Asthma Spacers Market Size & Industry Outlook

The growth of the asthma spacers market is being propelled by rapid technological advancements, as new designs enhance treatment efficiency, ease of use, and clinical effectiveness. Developments such as antistatic materials minimize drug waste and ensure more reliable medication delivery, while smart spacers equipped with sensors and Bluetooth connectivity assist patients in monitoring their inhaler usage and improving adherence. Ergonomically designed, portable versions promote better handling for both children and elderly users. Innovations in production methods, such as 3D molding and precision engineering, have increased the durability of products and decreased inconsistencies in drug dispersion. Furthermore, the integration of digital health platforms enables healthcare providers to remotely oversee patient technique, improving disease management.

Key Highlights

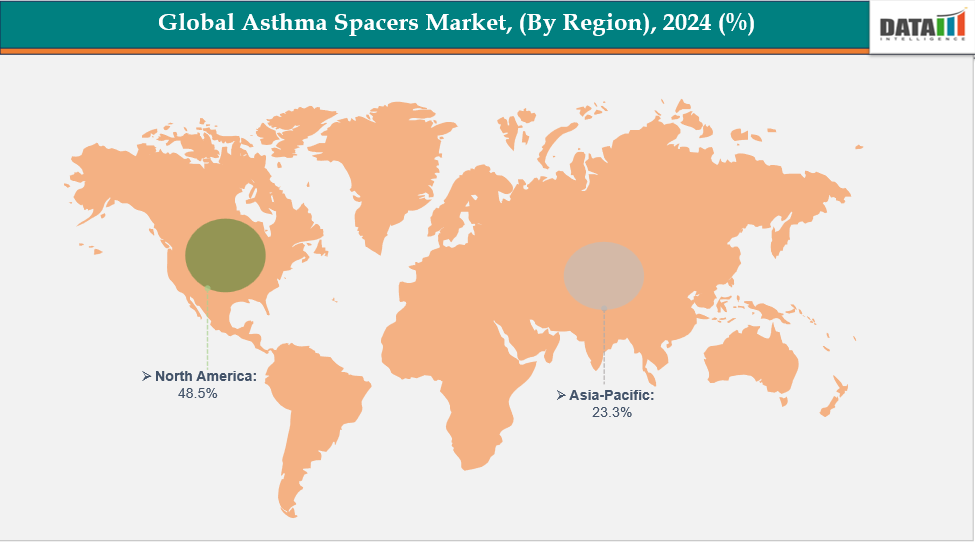

- North America is dominating the global asthma spacers market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global asthma spacers market, with a CAGR of 7.7% in 2024

- The Aerochamber segment is dominating the asthma spacers market with a 35.8% share in 2024

- The polycarbonate segment is dominating the asthma spacers market with a 42.3% share in 2024

- Top companies in the asthma spacers market are Monaghan Medical Corp., Flexicare (Group) Limited, Koninklijke Philips N.V., Space Chamber, Rossmax International Ltd., Trudell Medical International Inc., Able Healthcare, and Medline Industries, LP, among others.

Market Dynamics

Drivers: Rising asthma prevalence and emergencies are accelerating the growth of the asthma spacers market

The rising occurrence of asthma and the frequent need for emergency treatments are significantly contributing to the expansion of the global asthma spacers market. As the number of individuals suffering from asthma increases worldwide, especially among children and the elderly, the necessity for effective inhalation therapies grows. Asthma emergencies, often caused by improper inhaler usage or insufficient medication delivery, emphasize the importance of devices that guarantee accurate medication distribution in the lungs. Spacers enhance the efficiency of drug delivery, decrease coordination errors, and lessen side effects, making them vital for both everyday management and sudden exacerbations.

Owing to the factors like asthma prevalence. For instance, in May 2024, GINA reported that asthma was one of the most common chronic non-communicable diseases, affecting over 260 million people and causing more than 450,000 deaths annually worldwide, the majority of which were considered preventable.

Restraints: Alternative therapies and technologies are hampering the growth of the asthma spacers market

The development of the worldwide asthma spacers market is being hindered by the rise of alternative treatments and technologies. Breath-actuated inhalers and dry powder inhalers minimize the necessity for spacers by streamlining medication delivery and removing issues related to coordination.

Moreover, nebulizers and smart inhalers provide more practical, effective, and user-friendly choices, especially for young children and elderly patients. In certain areas, inexpensive or do-it-yourself spacers created from readily available materials are favored over branded products, which reduces demand. These alternatives, along with growing awareness of innovative inhalation technologies, are steering healthcare providers and patients away from conventional spacers.

For more details on this report, see Request for Sample

Asthma Spacers Market, Segmentation Analysis

The global asthma spacers market is segmented based on product type, material, distribution channel, and region

By Product Type: The Aerochamber segment is dominating the asthma spacers market with a 35.8% share in 2024

The Aerochamber segment leads the worldwide asthma spacers market, due to its well-established brand reputation, thorough clinical validation, and diverse range of products designed for both adults and children. Its anti-static, valve-equipped holding chamber design facilitates effective medication delivery and enhances patient adherence, especially for young and elderly individuals who have difficulty coordinating inhaler use.

Moreover, regulatory approvals across multiple regions, including FDA 510(k) clearance and CE marking, enhance trust among healthcare providers. For instance, in January 2025, Trudell Medical International received FDA 510(k) clearance for the AeroChamber2Go Anti-Static Valved Holding Chamber, a direct patient interface device enhancing inhaler drug delivery and portability.

By Material: The polycarbonate segment is dominating the asthma spacers market with a 42.3% share in 2024

The global asthma spacers market is primarily led by the polycarbonate segment, due to its excellent material characteristics and extensive clinical use. Polycarbonate is known for being lightweight, robust, and resistant to impact, which contributes to the ease of handling and longevity of spacers for multiple usages. The material's smooth, non-porous surface allows for optimal aerosol delivery while reducing the adherence of medication to the chamber walls, thereby enhancing the efficiency of the medication.

Moreover, polycarbonate can be used with different metered-dose inhalers (MDIs) and can endure multiple rounds of cleaning and sterilization without breaking down. The clarity of the material enables both caregivers and patients to see the aerosol delivery, improving proper use and compliance. These benefits, along with solid regulatory approval and accessibility from top manufacturers, make polycarbonate the material of choice for spacer manufacturing.

Asthma Spacers Market, Geographical Analysis

North America is dominating the global asthma spacers market with 48.5% in 2024

North America dominates the asthma spacers market due to its sophisticated healthcare infrastructure, widespread use of respiratory care technology, and increasing rates of asthma. Favorable reimbursement policies, extensive clinical expertise, and ongoing product innovation contribute to the market's growth. Additionally, stringent regulatory requirements guarantee broad availability, dependability, and patient compliance in various care environments.

The U.S. market for asthma spacers is growing, driven by a robust healthcare infrastructure, regular product innovations, favorable FDA approval processes, and strategic agreements for distribution and marketing rights that improve nationwide access and brand visibility. For instance, in September 2023, Monaghan Medical Corporation and Allergan Sales, LLC reached an agreement through which Monaghan regained all U.S. retail distribution and marketing rights for the AeroChamber VHC brand, assuming full retail pharmacy responsibilities effective January 1, 2024.

Europe is the second region after North America, which is expected to dominate the global asthma spacers market with 34.5% in 2024

In Europe, the market for asthma spacer devices is growing due to improved healthcare systems, a rising elderly population, and greater demands for respiratory care. The introduction of new products, positive reimbursement policies, and simplified CE-mark processes enhance innovation and safety for patients, leading to broader usage in hospitals, clinics, and point-of-care environments.

In Germany, the market for asthma spacer devices is expanding due to the increasing prevalence of respiratory disorders, bolstered by a robust clinical framework and a national focus on the precision of inhalation therapy. The greater accessibility of antistatic and valved spacers, favorable insurance policies, and heightened procurement by healthcare facilities and pharmacies are improving device usage, patient results, and driving overall market growth.

The Asia Pacific region is the fastest-growing region in the global asthma spacers market, with a CAGR of 7.7% in 2024

The market for asthma spacer devices in the Asia-Pacific region is growing rapidly, driven by increased healthcare expenditure, better clinical infrastructure, and heightened awareness of inhalation therapy. Advancements in technology, government-supported respiratory health programs, and greater accessibility to cost-effective devices are promoting their use in hospitals, pharmacies, and community care environments in both urban and rural areas.

In India, the market for asthma spacer devices is expanding, driven by an increase in respiratory illnesses, better access to healthcare, and robust government efforts promoting local production of medical devices, innovation, and cost-effectiveness through initiatives such as Make in India and Ayushman Bharat. For instance, in December 2024, Union Minister Anupriya Patel addressed the CII’s 21st Health Summit, highlighting India’s medical device sector as a sunrise industry. She emphasized how growing healthcare needs, technological progress, strong government backing, and expanding market opportunities had positioned MedTech as a key driver of India’s transformation toward Viksit Bharat 2047.

Asthma Spacers Market Competitive Landscape

Top companies in the asthma spacers market are Monaghan Medical Corp., Flexicare (Group) Limited, Koninklijke Philips N.V., Space Chamber, Rossmax International Ltd., Trudell Medical International Inc., Able Healthcare, and Medline Industries, LP, among others.

Monaghan Medical Corp.: Monaghan Medical Corp. is a leading U.S.-based respiratory device manufacturer known for its clinically validated asthma spacers and valved holding chambers, including the AeroChamber brand family. The company focuses on improving inhaler drug delivery, patient adherence, and respiratory outcomes through evidence-based designs, antistatic technology, and pediatric-friendly interfaces, serving hospitals, clinics, and home-care markets worldwide.

Key Developments:

- In October 2024, Monaghan Medical Corp. was honored with the prestigious AARC Zenith Award, reaffirming its leadership in respiratory care. The recognition showcased the company’s longstanding commitment to innovation, product quality, and advancing respiratory outcomes for patients and clinicians worldwide.

Market Scope

| Metrics | Details | |

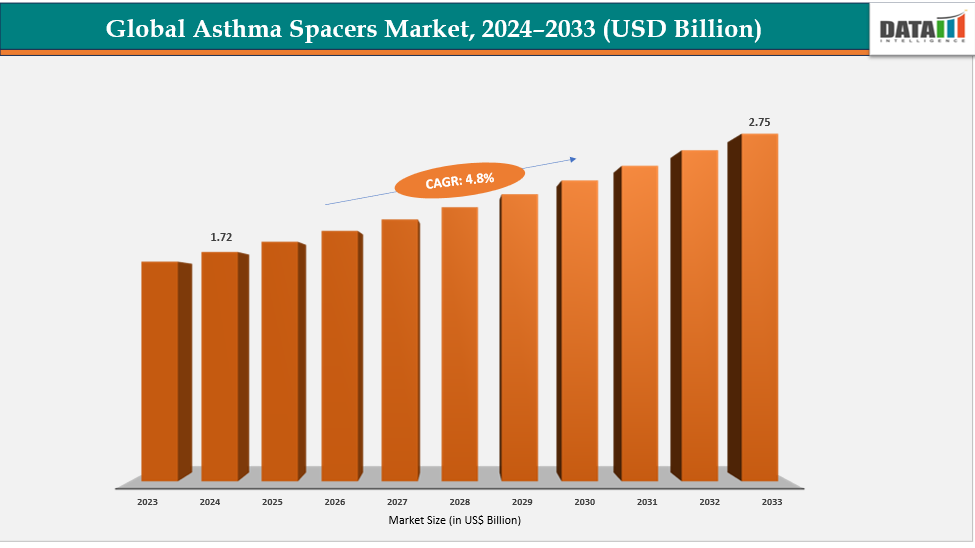

| CAGR | 4.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product Type | Aerochamber, Optichamber, Volumatic, Inspirease, Others |

| By Material | Polycarbonate, Acrylonitrile Butadiene Styrene, Polypropylene, Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global asthma spacers market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here