Disease Overview:

Spinocerebellar ataxias (SCAs) are a group of rare inherited neurological conditions that impair coordination, balance, and muscle control. These conditions involve the gradual deterioration of nerve cells in the hindbrain, especially in the cerebellum, which plays a key role in controlling movement and maintaining balance. The degeneration may also affect the brainstem, upper spinal cord, and sometimes other parts of the nervous system.

Epidemiology Analysis (Current & Forecast)

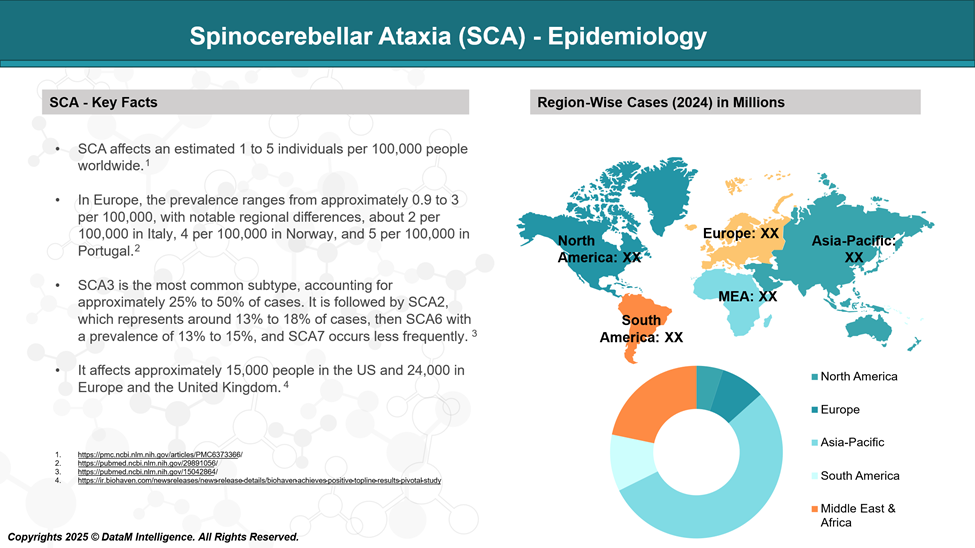

The global prevalence of spinocerebellar ataxia (SCA) is estimated to be between 1 and 5 per 100,000 individuals.

Currently, around 40 different forms of SCA have been identified, each caused by unique genetic mutations. SCA3 is the most common form of SCA globally, representing 25-50% of patients, followed by SCA2 and 6.

Approved Drugs (Current SoC) - Sales & Forecast

Currently, there is no approved treatment for SCA. However, Biohaven has submitted an application to the US FDA seeking approval to market its investigational drug, troriluzole (expected approval in Q4-2025). This therapy is designed to help regulate glutamate levels, a critical neurotransmitter believed to play a role in the development of the disease.

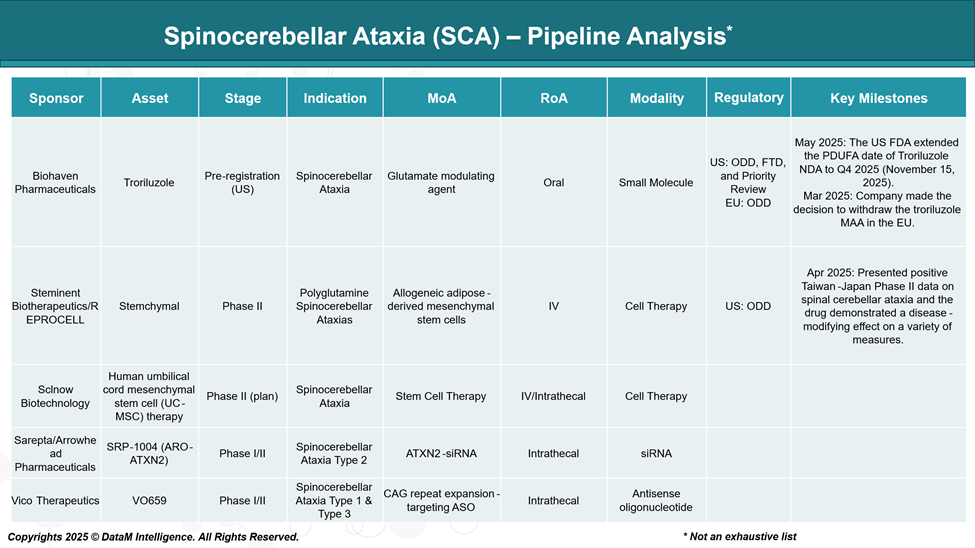

Pipeline Analysis and Expected Approval Timelines

The therapeutic pipeline for Spinocerebellar Ataxia (SCA) has seen significant advancements, with several promising candidates in various stages of development.

Competitive Landscape and Market Positioning

This competitive landscape analysis highlights the positioning of key players developing SCA therapies, focusing on their target populations, strategic differentiation, and market ambitions. As regulatory momentum builds and precision neurology advances, SCA is poised to transition from an underserved indication to a dynamic space for therapeutic innovation and value creation.

Strategic Competitive Landscape – Spinocerebellar Ataxia (SCA)

Company | Therapy | Target Indication | Target Population Scope | Differentiation Strategy | Strategic Positioning |

Biohaven | Troriluzole | SCA (general) | Broad, subtype-agnostic | Glutamate modulation to slow neurodegeneration and improve symptoms | Positioned to be the first commercial therapy; strong U.S. regulatory support. Anchored in symptomatic relief with potential long-term disease-modifying benefit. |

Steminent/ REPROCELL | Stemchymal | PolyQ SCAs | Moderate (subset of SCAs) | Regenerative cell therapy with disease-modifying potential | Demonstrated regional success (Asia); competitive edge in modifying disease course; potential partner for global expansion. |

Vico Therapeutics | VO659 | SCA Types 1 & 3 | Narrow, genetically defined | Antisense oligonucleotide targeting CAG repeat expansion | Precision therapy strategy targeting genetic root causes; scalable model for other CAG-based disorders (e.g., Huntington’s). |

Sarepta/ Arrowhead | SRP-1004 (ARO-ATXN2) | SCA Type 2 | Narrow, single subtype | Gene silencing via siRNA targeting ATXN2 | Aligned with Sarepta’s RNA therapy leadership; targeted approach provides high specificity, potential for rapid development in orphan market. |

Sclnow Biotechnology | UC-MSC Therapy | SCA | Broad, progressive ataxias | Neuroprotective stem cell approach aimed at slowing or reversing degeneration | Early in development, but appeals to severe cases lacking genetic clarity. Could support combination therapy or rehab integration. |

Strategic Summary:

- First-mover vs. Precision Strategy: Biohaven leads on timing; Vico and Sarepta target genetic precision with long-term pipeline potential.

- Broad vs. Subtype-Specific: Therapies span from general neuroprotection (Biohaven, PTC, Sclnow) to narrow subtype targeting (SCA2, SCA3).

- Platform vs. Product Play: Sarepta, Vico, and PTC align with platform strategies; others like Steminent focus on disease-specific dominance.

Key Companies:

Target Opportunity Profile (TOP)

A TOP for a disease-modifying therapy in Spinocerebellar Ataxia (SCA) is designed to support strategic decision-making across product development, competitive landscape assessment, and investment prioritization.

Parameter | Target Profile |

Therapeutic Goal | Disease modification with functional improvement and slowed progression in SCA patients |

Efficacy | ≥30% reduction in progression (e.g., SARA/ICARS score); delayed disability milestones; sustained benefit over 12–24 months |

Safety | No serious treatment-related AEs in >95% of patients; suitable for chronic use; low risk of neurotoxicity or immunogenicity |

Mechanism of Action | Genetic targeting (ASO/siRNA), glutamate modulation, neuroprotection, or neurorestoration with a validated link to disease pathogenesis |

Target Population Scope | SCA1, 2, 3 minimum; ideally pan-SCA coverage or subtype-specific if scalable across polyglutamine ataxias |

Onset of Action | Observable clinical stabilization or improvement within 3–6 months |

Route of Administration | Oral preferred; intrathecal or IV acceptable for long-interval (e.g., monthly or quarterly) dosing |

Dosing Regimen | Once daily (oral) or ≤ monthly (injectable); minimal titration; long-term maintenance |

Price Target (U.S.) | $200,000–$350,000/year for rare disease; ~$100,000/year for oral symptomatic agents |

Reimbursement Leverage | Orphan designation, QoL gains, caregiver burden reduction, and delay in institutionalization |

Differentiation Strategy | First-in-class or best-in-class efficacy; biomarker-aligned; platform potential; supportive digital biomarkers or diagnostics |

Patient Preference | Home-administrable; low monitoring burden; well-tolerated for chronic use |

Strategic Fit | High unmet need; early mover advantage; potential for label expansion into related neurodegenerative ataxias |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: