Disease Overview:

Spinal muscular atrophy (SMA) is a rare genetic disorder that causes muscle weakness throughout the body due to malfunctioning nerve cells in the spinal cord and brainstem. It is the leading genetic cause of infant mortality.

Most types of SMA are caused by an altered gene called SMN1 being passed on to a child by their parents (inherited).

There are four types of SMA:

| The most common types of SMA | |

| Type | When it starts |

| Type 1 | Babies less than 6 months old |

| Type 2 | Babies and toddlers aged 6 to 17 months old |

| Type 3 | Children and teenagers from 18 months to 17 years old |

| Type 4 | Adults 18 years old and over |

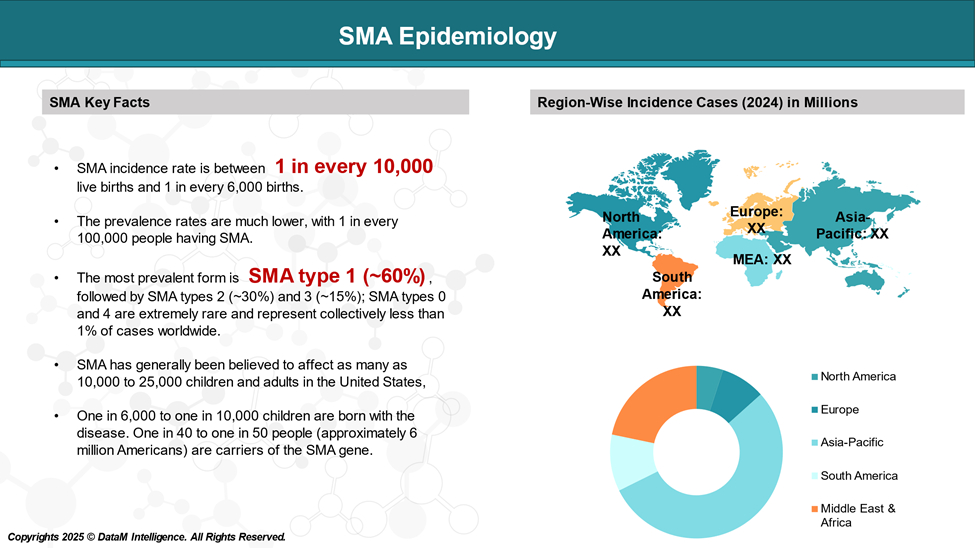

Epidemiology Analysis (Current & Forecast)

Since SMA is a genetic disorder, its incidence is best measured by birth prevalence—the number of children born with SMA during a specific period.

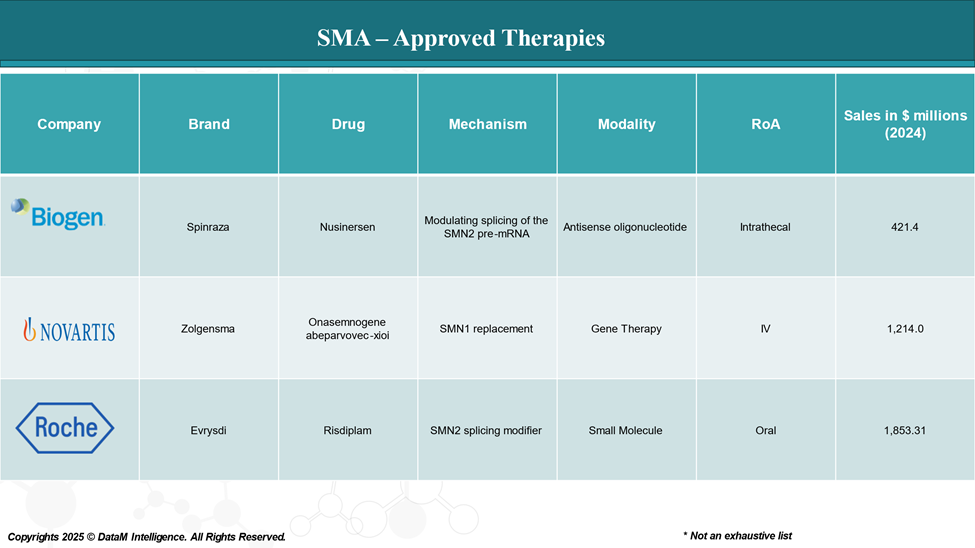

Approved Drugs (Current SoC) - Sales & Forecast

As of 2025, several drugs have been approved to treat spinal muscular atrophy (SMA), a genetic disorder characterized by muscle wasting due to the loss of motor neurons.

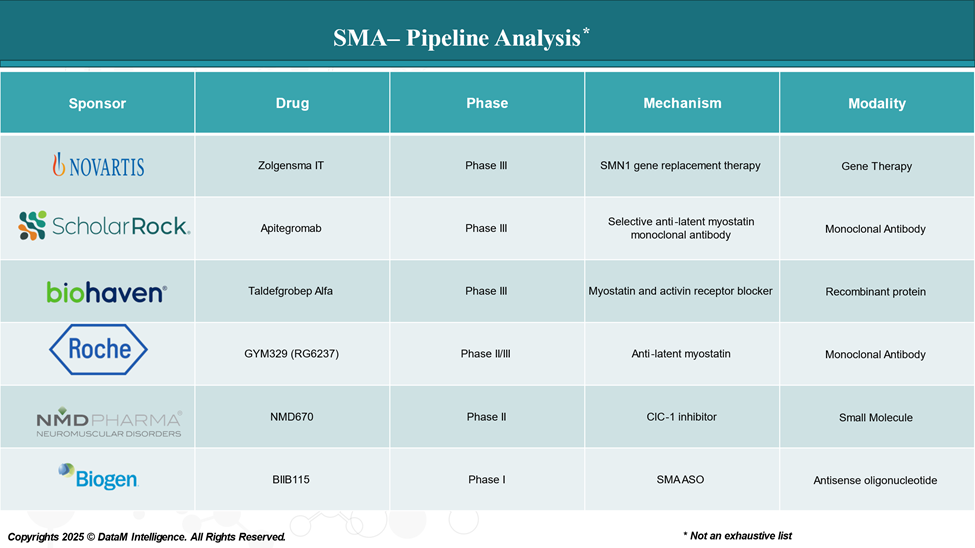

Pipeline Analysis and Expected Approval Timelines

As of April 2025, the pipeline for Spinal Muscular Atrophy (SMA) treatment has expanded beyond the three FDA-approved therapies Spinraza (nusinersen), Zolgensma (onasemnogene abeparvovec), and Evrysdi (risdiplam). Several promising candidates are advancing through clinical trials, targeting different aspects of the disease.

Competitive Landscape and Market Positioning

The SMA treatment landscape is experiencing significant growth, driven by recent drug approvals, a robust pipeline of therapies, and strategic market positioning by key pharmaceutical players.

SMA Drug Comparison Table

| Drug | Manufacturer | Administration | Efficacy | Market Share (2025) | Cost | Target Population |

| Spinraza | Biogen | Intrathecal injection | Improves motor function in Types 1–4 | Declining (initial market leader) | ~$375,000/year | All SMA types (infants to adults) |

| Zolgensma | Novartis | One-time IV infusion | High efficacy; ~95% survival in SMA Type 1 | Growing, favored for infants | ~$2.1 million (one-time) | Infants <2 years (Type 1 focus) |

| Evrysdi | Roche/PTC | Daily oral liquid | Maintains/improves motor function in Types 1–3 | Leading therapy globally | ~$340,000/year | Ages 2 months and older |

In summary, Evrysdi leads the SMA market in terms of patient reach and accessibility, offering a daily oral treatment with a favorable safety profile. Zolgensma provides a one-time gene therapy with high efficacy but is limited by its high cost. Spinraza, while effective, faces declining market share due to the emergence of more convenient and cost-effective therapies.

Key Companies:

Target Opportunity Profile (TOP)

As the treatment landscape for Spinal Muscular Atrophy (SMA) continues to evolve, the need for a Target Opportunity Profile (TOP) becomes essential to identify clinical, commercial, and mechanistic gaps left by currently approved therapies.

While drugs like Spinraza, Zolgensma, and Evrysdi have revolutionized care by significantly improving survival and motor function, especially in infants, they are still limited by challenges in long-term efficacy, invasiveness of administration, cost, and applicability to older or ambulatory patients.

Target Opportunity Profile (TOP) – SMA Emerging vs Approved Therapies

| Attribute | Unmet Need in Approved Drugs | Target Profile for Emerging Therapies | Example Emerging Therapies |

| Efficacy | - Limited sustained motor function gain in older patients - Plateauing effects over time | ➤ Greater and sustained motor gains ➤ Efficacy in later-onset SMA (Types 2–4) | Apitegromab, NMD670 |

| Safety | - Spinraza: spinal injection risks - Zolgensma: liver toxicity - Evrysdi: GI side effects | ➤ Fewer systemic side effects ➤ Avoid invasive delivery | Apitegromab (IV), Oral agents like NIDO-361 |

| Mechanism of Action | - All current therapies increase SMN protein via SMN1/SMN2 pathway | ➤ SMN-independent mechanisms (e.g., muscle enhancement, neuroprotection) | Apitegromab (myostatin inhibition) NIDO-361 (AR modulator) |

| Route of Administration (RoA) | - Intrathecal (Spinraza), IV (Zolgensma), oral (Evrysdi) | ➤ Non-invasive, outpatient-friendly (oral, subcutaneous) | NIDO-361, Evrysdi, future subQ candidates |

| Price/Cost | - High: Zolgensma ~$2.1M, Spinraza ~$375k/year, Evrysdi ~$340k/year | ➤ Affordable pricing (≤$150k/year) ➤ Wider access in developing countries | TBD (e.g., biosimilars, regional licensing) |

| Clinical Endpoints | - Focused on motor milestones (e.g., CHOP-INTEND) in infants | ➤ Broader endpoints: QoL, endurance (e.g., 6MWT), pulmonary function, adult use | Apitegromab (HFMSE, RULM) NMD670 (6MWT) |

Key Takeaways

- Mechanistic Diversification is a huge opportunity: drugs like Apitegromab go beyond SMN restoration by enhancing muscle growth.

- Oral or subcutaneous RoA remains a strong preference, especially for long-term treatment in adolescents/adults.

- Broader functional endpoints and adult-specific benefits (e.g., endurance, daily living ability) are still unmet.

- Cost containment is a major opportunity, particularly for emerging markets.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.