Disease Overview:

ATTR-CM (Transthyretin Amyloid Cardiomyopathy) is a chronic and progressive form of amyloidosis that affects the heart. It results from the misfolding and accumulation of a protein called transthyretin (TTR), which is primarily produced in the liver.

In ATTR-CM, unstable TTR proteins misfold and clump together, forming amyloid deposits in the heart tissue. Over time, these deposits disrupt the heart’s structure and function, leading to cardiomyopathy.

There are two types of ATTR-CM ‒ hereditary ATTR-CM (hATTR-CM) and wild-type ATTR-CM (wATTR-CM).

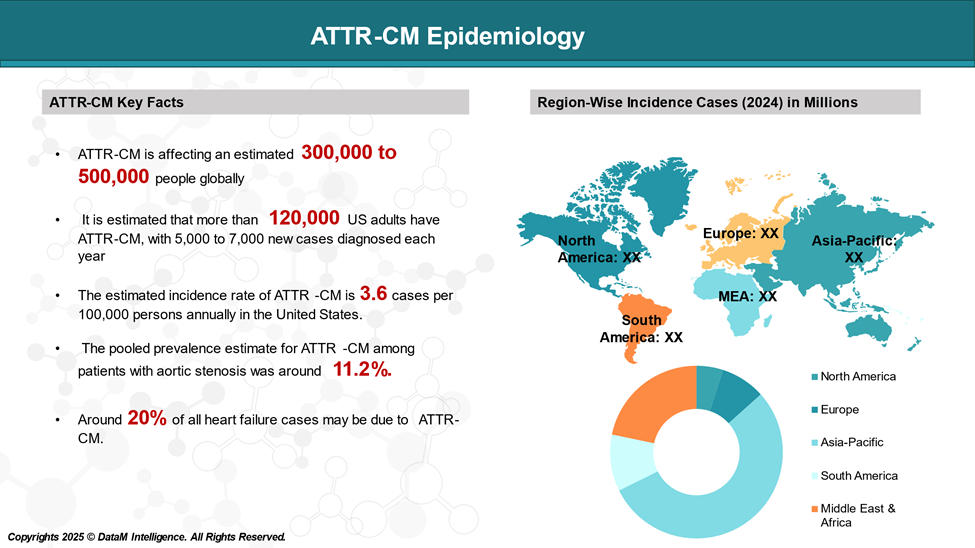

Epidemiology Analysis (Current & Forecast)

The prevalence of ATTR-CM varies significantly depending on factors like age, sex, and the specific population studied.

Approved Drugs (Current SoC) - Sales & Forecast

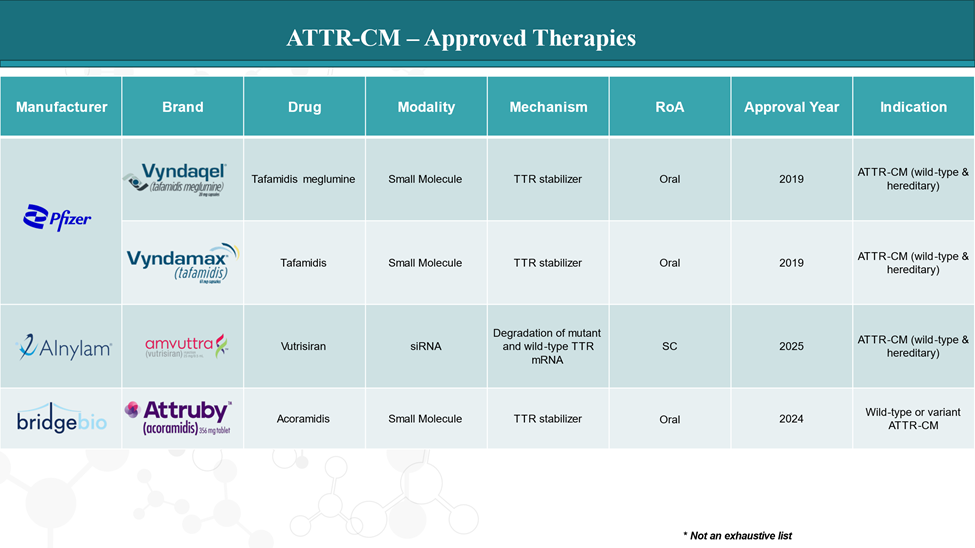

As of 2025, several FDA-approved drugs are available for treating transthyretin amyloid cardiomyopathy (ATTR-CM), targeting both wild-type and hereditary (variant) forms of the disease. These therapies primarily focus on stabilizing transthyretin (TTR) or reducing TTR production, slowing disease progression, and improving quality of life.

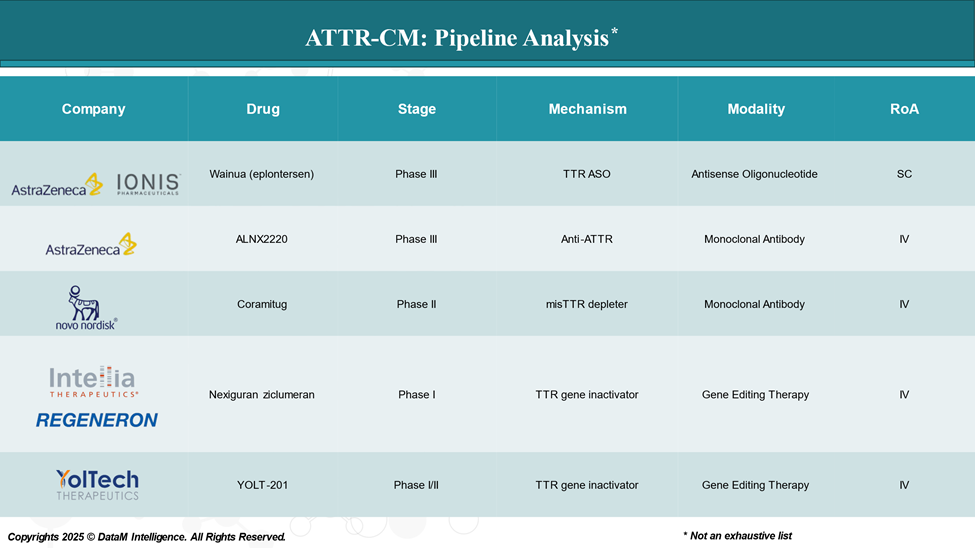

Pipeline Analysis and Expected Approval Timelines

As of April 2025, the pipeline for ATTR-CM is progressing rapidly, with several promising therapies advancing through clinical trials. These investigational treatments aim to address unmet needs in stabilizing transthyretin (TTR), reducing TTR production, and removing amyloid deposits.

Competitive Landscape and Market Positioning

The ATTR-CM treatment landscape is experiencing significant growth, driven by recent drug approvals, a robust pipeline of therapies, and strategic market positioning by key pharmaceutical players.

| Drug | RoA | Efficacy | Market Share | Cost (Est.) | Approved Indication |

| Vyndaqel® (tafamidis meglumine) | Oral (1x/day) | Reduces mortality & CV hospitalizations (~30%) | Market leader (Pfizer) | ~$225K–250K/year | ATTR-CM (both wild-type & hereditary) |

| Vyndamax® (tafamidis free acid) | Oral (1x/day, lower pill burden) | Bioequivalent to Vyndaqel | Market leader (Pfizer) | Similar to Vyndaqel | ATTR-CM (both wild-type & hereditary) |

| Vutrisiran (Amvuttra) | Subcutaneous (q3 months) | less frequent dosing (HELIOS-B data) | New entrant, potential to disrupt | ~$463.5K/year | ATTR-CM (both wild-type & hereditary) |

| Attruby (Acoramidis) | Oral (twice daily) | Near-complete TTR stabilization; rapid clinical benefit (ATTRibute-CM) | New entrant, potential to disrupt | $244K/year | Wild-type or variant ATTR-CM |

Key Companies:

Target Opportunity Profile (TOP)

Target Opportunity Profile (TOP) is designed for emerging ATTR-CM therapies. This framework outlines what an ideal new therapy would need to achieve or improve upon to outperform approved treatments.

| Parameter | Current Standard (Approved Drugs) | Target Profile to Outperform |

| Mechanism of Action | - TTR stabilizers (tafamidis, acoramidis) - RNA silencers (vutrisiran) |

|

| Route of Administration | - Oral (daily/twice daily) - IV/subQ (monthly to quarterly) |

|

| Clinical Endpoints | - Primary: All-cause mortality, CV hospitalization - Secondary: 6MWT, NT-proBNP, QoL scores |

|

| Safety & Tolerability | - Mostly well-tolerated - Injection site reactions, liver enzyme elevations (RNAi) |

|

| Efficacy | - ~30% reduction in mortality and CV events (tafamidis) - RNAi: strong TTR knockdown |

|

| Pricing/Cost | - ~$225K–$463K/year for tafamidis, vutrisiran |

|

| Trial Size | - 600–1000 patients (ATTRibute-CM, APOLLO-B, HELIOS-B) |

|

| Duration to Clinical Benefit | - Separation in outcomes at ~6–9 months for tafamidis - ~3–6 months for acoramidis |

|

Strategic Takeaways

- Multi-mechanism therapies (e.g. TTR stabilizer + amyloid removal) are ideal to push efficacy beyond existing benchmarks.

- Faster onset of benefit, ideally visible within 1–3 months, is a key competitive edge.

- Non-invasive, infrequent dosing (oral or infrequent subQ) improves adherence and market preference.

- Superior safety and economic value are crucial for payer acceptance and market expansion, especially for elderly patients.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.