Global Aircraft Parts Market: Industry Outlook

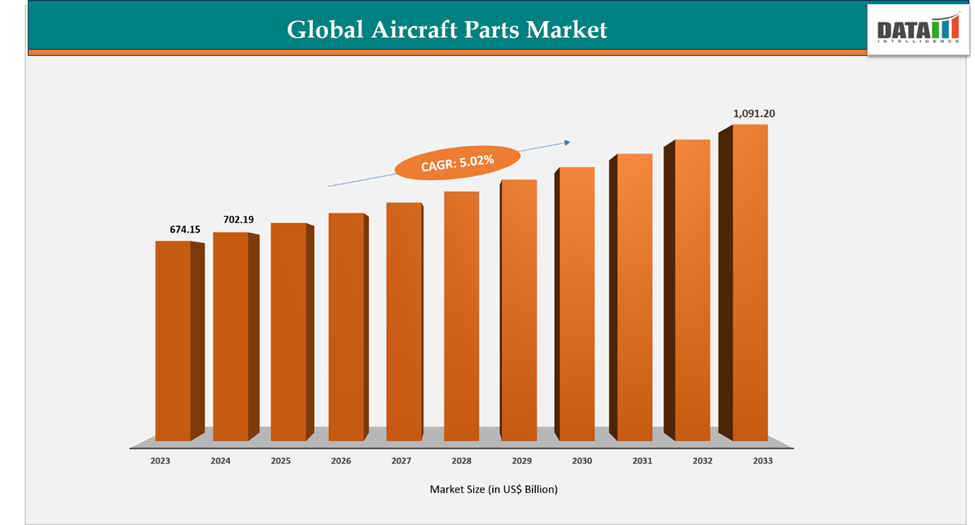

The global aircraft parts market reached US$ 674.15 billion in 2023, with a rise to US$ 702.19 billion in 2024, and is expected to reach US$ 1,091.20 billion by 2033, growing at a CAGR of 5.02% during the forecast period 2025–2033.

The global aircraft parts market is growing steadily, fueled by rising demand for lightweight materials, advanced avionics, and next-generation propulsion systems. Suppliers are focusing on innovation in composite materials, additive manufacturing, and digitalized supply chains, enabling shorter production cycles and greater operational efficiency. Increased collaborations between OEMs, Tier-1 suppliers, and MRO providers, along with rising investments in sustainable aviation technologies, are reshaping competition and driving market expansion.

The U.S. leads the aircraft parts market, supported by major aerospace giants such as Boeing, Raytheon Technologies (Collins Aerospace, Pratt & Whitney), and GE Aerospace. U.S. firms hold the largest market share, driven by strong demand in defense, commercial aviation, and space exploration. Growth is further supported by advanced R&D in propulsion systems, high-performance composites, and digital twin technologies. Government-backed initiatives such as the FAA’s Continuous Lower Energy, Emissions, and Noise (CLEEN) program and increasing investments in next-generation military aircraft sustain U.S. leadership in the global market.

Japan’s aircraft parts market is expanding on the back of its strengths in precision engineering, materials innovation, and partnerships with global aerospace leaders. Companies such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries play a vital role as Tier-1 suppliers to Boeing and Airbus, focusing on wings, fuselage sections, and engine components. Supported by government initiatives like the Japan Aerospace Exploration Agency (JAXA) programs and emphasis on advanced composites and automation, Japan is positioning itself as a critical hub for high-value aircraft components.

Key Market Trends & Insights

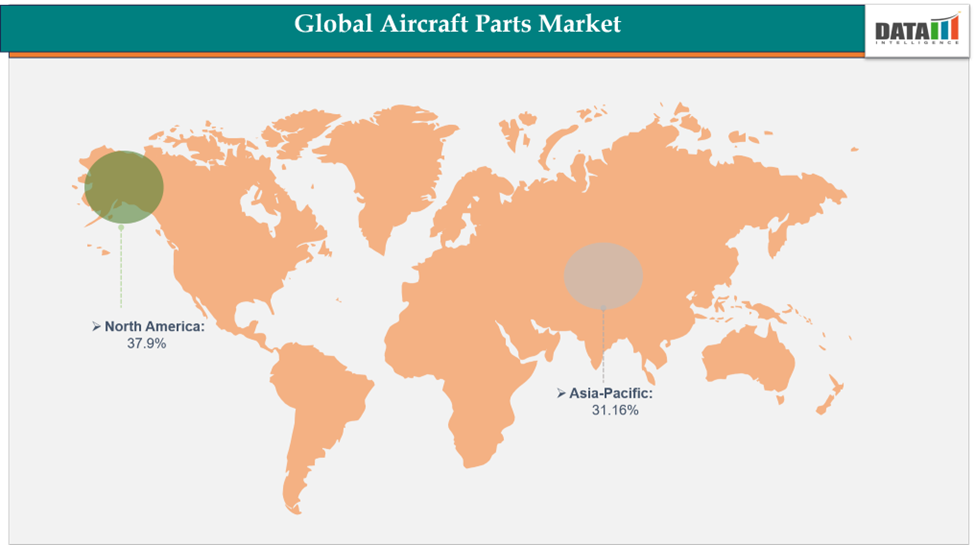

North America accounted for approximately 37.9% of the global aircraft parts market in 2024 and is expected to maintain its dominance throughout the forecast period. This leadership is driven by strong demand from commercial airlines, defense programs, and space exploration initiatives. The region benefits from established aerospace OEMs, advanced manufacturing infrastructure, and continuous R&D investments in lightweight materials, avionics, and propulsion systems. Close collaboration between manufacturers, Tier-1 suppliers, and MRO providers further strengthens North America’s position in the global aircraft parts ecosystem.

Asia-Pacific is projected to be the fastest-growing region in the global aircraft parts market, supported by rapid industrialization, expanding commercial aviation, and rising investments in regional aerospace manufacturing hubs. Countries such as China, Japan, and South Korea are actively enhancing their capabilities in high-value components like engines, wings, and fuselage sections. Government initiatives promoting aerospace innovation, adoption of automation, and partnerships with global OEMs are fueling regional growth. Increasing air travel demand, defense modernization, and emerging MRO services contribute to Asia-Pacific’s accelerated market expansion.

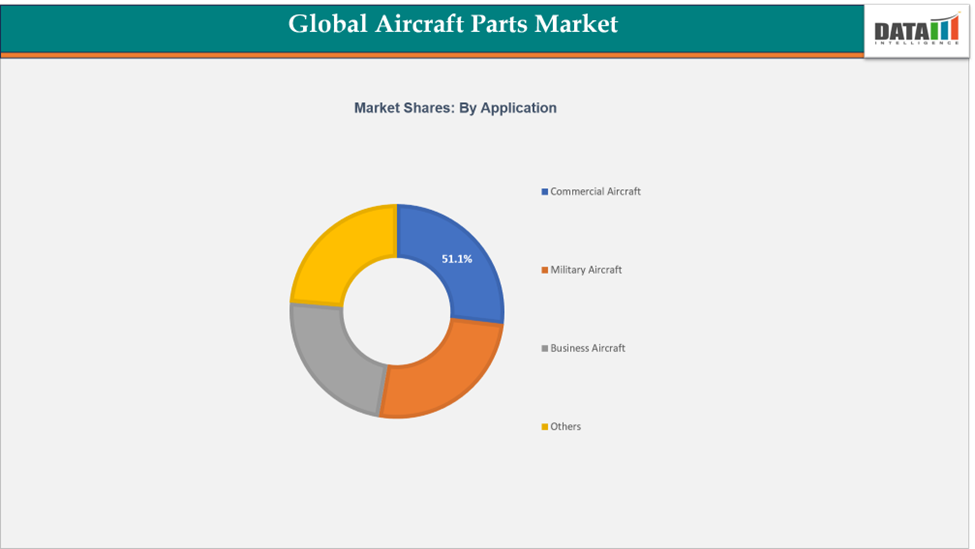

The Commercial Aircraft segment remains the dominant application category in the global aircraft parts market due to its critical role in passenger transport, cargo operations, and airline fleet expansion. Its widespread adoption across airlines worldwide highlights its importance in driving demand for high-precision airframe components, propulsion systems, avionics, and interior solutions, while enabling technological advancements in fuel efficiency, safety, and passenger comfort.

Market Size & Forecast

2024 Market Size: US$ 702.19 Billion

2033 Projected Market Size: US$ 1,091.20 Billion

CAGR (2025–2033): 5.02%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Expansion of Defense Aviation Programs and Military Fleet Modernization

The Global Aircraft Parts Market is witnessing robust growth driven by the expansion of defense aviation programs and the modernization of military fleets across the globe. Rising investments in next-generation fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs) are fueling demand for high-precision components, including engines, avionics, and mission-critical aircraft parts. These initiatives not only strengthen national defense capabilities but also spur innovation in advanced materials, propulsion technologies, and digital manufacturing processes.

For instance, the U.S. Air Force awarded contracts to major suppliers such as Lockheed Martin and Raytheon Technologies for components supporting modernization projects, including upgrades to the F-35 and KC-46 fleets. Such initiatives highlight how defense aviation programs are driving market expansion and creating significant opportunities for aircraft parts manufacturers worldwide.

Restraint: Lengthy Certification Cycles and Regulatory Compliance Challenges

The global aircraft parts market faces significant challenges due to extended certification processes and stringent regulatory compliance requirements. New aircraft components must undergo rigorous testing and validation to meet safety and airworthiness standards, which can delay production schedules, increase costs, and limit market entry speed. These regulatory hurdles impact both OEMs and Tier-1 suppliers, particularly smaller manufacturers aiming to compete in the high-value aerospace segment.

For instance, Mitsubishi Heavy Industries experienced multiple delays in its SpaceJet program, primarily due to the complexities of the type certification process. The company admitted to underestimating these challenges, leading to repeated design changes and ultimately the program's discontinuation in 2023

Similarly, Kawasaki Heavy Industries faced delays in the development of its C-2 military transport aircraft. The Japanese Ministry of Defense announced a two-year delay in the aircraft's entry into service following an airframe failure during strength testing. This setback was attributed to concentrated loads around the frames near the cargo door, highlighting the impact of stringent testing and certification requirements on project timelines.

These examples underscore how regulatory complexities and certification challenges can significantly affect the development and delivery timelines of aircraft components, posing constraints to the growth of the aircraft parts market.

For more details on this report, Request for Sample

Market Segmentation Analysis

The global aircraft parts market is segmented based on component, application, distribution channel, and region.

Application: The commercial aircraft parts segment is estimated to have 51.1% of the aircraft parts market share.

The commercial aircraft segment represents a key application in the global aircraft parts market, driving demand for components used in passenger planes, cargo aircraft, and fleet expansions. Manufacturers are focused on supplying high-precision airframe sections, propulsion systems, avionics, and cabin interiors, supporting both new aircraft production and modernization initiatives.

Growth in this segment is propelled by increasing airline orders, rising air travel, and the push for fuel-efficient and technologically advanced aircraft. Major players such as Boeing, Airbus, and COMAC dominate with large commercial aircraft programs, while specialized suppliers provide advanced avionics, lightweight materials, and propulsion solutions. For instance, in 2024, Japan’s Mitsubishi Heavy Industries supplied critical fuselage and wing components for regional jets, bolstering regional aviation capabilities. Similarly, U.S.-based Spirit Aero Systems expanded production for Boeing’s 737 and 777 fleets, emphasizing the role of strategic partnerships and localized manufacturing hubs.

Looking forward, narrow-body and next-generation wide-body aircraft are expected to witness the fastest growth, driven by rising global passenger and cargo traffic. Although long certification processes and regulatory requirements remain challenges, investments in digital manufacturing, advanced materials, and integrated systems are expected to sustain robust growth in the commercial aircraft application segment.

Geographical Analysis

The North America aircraft parts market was valued at 37.9% market share in 2024

The North America aircraft parts market accounted for 37.9% share in 2024. North America remains a leading region in the global aircraft parts market, anchored by established aerospace companies such as Boeing, GE Aviation, Honeywell, and Pratt & Whitney. U.S. suppliers dominate in engines, avionics, landing gear, and other critical components across commercial, defense, and space aviation segments. The market is strengthened by advanced manufacturing technologies, robust MRO infrastructure, and growing investments in next-generation aircraft and UAV programs.

For instance, the modernization of the F-35 and KC-46 fleets by the U.S. Air Force has driven substantial procurement of high-precision components from domestic suppliers, reinforcing North America’s leadership in the aircraft parts ecosystem. Government support through aerospace R&D funding and defense procurement initiatives continues to bolster innovation and competitiveness. While challenges like rising raw material costs and long certification cycles exist, North America’s engineering expertise and industrial infrastructure ensure sustained growth in the aircraft parts market.

The Asia-Pacific aircraft parts market was valued at 31.16% market share in 2024

The Asia-Pacific aircraft parts market held a 31.16% share in 2024. The region is fastest growing hub for the global aircraft parts industry, driven by rising demand for commercial airliners, defense aircraft, and expanded MRO (Maintenance, Repair, and Overhaul) services. China is rapidly enhancing its domestic aerospace manufacturing ecosystem through players like COMAC and AVIC, focusing on narrow-body aircraft, engines, and avionics systems. Japan continues to contribute high-precision components such as fuselage sections, wings, and engines, while South Korea and India are scaling up their aerospace capabilities and local supply chains.

For instance, COMAC’s C919 program, aimed at producing a domestic narrow-body jet, has created strong demand for advanced aircraft components across china and the region. This program supports local suppliers and strengthens the region’s manufacturing capabilities. Growth is further fueled by expanding airline fleets, defense modernization, and government-backed initiatives, although global supply chain disruptions and lengthy certification processes remain challenges.

Competitive Landscape

The major players in the aircraft parts market include Boeing, General Electric Company, Rolls-Royce plc, Airbus, Safran S.A., Pratt & Whitney, Leonardo S.p.A., AAR Corp. (, MTU Aero Engines AG, Spirit Aero Systems, Inc.

Boeing: Boeing is a leading player in the global aircraft parts market, specializing in high-precision components, airframes, engines, and avionics systems that support commercial, defense, and space aviation. Its advanced manufacturing capabilities integrate aero structures, propulsion systems, and digital technologies, delivering high performance, reliability, and efficiency across aircraft platforms. With extensive R&D investments and strategic partnerships with Tier-1 suppliers and MRO providers, Boeing continues to drive innovation in next-generation aircraft design, sustainable aviation technologies, and smart manufacturing, reinforcing its position as a key enabler of the global aerospace ecosystem.

Market Scope

Metrics | Details | |

CAGR | 5.02% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Airframe Components (Fuselage Sections, Wings & Winglets, Tail & Empennage, Landing Gear) Propulsion System Components (Engines (Turbofan, Turboprop, Turbojet) Engine Accessories & Modules)), Avionics (Navigation Systems Communication Systems, Flight Control Systems, Instrumentation & Displays) Mechanical Components (Actuators & Hydraulic Systems, Pumps & Valves, Bearings & Fasteners) Interior Components (Seating Systems, Cabin Interiors, Galley & Lavatory Systems) Other Components (Electrical Systems & Wiring, Fuel Systems, Auxiliary Power Units (APUs)) |

| Application | Commercial Aircraft, Military Aircraft, Business Aircraft, Others |

| Distribution Channel | OEMs, Aftermarket |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global aircraft parts market report delivers a detailed analysis with 55 key tables, more than 62 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.