Disease Overview:

Huntington's disease (HD) is an inherited disorder that causes nerve cells (neurons) in parts of the brain to break down and die gradually. The disease attacks areas of the brain that help to control voluntary movement and other areas. People living with Huntington’s disease develop uncontrollable jerky movements called chorea and abnormal body postures, as well as problems with behavior, emotion, thinking, and personality.

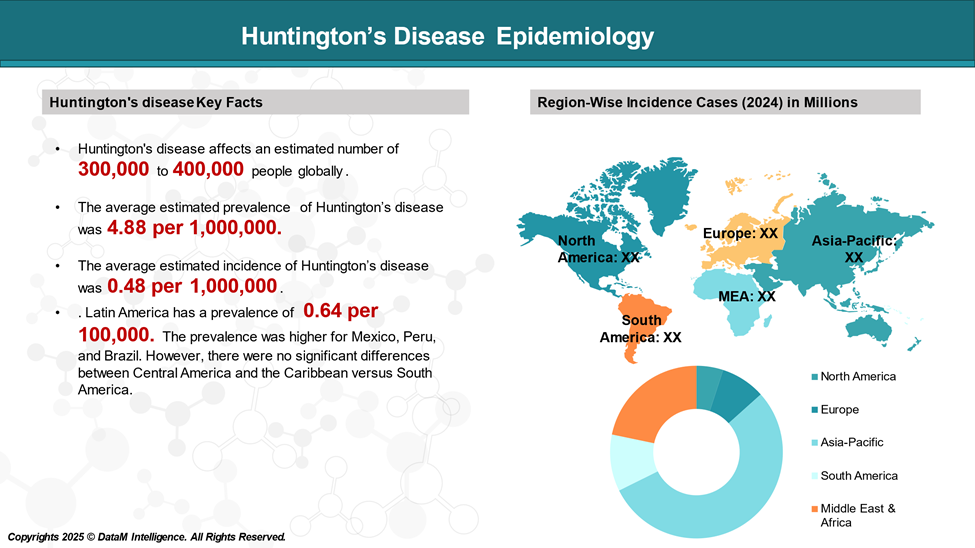

Epidemiology Analysis (Current & Forecast)

The prevalence of Huntington's disease varies significantly depending on factors like age, sex, and the specific population studied.

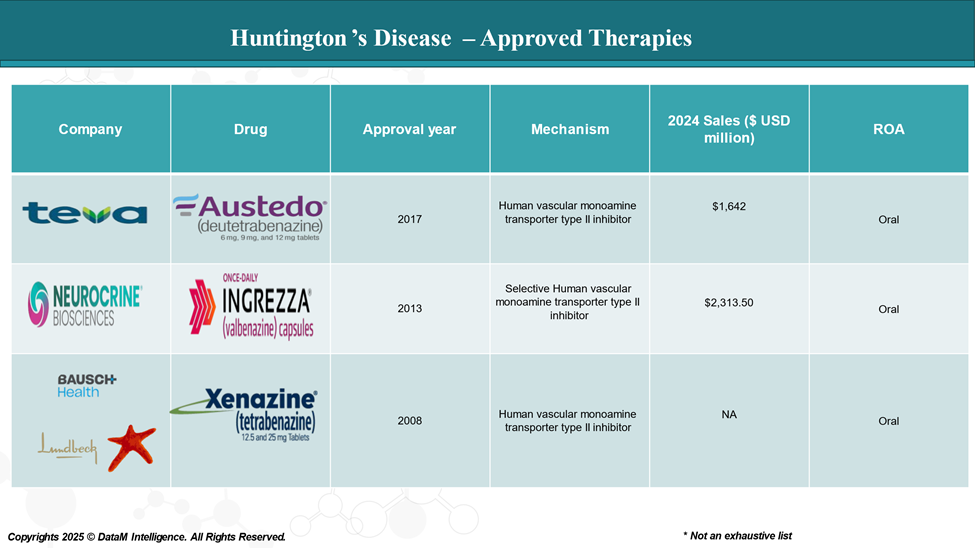

Approved Drugs (Current SoC) - Sales & Forecast

As of 2025, several FDA-approved drugs are available for treating Huntington's disease. These therapies primarily focus on decreasing the dopamine release.

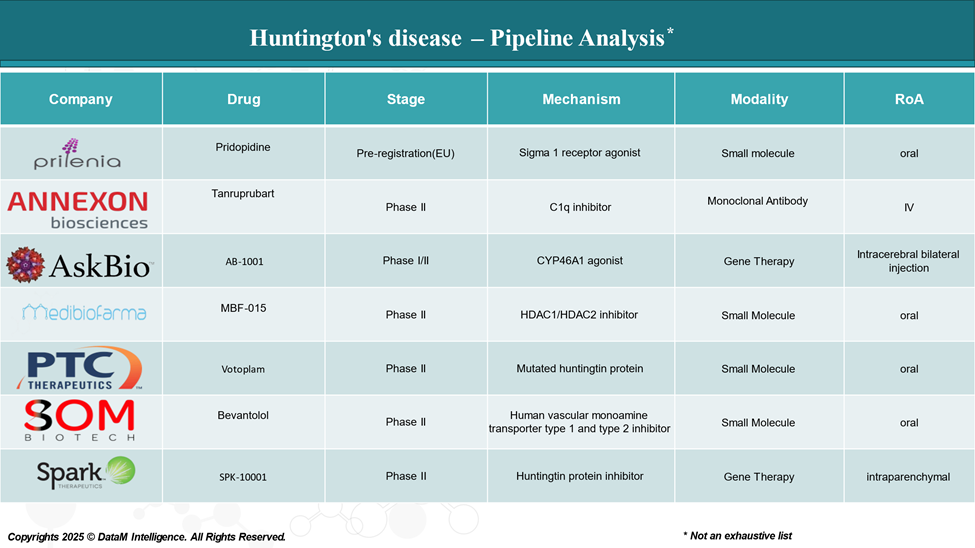

Pipeline Analysis and Expected Approval Timelines

As of April 2025, the pipeline for Huntington's disease is progressing rapidly, with several promising therapies advancing through clinical trials. These investigational treatments address unmet needs in reducing the symptoms of Huntington’s disease.

Competitive Landscape and Market Positioning

The Huntington's disease treatment landscape is experiencing significant growth, driven by recent drug approvals, a robust pipeline of therapies, and strategic market positioning by key pharmaceutical players.

| Drug | Route of Administration | Efficacy | Market Share | Approved Indication |

Xenazine® (tetrabenazine) Tablets | Oral (r 12.5 or 25 mg) | Huntington’s Disease Rating Scale (UHDRS) 0 to 4 (with 0 representing no chorea), drug group declined by 5 units, placebo 1.5 units. | Patent expired | Chorea associated with Huntington’s disease |

AUSTEDO® XR (deutetrabenazine) | Oral (one pill 24–48 mg/day) | 4.4-point improvement in people taking AUSTEDO vs 1.9 in people taking placebo based on Total Maximal Chorea (TMC) score. | Market leader (Teva Pharmaceuticals) | Huntington's disease, tardive dyskinesia |

| INGREZZATM (valbenazine) | Oral (40 mg) | 4.6-point improvement seen with INGREZZA vs 1.4 with placebo in TMC score from the start to the end of the 12-week | Market leader (Neurocrine Biosciences) | Huntington's disease, tardive dyskinesia |

Key Companies:

Target Opportunity Profile (TOP)

Target Opportunity Profile (TOP) is designed for emerging Huntington's disease therapies. This framework outlines what an ideal new therapy would need to achieve or improve upon to outperform approved treatments.

| Dimension | Requirements for Emerging Therapies to Surpass Approved Drugs |

| Mechanism of Action | - Must target root cause, e.g., mutant huntingtin (mHTT) gene or protein - Demonstrate disease-modifying potential rather than just symptomatic relief |

| Safety Profile | - Equal or superior safety to oral symptomatic drugs - Minimal CNS-related side effects (especially if delivered intrathecally or intracranially) - Tolerable for long-term use |

| Efficacy | - Show clinically meaningful slowing or halting of disease progression - Improve or stabilize motor, cognitive, and psychiatric symptoms - Proven impact on biomarkers (e.g., reduction in mHTT, NfL) |

| Route of Administration | - Preferably non-invasive or less invasive than current options - Oral therapies or infrequent administration (e.g., single-dose gene therapy) are ideal |

| Clinical Endpoints | - Achieve statistical and clinical significance in standard HD scales (e.g., UHDRS) - Show functional improvement or slower decline compared to baseline/placebo - Correlate biomarker changes with clinical benefit |

| Clinical Data | - Robust Phase II/III data demonstrating efficacy and safety across diverse patient groups - Evidence of long-term benefit (≥12 months) - Clear dose-response relationships and reproducibility across trials |

| Diagnosis & Stratification | - Incorporate biomarker-based patient selection (e.g., genetic confirmation, mHTT levels) - Enable earlier intervention (even pre-symptomatic) - Use imaging and fluid biomarkers to guide and monitor therapy |

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.