Global Automotive DC-DC Converters Market is Segmented By Product (Isolated DC-DC Converters, Non-Isolated DC-DC Converters), By Propulsion (Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Plug-in Hybrid Vehicles (PHEVs)), By Input Voltage (Below 40V, 40-70V, Above 70V), By Output Voltage (3.3V, 5V, 12V, 15V, 24V and Above), By Output Power (Below 1kW, 1-10kW, 10-20kW, Above 20kW), By Vehicle (Commercial Vehicles, Passenger Vehicles), By Application (Power Electronics, Lighting Systems, Infotainment Systems, Electric Powertrain Systems, Safety Systems, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030

Automotive DC-DC Converters Market Size

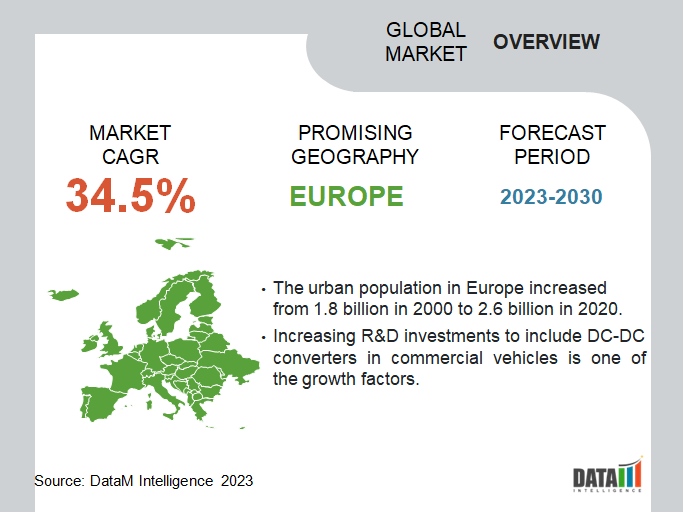

Global Automotive DC-DC Converters Market reached USD 604.4 million in 2022 and is expected to reach USD 6,159.0 million by 2030, growing with a CAGR of 33.7% during the forecast period 2023-2030. The market for automotive DC-DC converters is being heavily impacted by the growing trend toward hybrid and electric vehicles. These converters play an essential part in the conversion of high-voltage power from the battery to the low-voltage power needed for different vehicle systems, making them critical parts of hybrid and electric vehicles.

The popularity of electric vehicles is significantly affected by the development of the charging infrastructure for vehicles. Consumers are increasingly likely to switch to electric vehicles as more charging stations are built, which raises the need for automotive DC-DC converters.

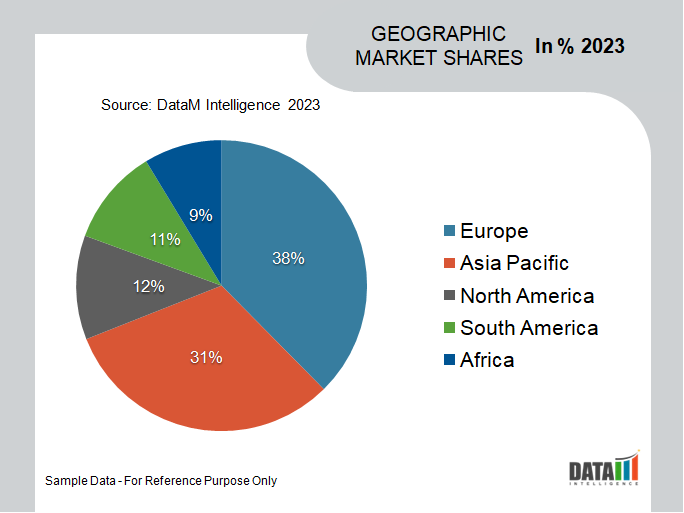

Europe is among the growing regions in the global automotive DC-DC converters market covering more than 1/3rd of the market and owing to the growing new developments in the automotive industry, as well as favorable government policies and assistance in the form of subsidies, grants and tax breaks, the European electric vehicle market has experienced tremendous growth. Governments in European nations are making significant investments in R&D. The German government has promised to invest more than USD 3 billion in the region's electric automobile industry in 2019.

Automotive DC-DC Converters Market Scope

|

Metrics |

Details |

|

CAGR |

33.7% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Product, Propulsion, Input Voltage, Output Voltage, Output Power, Vehicle, Application and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Europe |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To Know More Insights - Download Sample

Automotive DC-DC Converters Market Dynamics

Increasing R&D Investments to Include Dc-Dc Converters in Commercial Vehicles

Automotive OEMs are using innovative technologies in their vehicle offerings to improve fuel economy as stricter pollution standards are increasingly adopted. Electric drivetrains for medium and heavy commercial vehicles (M&HCVs) have been created as a result of this trend. To provide greater efficiency, the electric drivetrain requires the inclusion of a DC-DC converter. Component producers have upgraded their product lines in response to the rise in commercial vehicle sales.

Additionally, a 48V to 12V DC-DC converter from Prodrive that complies with the ISO/DIS 21780 standard for 48V automotive systems has been introduced in 2019. The converter comes in a variety of power choices ranging from 400W to 2.2kW and may be customized to fit automotive networks including can and FlexRay.

Furthermore, the logistics and municipal industries have experienced a major increase in demand for pick-up trucks because of rising freight and logistics activity. Particularly in Europe and North America, the market for personal electric pickup trucks has recently seen considerable growth. In context essentially, manufacturers like Ford, General Motors and Volkswagen have intensified their attention on electric production vehicles. In the upcoming years, a number of new businesses and startups have declared their intent to produce hybrid or all-electric pickup truck models.

Increasing Consumption of Energy-Efficient Electric Vehicles

The plans and initiatives of various governments, including those of India, China, France, Germany, U.S. and others, which encourage the use of environmentally friendly vehicles and contribute to the development of infrastructure for these vehicles, are driving up demand for electric vehicles. As a result, the market for these vehicles is expanding significantly.

For instance, the government of France has implemented an environmental bonus to encourage models with low CO2 emissions; the government of Germany offers grants of USD 2,370 for BEVs and FCEVs and $1,780 for PHEVs; and the government of China offers subsidies for the electrification of vehicles. Electric vehicle DC-DC converters are employed to modify the voltage levels from connected batteries in accordance with the power demands of various in-car systems.

Regulation Adhesion and Safety Demands For DC-DC Converters

To prevent harm or damage to people or property largely as a result of potential risks such electric shock, energy hazards, radiation hazards and chemical hazards, several international and local rules and standards have been created for DC-DC converters. Manufacturers of DC-DC converters are required to follow these rules and specifications, which cover a range of insulation types such as functional, primary, supplemental, double and reinforced insulation.

As these regulations limit manufacturers' growth as they differ from country to country leading to hampering the product’s growth. It may require a specialist to understand these standards given that they are so technically advanced. It gets more difficult for DC-DC converters to kee up with these requirements as they experience continuous development and modification thus acting as a major restraint for market growth.

Automotive DC-DC Converters Market Segment Analysis

The global automotive DC-DC converters market is segmented based on product, propulsion, input voltage, output voltage, output power, vehicle, application and region.

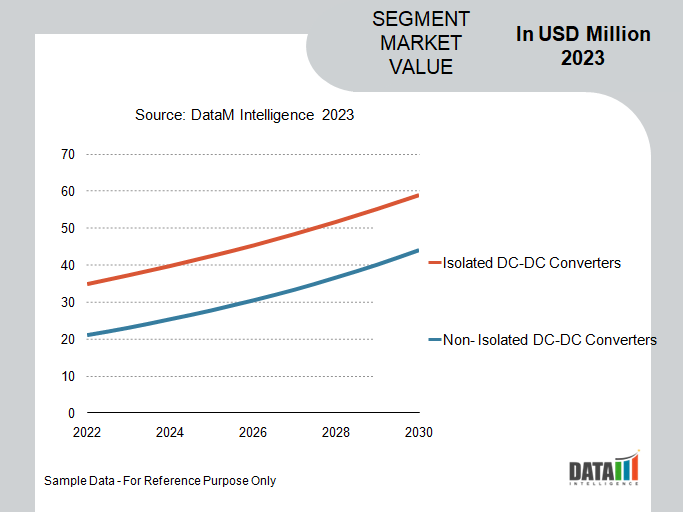

Rising Demand for Isolated DC-DC Converters in Renewable Energy Systems

The isolated DC-DC converters segment holds a major share of around 45.4% in the global automotive DC-DC converters market and countries like the U.S., Canada, Germany and the UK have shown the highest growth in the market. Isolated DC-DC converters are frequently used in this industry as essential components for power conversion because of the growing demand for secure and effective renewable energy systems.

The propulsion systems of electric and hybrid cars, which need high-frequency transformers to act as a barrier to high-frequency voltage, are another important factor driving the demand for isolated DC-DC converters. For automotive, e-mobility and battery applications, Calex introduced the Ruggedized 3kW Bi-Directional DC-DC Converter in 2020. In a similar vein, Artesyn introduced a 10-Watt Isolated DC-DC Converter in 2019 for a variety of uses, including automotive.

Global Automotive DC-DC Converters Market Geographical Share

Europe's Growing Automotive Industry

The Europe automotive DC-DC converters market has witnessed significant growth and popularity covering 1/3th share in 2022. According to Clean Technica, 35,000 passenger vehicles were registered in Europe in January 2022. With around 23,000 deliveries, the total amount of power in use in the first month of 2023 topped 69% annually.

With a record 1.8% proportion of all sold imported automobiles, this represents 63% of all imported vehicles. Nearly all cars in Europe include EPS and start-stopping systems. The increased demand for electrical and electronic components, particularly DC-DC converters, is a result of the electrification of these components.

In 2021, Spain committed to investing around USD 5.1 billion to launch the manufacture of electric vehicles and batteries as part of a significant national expenditure program funded primarily via European Union recovery funds. Similarly to this, Nissan has said it will invest USD 450 million in an all-electric car in 2021. In addition, start-stop systems and EPS are installed in practically all automobiles in Europe.

Europe was still leading the world in the adoption of battery-powered cars in 2022. 2.3 million electric LDVs are sold annually. France recorded 185 000 new electric automobiles, whereas Germany registered 395 000. To achieve 176000 registrations in 2022, UK has more than quadrupled its registration rate. 54% of electric vehicle registrations in European nations have been BEVs. The percentage of BEVs was especially high in the Netherlands (82% of all electric car registrations), Norway (73%), the United Kingdom (62%) and France (60%).

Automotive DC-DC Converters Market Companies

The major global players include Infineon Technologies AG, Texas Instruments Incorporated, ROHM Semiconductor, STMicroelectronics, Mitsubishi Electric Corporation, Toshiba Electronic Devices & Storage Corporation, Panasonic Corporation, Renesas Electronics Corporation, Delta Electronics, Inc. and Vicor Corporation.

COVID-19 Impact on Automotive DC-DC Converters Market

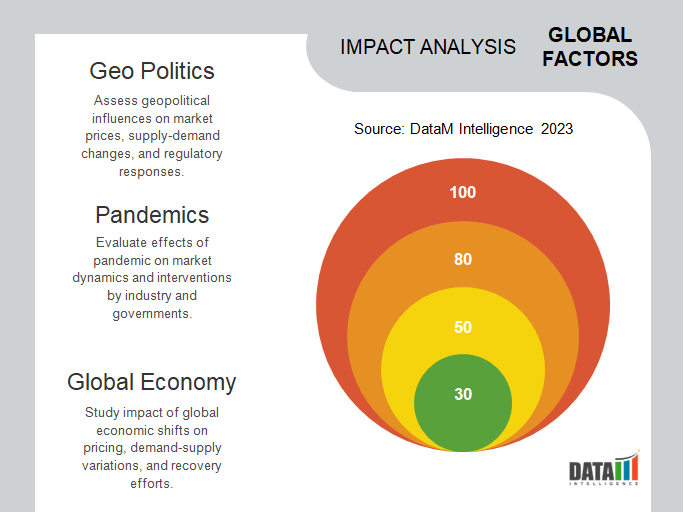

The pandemic led to economic uncertainty and reduced consumer spending. Many potential car buyers postponed their vehicle purchases or opted for cheaper options, leading to a decline in overall vehicle sales. As a result, the demand for automotive DC-DC converters also experienced a negative impact.

The global automotive industry faced disruptions in the supply chain due to lockdown measures and restrictions imposed by various countries. This resulted in a shortage of raw materials, components and electronic parts required for manufacturing automotive DC-DC converters. Many manufacturers had to halt or reduce production, leading to delays in product availability.

Russia-Ukraine War Impact

The war could impact the availability of parts and materials required to make vehicle AC-AC converters if it causes interruptions in the supply chain between Russia and Ukraine. Production delays and possible market shortages may follow from it.

Given the growing geopolitical threats, companies that operate in the automotive AC-AC converter market could review their geographical emphasis and business strategies. To maintain steady production and avoid risks linked with violence, they may diversify their supply chains to become less reliant on the impacted areas. They might also look at other choices for sourcing.

Scope

By Product

- Isolated DC-DC Converters

- Non- Isolated DC-DC Converters

By Propulsion

- Battery Electric Vehicles (BEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- Plug-in Hybrid Vehicles (PHEVs)

By Input Voltage

- Below 40V

- 40-70V

- Above 70V

By Output Voltage

- 3.3V

- 5V

- 12V

- 15V

- 24V and Above

By Output Power

- Below 1kW

- 1-10kW

- 10-20kW

- Above 20kW

By Vehicle

- Commercial Vehicles

- Passenger Vehicles

By Application

- Power Electronics

- Lighting Systems

- Infotainment Systems

- Electric Powertrain Systems

- Safety Systems

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

-

On February 28, 2023, Infineon Technologies AG, the global leader in automotive semiconductors partnered with Hon Hai Technology Group, the world’s largest electronics manufacturing services provider in the field of electric vehicles (EV) to jointly develop advanced electromobility with efficient and intelligent features. The Memorandum of Understanding (MoU) focuses on silicon carbide (SiC) development, leveraging Infineon’s automotive SiC innovations and Foxconn’s know-how in automotive systems.

- On November 9, 2020, ROHM, a Japan-based electronic parts manufacturer, developed a BD9P series automotive primary DC-DC converters. "BD9P series" has a high-efficiency design that contributes to low power consumption not only when the vehicle is running, but also when the engine is stopped.

- On January 20, 2020, Delta Electronics Inc., a leading manufacturer of power and thermal management solutions collaborated with GKN Automotive, the world's top supplier of electric drive, all-wheel drive and driveline technology and systems on the joint development that will enable the rapid development of next-generation integrated 3-in-1 eDrive systems with power classes ranging from 80kW to 155kW.

Why Purchase the Report?

- To visualize the global automotive DC-DC converters market segmentation based on product, propulsion, input voltage, output voltage, output power, vehicle, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of automotive DC-DC converters market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Technology mapping available as excel consisting of key technologies of all the major players.

The global automotive DC-DC converters market report would provide approximately 94 tables, 100 figures and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies