Balloon Valvuloplasty Devices Market Size

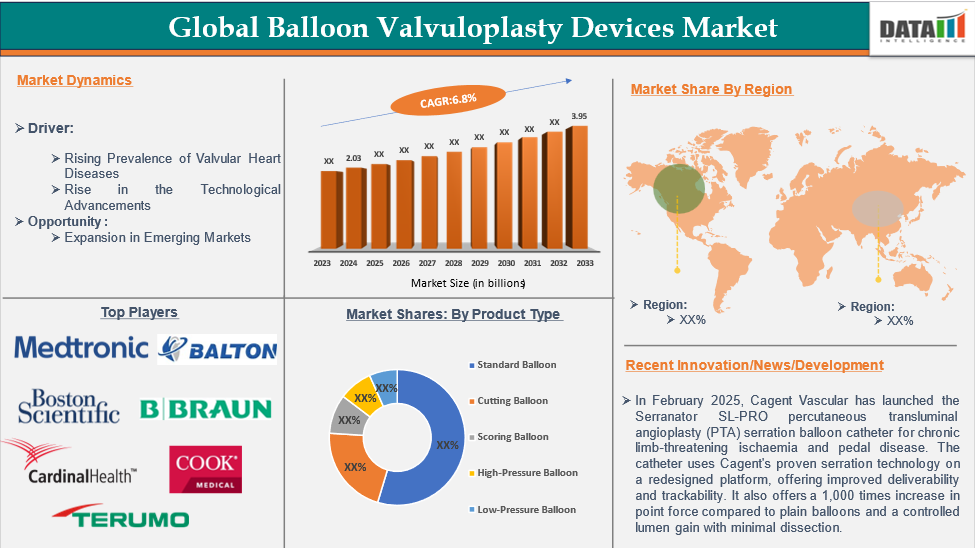

The global balloon valvuloplasty devices market reached US$ 2.03 billion in 2024 and is expected to reach US$ 3.95 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033.

Balloon valvuloplasty devices are medical devices used to treat valvular stenosis, a narrowing of heart valves. They widen the valve opening, improve blood flow, and reduce symptoms. They're commonly used in interventional cardiology for symptom relief, shorter recovery times, and reduced hospitalization duration.

Executive Summary

Market Dynamics: Drivers & Restraints

Rising Prevalence of Valvular Heart Diseases

The global balloon valvuloplasty devices market is driven by the increasing prevalence of valvular heart diseases, such as aortic stenosis, mitral stenosis, and pulmonary valve disorders. The aging population and lifestyle-related risk factors like hypertension, diabetes, obesity, and smoking further exacerbate these conditions. Balloon valvuloplasty is a minimally invasive alternative to surgical valve replacement, offering benefits like shorter hospital stays, faster recovery times, and reduced post-operative complications.

For instance, valvular heart disease, a global cardiovascular disease, is increasing globally, with rheumatic heart disease, the most common, affecting 41 million people, increasing in developing nations. This is due to the growth of the young adult population and improved access to antibiotics, microbiological testing, and echocardiography, which have reduced premature mortality rates.

Risk of Restenosis and Procedural Complications

The global balloon valvuloplasty devices market faces challenges due to restenosis and other procedural complications. Restenosis, the re-narrowing of the treated valve after the procedure, often requires repeat interventions, burdening patients and healthcare systems. This is particularly evident in elderly patients or those with severe calcification, where the procedure's effectiveness may be temporary.

Other risks include vascular complications, embolization, arrhythmias, and valve regurgitation, leading to adverse patient outcomes. The potential for complications makes healthcare providers hesitant to adopt the procedure widely, especially when more durable alternatives like surgical valve replacement are available. The availability of alternative treatment options, such as transcatheter aortic valve replacement (TAVR), may also limit the growth of the balloon valvuloplasty devices market.

Segment Analysis

The global balloon valvuloplasty devices market is segmented based on product type, application, age group, end user, and region.

Product Type:

The standard balloon from product type segment is expected to dominate the balloon valvuloplasty devices market with the highest market share

Standard balloons are medical devices used in balloon valvuloplasty to dilate narrowed heart valves, restoring blood flow in patients with valvular stenosis. These high-strength balloons, available in various sizes and diameters, are delivered via catheter-based systems and inflated to break calcific deposits, improving valve function in high-risk patients not candidates for open-heart surgery.

The balloon valvuloplasty devices market is growing due to the increasing prevalence of valvular heart diseases, preference for minimally invasive procedures, technological advancements, expanding healthcare infrastructure, and government initiatives. Benefits include reduced hospital stays, faster recovery times, and fewer post-operative complications. Technological advancements and improved access to interventional cardiology in developing regions further support market growth.

Geographical Analysis

North America is expected to hold a significant position in the balloon valvuloplasty devices market with the highest market share

The North American balloon valvuloplasty devices market is growing due to the increasing prevalence of valvular heart diseases, especially among the aging population. Technological advancements and favorable reimbursement policies are driving innovation. Increased awareness among healthcare professionals and patients, coupled with rising healthcare expenditure and government support for cardiovascular disease management, is expected to further accelerate market growth in North America.

For instance, in January 2025, Concept Medical has enrolled the first patient in its MAGICAL trial, comparing its sirolimus-coated balloon to traditional angioplasty for patients with below-the-knee PDA. The company secured an Investigational Device Exemption from the FDA for the MagicTouch PTA and is launching two more trials to evaluate its drug-coated alternative.

Competitive Landscape

The major global players in the balloon valvuloplasty devices market include Medtronic, Balton, Boston Scientific Corporation, B. Braun Melsungen AG, Cardinal Health, Inc., Cook Medical Inc., Terumo Corporation, Becton, Dickinson and Company (BD), TORAY MEDICAL CO,.LTD., and BVM Medical, among others.

Key Developments

- In February 2025, Cagent Vascular launched the Serranator SL-PRO percutaneous transluminal angioplasty (PTA) serration balloon catheter for chronic limb-threatening ischaemia and pedal disease. The catheter uses Cagent's proven serration technology on a redesigned platform, offering improved deliverability and trackability. It also offers 1,000 times increase in point force compared to plain balloons and a controlled lumen gain with minimal dissection.

Market Scope

| Metrics | Details | |

| CAGR | 6.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Standard Balloon, Cutting Balloon, Scoring Balloon, High-Pressure Balloon, Low-Pressure Balloon |

| Application | Aortic Valve Stenosis, Pulmonary Valve Stenosis | |

| Age Group | Pediatric, Adult | |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global balloon valvuloplasty devices market report delivers a detailed analysis with 70 key tables, more than 74 visually impactful figures and 165 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

Suggestions for Related Report

For more medical devices related reports, please click here