Disease Overview:

IgA nephropathy, also referred to as Berger’s disease, is a kidney condition in which a specific type of antibody immunoglobulin A (IgA) accumulates in the kidneys. This buildup leads to inflammation and damage in the glomeruli, which are tiny filtering units within the kidneys.

This immune system malfunction results in impaired kidney function over time, as the filters become damaged by the trapped antibodies.

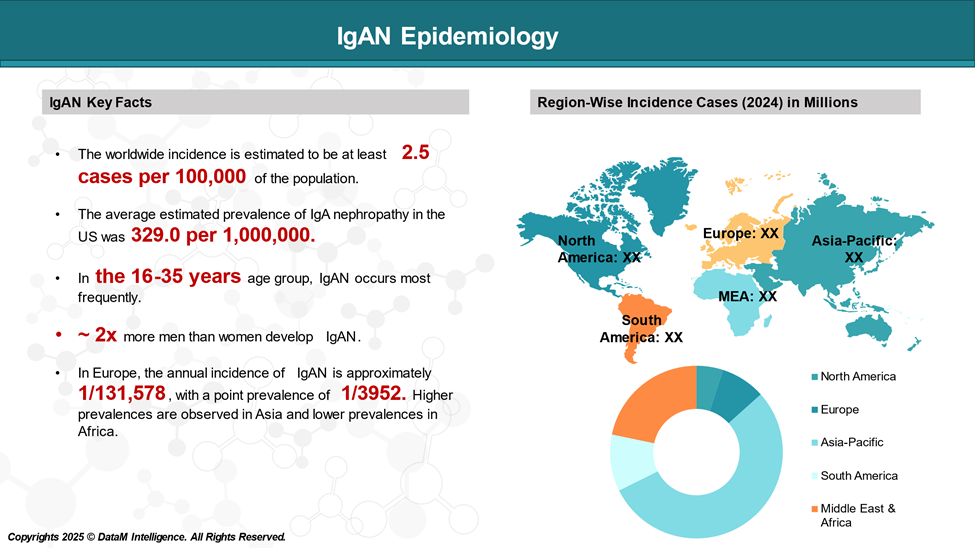

Epidemiology Analysis (Current & Forecast)

IgA nephropathy is among the most common primary glomerular diseases in the US and can progress to kidney failure.

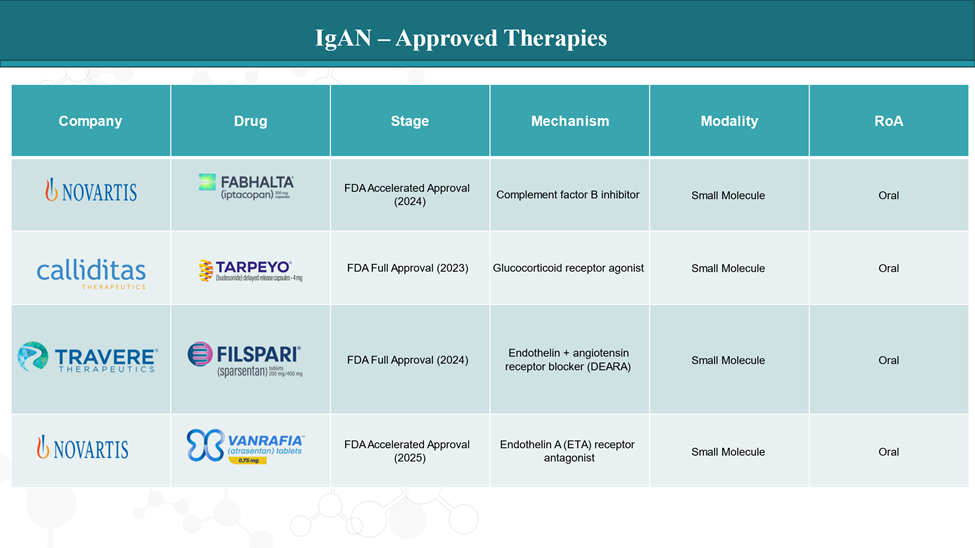

Approved Drugs (Current SoC) - Sales & Forecast

Currently, new targeted therapies like Tarpeyo (budesonide) and Filspari (sparsentan) offer more precise approaches with fewer systemic side effects, aiming to slow disease progression and improve kidney outcomes.

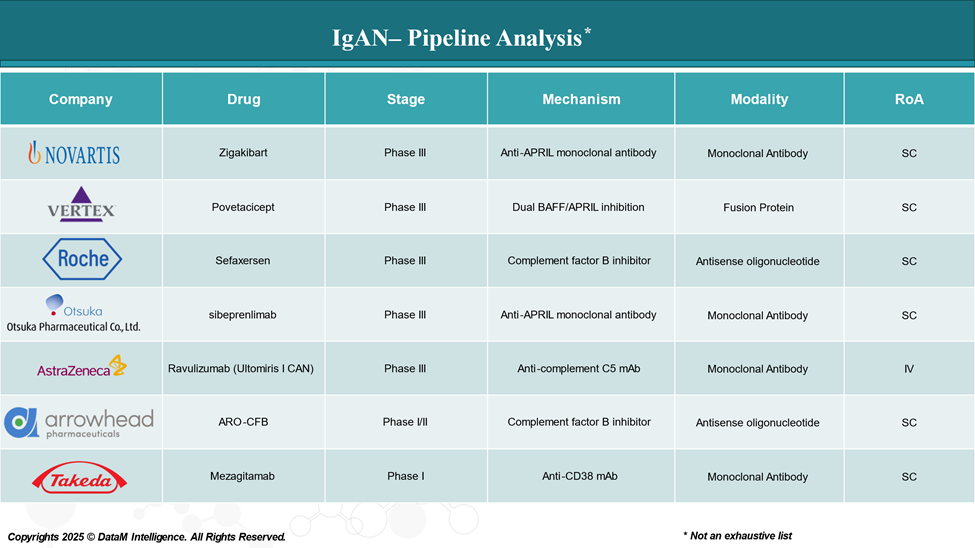

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for IgA nephropathy (IgAN) is rapidly evolving, with several new therapies approved and a robust pipeline of investigational drugs targeting various disease mechanisms.

Competitive Landscape and Market Positioning

IgA nephropathy (IgAN) treatment landscape is experiencing significant growth, driven by recent drug approvals, a robust pipeline of therapies, and strategic market positioning by key pharmaceutical players.

| Drug Name | Developer | Mechanism of Action | Unique Selling Points |

| Tarpeyo (budesonide DR) | Calliditas Therapeutics | Targeted-release corticosteroid (ileum-specific) |

|

| Filspari (sparsentan) | Travere Therapeutics | Dual endothelin/angiotensin receptor antagonist |

|

| Fabhalta (iptacopan) | Novartis | Oral factor B inhibitor (complement system) |

|

| Vanrafia (atrasentan) | Novartis / Chinook | Selective endothelin A receptor antagonist |

|

Key Companies:

Target Opportunity Profile (TOP)

To outperform current approved therapies for IgA Nephropathy (IgAN), emerging therapies must demonstrate clear, differentiated value across clinical and commercial dimensions.

Here's a focused breakdown of what a Target Opportunity Profile (TOP) for an emerging therapy needs to show to surpass the standard of care:

Strategic Differentiators Emerging Therapies Must Prove in Their TOP

| Dimension | TOP |

| Diagnosis Precision |

|

| Mechanism of Action |

|

| Efficacy |

|

| Safety & Tolerability |

|

| Trial Design |

|

| Clinical Endpoints |

|

| Patient Segment |

|

| Price & Value |

|

| Access & Convenience |

|

| Positioning Strategy |

|

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.