Adult Diaper Market Overview

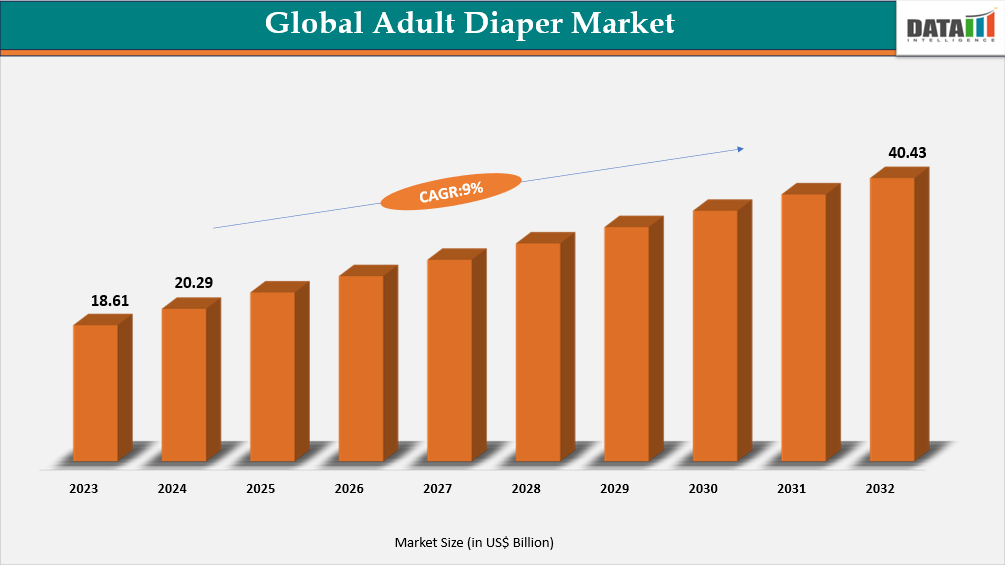

As per DMI analysis, the global adult diaper market reached US$18.61 billion in 2023, rising to US$20.29 billion in 2024, and is projected to reach US$40.43 billion by 2032, growing at a CAGR of 9% during the forecast period.

The global adult diaper market stands at a critical inflexion point, driven by profound demographic transformation and evolving consumer expectations. The worldwide share of people aged 65 has almost doubled between 1974 and 2024, increasing from 5.5% to 10.3%, fundamentally reshaping healthcare infrastructure requirements and consumer product demand. Approximately 24% to 45% of women report experiencing urinary incontinence, with daily occurrences reported by 9% to 39% of women over 60. Furthermore, the pooled global prevalence of fecal incontinence stands at 8.0%, affecting approximately one in twelve adults globally, with prevalence notably higher among persons aged 60 and older at 9.3%.

Companies are expanding into online retail and subscription-based sales channels along with continuous R&D in skin-friendly and discreet incontinence solutions, recognizing that sustained competitive advantage requires both product excellence and distribution innovation. Environmental sustainability has emerged as a critical strategic consideration, with leading manufacturers exploring biodegradable materials, recyclable packaging, and carbon-neutral manufacturing processes to address regulatory requirements and consumer preferences. This sustainability imperative, however, must be balanced against performance requirements and cost considerations, particularly in price-sensitive market segments.

Adult Diaper Market Industry Trends and Strategic Insights

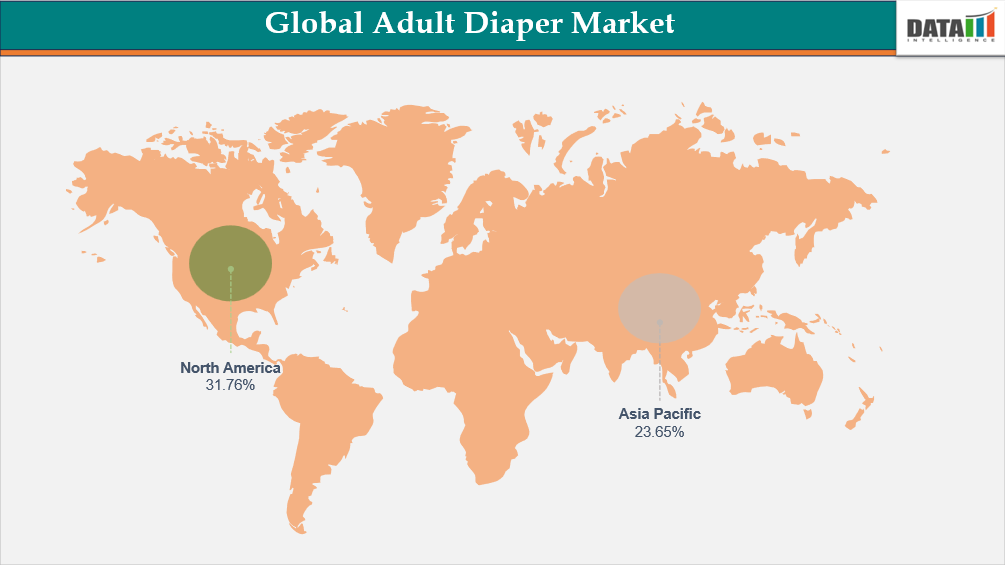

- North America leads the global adult diaper market, capturing the largest revenue share of 31.76% in 2024.

- By product type segment, pad type led the global adult diaper market, capturing the largest revenue share of 42.34% in 2024.

Global Adult Diaper Market Size and Future Outlook

- 2024 Market Size: US$20.29 billion

- 2032 Projected Market Size: US$40.43 billion

- CAGR (2025–2032): 9%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Pad Type (Incontinence Pads), Flat Type (Underpads/Chux), Pant Type (Pull-ups), Tape Type (Tab-style) |

| By Usage | Disposable Adult Diapers, Reusable/Cloth Adult Diapers |

| By Gender | Male, Female, Unisex |

| By Age Group | Below 50 years, 50–60 years, 60–70 years, 70–80 years, Above 80 years |

| By Distribution Channel | Hospitals and Clinics, Supermarkets and Hypermarkets, Pharmacies and Drugstores, E-commerce/Online, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detailed Information, Request for Sample

Market Dynamics

Rapidly Aging Global Population Directly Expanding Consumer Base

According to UN data, the global population aged 65 and over is projected to more than double from 761 million in 2021 to 1.6 billion by 2050. This represents a near-universal phenomenon, with particularly acute acceleration in Asia-Pacific regions like Japan, China, and South Korea. This demographic expansion directly translates into a larger addressable market, as age remains the primary correlative factor for incontinence prevalence.

Rising longevity is often accompanied by a higher prevalence of age-related chronic conditions, such as mobility issues, dementia, and, of course, urinary and fecal incontinence. The period of life spent managing these conditions, the “morbidity span”, is lengthening. This extends the usage window for adult diapers from a short-term, acute-care product to a long-term, everyday essential for a growing cohort. Furthermore, the psychological and social normalization of incontinence management, especially in developed markets, is reducing historical stigma. This cultural shift encourages earlier adoption and more consistent use, increasing per-user consumption rates alongside the growing user base.

Global Adult Diaper Market, Segmentation Analysis

The global adult diaper market is segmented based on product type, usage, gender, age group, distribution channel and region.

Pad-Type (Incontinence Pads) Lead the Market with 42.34% Due to Their High Convenience and Discreet Usability

The incontinence pads segment represents a pivotal growth driver within the global adult diaper market, commanding substantial market share due to its versatility, discretion, and cost-effectiveness. This product category addresses the nuanced needs of individuals experiencing mild to moderate incontinence, offering a less intrusive solution compared to full adult diapers while maintaining clinical efficacy and user dignity.

The pad segment's competitive positioning stems from several strategic advantages. Product innovation has yielded ultra-thin designs incorporating superabsorbent polymers capable of retaining 10-20 times their weight in fluid while maintaining breathability and skin integrity.

The US Centers for Disease Control and Prevention reports that approximately 51% of adult incontinence sufferers prefer pad-type products for daytime use, citing comfort and discretion as primary decision factors.

Regulatory frameworks continue shaping product development trajectories. The FDA's classification of incontinence pads as Class I medical devices ensures baseline safety standards, while reimbursement policies through Medicare and Medicaid influence purchasing patterns significantly. Regional variations in healthcare coverage create disparate market dynamics, with European markets demonstrating higher reimbursement rates compared to Asia-Pacific regions.

Flat Type has a significant share due to its Wide Healthcare Use And Cost-Effective Protection

Flat Type (Underpads/Chux) holds the highest share because they provide broad protection for beds, chairs, and medical surfaces, making them essential in hospitals and eldercare facilities. Their ease of use and quick replacement reduce caregiver workload. They are also cost-effective, encouraging bulk adoption in healthcare and home-care settings. The versatile design supports both bedridden and mobile patients. Overall, their practicality and wide application drive strong demand in the global adult diaper market.

Global Adult Diaper Market, Geographical Penetration

Dominating Region: North America as a Catalyst for Adult Diapers with a 31.76% share in the Global Market

North America constitutes the most mature and sophisticated regional market for adult diapers globally, characterized by advanced healthcare infrastructure, high consumer awareness, favorable reimbursement frameworks, and demographic trends that position the region as both a revenue leader and innovation hub.

US Adult Diaper Market Outlook

The US adult diaper market is expanding rapidly due to the fast-growing elderly population, projected to reach 82 million people aged 65+ by 2030. As ageing increases, so does the prevalence of bladder control issues, affecting around 25 million American adults. Incontinence rates rise sharply with age, from 11–17% in adults in their early 40s to 31–38% in those 80 and above. This demographic shift is driving strong demand for adult diapers and incontinence products across the country.

Canada Adult Diaper Market Trends

Canada's adult diaper market is expanding as the country’s senior population is expected to reach 23% by 2030, mirroring US aging trends and driving steady, recession-resistant demand. This growth attracts major global consumer goods companies seeking long-term market stability. At the same time, strict regulatory standards ensure product safety but raise entry barriers, with requirements like FDA oversight and California-style compliance laws demanding significant investment from manufacturers.

Fastest Growing Market: Asia-Pacific Records the Fastest Growth Driven by Rising Food Safety Demand and Blockchain Adoption

The Asia Pacific region emerged as the dominant market for adult diapers globally. The market in the region experienced robust growth. The large and rapidly growing population in the Asia Pacific, coupled with the increasing prevalence of incontinence issues, created significant market demand. The Asia Pacific market attracted major players who strategically focused on capturing the region's market share.

India Adult Diaper Market Insights

India’s adult diaper market is evolving with innovative products targeting younger consumers experiencing light incontinence. For example, in May 2023, Nobel Hygiene’s flagship brand, Friends, launched Friends UltraThinz, the country’s first slim disposable absorbent underpants. Designed for conditions like obesity, prostate issues, and postpartum incontinence, such products reflect growing awareness and adoption of adult hygiene solutions beyond the elderly population. This trend is expanding the market and attracting new consumer segments in India.

Japan Adult Diaper Market Industry Growth

Japan’s adult diaper market is strongly driven by its rapidly aging population, with 36.25 million people aged 65+ now representing nearly one-third of the nation. At 29.3%, Japan has the highest elderly population share globally among sizable countries. This extreme demographic shift fuels rising demand for incontinence products. As a result, adult diapers have become a major and steadily growing segment within Japan’s hygiene and healthcare market.

Regulatory Analysis

The global diaper market is subject to diverse regulatory frameworks depending on the region. In the United States, diapers are considered Class I medical devices with low to moderate risk, requiring manufacturers to register their facilities and comply with the FDA’s Quality System Regulation, though pre-market approval is generally not needed. In the European Union, diapers fall under MDR 2017/745 as Class I devices, where manufacturers must maintain a Technical File, declare conformity, and apply the CE marking, involving a Notified Body for sterile products.

In Asia, Japan regulates diapers as Class I medical devices under the PMD Act, requiring manufacturers to hold a Marketing Authorization Holder license and follow relevant JIS standards for performance. In China, diapers are classified as moderate-risk Class II devices, necessitating product registration, licensing, and potentially clinical data, with mandatory issuance of a Medical Device Registration Certificate. These regulatory variations highlight the need for region-specific compliance strategies for market entry.

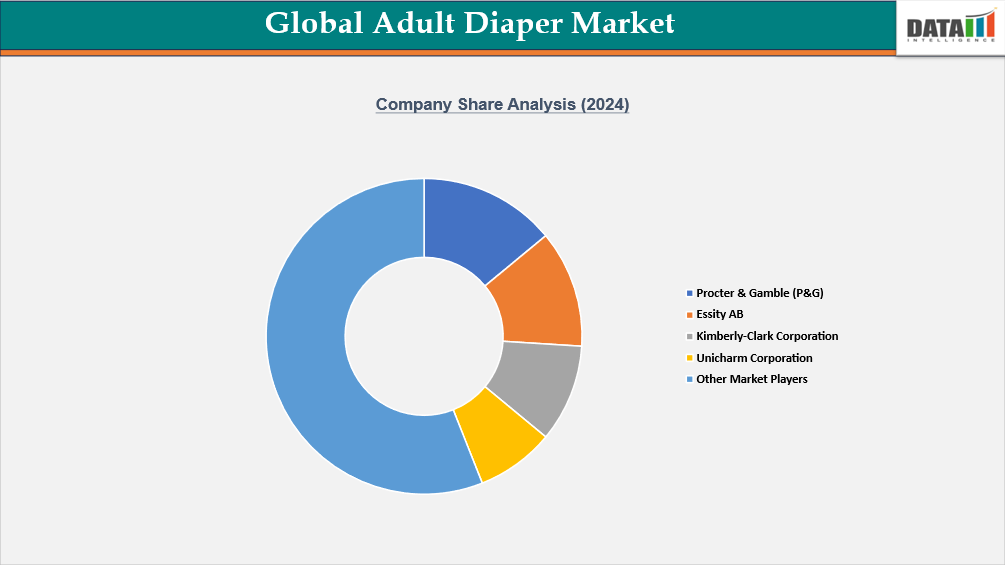

Competitive Landscape

- The global adult diaper market is highly fragmented, with intense competition defined by the strategic duality of global giants and aggressive regional players.

- Leading multinationals like Procter & Gamble, Kimberly-Clark, and Unicharm leverage their vast R&D capabilities, sophisticated supply chains, and strong brand equity to dominate in North America and Western Europe, primarily through retail channels.

- Concurrently, regional champions such as DSG International in Asia and Ontex in Europe compete effectively with deep local distribution networks, cost-efficient manufacturing, and products tailored to specific cultural preferences.

- The market is further pressured by the rapid growth of private-label offerings from large retailers, which squeezes margins and drives innovation.

Key Developments

- In September 2025, Tulips entered the adult hygiene segment with the launch of TULIPS Adult Diaper Pants, aiming to address urinary incontinence among seniors in India. The brand has roped in Bollywood actor Boman Irani as the face of its ‘Life par full control’ campaign to break the stigma around adult diaper usage.

- In December 2024, Liquid Death and Depend have teamed up to launch the “Pit Diaper,” a specially designed adult diaper for mosh pit enthusiasts, ensuring concertgoers don’t have to leave the stage area for bathroom breaks. Crafted from cruelty-free quilted pleather with chain and spike detailing, the diaper also features Depend Guards to prevent leaks.

Investment & Funding Landscape

The adult diaper market has seen significant investment inflows driven by rising demand from aging populations and increasing awareness of incontinence care. Venture capital and private equity are actively funding innovative product developments, including premium, eco-friendly, and technologically enhanced diapers. Strategic partnerships and joint ventures are also common, aimed at expanding production capacity and distribution networks.

| Company | Investment/Funding | Year | Details | |

| Nobel Hygiene | Fund Raise of US$20 Million | 2025 | Nobel Hygiene has raised approximately ₹170 crore (US$20 million) from Neo Asset Management, marking a significant milestone for India’s disposable hygiene sector. The funding supports the company’s next growth phase as it moves towards an IPO. | |

What Sets This Global Adult Diaper Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by Deployment, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Adult Diaper commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.