Anticoagulants Market Size and Trends

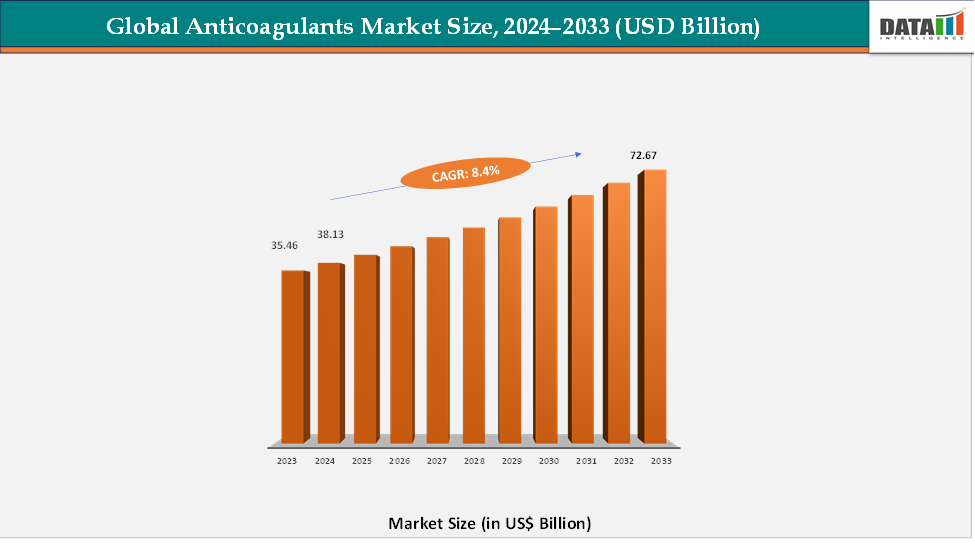

The global anticoagulants market reached US$ 35.46 billion in 2023, with a rise to US$ 38.13 billion in 2024, and is expected to reach US$ 72.67 billion by 2033, growing at a CAGR of 8.4% during the forecast period 2025–2033. experiencing robust growth, fueled by the rising prevalence of thromboembolic disorders, continuous advancements in drug development, and supportive regulatory frameworks. Key therapeutic applications in these regions include atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke prevention, all of which are major public health priorities. A clear market shift is underway toward direct oral anticoagulants (DOACs), driven by their favorable safety profiles, predictable pharmacokinetics, and ease of administration compared to vitamin K antagonists. Within this class, Factor Xa inhibitors such as rivaroxaban and apixaban dominate, holding a significant market share across both inpatient and outpatient care.

Regulatory advancements are also accelerating growth. For instance, in March 2025, the U.S. Food and Drug Administration (FDA) approved generic versions of rivaroxaban, significantly improving affordability and accessibility for patients requiring long-term anticoagulation therapy in the U.S. and setting a precedent for similar approvals in Europe.

Key Market highlights

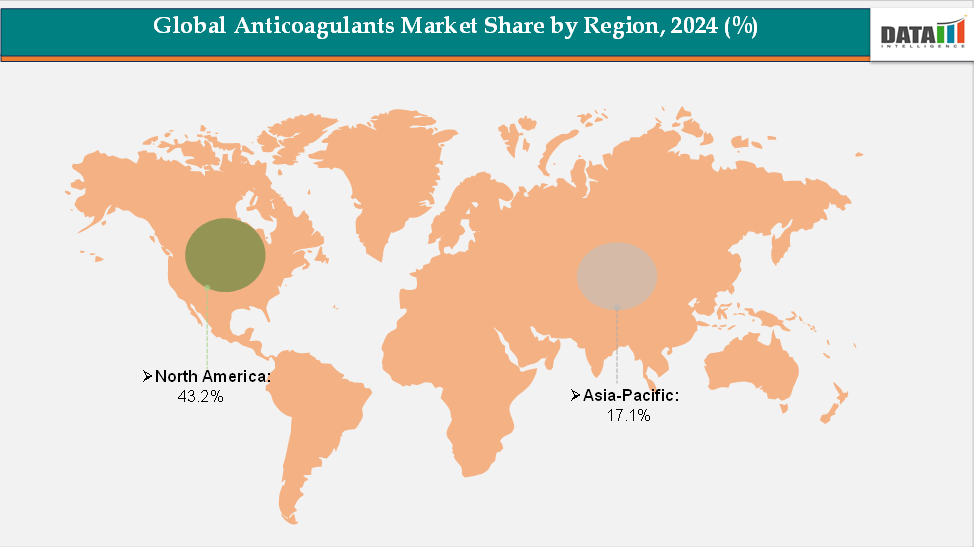

- North America leads the anticoagulants market, accounting for about 43.2% of global revenue. The region’s dominance is supported by high diagnosis and treatment rates of cardiovascular disorders, broad access to advanced therapies, and the strong presence of leading pharmaceutical players driving continuous innovation and adoption.

- Asia–Pacific is the fastest-growing regional market, holding around 17.1% of the share. Growth is fueled by the rising burden of atrial fibrillation and venous thromboembolism, and increasing government initiatives to improve access to novel oral anticoagulants (DOACs) across major economies such as China, India, Japan, and South Korea.

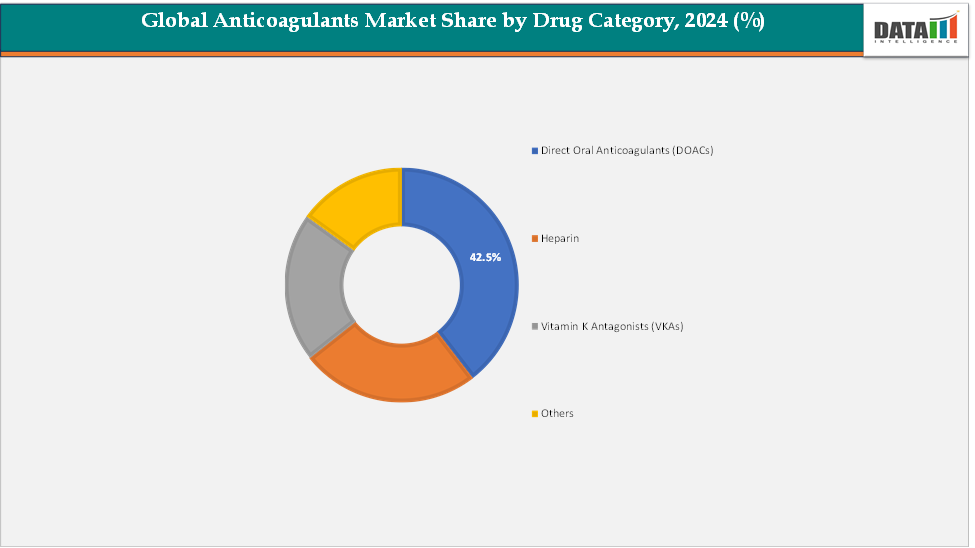

- DOACs (Direct Oral Anticoagulants) remain the dominant product segment, contributing approximately 42.5% of global revenue. Their widespread use is driven by favorable clinical guidelines, reduced monitoring requirements, improved safety compared to vitamin K antagonists, and growing preference among physicians and patients for long-term anticoagulation management.

Market Size & Forecast

- 2024 Market Size: US$ 38.13 billion

- 2033 Projected Market Size: US$ 72.67 billion

- CAGR (2025–2033): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Anticoagulants Market Dynamics: Drivers & Restraints

Driver: Rising Burden of Cardiovascular and Thromboembolic Disease

The growing prevalence of cardiovascular disorders and thromboembolic conditions is a major factor fueling the expansion of the anticoagulants market. Cardiovascular diseases, including atrial fibrillation, heart attacks, and stroke, remain the leading causes of morbidity and mortality worldwide.

