, wearables, audio devices, and smart home systems. With strong R&D capabilities, strategic partnerships, and a global customer base, Broadcom continues to drive innovation and maintain a significant share of the global Bluetooth controller market.

Market Scope

Metrics | Details | |

|---|---|---|

CAGR | 7.05% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type of Controllers | Single-Mode Bluetooth Controllers, Dual-Mode Bluetooth Controllers, Host-Based Controllers, Stand-Alone Controllers |

| Technology | Bluetooth Classic (BR/EDR), Bluetooth Low Energy (BLE), Bluetooth 5.0 and above |

| Connectivity Range | Short-Range (<10m), Medium-Range (10–50m), Long-Range (>50m) |

| End User | Consumer Electronics, Automotive & Transportation, Healthcare & Medical Devices, IT & Telecommunications, Industrial & Manufacturing, Retail & Logistics, Defense & Aerospace |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Bluetooth controller market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more Bluetooth controller-related reports, please click here