Disease Overview:

Hidradenitis suppurativa (HS) is a chronic inflammatory skin disorder characterized by the development of painful lumps or nodules. These lesions typically appear in areas where skin rubs together, such as the underarms, groin, and inner thighs, but they can also affect the chest, back, and buttocks.

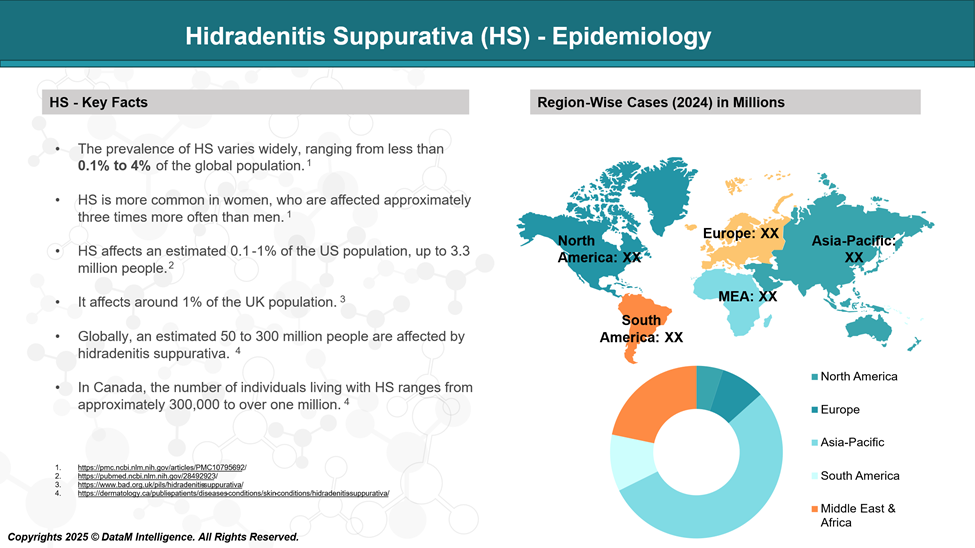

Epidemiology Analysis (Current & Forecast)

Hidradenitis suppurativa (HS) is impacting more than 3 million people globally and over 300,000 in the US. It is more commonly seen in women and people of African descent.

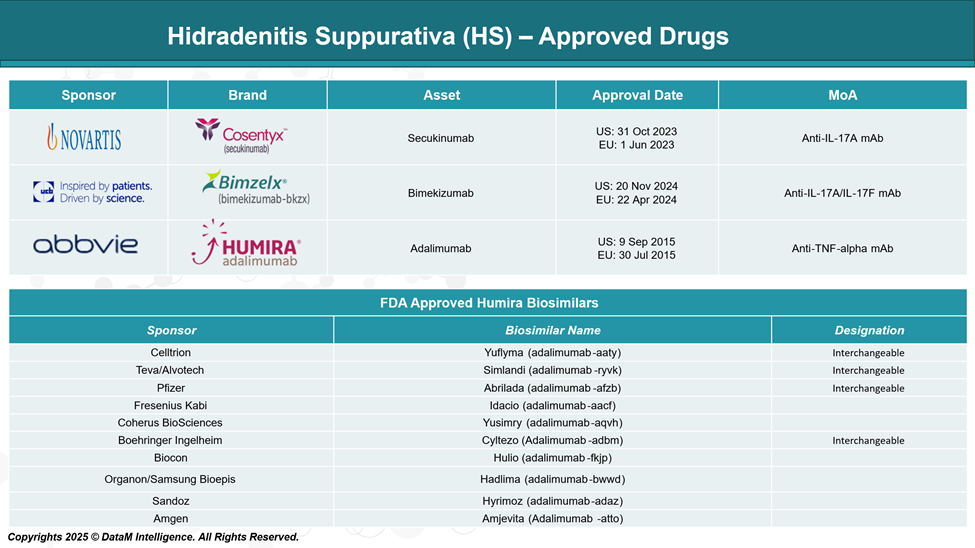

Approved Drugs (Current SoC) - Sales & Forecast

Currently, three approved biologics for treating HS include adalimumab, secukinumab, and bimekizumab. There are nearly 10 adalimumab biosimilars approved in the US.

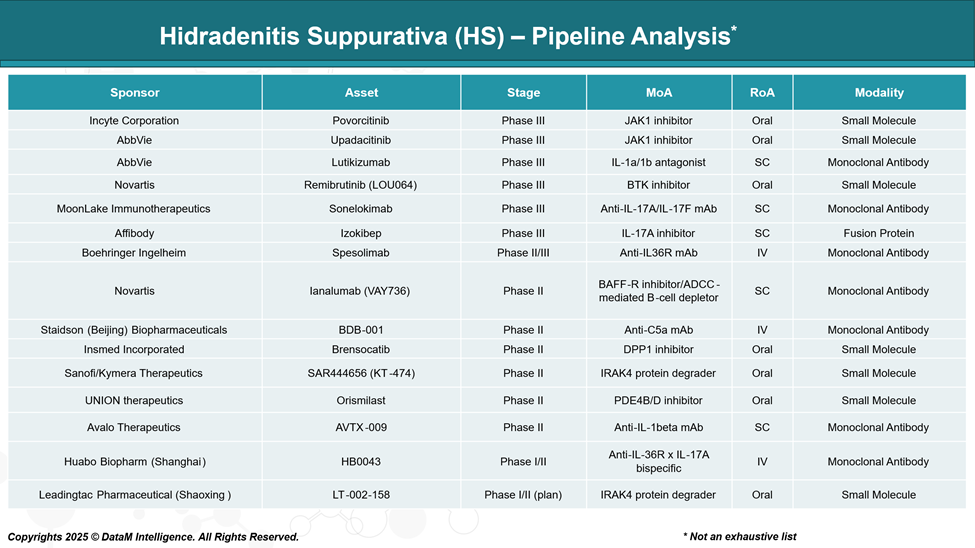

Pipeline Analysis and Expected Approval Timelines

The therapeutic landscape for Hidradenitis Suppurativa (HS) is rapidly evolving, with numerous promising treatments in various stages of clinical development.

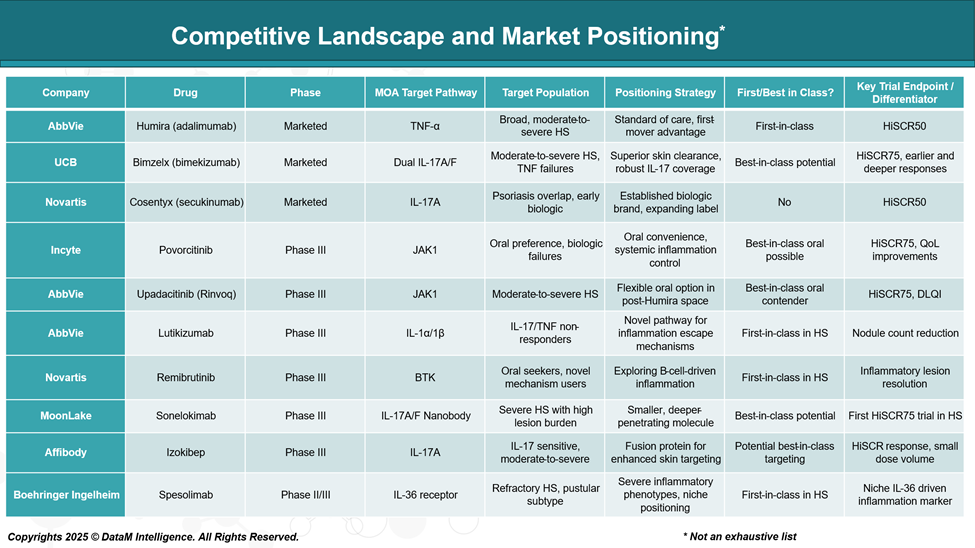

Competitive Landscape and Market Positioning

The treatment landscape for HS is becoming increasingly competitive, with multiple pharmaceutical companies advancing novel therapies through late-stage clinical trials. These candidates target various inflammatory pathways, aiming to provide alternatives to existing biologics like Humira.

Strategic Insights:

- First-in-Class Innovation: Lutikizumab, Remibrutinib, and Spesolimab bring novel immune pathways (IL-1, BTK, IL-36) into the HS space.

- Best-in-Class Contenders: Bimzelx and Sonelokimab aim for superior efficacy within the IL-17 landscape by targeting dual isoforms or using nanobody/fusion tech.

- Oral Therapies: Upadacitinib and Povorcitinib position themselves as convenient daily treatments but face JAK class safety scrutiny.

- Strategic Trial Design: A shift toward HiSCR75 (a stricter response threshold than HiSCR50) highlights ambition for deeper patient outcomes.

Key Companies:

Target Opportunity Profile (TOP)

The Target Opportunity Profile (TOP) is used to understand the competitive strategy, clinical development, and market differentiation, summarizing the key success benchmarks that new entrants must aim for to outperform existing treatments like Humira, Cosentyx, and Bimzelx.

Target Opportunity Profile (TOP) for Emerging HS Therapies

Category | Current Standard | Target Opportunity (TOP Benchmark) |

Efficacy | HiSCR50–75 (12–16 weeks); partial tunnel clearance | ≥ HiSCR75 at 12 weeks; ≥ 50% tunnel reduction; durable 1-year response |

Safety Profile | Injection site reactions, infection risk (biologics); JAK class black box | No black box warnings; minimal systemic immunosuppression; low AE/SAE incidence |

Mechanism of Action (MoA) | TNF-α, IL-17A/F, IL-1α/β (crowded); IL-36, JAK1, BTK (emerging) | Novel or upstream pathway (e.g. IL-36, BTK, inflammasome); precise, non-redundant immune modulation |

Onset of Action | Visible improvement by Week 12 | Rapid onset: improvement within 4–8 weeks |

Route of Administration | Mostly SC injections; some oral; 1 IV (Spesolimab) | Oral preferred; if SC, monthly or less frequent dosing; avoid IV unless highly differentiated |

Dosing Frequency | Weekly (Humira), Biweekly–Monthly (Bimzelx, Cosentyx), Daily (orals) | Monthly oral or SC; simplified or flexible regimen |

Patient Subgroups | Moderate-to-severe; limited tunnel/scar efficacy | Effective in Hurley Stage II/III; tunnel resolution; post-biologic failure; adolescent potential |

Patient-Reported Outcomes (PROs) | DLQI & pain modestly improved | DLQI ≥5-point reduction; significant pain and mobility relief |

Formulation & Convenience | Cold chain required; SC injections | Oral or room-temp SC; autoinjector or pill preferred |

Price / Cost Effectiveness | $40–60K/year (biologics); biosimilars cheaper | Competitive with biosimilars OR superior value; proven cost-offsets (e.g., reduced surgeries or flares) |

Trial Design Innovation | HiSCR50 primary endpoint; short durability focus | HiSCR75/HiSCR100 + long-term durability; incorporate tunnel/flare-specific endpoints and PROs |

Differentiation Potential | Many “me-too” biologics in IL-17 and TNF classes | Stand out with unique MoA, superior QoL gains, pediatric use, or efficacy in tunnel-rich and refractory populations |

Strategic Insight:

To gain market share or a regulatory advantage, an emerging HS therapy must:

- Deliver superior and sustained efficacy (HiSCR75+)

- Address hard-to-treat cases (tunnels, Hurley Stage III)

- Offer a more convenient and safer profile, especially oral or monthly SC

- Show clear pharmacoeconomic value or occupy unmet niches (e.g., adolescent or biologically refractory populations)

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: