Disease Overview:

Sjögren's disease is an autoimmune disorder primarily targeting the body's moisture-producing glands, particularly those in the eyes and mouth. This leads to a decrease in tear and saliva production, causing symptoms such as dry eyes (known as keratoconjunctivitis sicca) and dry mouth (xerostomia).

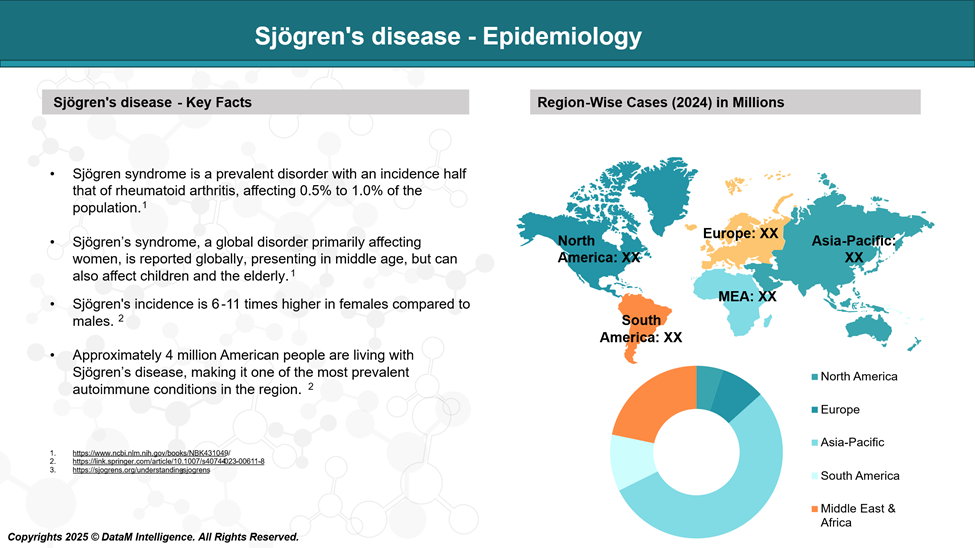

Epidemiology Analysis (Current & Forecast)

Sjögren's disease is frequently misrepresented as a rare condition; however, it is one of the most common autoimmune disorders, affecting an estimated four million people in the United States alone.

Approved Drugs - Sales & Forecast

Sjögren's disease, an autoimmune disorder primarily affecting moisture-producing glands, currently has no cure. However, various treatments are available to manage its symptoms and systemic complications.

Dry Mouth:

Approved: Pilocarpine (Salagen), Cevimeline (Evoxac)

Supportive: Artificial saliva (e.g., Biotene)

Dry Eyes:

Approved: Cyclosporine (Restasis), Lifitegrast (Xiidra)

Other: Punctal plugs (retain tears)

Systemic Symptoms:

Immunosuppressants: Hydroxychloroquine, Methotrexate

Biologics: Rituximab, Belimumab

Steroids: Prednisone (for flares)

Symptom Relief:

NSAIDs for pain, antidepressants for fatigue, and dental care for oral health

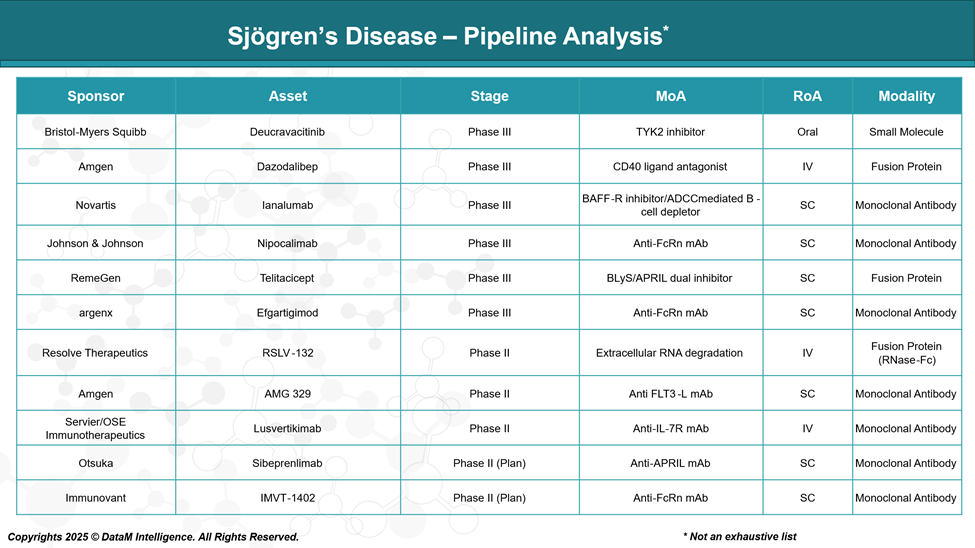

Pipeline Analysis and Expected Approval Timelines

As of May 2025, the therapeutic pipeline for Sjögren’s disease is advancing, with several promising candidates in various stages of development.

Here's an overview of key investigational therapies:

Competitive Landscape and Market Positioning

As of now, no therapies are approved specifically for Sjögren’s disease, making the current market wide open for first-in-class and first-to-market opportunities. Treatments focus on symptom management rather than disease modification, highlighting the unmet need for effective, targeted therapies.

Sponsor | Asset | Mechanism of Action | Stage | Key Differentiator | Potential Launch Window |

Amgen | Dazodalibep | Anti-CD40L (blocks T/B cell co-stimulation) | Phase III | Targets early immune activation with favorable Phase 2 data | Late 2025 – Early 2026 |

J&J (Janssen) | Nipocalimab | Anti-FcRn (reduces pathogenic IgG) | Phase III | First-in-class with BTD and fast track; broad autoimmunity potential | Early 2026 |

Novartis | Ianalumab | BAFF-R antagonist (B-cell depletion/inhibition) | Phase III | Dual action on B cells; precision immunology approach | Mid to Late 2026 |

Bristol Myers Squibb | Deucravacitinib | TYK2 inhibitor (cytokine pathway modulation) | Phase III | Oral route; appealing for long-term management | Late 2026 – Early 2027 |

argenx | Efgartigimod | FcRn antagonist (reduces circulating IgG) | Phase III | Rapid action in IgG-driven diseases; flexible administration | Late 2026 |

RemeGen | Telitacicept | Dual BAFF/APRIL inhibition | Phase III | Dual cytokine targeting; novel B-cell suppressive synergy | 2026–2027 |

Market Positioning Opportunities

First-to-Market Advantage

- The first approved disease-modifying therapy will likely capture a large share of the market due to strong physician and patient demand.

- J&J’s Nipocalimab and Amgen’s Dazodalibep are currently the most advanced and promising, both in Phase III with favorable early data and regulatory support.

Mechanism Differentiation

- B-cell modulation (Ianalumab, Telitacicept) targets Sjögren’s central pathogenic pathway.

- FcRn inhibitors (Nipocalimab, Efgartigimod) offer broad applicability across autoantibody-driven diseases.

- Cytokine modulation (Deucravacitinib) provides a novel, small-molecule approach with potential for oral administration, appealing for long-term use.

Commercial Potential

- With 4 million Americans and millions more globally affected, the market for a disease-modifying therapy is potentially multi-billion-dollar.

- High unmet need and lack of approved therapies support premium pricing and strong payer interest, especially for drugs with durable systemic benefits.

Strategic Insights

- Companies with biologics experience in autoimmune diseases (e.g., J&J, Novartis, Amgen) are well-positioned to launch and scale therapies effectively.

- Potential companion diagnostics or biomarker-driven patient selection (e.g., anti-SSA/SSB, BAFF levels) may enhance positioning and reimbursement strategy.

Key Companies:

Target Opportunity Profile (TOP)

Here is a Target Opportunity Profile (TOP) for emerging therapies in Sjögren’s disease, outlining the ideal characteristics a drug must demonstrate to enter and compete successfully in this high-unmet-need market:

Target Opportunity Profile: Ideal Attributes for Emerging Sjögren’s Disease Therapies

Dimension | Target Criteria for Market Entry & Leadership |

Efficacy | - Clinically meaningful improvement in systemic disease activity (e.g., ESSDAI score reduction ≥ 3–5 points) |

Safety & Tolerability | - Acceptable safety profile with minimal immunosuppression-related infections |

Mechanism of Action (MoA) | - Targeted immunomodulation (e.g., B-cell, T-cell co-stimulation, FcRn, BAFF/APRIL) |

Route of Administration (RoA) | - Oral preferred for chronic use |

Dosing Frequency | - Monthly or less frequent dosing preferred |

Modality | - Biologics and oral small molecules dominate the pipeline |

Innovation & Differentiation | - Novel approach that moves beyond symptom control to disease modification |

Patient-Centric Outcomes | - Improvement in patient-reported outcomes (PROs), fatigue, dryness, pain |

Competitive Edge | - Potential to be first-in-class or first-to-market |

Market Access Potential | - Strong health economics data (cost-offset from steroids, infections, dental costs) |

What It Takes to Win in Sjögren’s

For an emerging therapy to break into the Sjögren’s market, it must show:

- Superiority over symptomatic treatments

- A clear mechanism addressing disease pathology

- Sustained safety and convenience for long-term use

- And ideally, a transformational benefit in systemic and glandular outcomes

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: