Disease Overview:

Phenylketonuria (PKU) is a rare genetic condition in which the body is unable to properly break down phenylalanine, an amino acid found in many protein-containing foods. This results from a mutation in the gene responsible for producing the phenylalanine hydroxylase enzyme needed to metabolize phenylalanine.

When left untreated, phenylalanine accumulates in the body, potentially leading to a variety of symptoms. These can range in severity and may include intellectual delays, behavioral issues, seizures, a musty odor, skin rashes, lighter skin and hair, heart abnormalities, and an unusually small head size.

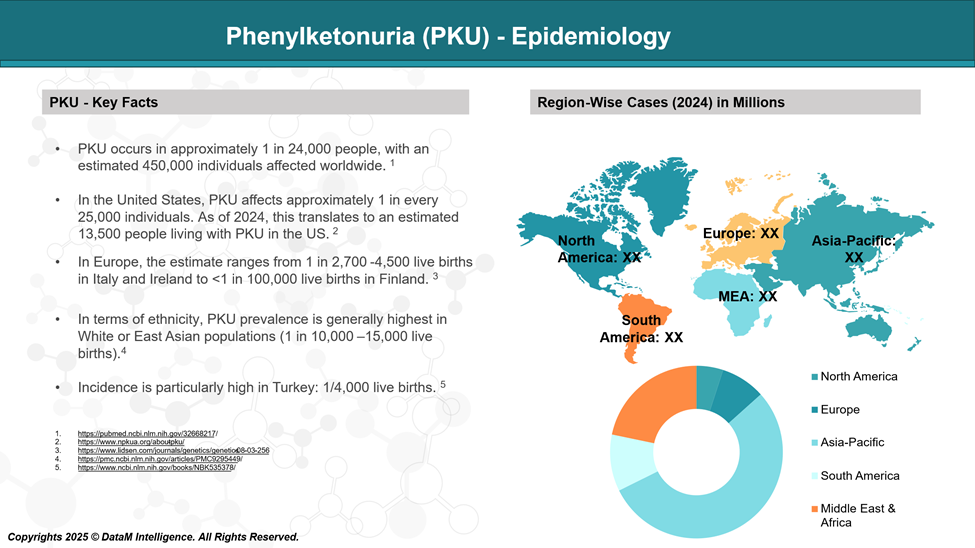

Epidemiology Analysis (Current & Forecast)

Globally, the prevalence of PKU varies considerably across different regions and ethnic groups. The global prevalence of phenylketonuria (PKU) is approximately 1 in 24,000 live births.

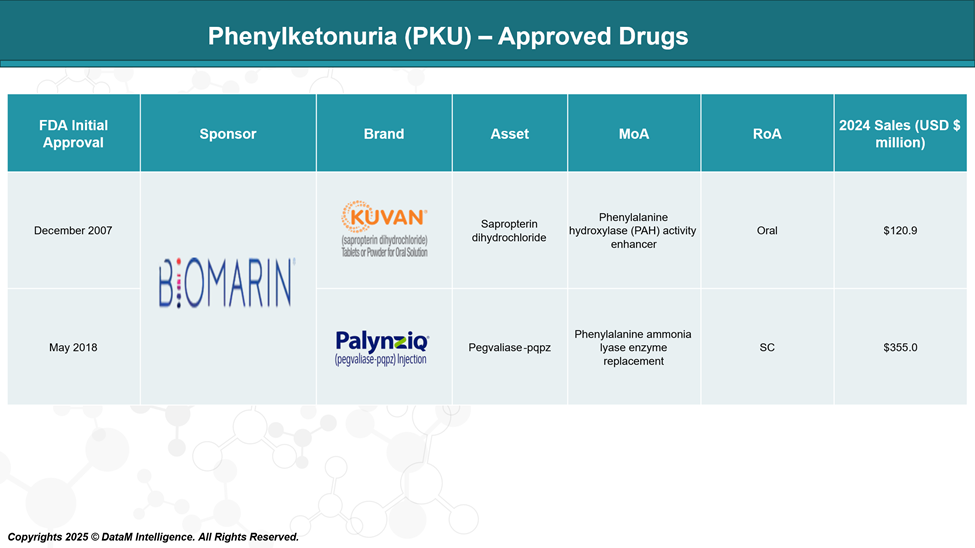

Approved Drugs (Current SoC) - Sales & Forecast

Currently, the US FDA has approved two drugs for treating Phenylketonuria (PKU) are sapropterin (Kuvan) and pegvaliase-pqpz (Palynziq). Sapropterin is a synthetic form of BH4, a substance in the body that helps break down phenylalanine, while pegvaliase is an enzyme that breaks down phenylalanine directly.

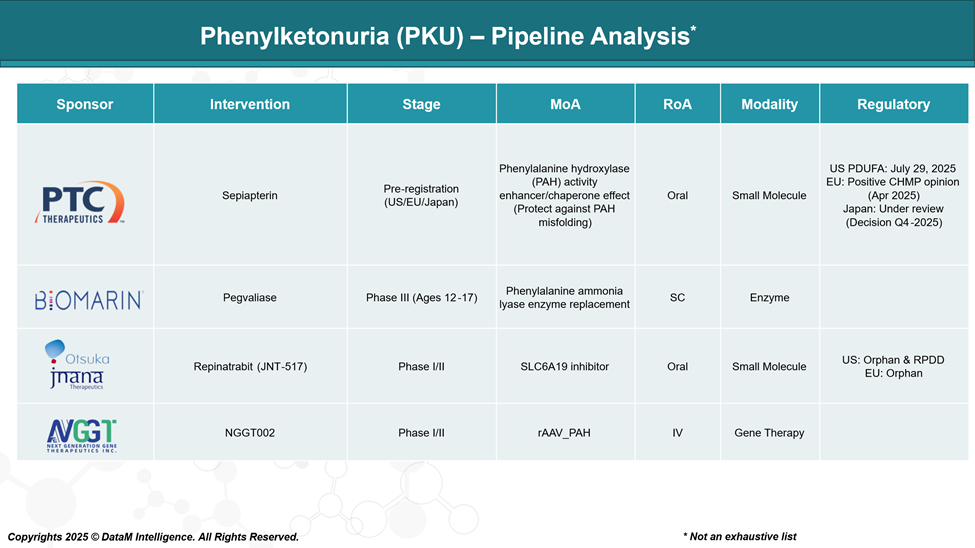

Pipeline Analysis and Expected Approval Timelines

The phenylketonuria (PKU) treatment landscape is experiencing significant advancements, and emerging treatments span various modalities, including enzyme replacement therapies, gene therapies, and small molecule inhibitors.

Competitive Landscape and Market Positioning

The competitive landscape for PKU therapies is defined by a small number of players due to the orphan disease designation and the limited patient population.

PKU Competitive Landscape & Market Positioning

Company | Drug | Target Population | Key Differentiators | Market Positioning | Strategic Advantage |

BioMarin | Kuvan | Mild-to-moderate PKU (BH4-responsive) | First approved drug for PKU; oral daily dosing | First-line therapy for responsive patients | Established market share; strong physician familiarity |

Palynziq | Adults and adolescents with severe PKU | Enzyme substitution therapy; effective at lowering Phe levels | Second-line for uncontrolled PKU despite dietary management | Addresses unmet need in severe PKU; only enzyme therapy on the market | |

PTC Therapeutics | Sepiapterin | Broader BH4-responsiveness spectrum | More potent than Kuvan; improved brain penetration | Potential upgrade/replacement for Kuvan | Pre-registration status: potential to disrupt Kuvan market |

Otsuka / Jnana | Repinatrabit (JNT-517) | Broad PKU population, including non-responders | Novel Phe elimination via kidney; oral, non-dietary therapy | First-in-class small molecule alternative to enzyme or BH4 therapies | Differentiated mechanism; convenient oral formulation |

NGGT INC. | NGGT002 | All PKU types (regardless of severity or response) | Gene therapy: one-time, potentially curative treatment | Future long-term solution for PKU | High-impact innovation; possible once-in-a-lifetime intervention |

Strategic Insights Summary

- BioMarin's dominance is threatened by newer, more convenient, and potentially more effective therapies.

- PTC Therapeutics is well-positioned to cannibalize Kuvan’s market with sepiapterin, especially if priced competitively and proven superior.

- Otsuka’s JNT-517 has the potential to bypass current diet-dependence in treatment, making it highly attractive for non-responsive or non-adherent patients.

- NGGT’s gene therapy offers a paradigm shift, but it will face commercialization, reimbursement, and long-term efficacy challenges.

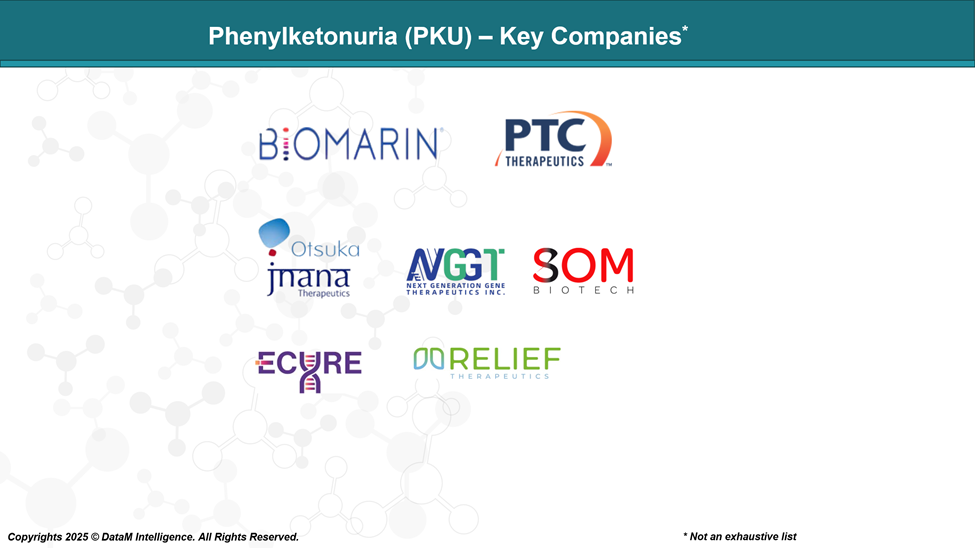

Key Companies:

Target Opportunity Profile (TOP)

Target Opportunity Profile (TOP) for emerging PKU drugs, outlining the critical performance and innovation benchmarks they must meet or exceed to compete with or outperform currently approved therapies (e.g., Kuvan, Palynziq):

Parameter | Current Standard | Opportunity for Differentiation | Ideal Emerging Profile |

Efficacy | Kuvan: Modest Phe reduction; Palynziq: High Phe reduction with immunogenicity risk | Need consistent and significant Phe reduction across responder types (≥60% reduction ideal) | ≥50–70% blood phenylalanine reduction in the majority of patients, including non-BH4 responders |

Safety | Palynziq: Risk of anaphylaxis and injection-site reactions; Kuvan: Well-tolerated | Fewer side effects, lower immunogenicity, especially for chronic therapies | Minimal systemic side effects; no immune complications; safe in pediatric and long-term use |

Mechanism of Action | BH4 cofactor support (Kuvan); enzyme replacement (Palynziq) | Novel or optimized pathway targeting (e.g., renal clearance, gut metabolism, gene correction) | First-in-class or best-in-class mechanism (e.g., transporter inhibition, gene editing, probiotic metabolism) |

Route of Administration (ROA) | Oral (Kuvan), SC (Palynziq) | Shift away from injectable therapies; ease of use is critical | Oral or non-invasive preferred; once-daily or less frequent dosing ideal |

Innovation | Limited — repurposed small molecule (Kuvan), biologic enzyme (Palynziq) | Demand for breakthrough innovation: gene therapy, synthetic biology, engineered microbiome | High novelty mechanism (e.g., AAV gene therapy, synthetic probiotics, CRISPR-based solutions) |

Dosing Frequency | Kuvan: daily; Palynziq: daily SC injection | Reduced treatment burden for better adherence | Once-daily or weekly dosing, or one-time (curative) therapy like gene therapy |

Onset of Action | Palynziq: gradual over months; Kuvan: relatively faster | Need for faster onset, particularly in uncontrolled PKU | Clinical effect within 2–4 weeks of initiation |

Patient Subtype Coverage | BH4-responsive (Kuvan); non-responsive severe PKU (Palynziq) | Broader coverage needed, especially for non-responders, pediatrics, and adolescents | Effective across all genotypes, including severe, non-BH4 responders, and pediatric populations |

CNS Outcomes | Limited direct evidence of neuroprotection | Need to demonstrate cognitive and quality-of-life improvements, not just Phe reduction | Proven impact on cognition, mood, and executive function, validated through neurocognitive endpoints |

Formulation | Oral tablets (Kuvan); injection (Palynziq) | Improved palatability, stability, and adherence | Palatable, shelf-stable formulations for children and adults |

Strategic Must-Haves for Market Success

- Efficacy across all phenotypes, including non-BH4 responsive and pediatric populations.

- Safe, convenient, and non-invasive administration, ideally oral or single-dose therapy.

- Differentiated or novel MOA to bypass current resistance/tolerance limitations.

- Superior patient adherence and quality-of-life impact through simplified regimens.

- Regulatory & HTA alignment showing cost-effectiveness and measurable functional benefits (especially for gene therapies).

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: