Bioequivalence Studies Market Size & Industry Outlook

The global bioequivalence studies market size was US$ 701.70 Million in 2024 and is expected to reach US$ 1349.06 Million by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The increasing regulatory support for model-informed strategies, the rapid advancement of digital technologies in research and development, and the growth of the biosimulation market are key drivers behind the expansion of the bioequivalence studies market. Regulatory bodies like the FDA and EMA are progressively promoting model-informed drug development (MIDD) to improve decision-making, cut down on clinical trial expenses, and speed up the approval process. The digital transformation of pharmaceutical R&D allows for the incorporation of AI, machine learning, and sophisticated simulation tools, enhancing the precision and efficiency of study designs. At the same time, the growth of the global biosimulation market offers access to cutting-edge software platforms for conducting virtual bioequivalence assessments, thereby reducing dependence on lengthy in vivo trials.

Key Highlights

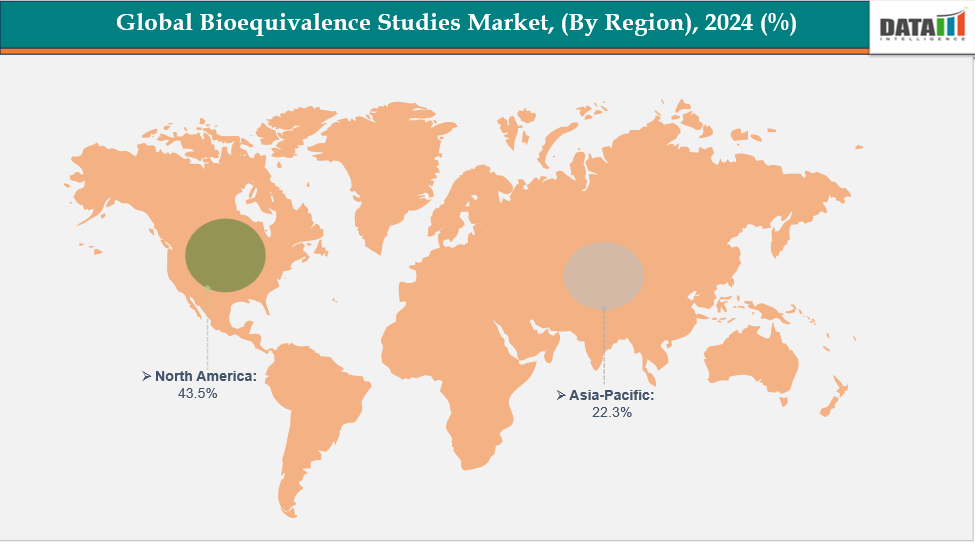

- North America dominates the bioequivalence studies market with the largest revenue share of 43.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.4% over the forecast period.

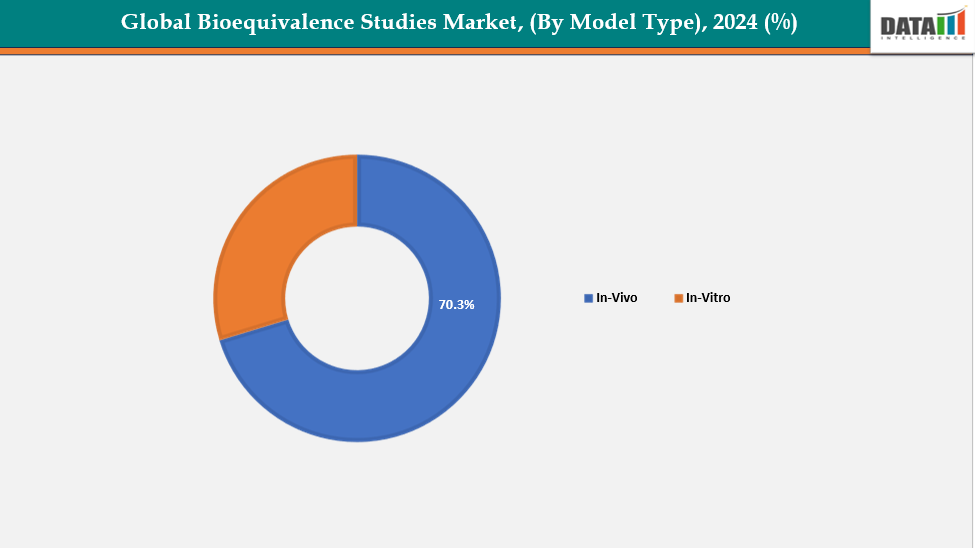

- The in-vivo studies are dominating the bioequivalence studies market with a 70.3% share in 2024

- The oncology segment from the application is dominating the bioequivalence studies market with a 48.3% share in 2024

- Top companies in the bioequivalence studies market include Certara, Simulations Plus, Open Systems Pharmacology, APL Software and Pharma Consulting Company, IntiQuan AG, Evotec, Dassault Systèmes, Thermo Fisher Scientific Inc., The MathWorks, Inc., Pumas-AI Inc., and ICON plc, among others.

Market Dynamics

Drivers: Technical advances in PBPK, PBBM, and computing are significantly driving the bioequivalence studies market growth.

Advancements in Physiologically Based Pharmacokinetic (PBPK) and Physiologically Based Biopharmaceutics Modeling (PBBM) significantly propel the bioequivalence studies market. Contemporary PBPK and PBBM platforms employ improved algorithms, comprehensive physiological databases, and advanced computing power to more accurately simulate the processes of drug absorption, distribution, metabolism, and excretion. For instance, in May 2024, Simulations Plus, Inc. launched GastroPlus X (GPX), the next-generation PBPK/PBBM modeling and simulation software. It featured advanced algorithms, integrated machine learning, and an enhanced user interface that delivered faster processing, intuitive workflows, and improved accuracy for pharmaceutical modeling and bioequivalence studies.

Furthermore, these innovations enable scientists to virtually predict human bioequivalence, minimizing the necessity for expensive and lengthy clinical trials. The integration of cloud computing and machine learning enhances the accuracy and scalability of models.

Restraints: Model validation and data-quality requirements are expected to hamper the growth the bioequivalence studies market.

The advancement of the bioequivalence studies market is significantly hindered by model validation and data quality standards. The effectiveness of these simulators relies on precise physiological, pharmacokinetic, and formulation information to yield dependable outcomes. Inadequate or subpar input data can result in erroneous predictions, thereby diminishing trust among researchers and regulatory bodies.

Additionally, every model is required to go through thorough validation to demonstrate its accuracy when compared to actual clinical data, a process that is both time-intensive and expensive. Smaller or mid-sized firms frequently do not have the necessary expertise and resources to carry out these validation procedures. Consequently, the uptake of simulation tools is hindered, as regulatory bodies will only accept models that have been well-validated.

For more details on this report, see Request for Sample

Bioequivalence Studies Market, Segmentation Analysis

The global bioequivalence studies market is segmented based on study type, application, end user, and region

By Study Type: The in vivo studies segment is dominating the bioequivalence studies market with a 70.3% share in 2024

The in vivo studies segment leads the global bioequivalence studies market as it is considered the gold standard for evaluating the therapeutic equivalence of generic medications in real physiological settings. These studies yield precise pharmacokinetic information regarding absorption, distribution, metabolism, and excretion, which are crucial for confirming safety and efficacy. Regulatory bodies like the U.S. FDA, EMA, and CDSCO require in vivo bioequivalence trials for the majority of drug approvals, further emphasizing their significance.

Furthermore, progress in software development and updates for various in-vivo studies for modeling enhance its dominance. For instance, In April 2025, Certara, Inc. released an enhanced version of its Simcyp Simulator, advancing biopharmaceutics, drug-drug interaction, and biologic modeling capabilities, further strengthening its leadership in PBPK modeling and supporting data-driven regulatory decision-making across drug development stages.

By Application: The oncology segment is dominating the bioequivalence studies market with a 48.3% share in 2024

The oncology sector leads the global bioequivalence studies market due to the increasing need for effective and safer cancer treatments and the swift advancement of generic oncology medications. Treatments for cancer frequently involve complicated formulations and narrow therapeutic windows, necessitating accurate evaluation of drug absorption, distribution, metabolism, and excretion. Bioequivalence simulators allow researchers to effectively model these parameters, minimizing the requirement for extensive clinical trials and expediting regulatory submissions.

Moreover, the rising incidence of cancer worldwide, for instance, according to AACR, about 2,001,140 new cancer cases were diagnosed in the U.S. in 2024, reaching 35 million globally by 2050. This, coupled with increasing R&D investments in oncology drug development, has driven pharmaceutical companies to adopt advanced simulation tools like PBPK modeling.

Bioequivalence Studies Market, Geographical Analysis

North America is expected to dominate the global bioequivalence studies market with 43.5% in 2024

The North American market leads in bioequivalence studies, due to its well-established pharmaceutical infrastructure, robust research and development capabilities, and the early implementation of computational modeling and artificial intelligence. Increasing investments in drug development, regulatory support for model-informed drug design, and a rising demand for quicker, more affordable clinical evaluations are further propelling growth in the region.

The United States is at the forefront of the bioequivalence studies market, backed by robust FDA funding, government assistance, cutting-edge computational resources, swift implementation of AI, and novel, efficient methods for drug development that expedite regulatory approval. For instance, in October 2024, Simulations Plus, Inc., in collaboration with the University of Strathclyde and InnoGI Technologies, received an FDA grant to enhance understanding of amorphous solid dispersions and predict food and pH-dependent drug-drug interactions using mechanistic modeling and simulation.

Europe is the second region after North America, which is expected to dominate the global bioequivalence studies market with 34.5% in 2024

The market for bioequivalence studies in Europe is growing rapidly, particularly led by Germany, the UK, and France. The presence of advanced computing infrastructure, a strong embrace of AI, and robust support from the EMA and EU regulations, combined with a rise in collaborations and strategic alliances, are promoting efficient, innovative, and cost-effective drug development throughout the region.

Owing to the factors like strong EMA and EU regulatory support. For instance, in August 2025, Certara, Inc., a global leader in biosimulation, achieved a major milestone when the European Medicines Agency (EMA) formally qualified its Simcyp Simulator for regulatory submissions, making it the first and only PBPK modeling software platform to receive this prestigious EMA qualification opinion.

The Asia Pacific region is the fastest-growing region in the global bioequivalence studies market, with a CAGR of 7.4% in 2024.

The market for bioequivalence studies in the Asia-Pacific area, encompassing China, India, Japan, and South Korea, is experiencing significant growth. This growth is driven by the increasing use of AI, governmental backing for digital health programs, enhanced research facilities, and a growing recognition of simulation-based drug development aimed at improving clinical efficiency, lowering expenses, and speeding up innovation.

Bioequivalence Studies Market Competitive Landscape

Top companies in the bioequivalence studies market include Certara, Simulations Plus, Open Systems Pharmacology, APL Software and Pharma Consulting Company, IntiQuan AG, Evotec, Dassault Systèmes, Thermo Fisher Scientific Inc., The MathWorks, Inc., Pumas-AI Inc., and ICON plc among others.

Certara: Certara, Inc. is a global leader in biosimulation and model-informed drug development, offering advanced solutions like the Simcyp Simulator for bioequivalence and bioavailability studies. Its PBPK and biopharmaceutics modeling platforms enable virtual bioequivalence assessments, optimize formulation development, and support regulatory submissions worldwide, strengthening its leadership in simulation-driven, efficient, and cost-effective drug development.

Key Developments:

- In July 2025, Simulations Plus, Inc., in collaboration with the Institute of Medical Biology of the Polish Academy of Sciences, announced published results in ACS Medicinal Chemistry Letters, validating its AI-driven ADMET Predictor models and demonstrating significant advancements in artificial intelligence-based drug design and biosimulation research.

- In March 2025, Certara, Inc., a global leader in model-informed drug development, formed a strategic partnership with Biowaived, a biopharmaceutics and dissolution CRO, combining Certara’s advanced simulation tools with Biowaived’s experimental expertise to deliver integrated biopharmaceutics, formulation, and bioequivalence solutions that streamline drug development processes.

Bioequivalence Studies Market Scope

| Metrics | Details | |

| CAGR | 7.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Study Type | In Vivo, In Vitro |

| By Application | Oncology, Cardiovascular Disease, Central Nervous System (CNS) Disorders, Infectious Diseases, Others | |

| By End User | Pharmaceutical Companies, Contract Research Organizations, Research Institutes, Research Laboratories | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global bioequivalence studies market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more healthcare IT-related reports, please click here