Disease Overview:

Hemophilia B, also known as factor IX (FIX) deficiency or Christmas disease, is a hereditary condition characterized by a deficiency or malfunction of factor IX, a protein essential for blood clotting.

While it is typically inherited from parents, approximately one-third of cases result from a spontaneous mutation, which involves a genetic change.

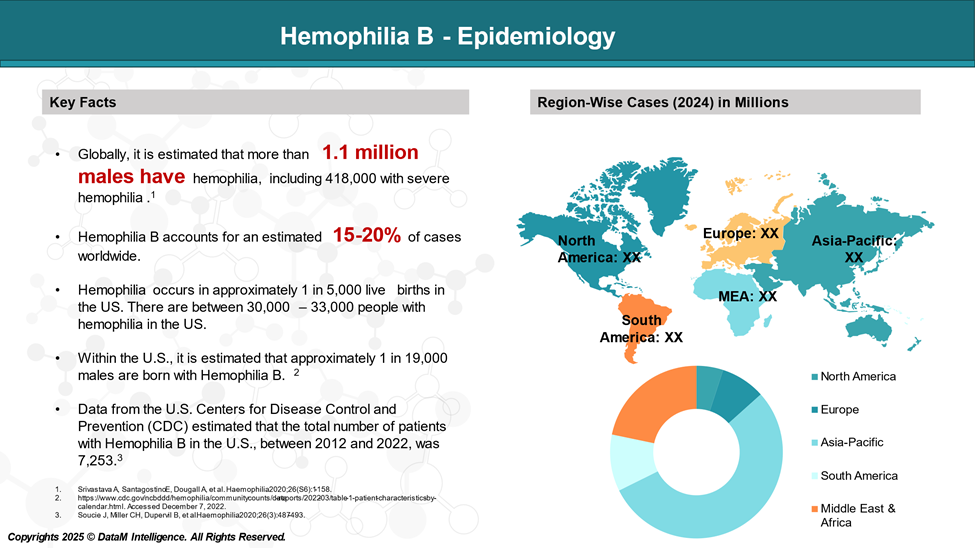

Epidemiology Analysis (Current & Forecast)

According to the US CDC, hemophilia occurs in approximately 1 in 5,000 live births. There are between 30,000 – 33,000 people with hemophilia in the US. Hemophilia B is four times less common than hemophilia A.

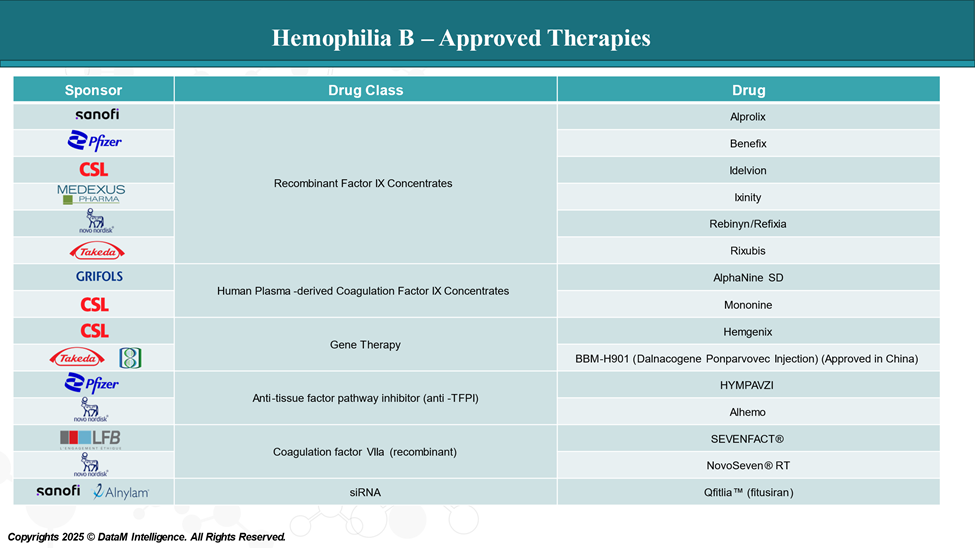

Approved Drugs (Current SoC) - Sales & Forecast

Hemophilia B treatments vary in their mechanisms, with some providing standard clotting factor replacement, others offering long-acting therapies, and some introducing gene therapies or novel approaches to increase clotting.

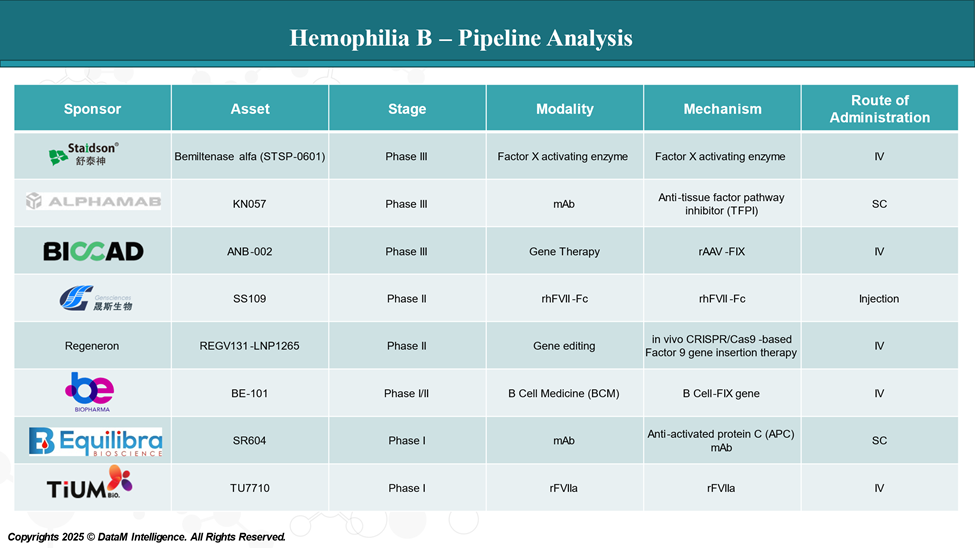

Pipeline Analysis and Expected Approval Timelines

The treatment landscape for Hemophilia B is rapidly evolving, with several new gene therapy and mAbs in the pipeline targeting various disease mechanisms.

Competitive Landscape and Market Positioning

The Hemophilia treatment landscape is experiencing significant growth, driven by several approved therapies and with an upcoming pipeline therapies.

| Drug | Sponsor | Type | Annualized Bleed Rate (ABR) | Dosing Frequency | Route | Innovation Level | Cost (Est.) | Notes / Differentiators |

| Idelvion | CSL Behring | EHL Recombinant FIX | ≤1 in most trials | Every 7–14 days | IV | Moderate | High (~$500k–$600k/year) | Longest dosing interval among FIX products |

| Alprolix | Biogen | EHL Recombinant FIX | ~1–3 | Weekly | IV | Moderate | High (~$450k–$550k/year) | First extended half-life FIX product |

| BeneFix | Pfizer | SHL Recombinant FIX | ~2–5 | 2–3 times/week | IV | Low | Moderate (~$350k–$450k/year) | Legacy therapy; widely available |

| Rebinyn / Refixia | Novo Nordisk | EHL Recombinant FIX | ~0–3 | Once weekly | IV | Moderate | High (~$500k+/year) | High peak FIX activity; good for on-demand control |

| Hemgenix | CSL/uniQure | Gene Therapy | ~0–1 (post-therapy) | One-time infusion | IV | Very High (Transformational) | Very High (>$3.5M one-time) | First and only approved gene therapy for Hemophilia B |

| Qfitlia™ (Fitusiran) | Sanofi | RNAi (non-factor therapy) | ~0–1 | Monthly (Subcutaneous) | SQ | High | TBD (likely high) | Works in both Hemophilia A and B; subcutaneous convenience |

| AlphaNine SD | Grifols | Plasma-Derived FIX | ~3–6 | 2–3 times/week | IV | Low | Lower than recombinants | Preferred in some markets for perceived natural origin |

Key Companies:

Target Opportunity Profile (TOP)

Creating a Target Opportunity Profile (TOP) for emerging therapies in Hemophilia B helps define the clinical and commercial benchmarks new products must meet—or surpass—to gain a competitive edge over approved therapies. This profile focuses on the essential dimensions: efficacy, safety, mechanism of action, route of administration, dosing frequency, and cost.

Target Opportunity Profile (TOP) for Emerging Hemophilia B Therapies

| Attribute | Target Benchmark (Emerging Therapies Must Achieve or Exceed) | Rationale / Justification |

| Efficacy (ABR) | ≤1 Annualized Bleed Rate (ABR) | Gene therapies and best EHLs already achieve near-zero ABR; new therapies must match or improve. |

| Durability of Response | Multi-year efficacy (≥5 years preferred) or potentially curative (e.g., in gene therapies) | Competing with long-term or one-time therapies like Hemgenix requires sustained response. |

| Safety | Minimal thrombosis risk, low immunogenicity, safe in all genotypes | Current treatments have well-established safety; any safety trade-offs will hurt adoption. |

| Mechanism of Action | Novel or improved mechanism (e.g., gene editing, RNAi, protein rebalancing) | Must offer meaningful clinical advantage over traditional factor replacement. |

| Route of Administration | Subcutaneous (SQ) or Oral (future aspiration) | IV infusions are burdensome. SQ delivery (e.g., Qfitlia™) or oral would be highly disruptive. |

| Dosing Frequency | Monthly or less (ideally one-time in gene therapy or monthly SQ in RNAi) | Convenience is a key driver of adherence and patient preference. |

| Onset of Action | Rapid and predictable FIX activity or coagulation rebalancing effect | Quick protection against bleeding is essential, especially in children and surgery contexts. |

| Inhibitor Risk | Very low or none | Inhibitor development limits efficacy and increases reliance on expensive bypassing agents. |

| Compatibility | Effective in all severities and with/without inhibitors | Broad applicability increases market access and prescriber preference. |

| Cost / Value Proposition | Competitive with EHLs (~$400K–$600K/year) or cost-offsetting model (for gene therapies >$2M) | Must show health economic benefit—fewer bleeds, lower total cost of care, better QoL. |

| Monitoring Burden | Minimal lab/clinic visits post-administration | Especially important for gene therapies or rural populations with access barriers. |

What Must Emerging Therapies Deliver?

To displace or outperform currently approved therapies, emerging Hemophilia B treatments must offer:

- Equal or better bleed protection than Idelvion, Hemgenix, or Qfitlia.

- Superior patient convenience (subcutaneous, infrequent dosing).

- Safe and sustained long-term effect with minimal risk of immunogenicity or thrombosis.

- A clear economic argument (cost neutrality or better value through fewer interventions).

- Scalability and applicability across many patients, including pediatric and inhibitor-positive cases.

Strategic Opportunity Areas

- First oral therapy – If safe and effective, it would be a paradigm shift.

- Curative gene editing (e.g., CRISPR) – Safer, targeted, and permanent FIX correction.

- Pediatric-specific therapies – Especially for gene therapy, where options are limited.

- Therapies effective in inhibitor patients – Broadens use in challenging cases.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business:

1. Gain a Competitive Edge & Make Data-Driven Decisions

- Stay ahead of competitors by tracking drug pipelines, clinical trials, regulatory approvals, and market strategies in real time.

- Anticipate competitor moves and adjust your strategy proactively.

- Get accurate, up-to-date intelligence to support R&D, market entry, and investment decisions.

- Identify high-potential markets and unmet needs before your competitors.

2. Benefit from Key Opinion Leader (KOL) Insights

- Understand market trends, physician preferences, and treatment adoption with expert analysis from leading doctors and researchers.

- Use KOL feedback to refine your product strategy and improve market penetration.

3. Optimize R&D and Clinical Development & Enhance Market Access & Pricing Strategy

- Benchmark your clinical trials against competitors to improve success rates and reduce risks.

- Get insights into trial design, patient recruitment, and regulatory hurdles to streamline your drug development process.

- Stay updated on FDA, EMA, and global regulatory approvals, pricing trends, and reimbursement policies.

4. Identify M&A and Licensing Opportunities

- Discover potential partnerships, acquisitions, and licensing deals to expand your market presence.

- Evaluate investment opportunities based on market trends and competitor performance.

5. Custom-Tailored for Your Needs

- Our report is not just generic data—it’s customized for your business, focusing on your therapy area, competitors, and specific market challenges.

- Get actionable insights that align with your strategic goals.

How Our CI Report Helps You Succeed:

- Pharma Executives & Decision-Makers: Make informed strategic moves and stay ahead of competitors.

- R&D Teams: Optimize clinical trials and improve success rates.

- Business Development & M&A Teams: Find the right partnerships and acquisition opportunities.

- Market Access & Pricing Teams: Develop effective market entry and reimbursement strategies.

Would you like a customized version focusing on your specific market or key competitors? Let’s refine it to meet your needs.