Venous thromboembolism (VTE) is the second most common cardiovascular disorder after myocardial infarction and occurs more frequently than stroke. Its incidence in the general population ranges from 1 to 5 cases per 1,000 individuals annually, approximately 1 per 100,000 per year in children, 1 per 1,000 per year in adults, and up to 1 per 100 per year in the elderly. Additionally, up to 4% of strokes are attributed to underlying hypercoagulable disorders. These conditions significantly increase the risk of long-term complications and mortality if left untreated, driving continuous demand for effective anticoagulant therapies.

The increasing patient pool and shift toward aging populations globally are further accelerating market growth. Anticoagulants, including novel oral anticoagulants (NOACs) and injectable heparins, are increasingly preferred due to their efficacy in preventing clot formation and minimizing stroke risk.

Furthermore, rising awareness among healthcare providers and patients regarding early diagnosis and prophylactic treatment of thromboembolic events encourages broader adoption of anticoagulant therapies. Ongoing research, FDA approvals, and real-world evidence studies highlighting the safety and effectiveness of newer anticoagulants are also expected to expand clinical use, thereby boosting market revenue.

Restraint: Patent Expiries and Generic Competition

Patent expiries and the entry of generics are expected to hamper the anticoagulants market by eroding revenues of leading brands, especially blockbuster DOACs such as rivaroxaban, apixaban, and dabigatran. Once exclusivity ends, multiple low-cost generics quickly penetrate the market, creating intense price competition and driving down overall treatment costs.

For more details on this report, Request for Sample

Segmentation Analysis

The global anticoagulants market is segmented by drug category, route of administration, application, and distribution channel, and region.

Drug Category: The direct oral anticoagulants (DOACs) segment is estimated to have 42.5% of the anticoagulants market share.

The direct oral anticoagulants (DOACs) segment is expected to maintain its dominant position in the anticoagulants market. Their widespread adoption is driven by a superior safety profile, ease of oral administration, predictable pharmacokinetics, and a reduced need for routine monitoring compared to traditional vitamin K antagonists. DOACs are extensively prescribed across the region for atrial fibrillation, venous thromboembolism (VTE), and stroke prevention, with real-world evidence consistently demonstrating comparable or improved efficacy along with lower bleeding risk.

Segment’s growth is further supported by the rising prevalence of cardiovascular and thromboembolic disorders, along with increasing physician preference and patient demand for convenient oral therapies. Recent regulatory approvals and patient-access initiatives have strengthened the segment’s momentum. For instance, in July 2025, the Bristol Myers Squibb-Pfizer Alliance launched a direct-to-patient program for Eliquis (apixaban) in the U.S. through the Eliquis 360 Support initiative, enabling uninsured, underinsured, or self-pay patients to significantly lower out-of-pocket costs.

Similarly, in April 2025, Aurobindo Pharma Limited secured final USFDA approval to manufacture and market Rivaroxaban Tablets USP, 2.5 mg, bioequivalent to Xarelto, with a planned launch in Q1 FY26, increasing availability in the U.S. market.

These developments highlight how regulatory advancements, patient-support initiatives, and expanding manufacturing capacity are enhancing access to DOACs across the globe. As a result, DOACs are expected to remain the cornerstone of anticoagulant therapy in these regions, ensuring sustained growth and reinforcing their leadership in the market.

The heparin segment is estimated to have 24.7% of the anticoagulants market share.

Heparin remains a critical segment of the anticoagulants market, especially for hospital-based care. Its continued demand is driven by its established role in surgical procedures, dialysis, catheterization, and as a standard of care for the prevention and treatment of venous thromboembolism in acute settings. Low molecular weight heparins (LMWHs) are preferred for their predictable pharmacokinetics and lower monitoring requirements compared to unfractionated heparin. Moreover, during the COVID-19 pandemic, heparin gained renewed importance for managing coagulation disorders in critically ill patients, which reinforced its relevance.

Geographical Analysis

The North America anticoagulants market was valued at 43.2% market share in 2024

Anticoagulants are extensively prescribed in North America for atrial fibrillation, venous thromboembolism (VTE), pulmonary embolism, and stroke prevention, reflecting the country’s high burden of cardiovascular and thromboembolic conditions.

Among the widely used anticoagulants in the region, direct oral anticoagulants (DOACs) such as apixaban (Eliquis) and rivaroxaban (Xarelto) lead the market due to their superior safety profile, predictable dosing, lower risk of major bleeding, and ease of oral administration compared to vitamin K antagonists like warfarin. Their convenience and reduced need for frequent INR monitoring have made them the preferred choice for both physicians and patients. In addition, low-molecular-weight heparins (LMWHs) such as enoxaparin remain widely used in hospital and acute care settings, particularly for prophylaxis in surgical patients, including those undergoing orthopedic procedures.

The dominance of the U.S. is further reinforced by recent regulatory and market developments. In March 2025, the U.S. FDA approved generic versions of rivaroxaban, expanding patient access and affordability. Similarly, in July 2025, the Bristol Myers Squibb-Pfizer Alliance launched the Eliquis 360 Support direct-to-patient program, improving access for uninsured and underinsured patients. These initiatives highlight how North America is setting the pace in expanding access to newer anticoagulants and driving market growth across North America and Europe.

The Europe anticoagulants market was valued at 20.9% market share in 2024

Europe represents a well-established and highly regulated anticoagulants market. The region benefits from strong clinical guideline support, widespread adoption of DOACs over vitamin K antagonists, and an ageing population that requires long-term anticoagulation for conditions such as atrial fibrillation, stroke prevention, and venous thromboembolism.

European healthcare systems generally provide broad reimbursement coverage, which supports consistent treatment uptake. Western Europe, in particular, is marked by advanced healthcare infrastructure and early adoption of novel therapies, while Eastern Europe is catching up as access and affordability improve. Overall, Europe maintains a significant position in the global market with steady, sustainable growth supported by medical guidelines, clinical research activity, and structured healthcare systems.

Europe remains a key regional market with stable growth prospects and ongoing investment in healthcare modernization.

The Asia-Pacific anticoagulants market was valued at 17.1% market share in 2024

Asia–Pacific is emerging as one of the fastest-growing regions in the anticoagulants market. The growth is primarily fueled by the rising prevalence of cardiovascular diseases, especially atrial fibrillation and venous thromboembolism, which are increasing due to lifestyle changes and ageing populations. Healthcare infrastructure improvements, broader access to advanced therapies, and favorable regulatory reforms are further accelerating the adoption of direct oral anticoagulants (DOACs) in countries such as China, India, Japan, and South Korea.

The region’s large patient base and increasing awareness of preventive care continue to drive steady expansion. Asia–Pacific is therefore positioned as a growth engine for the global market, with stronger momentum compared to mature regions.

Competitive Landscape

The major players in the anticoagulants market include Pfizer Inc., Bristol-Myers Squibb Company, DAIICHI SANKYO COMPANY, LIMITED, Sanofi, Bayer AG, Boehringer Ingelheim Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, Mylan N.V. (Viatris Inc.), B. Braun SE, Fresenius SE & Co. KGaA, Syntex S.A. and Intelicure Lifesciences, among others.

Market Scope

| Metrics | Details | |

| CAGR | 8.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Category | Direct Oral Anticoagulants (DOACs), Heparin, Vitamin K Antagonists (VKAs), Others |

| Route of Administration | Oral, Injectable | |

| Application | Deep Vein Thrombosis (DVT), Thrombosis Prophylaxis in Orthopedic Surgeries, Pulmonary Embolism (PE), Atrial Fibrillation Management, Heparin-Induced Thrombocytopenia (HIT), Management, Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global anticoagulants market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here