Disease Overview:

Prurigo nodularis (PN) is a chronic inflammatory skin disorder characterized by the development of hard, intensely itchy, and sometimes painful nodules. The condition typically begins with severe itching, which may affect just a few areas or become more widespread across the body (According to the American Academy of Dermatology (AAD)).

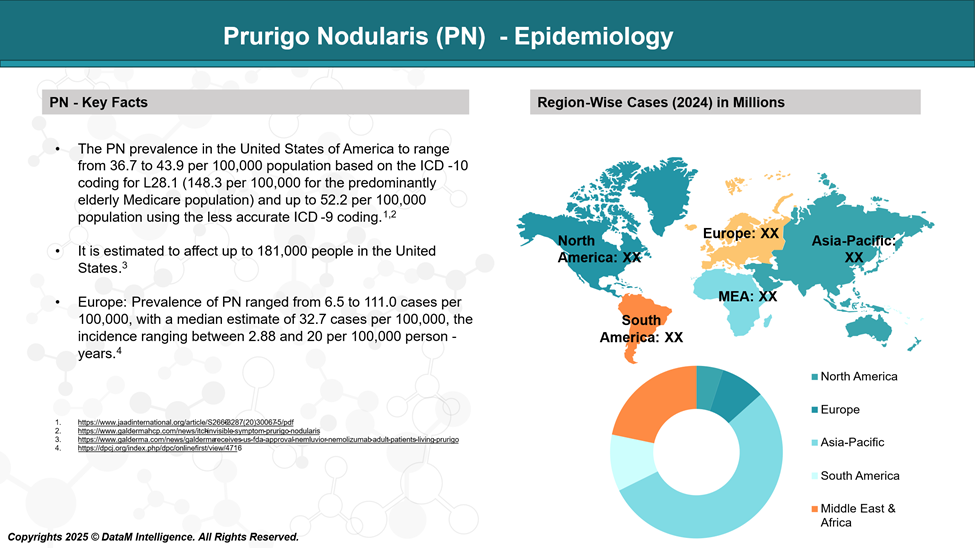

Epidemiology Analysis (Current & Forecast)

In European populations has estimated PN prevalence has been estimated to range between 3.27 and 11.10 cases per 10,000 individuals. In comparison, studies conducted in the United States report prevalence rates ranging from 3.6 to 14.8 per 10,000 people.

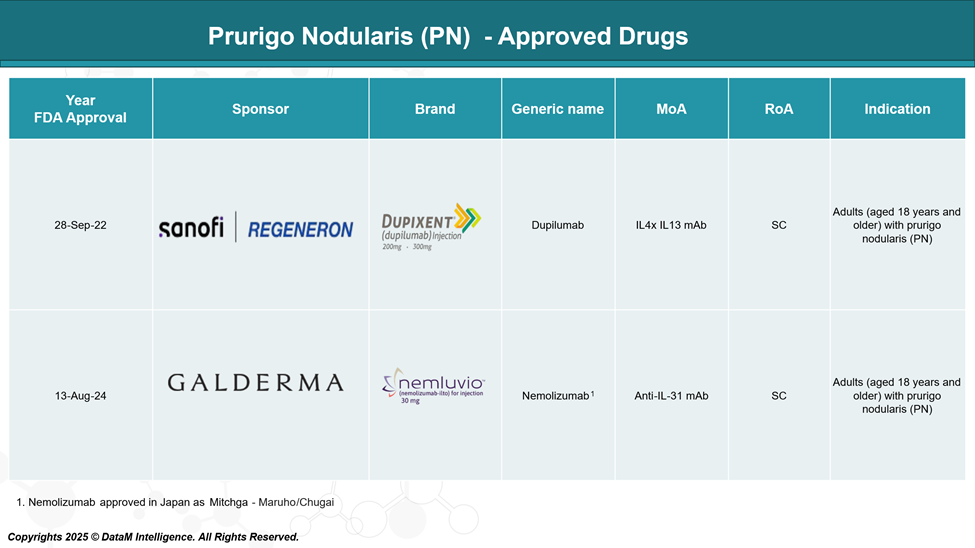

Approved Drugs - Sales & Forecast

As of now, the FDA has approved two medications for the treatment of prurigo nodularis (PN) in adults: dupilumab (Dupixent) and nemolizumab (Nemluvio). Dupilumab received approval in September 2022, followed by the approval of nemolizumab in August 2024.

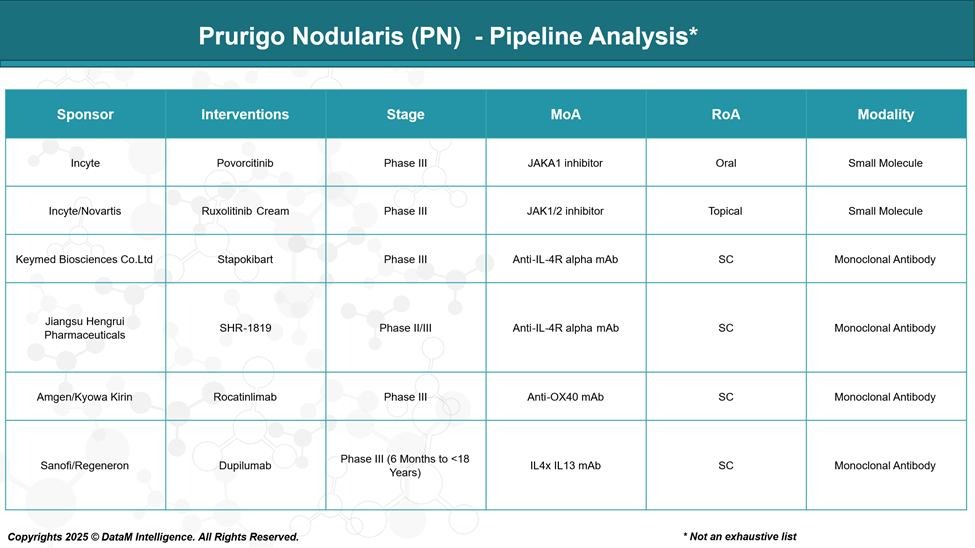

Pipeline Analysis and Expected Approval Timelines

The therapeutic landscape for prurigo nodularis (PN) is rapidly evolving, with several promising treatments in various stages of development. Here's an overview of the current pipeline:

Competitive Landscape and Market Positioning

The competitive landscape for prurigo nodularis (PN) is undergoing a dynamic shift as more pharmaceutical companies enter the field with novel therapies targeting key immunological pathways. The market, once underserved, is now becoming a high-interest area driven by the approvals of Dupixent (dupilumab) and Nemluvio (nemolizumab) and a robust pipeline of late-stage candidates.

Drug (Sponsor) | MoA | Current Stage | Key Differentiator | Competitive Risk to Market Leaders |

Dupilumab (Sanofi/Regeneron) | IL-4/IL-13 mAb | Approved | First-in-class; multi-indication; high brand equity | High — Benchmark for efficacy; market incumbent |

Nemolizumab (Galderma/Mitsubishi Tanabe) | IL-31RA mAb | Approved | Targeted itch control; differentiated MoA | High — Especially in pruritus-dominant PN |

Povorcitinib (Incyte) | JAK1 inhibitor | Phase III | First oral systemic PN drug; patient convenience | Medium–High — May appeal to injection-averse patients |

Ruxolitinib Cream (Incyte/Novartis) | JAK1/2 inhibitor | Phase III | Non-systemic option; low barrier to adoption | Medium — Could dominate mild/moderate PN segment |

Stapokibart (Keymed Biosciences) | IL-4Rα mAb | Phase III | Competes directly with Dupixent; may undercut on price | Medium — Depends on pricing and regional approval |

SHR-1819 (Jiangsu Hengrui) | IL-4Rα mAb | Phase II/III | Regional challenger with strong Chinese presence | Low–Medium — May compete in Asia-pacific markets |

Rocatinlimab (Amgen/Kyowa Kirin) | Anti-OX40 mAb | Phase III | Novel MoA targeting T-cell modulation; potential for disease-modifying effects | High — If long-term benefits are proven |

Dupilumab Pediatric (Sanofi/Regeneron) | IL-4/IL-13 mAb | Phase III (6 mo–<18 yrs) | Expands reach to pediatric population; brand lock-in | Medium — Reinforces market leadership early in disease |

Key Takeaways:

- Diversity of MoA and delivery routes will drive niche segmentation within the PN market.

- Oral and topical therapies (povorcitinib, ruxolitinib cream) may attract patients seeking less invasive treatments.

- Regional players may exert pricing pressure and offer alternatives in non-Western markets.

- Next-gen biologics like rocatinlimab could shift treatment paradigms if they show durable disease modification.

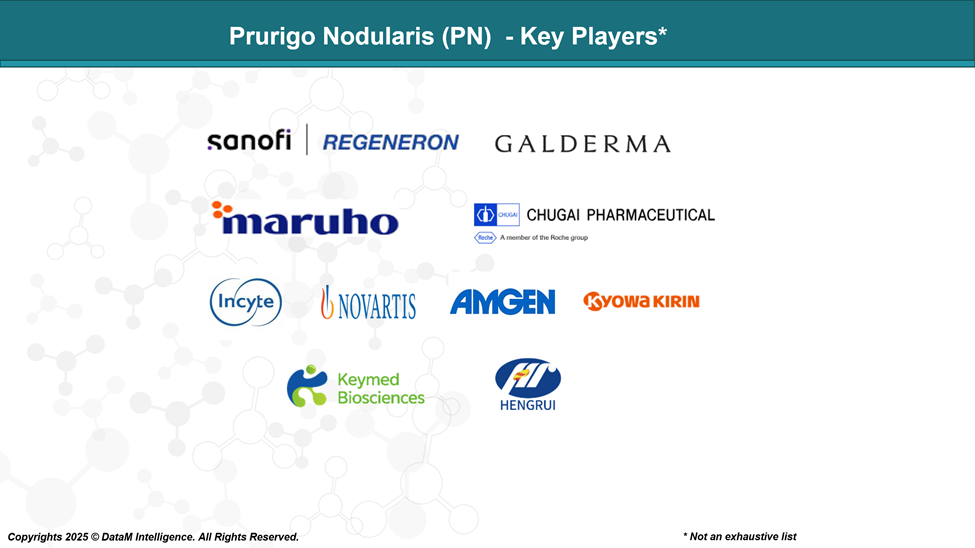

Key Companies:

Target Opportunity Profile (TOP)

To surpass existing market leaders like Dupixent and Nemluvio in prurigo nodularis (PN), emerging therapies must align with a highly competitive Target Opportunity Profile (TOP).

This profile outlines ideal benchmarks across safety, efficacy, mechanism of action (MoA), route of administration (RoA), dosage, innovation, and patient-centric advantages that would make new entrants not just viable, but preferable in clinical practice and patient use.

Target Opportunity Profile (TOP) for Future PN Therapies:

Attribute | Benchmark Criteria | Justification & Competitive Advantage |

Efficacy | ≥75% patients achieve ≥4-point itch reduction and ≥40% reach clear/almost clear skin (IGA 0/1) in ≤12 weeks | Needs to exceed or match Dupilumab/Nemolizumab efficacy with faster onset to gain preference |

Onset of Action | Rapid itch reduction within 2–4 weeks | Dupixent shows benefit at week 4; faster relief would appeal to patients suffering severe pruritus |

Safety Profile | Low systemic immunosuppression; minimal serious adverse events; long-term tolerability | Must avoid black-box warnings (common in JAK inhibitors); improve upon injection-site reactions of biologics |

Mechanism of Action (MoA) | Novel or complementary to IL-4/13 or IL-31 (e.g., OX40, JAKs, mast cell inhibition, neuroimmune targets) | Offers an alternative for Dupixent/Nemolvio non-responders; allows for combo therapies or stepwise treatment |

Route of Administration (RoA) | Oral or topical preferred; monthly or less frequent injectable acceptable | Convenience and lower treatment burden offer differentiation, particularly valuable for chronic conditions |

Dosage Frequency | ≤ once weekly (oral/topical) or once monthly (injectable) | Less frequent dosing enhances adherence and quality of life compared to Dupixent’s every-2-week injection |

Modality | Oral small molecules, topical agents, or long-acting biologics | Innovation in modality supports niche use cases (e.g., needle-phobic patients, self-administration) |

Durability | Sustained remission post-treatment (disease-modifying effect) | Rocatinlimab (anti-OX40) aims for this; could be a game-changer if proven |

Innovation Potential | Dual-pathway inhibitors, skin-selective JAKs, neuroimmune modulators, and mast cell stabilizers | New science-backed mechanisms that address itch, inflammation, and nodules holistically |

Patient Experience | Minimal pain, easy administration, quick symptom relief, long-term satisfaction | Patient preference can drive uptake even in equally effective competitors |

Pediatric or Elderly Use | Broad age-range labeling or low contraindication profile | Expansion into these populations opens large and underserved market segments |

Health Economic Value | Competitive pricing, cost-effectiveness, payer-friendly profiles | Critical in differentiating from high-cost biologics, especially in budget-sensitive markets |

Strategic Implications for Developers:

- Outperforming Dupixent/Nemolvio requires excellence on multiple fronts, not just efficacy.

- Players like Incyte (povorcitinib) and Amgen/Kyowa Kirin (rocatinlimab) are aligning with key elements of this TOP.

- Emphasis on patient-centered features such as fast relief, convenience, and tolerability may win over prescribers.

- Innovation beyond Th2 blockade (e.g., OX40, JAK-STAT, IL-31RA) will be necessary to break out of the “me-too” label.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: