Disease Overview:

Warm Autoimmune Hemolytic Anemia (wAIHA) is a rare condition where the immune system mistakenly targets and destroys the body’s own red blood cells. This occurs when certain antibodies, most often of the IgG type, bind to red blood cells at normal body temperature. The immune system then recognizes these tagged cells as abnormal and removes them, primarily through the spleen, leading to anemia.

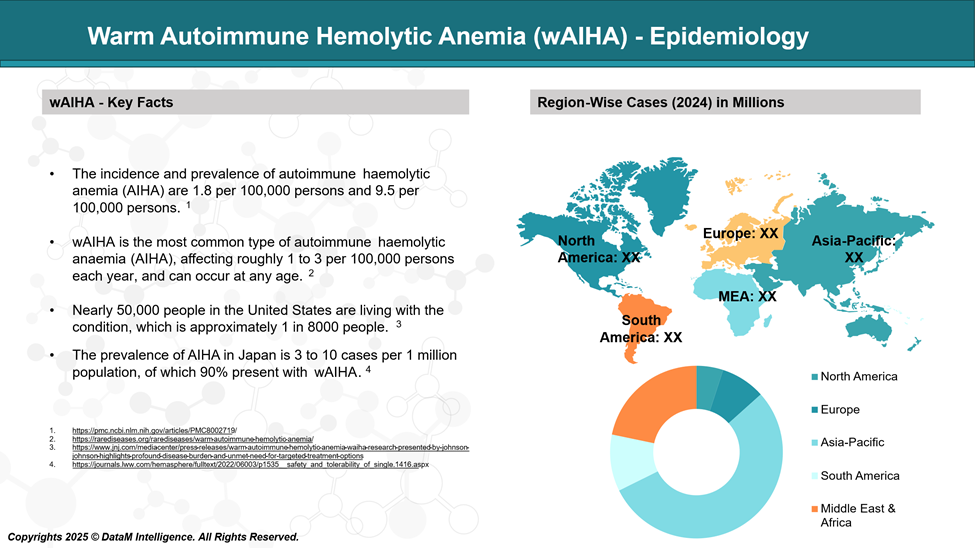

Epidemiology Analysis (Current & Forecast)

Warm autoimmune hemolytic anemia (wAIHA) is the most frequently diagnosed form of autoimmune hemolytic anemia. It can affect individuals across all age groups and is estimated to occur in about 1 to 3 people per 100,000 annually.

Approved Drugs - Sales & Forecast

Currently, there are no therapies specifically approved by the FDA for the treatment of warm autoimmune hemolytic anemia (wAIHA). Management generally involves the use of corticosteroids, immunosuppressive agents, and therapies that target B cells.

- Corticosteroids are the mainstay of initial treatment.

- Rituximab is a well-established off-label second-line option.

- Splenectomy and immunosuppressants are used in refractory cases.

No therapies are specifically approved by the FDA for wAIHA yet, but clinical trials and novel agents are actively being pursued.

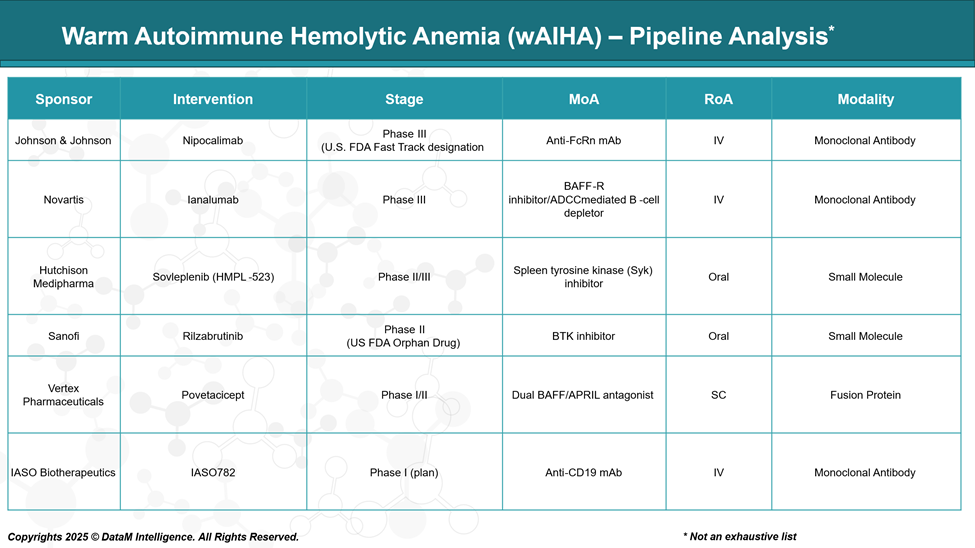

Pipeline Analysis and Expected Approval Timelines

With no FDA-approved therapies for wAIHA, current treatments rely on immunosuppression and off-label use. However, a new wave of investigational drugs is targeting novel pathways such as B-cell signaling, FcRn, and complement, in an effort to offer safer, more effective, and durable treatment options.

Competitive Landscape and Market Positioning

With no approved treatments for wAIHA, companies like Johnson & Johnson, Novartis, Hutchmed, Sanofi, and Vertex are developing innovative therapies targeting FcRn, B-cells, and kinase pathways. These emerging candidates aim to offer better safety, efficacy, and convenience, shaping the future competitive market for wAIHA.

Company | Drug Candidate | MoA | Modality | Innovation Focus | Clinical Edge / Differentiation | Strategic Value Proposition |

Johnson & Johnson | Nipocalimab | Anti-FcRn monoclonal antibody | IV biologic | Novel IgG clearance without B-cell depletion | Reduces pathogenic IgG levels without broad immunosuppression | First-in-class opportunity; broad autoimmune potential |

Novartis | Ianalumab | BAFF-R inhibitor; ADCC-mediated B-cell depletion | Subcutaneous mAb | Selective B-cell targeting | Precision depletion of autoreactive B-cells | Rituximab alternative with more controlled B-cell modulation |

Hutchmed | Sovleplenib (HMPL-523) | Syk kinase inhibitor | Oral small molecule | Downstream signaling inhibition | Convenient oral dosing; potential use in complement-activating forms | Differentiated by route, chronic use potential, and safety |

Sanofi | Rilzabrutinib | BTK inhibitor | Oral small molecule | B-cell signaling blockade with reduced toxicity | Non-cytotoxic, oral, and rapid-acting | Outpatient-friendly; competitive safety profile vs. broad therapies |

Vertex Pharmaceuticals | Povetacicept | Dual BAFF/APRIL antagonist | Fc-fusion protein (IV) | Broader B-cell survival pathway inhibition | Simultaneously targets BAFF and APRIL pathways | Positioned for durability and cross-indication potential |

Key Takeaways

- The pipeline is diversifying beyond steroids and rituximab, with innovation driven by precision immunology, IgG modulation, and oral therapies.

- Nipocalimab and Ianalumab are front-runners due to their novel mechanisms and advanced development.

- Oral agents like Sovleplenib and Rilzabrutinib are well-positioned for chronic outpatient care, a key unmet need.

- Povetacicept’s dual-target approach may offer broader and longer-lasting disease control.

Key Companies:

Target Opportunity Profile (TOP)

There is a substantial unmet medical need and a significant opportunity for new, targeted treatments. To successfully enter the wAIHA market, emerging therapies must demonstrate clear advantages in safety, efficacy, mechanism of action, and patient convenience.

Target Opportunity Profile for Emerging wAIHA Therapies

Aspect | Details & Expectations |

Safety | - Must exhibit a strong safety profile with minimal serious adverse events, especially avoiding broad immunosuppression-related risks like infections. |

Efficacy | - Rapid onset of action to quickly control hemolysis and improve hemoglobin levels. |

Mechanism of Action (MoA) | - Targeted and specific immunomodulation rather than broad suppression. |

Route of Administration (RoA) | - Oral administration preferred for convenience and adherence, especially for long-term therapy. |

Dosing | - Simple and flexible dosing schedules (e.g., once daily, weekly, or monthly) to improve patient compliance. |

Modality | - Small molecules for oral convenience or biologics with engineered properties (e.g., extended half-life, reduced immunogenicity). |

Innovation | - Therapies offering novel mechanisms that differentiate from corticosteroids and rituximab. |

Patient Experience | - Reduced hospital visits and monitoring requirements. |

Summary

To gain a competitive edge in the wAIHA market, emerging drugs must deliver targeted, effective treatment with a superior safety profile compared to current standards. Emphasis on oral or less frequent dosing routes, novel mechanisms addressing underlying disease pathology, and improved patient quality of life will be critical. Demonstrating durable efficacy and steroid-sparing effects will also be key factors for regulatory approval and commercial success.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: