Industry Outlook

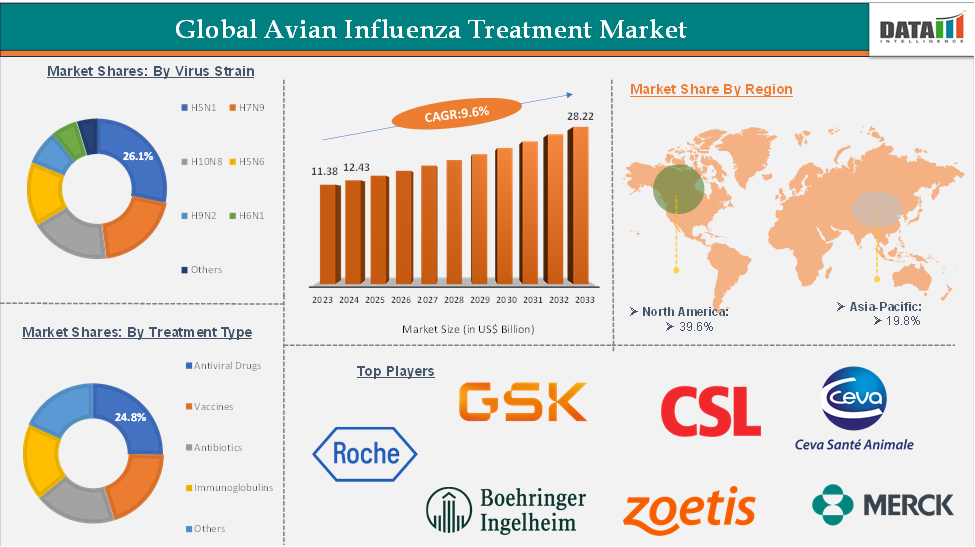

The global avian influenza treatment market reached US$ 11.38 billion in 2023, with a rise of US$ 12.43 billion in 2024, and is expected to reach US$ 28.22 billion by 2033, growing at a CAGR of 9.6% during the forecast period 2025-2033.

The avian influenza treatment market is revolutionizing through rapid advancements in next-generation vaccines, such as recombinant and vector-based platforms, enabling quicker response to emerging strains. AI and genomics enhance early detection and outbreak prediction, allowing for targeted containment. Public-private partnerships and global funding initiatives are accelerating R&D and mass immunization efforts, especially in high-risk poultry regions.

Executive Summary

Market Dynamics: Drivers & Restraints

Driver: Emergence of Highly Mutating and Zoonotic Strains

The emergence of highly mutating and zoonotic strains of avian influenza is expected to significantly drive the growth of the avian influenza treatment market. As the virus continues to evolve rapidly, it raises serious public health concerns. For instance, the H5N1 strain, which has been detected in both wild birds and poultry, has also been found in humans and even in dairy cattle in recent outbreaks. These developments heighten the urgency for more effective antiviral therapies, vaccines, and diagnostic tools.

For instance, the 2024 outbreak of HPAI H5N1 in U.S. dairy cattle highlighted how the virus can cross species barriers, exposing critical gaps in surveillance and biosecurity. This incident emphasized the need for integrated health approaches and accelerated research to better control and treat such zoonotic infections.

Governments and health organizations around the world are ramping up surveillance and preparedness strategies, leading to increased funding and the fast-tracking of treatment research. The unpredictability and severity of these mutations not only amplify demand for existing solutions but also open the door for new players and innovations in the market, making this a key growth driver in the coming years.

Restraint: Rapid Virus Mutation and Antigenic Drift

Rapid virus mutation and antigenic drift could significantly hamper the avian influenza treatment market by undermining the effectiveness of existing vaccines and antiviral drugs. As the avian influenza virus constantly changes its genetic makeup, especially through antigenic drift, the proteins on its surface mutate enough to evade immune responses. For instance, a vaccine designed to target the H5N1 strain might not offer protection against a mutated H5N6 or H7N9 variant.

Similarly, antiviral treatments can lose potency as the virus develops resistance over time. These frequent changes increase the complexity and cost of research and development, delay regulatory approvals, and create uncertainty for manufacturers and healthcare providers. As a result, while the need for treatment remains high, the unpredictable nature of the virus can slow market growth and limit the long-term viability of current therapeutic options.

For more details on this report, Request for Sample

Segmentation Analysis

The global avian influenza treatment market is segmented based on virus strain, treatment type, end-user, and region.

Treatment Type:

The antiviral drugs segment is expected to have 44.4% of the avian influenza treatment market share.

The antiviral drugs segment is expected to hold a dominant position in the avian influenza treatment market due to their critical role in managing and controlling the spread of the virus, especially during outbreaks. Antiviral drugs offer a more immediate line of defense by reducing the severity and duration of the illness. Drugs like oseltamivir (Tamiflu) and zanamivir (Relenza) have been widely used to treat various strains of avian influenza, particularly in high-risk populations and during pandemic preparedness efforts.

Additionally, the growing incidence of zoonotic transmission to humans and the global emphasis on stockpiling antivirals for emergency use have further boosted demand. With governments and healthcare systems prioritizing quick-response treatment options and ongoing R&D into broad-spectrum antivirals, this segment is well-positioned to lead the market in the foreseeable future.

For instance, in May 2025, the U.S. Department of Health and Human Services (HHS) and the National Institutes of Health (NIH) announced the development of a next-generation universal vaccine platform called Generation Gold Standard, which utilizes a beta-propiolactone (BPL)-inactivated, whole-virus approach. This initiative marks a significant move toward greater transparency, improved efficacy, and enhanced pandemic preparedness. It supports the NIH’s internal efforts to develop universal vaccines targeting both influenza and coronaviruses, including vaccine candidates BPL-1357 and BPL-24910. These vaccines are designed to offer broad-spectrum protection against multiple pandemic-prone viruses such as the H5N1 avian influenza strain and coronaviruses.

Geographical Analysis

The North America avian influenza treatment market was valued at 39.6% market share in 2024

North America holds a dominant position in the global avian influenza treatment market due to several key factors. The region benefits from well-established healthcare infrastructure and advanced research facilities that support the development and distribution of effective antiviral drugs and vaccines. Strong government initiatives and significant funding for infectious disease control further boost market growth.

Additionally, North America’s robust surveillance systems enable early detection and rapid response to avian influenza outbreaks, increasing demand for timely treatments. The presence of major pharmaceutical companies and ongoing investment in innovative therapies also contribute to the region’s leadership in this market. The supportive government initiatives and funding are expected to further expand the region’s market share in the global market.

For instance, in January 2025, the Department of Health and Human Services announced the allocation of approximately $306 million to support the federal response to the H5N1 bird flu. Out of this, the Administration for Strategic Preparedness and Response will distribute nearly $183 million to bolster regional, state, and local preparedness efforts. This includes $90 million for the Hospital Preparedness Program, $10 million for the National Emerging Special Pathogens Training and Education Center, $26 million for the Regional Emerging Special Pathogen Treatment Centers, $43 million dedicated to Avian Influenza Preparedness and Response Activities at the Special Pathogen Treatment Centers, and $14 million for the National Disaster Medical System.

Major Players

The major players in the avian influenza treatment market include F. Hoffmann-La Roche Ltd, GSK plc, CSL, Boehringer Ingelheim International GmbH, Ceva, Zoetis Services LLC, Merck & Co., Inc., among others.

Key Developments

In May 2025, Cocrystal Pharma, Inc. (Nasdaq: COCP) announced promising results from a recent virology study, revealing that its novel broad-spectrum influenza PB2 inhibitor, CC-42344, demonstrated strong antiviral activity against the highly pathogenic H5N1 avian influenza A strain.

In January 2025, Traws Pharma completed Phase I clinical trials of tivoxavir marboxil, a single-dose treatment for H5N1 bird flu. The randomized, double-blind, placebo-controlled study assessed the drug’s safety, pharmacokinetics (PK), pharmacodynamics (PD), and tolerability in healthy, influenza-negative adults.

Report Scope

Metrics | Details | |

CAGR | 9.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Virus Strain | H5N1, H7N9, H10N8, H5N6, H9N2, H6N1, Others |

Treatment Type | Antiviral Drugs, Vaccines, Antibiotics, Immunoglobulins, Others | |

| End-User | Hospitals & Clinics, Government Health Agencies, Research Institutes, and Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global avian influenza treatment market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here