Disease Overview:

Giant Cell Arteritis (GCA) is an inflammatory disease of the large and medium-sized arteries, most often affecting the temporal arteries in older adults. It commonly presents with headache, jaw pain, visual changes, and systemic symptoms such as fatigue or fever.

If untreated, it can lead to serious complications such as irreversible vision loss. The condition is immune-mediated and typically requires prompt treatment with corticosteroids or targeted immunotherapies.

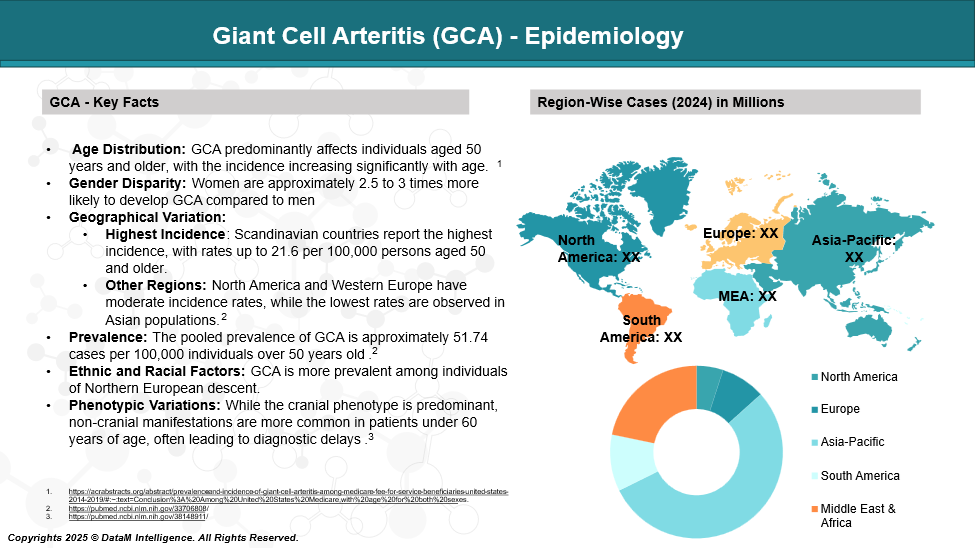

Epidemiology Analysis (Current & Forecast)

Giant Cell Arteritis (GCA) is the most common form of large-vessel vasculitis, primarily affecting adults over the age of 50. It shows a higher incidence in women and individuals of Northern European descent, particularly in Scandinavian countries. The condition becomes more prevalent with age, with incidence rates ranging from 15 to 30 cases per 100,000 people aged 50 and older.

Approved Drugs - Sales & Forecast

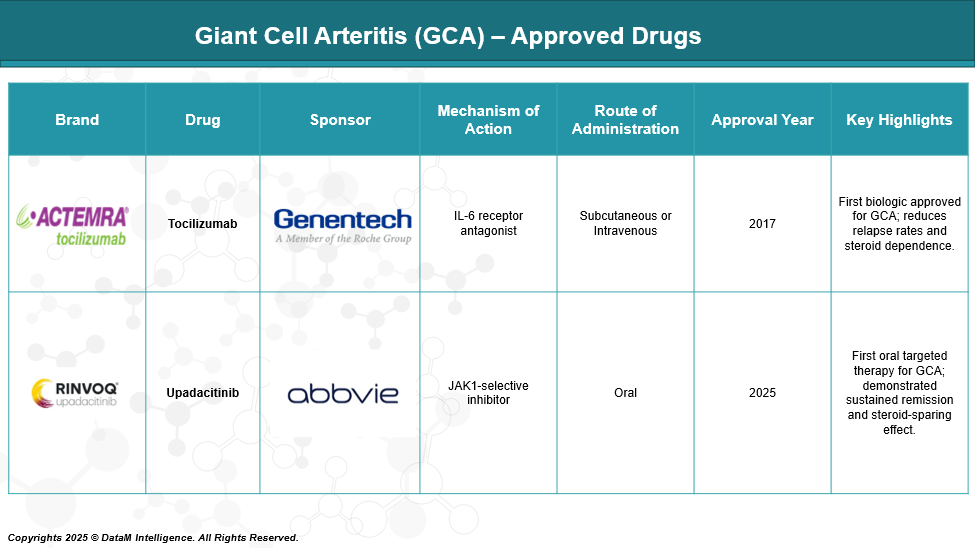

As of May 2025, the U.S. Food and Drug Administration (FDA) has approved two targeted therapies for the treatment of Giant Cell Arteritis (GCA), supplementing the traditional use of corticosteroids.

Pipeline Analysis and Expected Approval Timelines

Secukinumab (Cosentyx), an interleukin-17A (IL-17A) inhibitor developed by Novartis, is currently in the Phase III clinical stage for the treatment of Giant Cell Arteritis (GCA).

Phase II Trial: TitAIN Study

The TitAIN trial was a randomized, double-blind, placebo-controlled Phase 2 study evaluating the efficacy of secukinumab in patients aged 50 and above with new-onset or relapsing GCA. Participants received 300 mg of secukinumab or placebo subcutaneously weekly for 5 weeks, followed by every 4 weeks up to week 48, alongside a 26-week prednisolone taper regimen.

Key Findings:

Sustained Remission at Week 28: 70.1% in the secukinumab group achieved sustained remission compared to 20.3% in the placebo group.

Sustained Remission at Week 52: 59.3% of secukinumab-treated patients remained in remission versus 8.0% in the placebo group.

Time to First Flare: Median time to flare was not reached in the secukinumab group, indicating prolonged remission, whereas it was 197 days in the placebo group.

Safety Profile: Secukinumab was well-tolerated, with adverse events comparable between both groups.

These results suggest that secukinumab may offer a steroid-sparing effect and sustained disease control in GCA patients.

Phase III Trial: GCAptAIN Study

Building on the positive Phase II outcomes, the GCAptAIN Phase III trial is currently underway to further assess the efficacy and safety of secukinumab in GCA. This multicenter, randomized, double-blind study compares 300 mg and 150 mg doses of secukinumab versus placebo, all in combination with a glucocorticoid taper regimen. The primary objective is to evaluate sustained remission at Week 52.

Study Highlights:

Design: Participants (N=349) receive secukinumab or placebo subcutaneously, with dosing schedules mirroring the Phase II trial.

Glucocorticoid Taper: All participants undergo a standardized glucocorticoid tapering protocol.

Endpoints: The Primary endpoint is the proportion of patients achieving sustained remission at Week 52. Secondary endpoints include time to clinical failure, cumulative glucocorticoid dose, and quality of life assessments.

Readout Milestone(s): Primary results are expected in 2025.

Secukinumab's targeted mechanism of action and favorable safety profile observed in earlier studies position it as a promising candidate in the evolving treatment landscape of GCA.

Competitive Landscape and Market Positioning

The current GCA market is led by Actemra and Rinvoq, but faces growing competition from Phase III Cosentyx.

Drug | Sponsor | MOA | Route | Development Status | Key Differentiator | Market Positioning |

Tocilizumab (Actemra) | Roche/Genentech | IL-6 receptor antagonist | IV/SC | Approved | First biologic for GCA, proven long-term data | Biologic standard of care; effective steroid-sparing agent |

Upadacitinib (Rinvoq) | AbbVie | JAK1-selective inhibitor | Oral | Approved (2025) | First oral non-steroidal drug for GCA | Oral convenience, alternative to injections |

Secukinumab (Cosentyx) | Novartis | IL-17A inhibitor | SC | Phase III (GCAptAIN) | Novel MOA in GCA, strong Phase 2 data | Potential option for IL-6/JAK non-responders; expanding class |

Strategic Positioning Insights

- Rinvoq has set a new benchmark with its oral route, appealing to patients seeking convenience and steroid-free options.

- Secukinumab is the most advanced late-stage competitor, with robust efficacy and potential to challenge Actemra's dominance.

- Other pipeline drugs are leveraging differentiated mechanisms of action (e.g., GM-CSF, IL-17, IL-1) to target patients who are partial or non-responders to existing biologics.

- The future GCA market will likely be defined by mechanism-specific stratification, steroid-sparing potential, remission durability, and patient convenience (oral vs. injectable).

Key Companies:

Target Opportunity Profile (TOP)

Here’s a strategic Target Opportunity Profile for emerging therapies in Giant Cell Arteritis (GCA) — highlighting the ideal attributes a new drug would need to outcompete current standards like Tocilizumab and Upadacitinib:

Target Opportunity Profile for Emerging GCA Drugs

Parameter | Optimal Target Profile | Rationale / Benchmark |

Efficacy | ≥70% sustained remission at 52 weeks | Must match or exceed efficacy seen in Tocilizumab trials (e.g., GiACTA) and Secukinumab P2 |

Safety | Low risk of serious infections, cardiovascular events, and malignancies | Better safety profile than JAK inhibitors (e.g., Upadacitinib) and IL-6 agents |

MOA (Mechanism) | Novel, cytokine-independent or pathway-differentiated | To address IL-6/JAK non-responders or relapse-prone patients |

ROA (Route) | Oral or infrequent subcutaneous dosing | Oral route preferred for convenience (as in Upadacitinib); SC > IV for patient compliance |

Dosing | Once daily oral or once-monthly injection | Lower frequency dosing boosts adherence and satisfaction |

Modality | Small molecule or stable antibody fragment | Easier manufacturing, lower cost, and potentially better tissue penetration |

Onset of Action | Rapid – within 2–4 weeks | Early control reduces steroid burden and flare risk |

Steroid-Sparing | Demonstrated steroid-sparing with fast taper (≤12 weeks) | Key unmet need; benchmarked from GiACTA and TitAIN trials |

Durability | ≥1 year flare-free maintenance | Long-term remission aligns with chronic nature of GCA |

Innovation | Biomarker-based targeting or precision immunomodulation | Differentiation in MOA, target population, or disease phenotyping |

Strategic Insight:

To gain clinical and commercial advantage, emerging therapies must either:

- Outperform in remission durability, safety, or patient convenience, or

- Target refractory/resistant subpopulations who fail IL-6 or JAK pathways.

Additionally, oral small molecules with differentiated mechanisms (e.g., GM-CSF, IL-17, complement pathways) may become attractive alternatives if they offer a favorable balance of efficacy and safety.

Why Buy Our Pharma Competitive Intelligence Report?

Our Pharma Competitive Intelligence Report is designed to give you a strategic advantage by providing deep insights into the pharmaceutical landscape. Here’s how it benefits you and your business: