Bioanalytical Testing Services Market Size& Industry Outlook

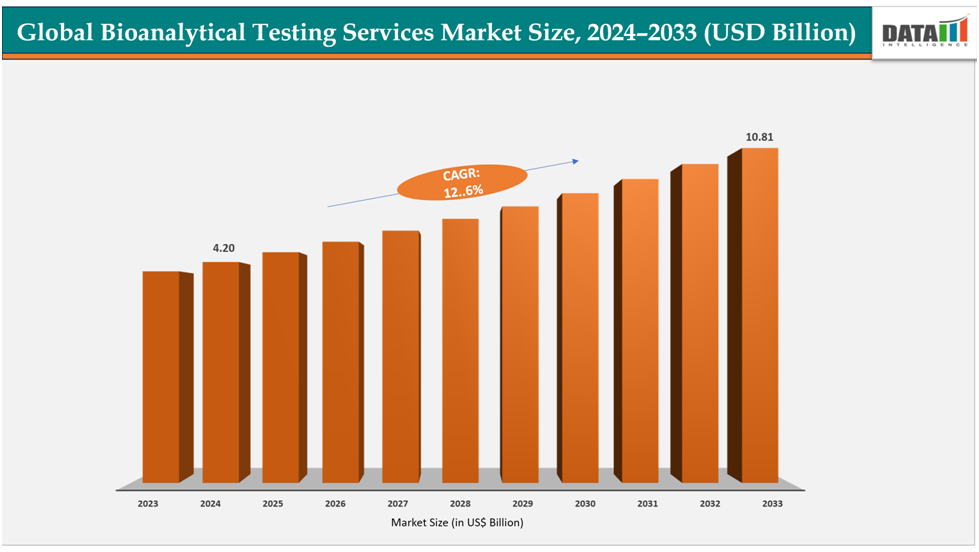

The global bioanalytical testing services market size reached US$ 3.80billion with rise of US$4.20billion in 2024 is expected to reach US$ 10.81billion by 2033, growing at a CAGR of 12.6%during the forecast period 2025-2033.

The bioanalytical testing services market is changing quickly as the use of biologics, biosimilars, and personalized medicines grows, all of which require specialized analytical support. With more chronic diseases and increasingly complex drug pipelines, the need for services like PK/PD, ADME, bioavailability, and biomarker testing is growing steadily.

New technologies such as high-resolution mass spectrometry, automation, and AI-based tools are making testing faster, more accurate, and more consistent. At the same time, strict regulations from agencies such as the FDA and EMA require strong bioanalytical validation for drug approvals, making these services essential. Many pharma and biotech companies are outsourcing this work to CROs and CDMOs to save costs and gain access to advanced expertise.

Key Highlights

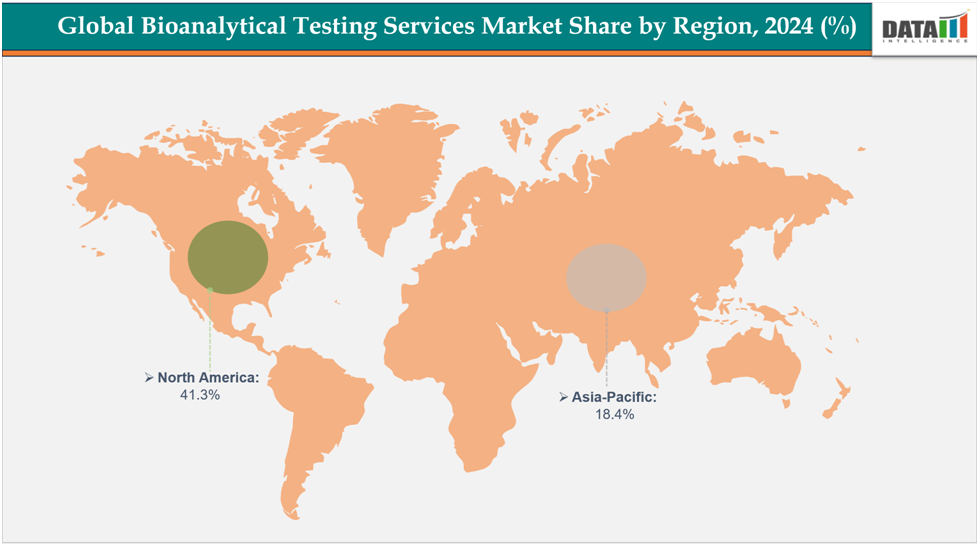

- North America dominates the bioanalytical testing services market with the largest revenue share of 41.3% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.1% over the forecast period.

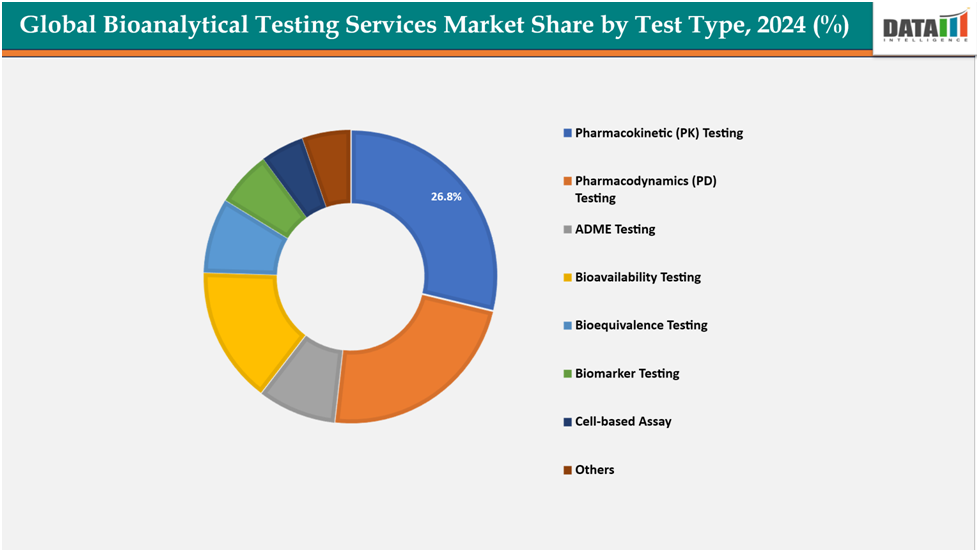

- Based on test type, pharmacokinetic testing segmented the market with the largest revenue share of 26.8% in 2024.

- The major market players in the SGS Société Générale de Surveillance SA, Eurofins Scientific, Lonza, Charles River Laboratories, Syneos Health, ICON plc, IQVIA, WuXi AppTec, Intertek Group Plc., Thermo Fisher Scientific Inc.and among others.

Market Dynamics

Drivers: Rising demand for biologics and biosimilars is significantly driving the bioanalytical testing services market growth

The rising demand for biologics and biosimilars is one of the strongest drivers of the global bioanalytical testing services market, as these complex therapies require highly specialized analytical approaches to ensure safety, efficacy, and regulatory compliance. Unlike traditional small molecules, biologics such as monoclonal antibodies, recombinant proteins, and cell or gene therapies involve larger, more intricate structures that need advanced methods like ligand-binding assays, hybrid LC–MS/MS workflows, and immunogenicity testing for accurate characterization.

Similarly, the surge in biosimilar development driven by patent expiries of blockbuster biologics has intensified the need for bioanalytical services to conduct comparative pharmacokinetic, pharmacodynamic, and bioequivalence studies. For instance, the increasing number of biosimilar approvals in the U.S. and Europe has led companies to expand partnerships with CROs and specialized labs to accelerate time-to-market. This growing reliance on bioanalytical testing for biologics and biosimilars not only expands service demand but also pushes providers to continuously upgrade technologies and global capacities.

Restraints: Regulatory challenges are hampering the growth of the bioanalytical testing services market

A key regulatory challenge in the global bioanalytical testing services market is the complexity and variability of compliance requirements across different regions. Regulatory agencies such as the FDA (U.S.), EMA (Europe), and PMDA (Japan) have strict guidelines for bioanalytical method validation, data integrity, and reporting, but variations in interpretation and implementation can create hurdles for service providers operating globally.

Meeting evolving standards, such as ICH M10 for bioanalytical method validation, requires continuous investment in updated technologies, staff training, and robust quality management systems. Additionally, the growing complexity of biologics, cell and gene therapies, and novel modalities demands more sophisticated assays and validation strategies, further intensifying regulatory scrutiny. Ensuring consistent compliance across multiple studies and geographies adds cost, time, and operational challenges for CROs and pharma companies alike.

For more details on this report – Request for Sample

Segmentation Analysis

The global bioanalytical testing services market is segmented based on test type, molecule type, end user, and region.

Test Type:

The pharmacokinetic (PK) testing from test type segment to dominate the bioanalytical testing services market with a 26.8% share in 2024

The pharmacokinetic (PK) testing segment is driven by the growing importance of understanding drug absorption, distribution, metabolism, and excretion (ADME) profiles during drug development. Regulatory authorities increasingly require comprehensive PK data to ensure drug safety and efficacy, especially for complex biologics and biosimilars. The rising number of clinical trials across all phases, coupled with the push for personalized medicine and precision dosing, further boosts demand for PK studies. Additionally, the integration of advanced analytical technologies such as LC-MS/MS, high-resolution mass spectrometry, and hybrid bioanalytical methods is enhancing sensitivity, throughput, and reproducibility in PK testing, making it a critical driver in this market.

Molecule Type: The large molecule segment is estimated to have a 68.2% of the bioanalytical testing services market share in 2024

The large molecule segment is driven by the continued dominance of traditional pharmaceuticals, which still account for a significant share of global drug pipelines. Despite the rise of biologics, large molecules remain vital due to their lower cost of development, oral bioavailability, ease of manufacturing, and wide therapeutic applicability in conditions such as oncology, cardiovascular, and infectious diseases. Increasing demand for generics and biosimilars also fuels the need for robust large molecule bioanalytical testing, including bioequivalence and bioavailability studies. Advances in chromatographic techniques, mass spectrometry, and automation are further supporting faster and more accurate analysis of large molecules, reinforcing growth in this segment.

Geographical Analysis

North America dominates the global bioanalytical testing services market with a 41.3% in 2024

North America is dominant in the bioanalytical testing services market, driven by its strong pharmaceutical and biotechnology industry, high R&D expenditure, and early adoption of advanced analytical technologies. The region benefits from a well-established regulatory framework by the FDA, which mandates rigorous PK/PD, ADME, bioavailability, and bioequivalence studies for drug approval, fueling steady demand for testing services.

The surge in biologics and biosimilars is accelerating the growth of the U.S. bioanalytical testing services market, as these complex therapies demand extensive pharmacokinetic, immunogenicity, and biomarker-based studies to ensure safety and regulatory compliance. Increasing adoption of precision medicine and the rising role of biomarkers are further strengthening the need for specialized testing, supported by a strong ecosystem of CROs and CDMOs offering advanced capabilities. The U.S. biologics market has expanded at an average annual rate of 12.5% over the last five years on an invoice-price basis and now accounts for 46% of total drug spending, which is significantly boosting demand for bioanalytical services across the region.

Europe is the second region after North America which is expected to dominate the global bioanalytical testing services market with a 34.5% in 2024

Germany remains one of the strongest hubs for bioanalytical testing in Europe, supported by a well-established pharmaceutical and biotechnology sector, advanced clinical trial infrastructure, and strict regulatory standards. The market is driven by the rising need for outsourcing bioanalytical services such as method development, validation, and bioequivalence testing, especially for biologics and biosimilars.

Adoption of high-sensitivity analytical technologies, digitalization of laboratory processes, and harmonized regulatory guidelines further strengthen growth. Increasing healthcare spending and growing demand for complex therapies, including cell and gene therapies, also fuel the need for advanced testing services in Germany and across Europe.

The Asia Pacific region is the fastest-growing region in the global bioanalytical testing services market, with a CAGR of 7.1% in 2024

The Asia-Pacific region is experiencing rapid growth in bioanalytical testing services due to expanding pharmaceutical R&D investments, government support, and increasing clinical trial activity. Rising incidences of chronic diseases, coupled with aging populations, create a higher demand for novel therapies and diagnostics, which in turn drives the need for advanced bioanalytical support. Many regional pharmaceutical and biotech firms are outsourcing bioanalytical services to CROs, boosting the outsourcing trend. The adoption of automation, high-throughput assays, and advanced mass spectrometry technologies is enhancing testing capabilities. Moreover, growing alignment with international regulatory standards is helping Asia-Pacific laboratories meet global drug approval requirements.

In Japan, the bioanalytical testing services market is driven by strong government support for biopharmaceutical innovation, an aging population, and a growing demand for precision medicine. The high prevalence of chronic and age-related diseases increases the need for sophisticated testing solutions to support new drug development. Rising investment in biologics and biosimilars is fueling demand for complex bioanalytical methods, including ligand binding assays, immunogenicity testing, and cell-based assays. Japan is also adopting advanced technologies such as next-generation sequencing and high-resolution mass spectrometry to improve data quality and speed.

Competitive Landscape

Top companies in the bioanalytical testing services market include SGS Société Générale de Surveillance SA, Eurofins Scientific, Lonza, Charles River Laboratories, Syneos Health, ICON plc, IQVIA, WuXi AppTec, Intertek Group Plc., Thermo Fisher Scientific Inc.and among others.

SGS Société Générale de Surveillance SA:SGS S.A. plays a significant and expanding role in the global bioanalytical testing services market, acting as one of the key players providing comprehensive, regulated, and high-quality bioanalytical support across the drug development lifecycle. They offer services such as method development, transfer, and validation; PK (pharmacokinetics) and PD (pharmacodynamics) bioanalysis; immunogenicity testing; ELISA and multiplex assays; and hybrid bioassays (e.g. combining ligand binding assays and LC-MS/MS) among others.

Key Developments:

- In August 2024, SGS expanded its bioanalytical testing services in North America with a new state-of-the-art lab in Hudson, New Hampshire, near the Boston biotech hub. The facility, developed in partnership with Agilex Biolabs, offers comprehensive solutions spanning discovery to Phase 1–3 clinical trials, including PK/PD analysis, immunogenicity testing, ELISA, multiplex assays, and bioassays.

- In October 2024, Ardena, a specialist CDMO with GMP facilities across Belgium, Spain, the Netherlands, and Sweden, announced the expansion of its bioanalytical services in the Netherlands. The investment includes a new bioanalytical lab at the Pivot Park facility in Oss and enhanced GLP capabilities at its Bioanalytical Center of Excellence in Assen, strengthening capacity to meet growing demand for advanced bioanalytical solutions.

Market Scope

| Metrics | Details | |

| CAGR | 12.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Test Type | Pharmacokinetic (PK) Testing, Pharmacodynamics (PD) Testing, ADME Testing, Bioavailability Testing, Bioequivalence Testing, Biomarker Testing, Cell-based Assay, Others |

| Molecule Type | Small Molecule, Large Molecule | |

| End User | Biopharmaceutical Companies, Clinical Research Organizations, Contract Development and Manufacturing Organization (CDMO) | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global bioanalytical testing services market report delivers a detailed analysis with 62 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.