Animal Health Market Size & Industry Outlook

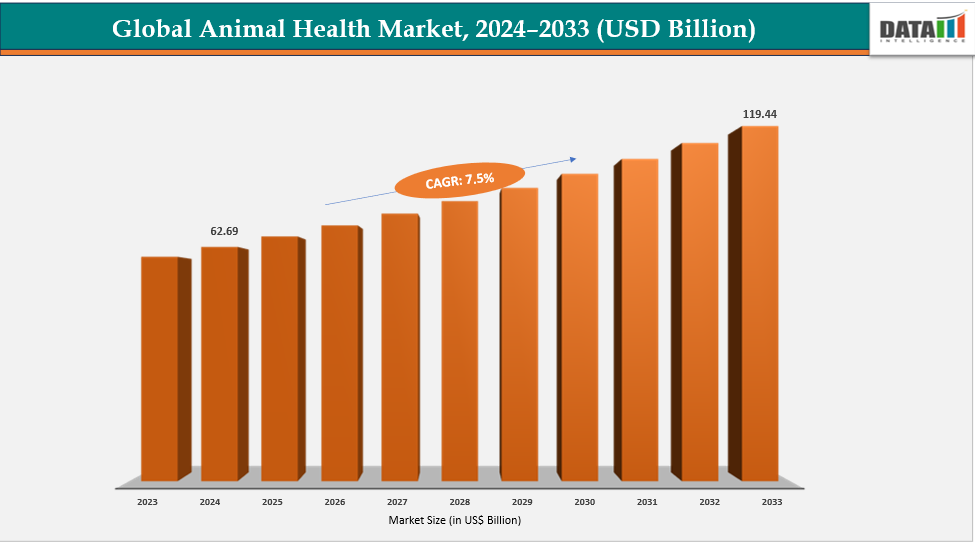

The Global Animal Health Market size reached US$ 58.64 Billion with a rise of US$ 62.69 Billion in 2024 and is expected to reach US$ 119.44 Billion by 2033, growing at a CAGR of 7.5% during the forecast period 2025-2033.

The animal health market is experiencing strong growth due to rising pet ownership and the increasing humanization of pets, which drives demand for preventive care, diagnostics, vaccines, and advanced treatments. The market for companion animal products is strong because pet owners are prepared to make investments to ensure the longevity and well-being of their animals. The need for vaccinations, biologics, and treatments to prevent disease and sustain productivity has increased as a result of the expansion of livestock production brought about by the rising demand for animal-protein foods such as fish, chicken, cattle, and pig on a worldwide scale. The global market for animal health is growing as a result of these combined dynamics.

Key Highlights

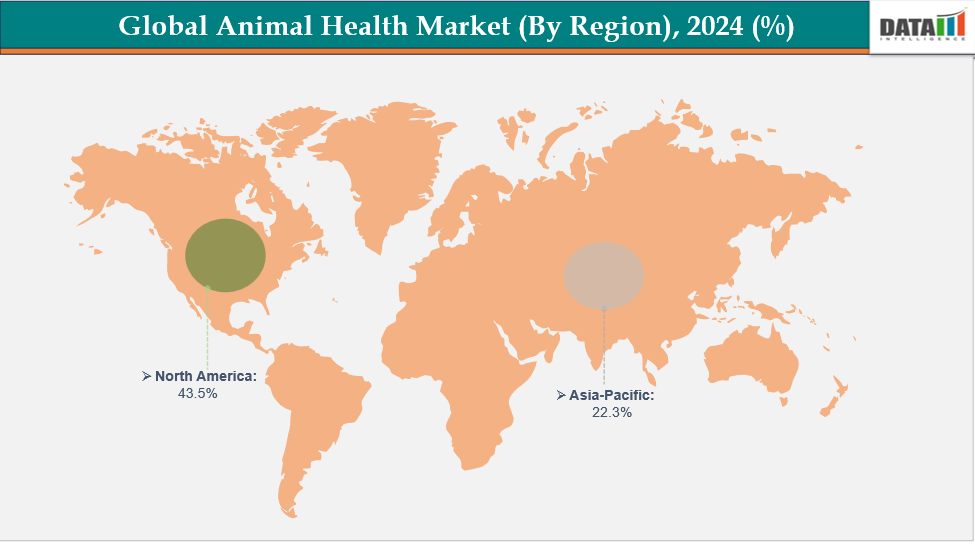

- North America dominates the Animal Health Market with the largest revenue share of 43.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.4% over the forecast period.

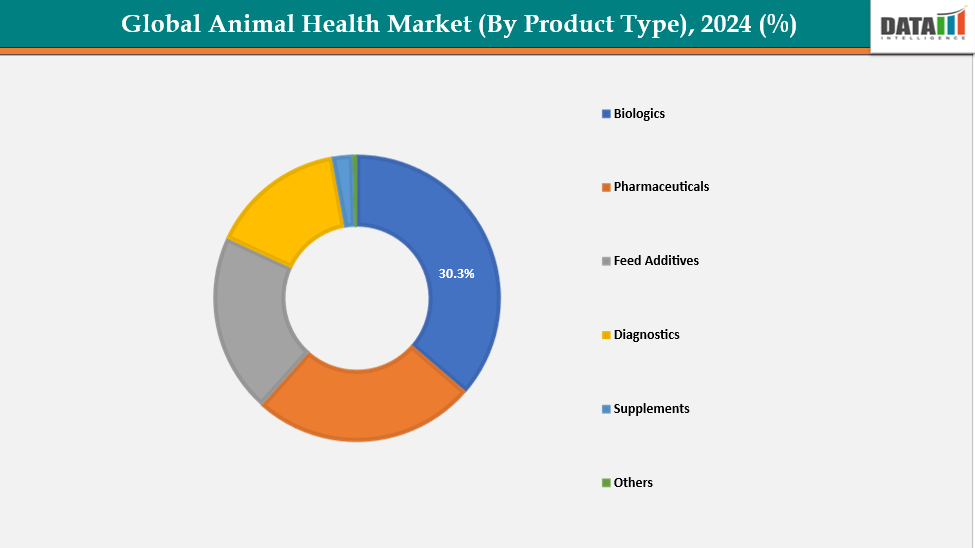

- The biologics segment from product type is dominating the animal health market with a 30.3% share in 2024

- The production animal segment from animal type is dominating the animal health market with a 60.3% share in 2024

- Top companies in the animal health market include Zoetis, Boehringer Ingelheim International GmbH, Elanco, Merck & Co., Ceva, Virbac, Vetoquinol, Dechra, Phibro Animal Health Corporation, and Bimeda US, among others.

Market Dynamics

Drivers: The prevalence of zoonotic and chronic animal diseases is significantly driving the animal health market growth

The rising prevalence of zoonotic and chronic animal diseases is significantly driving the animal health market. Outbreaks of avian influenza, swine fever, rabies, mastitis, and other infectious and chronic conditions pose serious threats to livestock productivity and public health. This promotes the use of vaccines, treatments, and preventative healthcare practices, such as routine diagnostics, herd management, and biosecurity initiatives, by farmers and veterinarians. Through immunization campaigns and regulatory actions, governments also aid in the management of illness. As a result, rising disease burdens drive demand for veterinary care, feed additives, biologics, and improved diagnostics, spurring innovation and expansion in the global animal health industry.

For instance, according to the CDC, since January 2022, more than 17,000 HPAI A(H5N1) outbreaks have been reported across 80 countries, affecting wild birds, poultry, and mammals. In the United States, between January 2022 and December 2023, over 8,500 wild birds and more than 1,000 commercial and backyard flocks were infected, impacting approximately 77.9 million birds across 47 states.

Restraints: High cost of products and veterinary treatments are hampering the growth of the animal health market

The high cost of animal health products and veterinary treatments is restraining market growth. The high cost of advanced vaccines, biologics, and specialist medications, as well as diagnostic procedures and expert veterinary care, frequently restricts access, particularly in developing nations. Product uptake may be lowered by low-income pet owners and small-scale farmers who choose less expensive alternatives or forgo preventive care. Innovative technologies like cell-cultured feed, novel biologics, and intelligent monitoring systems are also difficult to catch on due to their high costs. Therefore, limiting market penetration, especially in low- and middle-income areas, price sensitivity and affordability obstacles limit the possibility for total growth.

For more details on this report, see Request for Sample

Segmentation Analysis

The global animal health market is segmented based on animal type, product type, distribution channel, region

By Product Type:The biologics segment from product type is dominating the animal health market with a 30.3% share in 2024

The biologics segment, including vaccines such as attenuated, inactivated, autogenous, and other types of vaccines, dominates the global animal health market due to its preventive and cost-effective nature. Large populations of fish, cattle, pigs, and poultry are protected against infectious diseases by vaccines, which lower mortality and increase productivity. The focus has switched from medicinal medications to immunization campaigns due to tighter regulations and growing worries about antimicrobial resistance. Recombinant and vector-based vaccinations benefit from technological advancements that improve both immunity and administration simplicity. Programs for mass immunization are cost-effective; they reduce outbreak expenses while maintaining food safety. Because of these considerations, biologics—especially vaccines—are the veterinary health product category that generates the most income globally.

For instance, AviPro Autogenous Vaccine is a vaccination designed specifically for chickens raised on a particular farm using a strain of Salmonella that was isolated from the flock there. Unlike commercial vaccinations that cover broader strains, it offers tailored protection against the disease because it is created from the particular pathogen infecting the animals on that farm.

By Animal Type: The production animal segment from animal type is dominating the animal health market with a 60.3% share in 2024

The production-animal segment, such as poultry, swine, cattle, sheep, goats, and fish, dominates the global animal health market due to its scale and economic importance. Growing worldwide demand for meat, milk, eggs, and seafood requires huge livestock populations. To keep output high and avoid expensive losses, farmers make significant investments in biosecurity, diagnostics, vaccines, and anti-parasites. In addition to being more economical than treatment, preventive care supports laws that reduce antibiotic residues while yet satisfying consumer demands for safe food. While pigs and cattle produce substantial profits from pork, meat, and dairy, poultry leads by volume due to its quick production cycles. The fastest-growing subsegment is aquaculture, while sheep and goats continue to hold a considerable regional market share, supporting the dominance of producing animals.

For instance, according to a February 2025 analysis from Our World in Data and the Sentience Institute, the United States had already confined an estimated 9.2 billion chickens, about 260 million turkeys, roughly 73 million pigs, and around 380 million egg-laying hens in factory-farming systems.

Geographical Analysis

North America is expected to dominate the global animal health market with a 43.5% in 2024

North America is expected to dominate the global animal health market due to its large livestock and companion-animal populations, which drive high demand for vaccines, biologics, and pharmaceuticals. The region benefits from advanced veterinary infrastructure, strong research and development, and rapid adoption of innovative technologies, including diagnostics and therapeutics. Additionally, high disposable incomes and increasing pet ownership fuel spending on companion animal health.

The U.S. animal health market is expected to dominate due to its large livestock and companion animal populations, which create strong demand for vaccines, biologics, and pharmaceuticals. The country benefits from advanced veterinary infrastructure, significant investment in research and development, and rapid adoption of innovative technologies, including diagnostics, therapeutics, and preventive solutions.

Owing to factors like large livestock and companion-animal populations, for instance, according to the U.S. Department of Agriculture’s National Agricultural Statistics Service (NASS), as of July 1, 2025, the United States had a total cattle and calf inventory of 94.2 million head. Of these, 38.1 million were cows and heifers that had calved, including 28.7 million beef cows and 9.45 million milk cows. The U.S. calf crop was estimated at 33.1 million head, while 13.0 million cattle were on feed for beef production. These figures reflect the scale of the U.S. cattle industry and its substantial contribution to both beef and dairy production.

Europe is the second region after North America which is expected to dominate the global animal health market with a 34.5% in 2024

The global animal health market is expanding rapidly in Europe, led by countries such as Germany, the UK, and France. High adoption of farm-specific vaccines, well-established veterinary services, and advanced livestock, poultry, and swine farming operations are key growth drivers. Regulatory support and guidance from agencies like the European Medicines Agency (EMA) further boost demand, emphasizing biosecurity, disease prevention, and rapid outbreak control.

Germany’s advanced cattle and poultry industries, where farm-specific bacterial and viral diseases are prevalent, are driving growth in the animal health market. The adoption of customized vaccines and biologics is further supported by strict regulations emphasizing biosecurity and the prevention of antibiotic resistance. The Federal Office of Consumer Protection and Food Safety (BVL) implement various initiatives and regulatory measures for autogenous vaccinations, reinforcing Germany’s leadership in preventive animal health solutions.

Owing to factors such as strong regulatory support for approvals, HIPRA launched ICHTIOVAC ERM in April 2025, its first inactivated vaccine for Atlantic salmon against Yersiniosis, designed for immersion administration during the freshwater phase. The launch event, held in Castell de Peralada (Girona), gathered key representatives from the European salmon industry to highlight the vaccine’s role in combating the disease and advancing aquaculture health management.

The Asia Pacific region is the fastest-growing region in the global animal health market, with a CAGR of 7.4% in 2024.

The animal health market in the Asia-Pacific region, including countries such as China, India, Japan, and South Korea, is expanding rapidly. Growth is driven by the increasing prevalence of farm-specific bacterial and viral diseases alongside the rapid expansion of cattle, poultry, and swine production. In Japan, adoption is supported by government-backed biosecurity programs and advanced veterinary practices. In China and India, rising awareness of animal health management and improvements in veterinary infrastructure are boosting demand for targeted vaccines, diagnostics, and therapeutics to prevent disease outbreaks and ensure productivity in livestock and poultry sectors.

China’s animal health market has been expanding significantly due to its large cattle, poultry, and swine sectors, which are vulnerable to farm-specific bacterial and viral diseases such as E. coli, Salmonella, and avian influenza. Growing awareness of biosecurity measures, improvements in veterinary infrastructure, poultry health, and rising demand for animal protein have driven increased adoption of animal health products.

For instance, on July 18, 2024, China’s Ministry of Agriculture approved Pyrroloquinoline Quinone Disodium, produced using the FINU-R8 strain of Pseudomonas desmolyticum. Applied for by Guangdong Wens Dahuanong Biotechnology Co., Ltd., the product enhances antioxidant capacity in animals and is intended for use in broilers.

Competitive Landscape

Top companies in the animal health market include Zoetis, Boehringer Ingelheim International GmbH, Elanco, Merck & Co., Ceva, Virbac, Vetoquinol, Dechra, Phibro Animal Health Corporation, and Bimeda US, among others.

Zoetis: Zoetis Inc., headquartered in New Jersey, is the world’s leading animal health company, specializing in vaccines, medicines, diagnostics, and precision health technologies for livestock and companion animals. Founded in 1952 and independent since 2013, it operates in over 100 countries, generating $9.3 billion in revenue in 2024, driven by innovation and global presence.

Key Developments:

- In August 2024, Merck Animal Health, a division of Merck & Co., Inc., announced that the USDA has approved the manufacturing and sale of Cambridge Technology’s experimental autogenous vaccine in the U.S. for the emerging and deadly avian metapneumovirus type B, impacting broilers, broiler breeders, layers, and turkey breeders.

Market Scope

| Metrics | Details | |

| CAGR | 7.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Animal Type | Production Animals, Companion Animals |

| By Product Type | Biologics, Pharmaceuticals, Feed Additives, Diagnostics, Supplements and Others | |

| By Distribution Channel | Hospital, E-Commerce, Retail and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

By Animal Type (Production Animals, Companion Animals), By Product Type (Biologics, Pharmaceuticals, Feed Additives, Diagnostics, Supplements and Others), By Distribution Channel (Hospital, E-Commerce, Retail and Others), By Region (North America, Europe, Asia-Pacific, South America and the Middle East & Africa)

The Global Animal Health Market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more veterinary health-related reports, please click here