Ankle Replacement Devices Market Size

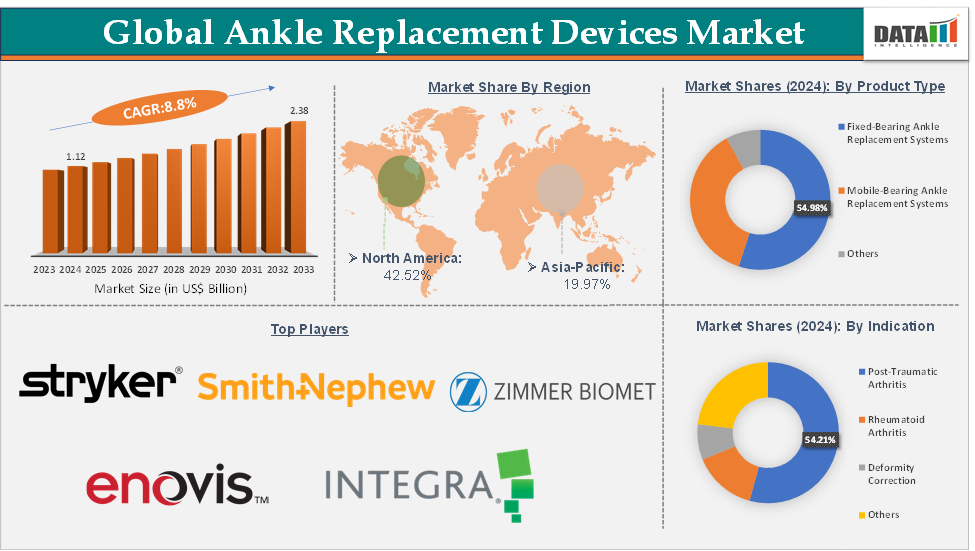

The global ankle replacement devices market size reached US$ 1.12 Billion in 2024 from US$ 1.04 Billion in 2023 and is expected to reach US$ 2.38 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

Key Trends and Insights

The ankle replacement devices market growth is driven by rising osteoarthritis prevalence and ageing, and active populations.

North America dominates the ankle replacement devices market with the largest revenue share of 42.52% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.9% over the forecast period.

Based on product type, the fixed-bearing ankle replacement systems segment led the market with the largest revenue share of 54.98% in 2024.

Based on indication, the post-traumatic arthritis segment is expected to lead the market with the largest revenue share of 54.21% in 2024.

Competitive landscape is moderately concentrated, led by Stryker, Zimmer Biomet, Smith & Nephew, Enovis, and niche innovators.

Emerging patient-specific and robotic-assisted procedures are in early adoption, offering differentiation potential. M&A and partnerships continue to reshape competitive positioning.

Executive Summary

Dynamics

Drivers - The rising prevalence of end-stage ankle osteoarthritis and post-traumatic injuries is significantly driving the ankle replacement devices market growth

The rising prevalence of end-stage ankle osteoarthritis, particularly cases stemming from post-traumatic injuries, is a major driver of ankle replacement device market growth. Unlike hip and knee osteoarthritis, which is often degenerative, approximately 80% of ankle OA cases are post-traumatic, according to the National Institutes of Health (NIH), commonly linked to fractures and severe sprains.

According to the World Health Organization (WHO), every year, the lives of approximately 1.19 million people are cut short as a result of a road traffic crash. Between 20 and 50 million more people suffer non-fatal injuries, with many incurring a disability. This surge in global road traffic accidents, sports-related injuries, and aging populations has further intensified disease incidence, while older adults now increasingly seek motion-preserving alternatives to fusion.

According to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. At this time, the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion in 2030. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). With these demographic projections indicating that the elderly population will double by 2050 and growing awareness of ankle replacement as a superior option for mobility preservation, demand is accelerating across regions.

Restraints - High device and procedure costs are hampering the growth of the ankle replacement devices market

The high cost of ankle replacement devices and procedures is a major factor hampering market growth, especially when compared to the more economical ankle fusion. On average, total ankle replacement costs range from $5,130 to $39,253. With Medicare, ankle replacement surgery costs $1,446 to the person undergoing the surgery. In emerging markets, where healthcare reimbursement systems are still developing, device and procedure costs well higher, often pushing surgeons to recommend fusion instead, which is cheaper and more widely accessible. For instance, the basic price for total ankle replacement cost in India in a general ward starts at USD 6,500, and for a twin-sharing room, the price tag is approximately USD 7,500.

Moreover, TAR demands specialized instruments, longer operating times, and higher post-operative care costs, further straining hospital budgets and insurance approvals. This financial burden, coupled with inconsistent reimbursement policies, restricts patient access and slows adoption, making cost one of the most persistent restraints limiting the ankle replacement devices market despite their clinical advantages.

For more details on this report – Request for Sample

Segmentation Analysis

The global ankle replacement devices market is segmented based on product type, material, indication, end-user, and region.

Product Type - The fixed-bearing ankle replacement systems segment is dominating the ankle replacement devices market with a 54.98% share in 2024

Fixed-bearing ankle replacement systems dominate the global market, primarily due to their simpler two-component design, cost-effectiveness, and proven clinical reliability. Their popularity is reinforced by strong product portfolios such as INBONE II and INFINITY ankle systems and Salto Talaris fixed-bearing solutions. These implants have consistently demonstrated high survivorship rates, functional improvement, and lower revision risks compared to mobile-bearing devices, making them the preferred choice among surgeons.

Clinical studies also highlight that fixed-bearing systems may yield lower cumulative revision rates than mobile-bearing alternatives, reinforcing payer and provider confidence. For instance, according to the study conducted by the National Institutes of Health (NIH), 3902 ankles in 28 studies were included. 719 were fixed-bearing and 3104 mobile bearings with an overall survivorship of 94% and 89% respectively. With their balance of affordability, ease of surgical use, and durability, fixed-bearing systems continue to maintain their lead as the gold standard in ankle replacement worldwide.

Indication - The post-traumatic arthritis segment is dominating the ankle replacement devices market with a 54.21% share in 2024

The post-traumatic arthritis segment is driven by the high prevalence of trauma-related ankle degeneration and the growing need for motion-preserving alternatives. According to the National Institutes of Health, in the case of ankle replacement, post-traumatic is the dominant one, accounting for 54%, whereas primary osteoarthritis had 19%, and rheumatoid had 14.6%. For the demographic, total ankle replacement (TAR) offers superior functional restoration compared to ankle fusion, helping preserve gait biomechanics and mobility.

Leading products such as Stryker’s INFINITY and INBONE II systems and Integra’s Salto Talaris are widely used in PTA cases due to their proven durability and adaptability to post-traumatic deformities. Moreover, expanding adoption in Asia-Pacific, where trauma-related arthritis incidence is rising, is expected to fuel further growth. Collectively, these factors underscore why post-traumatic arthritis dominates as a key driver for ankle replacement devices, balancing clinical demand with robust industry innovation.

Geographical Share Analysis

North America is expected to dominate the global ankle replacement devices market with a 42.52% in 2024

North America, especially the United States, is the undisputed leading region in the global ankle replacement devices market, a dominance driven by its advanced healthcare infrastructure, high procedural volume, and strong presence of major orthopedic manufacturers. On the innovation side, North America is home to front-line product development and approvals.

For instance, in August 2024, Enovis Corporation unveiled its Scandinavian Total Ankle Replacement (STAR Ankle), now with new e+ Polyethylene. Recent U.S. Food and Drug Administration (FDA) approval makes STAR Ankle the first and only mobile bearing ankle system with e+ Polyethylene in the United States. The implant’s new vitamin E-blended e+ Polyethylene insert will offer improved durability, stability, and longevity.

Moreover, leading global orthopedics companies such as Stryker, Zimmer Biomet, DePuy Synthes, and Enovis have deep U.S. roots. Their local R&D operations, surgeon training programs, and distribution networks underpin the region’s strength.

Competitive Landscape

Top companies in the ankle replacement devices market include Stryker, Smith+Nephew, Enovis Corporation, Zimmer Biomet, restor3d, CONMED Corporation, Exactech, Inc., Arthrex, Inc., and Integra LifeSciences, among others.

Stryker: Stryker is a major market leader in the ankle replacement devices market, largely due to its acquisition of Wright Medical, which added the flagship INBONE and INFINITY Total Ankle Systems to its portfolio. The INFINITY system, in particular, has become the most widely implanted prosthesis in the U.S. and U.K., with over 48,000 procedures performed globally. Building on this foundation, Stryker has continued to innovate, most recently gaining FDA clearance in June 2025 for the Incompass Total Ankle System, which merges the strengths of INBONE and INFINITY into a single next-generation platform.

Recent Developments

In June 2025, Stryker received U.S. Food and Drug Administration (FDA) 510(k) clearance for the Incompass Total Ankle System, an implant intended for patients with ankle joints damaged by severe rheumatoid, post-traumatic, or degenerative arthritis. This new platform integrates the innovative technologies of Stryker’s Inbone and Infinity systems into a single, comprehensive solution for total ankle replacement.

In May 2025, restor3d, a leader in 3D printed, personalized orthopedic implant care, proudly announces the successful limited market release of the Aeros Modular Stem Total Ankle System. The Aeros Modular Stem, the latest addition to the Kinos Total Ankle family, represents the first and only anteriorly inserted modular stem tibial implant available for Total Ankle Replacement (TAR). Cleared by the FDA for both primary and revision indications, the system enters a limited market release throughout 2025, with full commercial launch anticipated in 2026.

Report Scope

Metrics | Details | |

CAGR | 8.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Fixed-Bearing Ankle Replacement Systems, Mobile-Bearing Ankle Replacement Systems and Others |

Material | Metals, Polymers, Ceramics or Ceramic-Coated Components and Others | |

Indication | Post-Traumatic Arthritis, Rheumatoid Arthritis, Deformity Correction and Others | |

End-User | Hospitals, Ambulatory Surgical Centers, Orthopedic Specialty Clinics, Rehabilitation Centers and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global ankle replacement devices market report delivers a detailed analysis with 67 key tables, more than 65 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.