Biopharmaceutical Tubing Market Size and Trends

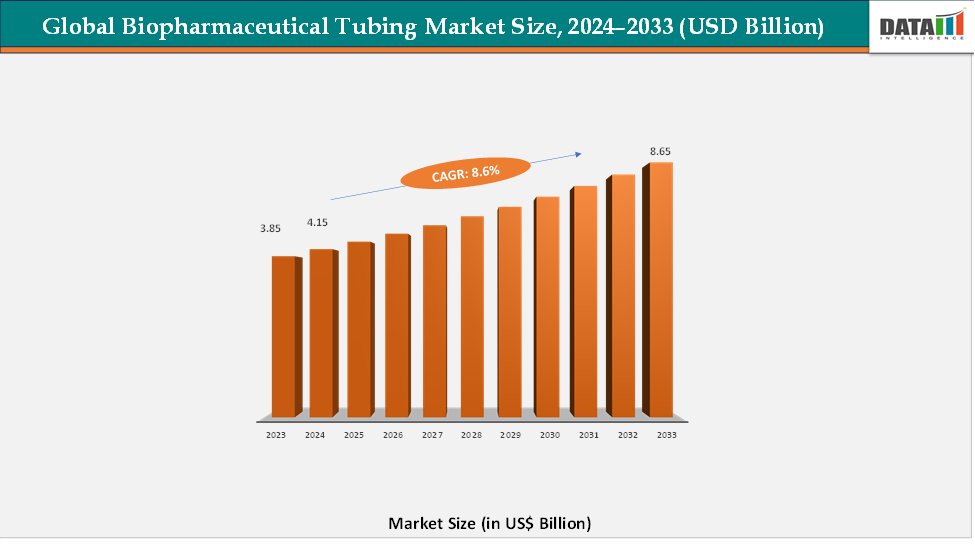

The global biopharmaceutical tubing market reached US$ 4.15 Billion in 2024 and is expected to reach US$ 8.65 Billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025-2033. The global biopharmaceutical tubing market is witnessing steady growth, driven by the expanding biopharmaceutical industry and the increasing demand for high-purity, contamination-free fluid transfer systems. The market is benefiting from the surge in biologics and cell & gene therapy production, where stringent hygiene and safety standards necessitate advanced tubing solutions. Rising adoption of single-use technologies, coupled with the growing shift toward flexible and efficient manufacturing processes, is fueling product innovation. Manufacturers are focusing on developing tubing with superior chemical resistance, durability, and biocompatibility to meet evolving industry standards. Additionally, the integration of automation, smart monitoring systems, and digital quality control in bioprocessing facilities is enhancing process efficiency and product integrity. The growing investment in biomanufacturing infrastructure, coupled with increased R&D in vaccine and therapeutic production, is further propelling the growth of the Biopharmaceutical Tubing Market globally.

Key Market highlights

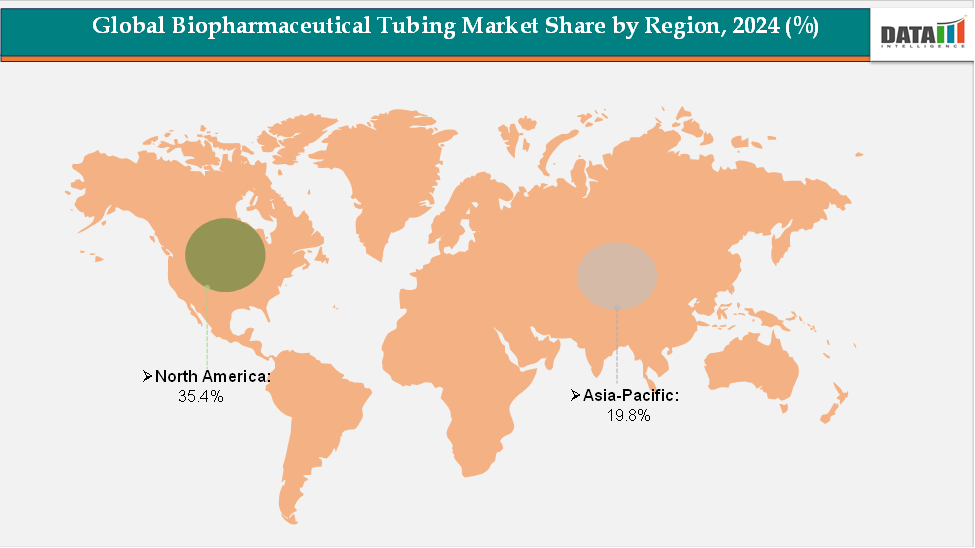

- North America accounted for approximately 35.4% of the global biopharmaceutical tubing market in 2024 and is expected to maintain its leading position throughout the forecast period. The region’s dominance is driven by the strong presence of established biopharmaceutical companies, advanced manufacturing capabilities, and high adoption of single-use systems.

- Asia-Pacific holds around 19.8% of the global market and is projected to be the fastest-growing region during the forecast period. Growth in the region is fueled by increasing investment in biomanufacturing infrastructure, expanding pharmaceutical production capacity, and growing government support for local biologics and vaccine development.

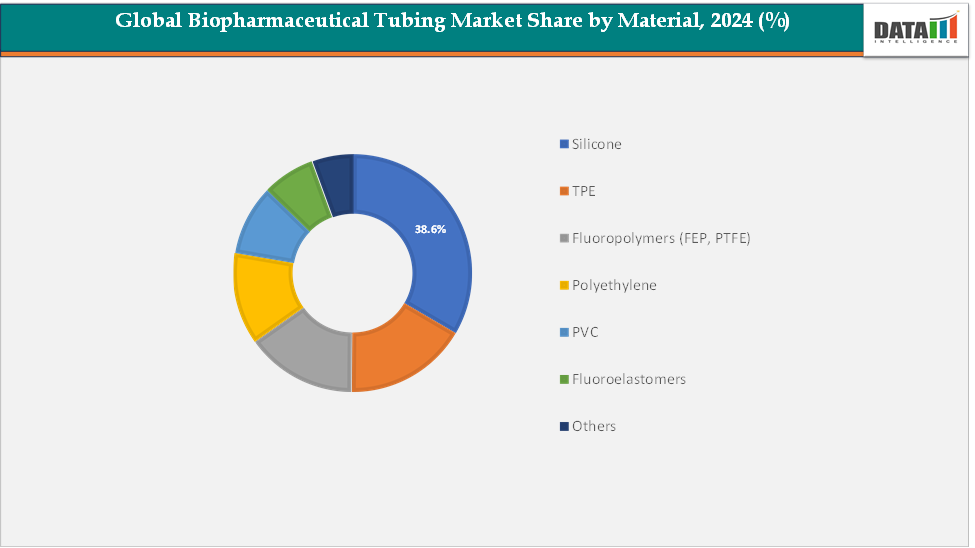

- By material type, silicone remains the dominant segment, accounting for approximately 38.6% of the global market in 2024. Its widespread use is attributed to its superior flexibility, chemical resistance, and biocompatibility, which make it ideal for critical applications such as fluid transfer, filtration, and filling in biopharmaceutical manufacturing.

Market Size & Forecast

- 2024 Market Size: US$4.15 billion

- 2033 Projected Market Size: US$8.65 billion

- CAGR (2025–2033): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics:

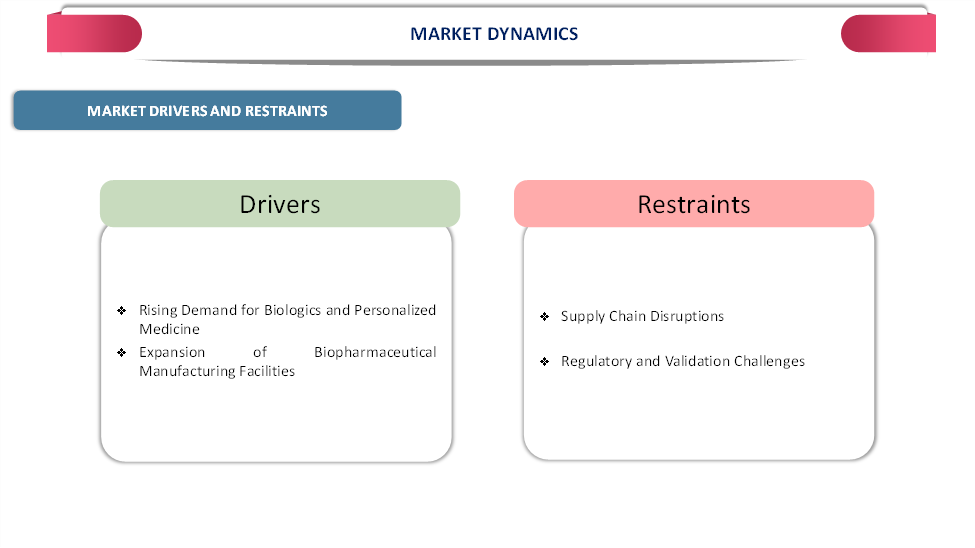

Driver: Rising Demand for Biologics and Personalized Medicine

The rising demand for biologics and personalized medicine is a key factor driving the growth of the biopharmaceutical tubing market. As the industry shifts from traditional small-molecule drugs to complex biologics such as monoclonal antibodies, vaccines, and cell and gene therapies, the need for high-performance tubing solutions that ensure sterile, contamination-free fluid transfer has intensified. Personalized medicine, which focuses on patient-specific treatments, requires flexible and scalable manufacturing systems capable of handling smaller, more specialized production batches.

Biopharmaceutical tubing plays a crucial role in maintaining process integrity, product purity, and regulatory compliance in these advanced therapeutic manufacturing processes. This growing focus on precision medicine and biologics development is prompting manufacturers to invest in advanced tubing materials and single-use technologies, further boosting market expansion.

Restraint: Supply Chain Disruptions

Supply chain disruptions are expected to hamper the growth of the biopharmaceutical tubing market by creating delays and inconsistencies in the availability of critical raw materials such as silicone, TPE, and PVC used in tubing production. The biopharmaceutical industry relies heavily on a consistent supply of high-quality materials that meet stringent regulatory standards, and any interruption can affect production timelines and product quality.

For more details on this report, Request for Sample

Global Biopharmaceutical Tubing Market Segmentation Analysis

The global biopharmaceutical tubing market is segmented by material, usage, application, end-user and region.

Material: The silicone segment is estimated to have 38.6% of the biopharmaceutical tubing market share.

Silicone is currently dominating the biopharmaceutical tubing market due to its exceptional biocompatibility, flexibility, and resistance to extreme temperatures and chemicals. It has become the material of choice for critical fluid transfer applications in biopharmaceutical production, including filtration, fermentation, and drug filling. Its inert nature ensures that there is no interaction between the tubing material and sensitive biologic products, maintaining product purity and integrity.

Additionally, silicone tubing offers superior sterilization compatibility with autoclaving and gamma irradiation, making it ideal for both reusable and single-use systems. The long-standing trust in silicone’s performance, coupled with its compliance with global regulatory standards, continues to reinforce its dominance across biopharmaceutical manufacturing facilities worldwide.

The TPE segment is estimated to have 24.8% of the biopharmaceutical tubing market share.

Thermoplastic elastomer (TPE) tubing is emerging as the fastest-growing segment in the Biopharmaceutical Tubing Market, driven by its versatility, cost-effectiveness, and ease of processing. TPE combines the flexibility of rubber with the recyclability and weldability of thermoplastics, making it highly suitable for modern single-use systems. Its ability to be heat-sealed, welded, and customized for various applications without the need for adhesives enhances process efficiency and reduces contamination risks.

Moreover, TPE tubing offers excellent clarity, durability, and compatibility with a wide range of bioprocessing fluids. As the industry moves toward sustainable and disposable solutions to streamline operations and minimize cross-contamination, TPE is rapidly gaining traction among biopharmaceutical manufacturers seeking efficient and scalable tubing alternatives.

Global Biopharmaceutical Tubing Market, Geographical Analysis

The North America biopharmaceutical tubing market was valued at 35.4% market share in 2024

North America is dominant in the global biopharmaceutical tubing market, driven by its advanced pharmaceutical and biotechnology infrastructure, significant R&D investment, and early adoption of single-use technologies. The growing demand for biologics, personalized medicine, and cell and gene therapies has further accelerated the need for reliable, regulatory-compliant tubing systems.

The region has many of the world’s leading biopharmaceutical companies and contract development and manufacturing organizations (CDMOs), which rely heavily on high-performance tubing for sterile fluid transfer, processing, and drug delivery. In recent years, the U.S. has seen a remarkable surge in biopharmaceutical production capacity. As of April 2023, biopharmaceutical companies and their suppliers operated 1,580 manufacturing facilities across 48 states and Puerto Rico. This expansion shows a broader national push to enhance domestic biopharmaceutical capabilities. This expanding manufacturing footprint directly increases the demand for high-performance biopharmaceutical tubing, which is vital for sterile fluid transfer, single-use systems, and advanced bioprocessing workflows. As production scales up to support next-generation therapies and complex biologics, the need for reliable, regulatory-compliant tubing solutions continues to grow in parallel.

In addition, North America benefits from a strong regulatory framework that emphasizes safety, quality, and innovation in drug manufacturing processes. This drives continuous adoption of advanced tubing materials such as silicone, TPE, and fluoropolymers that meet stringent USP Class VI and ISO standards. The rising incidence of chronic diseases, along with increasing production of monoclonal antibodies and vaccines, is also contributing to market expansion.

The European biopharmaceutical tubing market was valued at 23.2% market share in 2024

Europe holds a significant position in the biopharmaceutical tubing market, supported by its strong biopharmaceutical manufacturing base, well-established healthcare infrastructure, and stringent regulatory standards ensuring high product quality. The region is home to several leading biopharma companies and research institutions engaged in the development of advanced biologics, vaccines, and cell and gene therapies, all of which require reliable and high-purity tubing systems. Continuous investments in expanding bioprocessing facilities, coupled with favorable government initiatives to promote pharmaceutical innovation, are further driving market demand. Additionally, the increasing adoption of single-use technologies and automation in biomanufacturing processes across countries such as Germany, the U.K., and France is reinforcing Europe’s leadership in the global market.

The Asia-Pacific biopharmaceutical tubing market was valued at 19.8% market share in 2024

Asia-Pacific is expected to be the fastest-growing region in the biopharmaceutical tubing Market, fueled by rapid expansion of the biopharmaceutical sector and increasing investments in healthcare infrastructure. Countries such as China, India, South Korea, and Japan are witnessing a surge in biologics and biosimilar production, supported by favorable government policies and the growing presence of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs). The rising focus on cost-effective bioprocessing solutions, coupled with a growing patient base and rising healthcare expenditure, is driving strong regional growth. Furthermore, the increasing adoption of single-use systems, advancements in local tubing manufacturing capabilities, and collaborations with global players are positioning Asia-Pacific as a key hub for future market expansion in biopharmaceutical tubing.

Competitive Landscape

The major players in the biopharmaceutical tubing market include W. L. Gore & Associates, Inc., DuPont de Nemours, Inc., Holland Applied Technologies, Saint-Gobain Life Sciences, AdvantaPure, Freudenberg Medical, Kent Elastomer Products, Fusion-Polymer, Accuflow Systems, Liquidyne Process Technologies, Inc., among others.

Key Developments:

- In March 2025, NewAge Industries, Inc., the parent company of AdvantaPure and NewAge Performance Products, entered into a strategic collaboration with Carolina Components Group, Inc. (CCG) to co-develop and co-market eco-friendly solutions tailored for single-use biopharmaceutical manufacturing. This partnership will initially focus on a new line of Thermoplastic Elastomer (TPE) tubing designed to reduce carbon footprints significantly, support sustainability-focused purchasing, meet emerging regulatory standards, and advance progress toward a circular economy.

- In April 2025, DuPont unveiled its latest innovation in biopharmaceutical processing: the DuPont Liveo Pharma TPE Ultra‑Low Temp Tubing. Engineered for applications demanding extremely low temperatures, this new thermoplastic elastomer tubing is sterilizable, weldable, and sealable.

- In July 2025, Pune-based startup PharmNXT Biotech expands its global reach and capabilities with the acquisition of Ireland-based Defined Tubing Routing (DTR), a recognized leader in advanced bioprocess tubing solutions. This strategic move gives PharmNXT access to DTR’s innovative tubing-routing technology tailored for single-use systems. The acquisition significantly enhances PharmNXT’s capacity to deliver more customized, technically sophisticated offerings to pharmaceutical and biopharma clients.

Market Scope

| Metrics | Details | |

| CAGR | 8.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Silicone, TPE, Fluoropolymers (FEP, PTFE), Polyethylene, PVC, Fluoroelastomers, Others |

| Usage | Single-use, Multi-use | |

| Application | Fluid Transfers in Bioprocess and Biomanufacturing, Single-use Assemblies, Peristaltic Pump Applications, Aseptic Connection and Disconnection Without Connectors, Others | |

| End-User | Biotechnology Companies, Pharmaceutical Companies, Contract Development and Manufacturing Organizations (CDMOs), Research Laboratories | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global biopharmaceutical tubing market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here